In markets such as forex, futures, or equities, there is a concept called contract size. It is one of the main factors that determines how much profit or loss you ultimately make on a trade.

Many beginner traders focus most of their attention on chart analysis and predicting price direction. But what often gets overlooked is contract size, the factor that determines how every small price move will affect your account balance. If you ignore it, a few ordinary market fluctuations can wipe out a large part of your capital, even if your analysis was correct.

In this article from Aron Groups, we will explain why choosing the right contract size is one of the most essential risk management skills, and how mastering this concept can help you avoid heavy losses and trade with greater confidence on a professional path.

Key points

- Contract size refers to how much of an underlying asset one contract represents (e.g., how many barrels of oil or how many currency units). Trade volume means how many of those contracts (or lots) you buy or sell.

- Trading a larger contract size can increase potential profits, but it also increases potential losses and usually requires more funds in your account.

- To protect your capital, it is generally better to risk only 1-2% of your total account on any single trade, and choose your trade size so it does not exceed that limit.

- Many traders avoid calculating contract size properly and make emotional decisions or trade larger volumes, which is a common reason accounts get wiped out.

What is the contract size?

According to Investopedia, Contract size is the fixed amount of a specific asset traded per unit of a financial contract. In other words, when you buy or sell a contract, you are effectively trading a predefined quantity of the underlying asset. This quantity is set and standardised by the market (such as an exchange) or by brokers.

To better understand contract size, consider a real example from the gold market. Suppose you want to trade gold via futures or gold CFDs (Contracts for Difference). In these markets, the standard contract size for gold is typically 100 ounces.

When you buy one gold contract, you are effectively trading the equivalent of 100 ounces of gold. So if you buy two gold contracts, it is as if you hold 200 ounces of gold.

Now assume the price of gold is USD 1,950 per ounce. The total notional value of buying two contracts would be USD 390,000 (1,950 × 200).

Note: Contract size sets the notional exposure; margin is only the deposit. That’s why a “small” margin requirement can still control a very large position.

In many forex and CFD broker platforms, you are not necessarily required to trade one full contract (i.e., 100 ounces of gold). These platforms often allow smaller lot sizes, such as mini lots (0.1 lot) and micro lots (0.01 lot).

For example, if the standard contract size for gold is 100 ounces:

- 1 mini lot (0.1 lot) = 10 ounces of gold;

- 1 micro lot (0.01 lot) = 1 ounce of gold.

Now, assume gold is still USD 1,950 per ounce:

- If you trade 0.1 lot, your position value would be USD 19,500 (1,950 × 10).

- If you enter with a 0.01 lot, you are effectively trading USD 1,950, because you are buying just 1 ounce.

This example shows how contract size and the choice of trade volume relative to that contract size directly affect your trading outcomes.

The difference between contract size and volume

In finance, contract size and trade volume are two completely separate concepts with different purposes. To make the distinction clear, let’s start with a simple example:

Imagine you want to buy a bottle of water.

Contract size

This is the amount of water in one standard bottle. For example, each bottle might contain 1 litre. That “1 litre” is a fixed, predefined amount for each bottle.

In financial markets, contract size is also a fixed, standardised value. It shows how much of the underlying asset is included in one unit of a trading contract. Exchanges or financial service providers set this amount and cannot change it.

Trade volume

This refers to the total number of bottles you buy at once. If you buy 5 bottles of water, your purchase volume is “5 bottles.”

In financial markets, trade volume refers to the total number of contracts a trader buys or sells at a given time. For example, in forex, if the contract size of a micro lot is 1,000 units, you can trade a volume of “5” micro lots, which means you are trading 5,000 units of the base currency.

This value is variable, and the trader determines it based on their analysis, risk management strategy, and available capital.

Many professional traders use a position size calculator to align contract size with their stop-loss level and account size.

The role of contract size in risk management

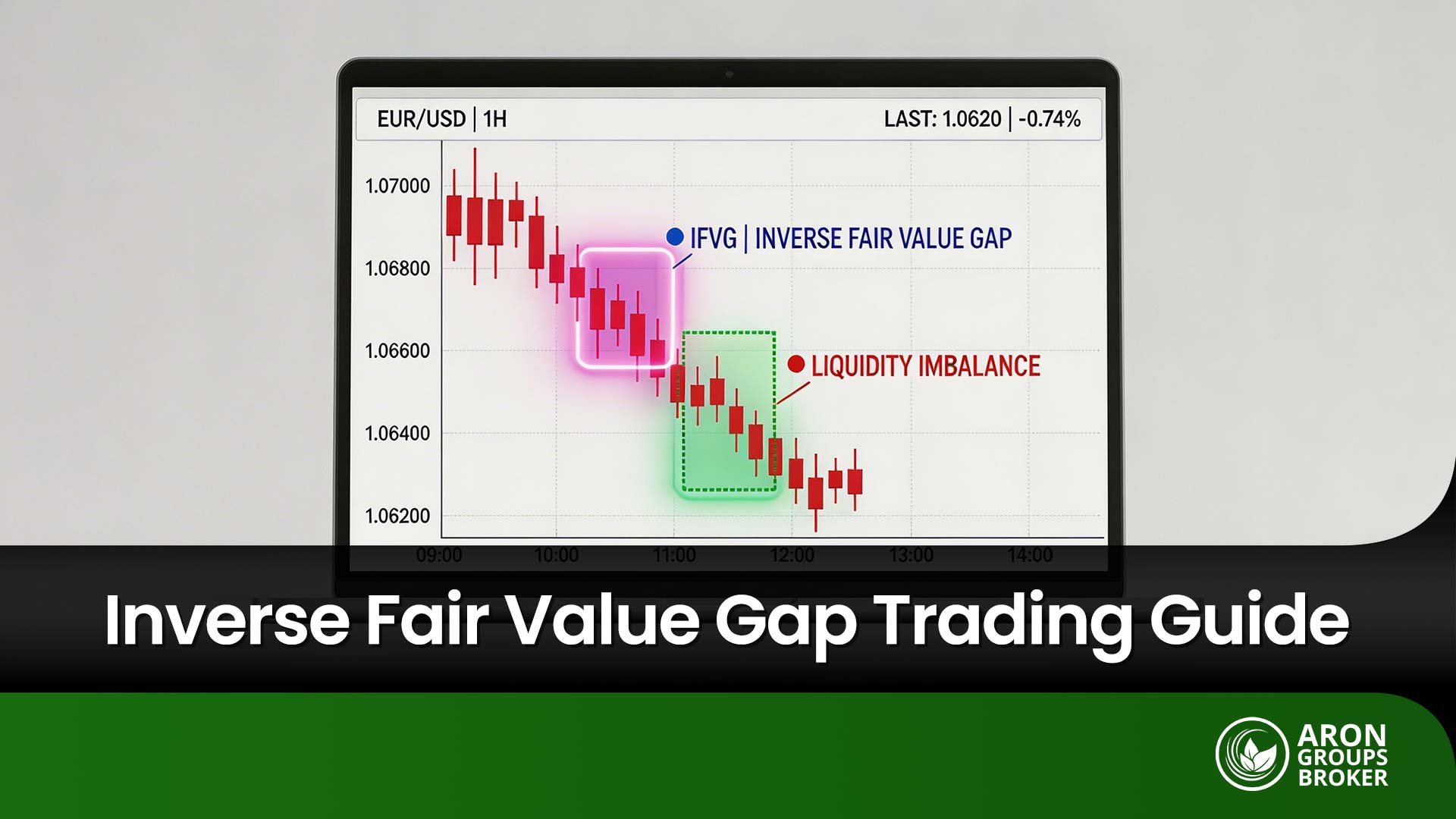

Contract size is a core element of risk management in trading. Price movements in financial markets are typically influenced by factors such as news, central bank policies, and economic indicators. Releases like interest rates, unemployment figures, inflation data, and GDP growth can trigger sudden market swings.

How contract size affects profit and loss

Contract size directly determines how much profit or loss you make from even small price changes. For example, in forex:

- If you trade 1 standard lot (100,000 units), each pip movement is typically worth USD 10 in profit or loss.

- If you trade 0.1 lot (a mini lot), that same pip move is worth USD 1.

So, as contract size increases, the impact of market fluctuations on your account becomes larger. If you aim for higher profits, you must recognise that the risk increases in the same direction. A smart choice is about balancing potential reward with real, measurable risk.

Good To Know:

Pip value changes when the quote currency isn’t USD (e.g., GBP/JPY) and can shift with exchange rates, so don’t hard-code $10/pip as a universal rule.

How contract size affects margin

Margin is the amount of money you must keep in your account to open and maintain a position. The larger your contract size, the more margin you typically need.

For example, assume your account leverage is 1:100:

- To open a USD 100,000 position (1 lot), you need at least USD 1,000 in margin.

- If you trade USD 10,000 (0.1 lot), the required margin is only USD 100.

Choosing the right contract size helps you avoid tying up too much margin and keeps room available for other trades.

The direct link between contract size and money management

Money management means planning how much capital to allocate to each trade so your overall portfolio risk stays at an acceptable level.

Here is how contract size connects directly to money management:

Controlling risk per trade

One of the golden rules of money management is to risk only a small portion of your total capital per trade, typically 1% to 2%. To do that, you must set your contract size based on your stop-loss. If your stop-loss is far from your entry point, you need a smaller contract size to keep your risk within the allowed percentage.

Example:

Assume you have USD 1,000, and you decide you do not want to lose more than USD 20 per trade. That means your maximum risk is 2% of your account.

Now, assume your analysis tells you that if the price moves 20 pips against you, you should exit the trade (your stop-loss is 20 pips).

To ensure your loss does not exceed USD 20, you must choose a position size where each pip is worth only USD 1, because:

20 pips × USD 1 = USD 20

This calculation tells you what trade volume you should use so your loss does not exceed USD 20. It helps you manage your capital effectively and avoid unnecessary, oversized risks.

Preserving your capital

To keep your capital safe, especially when you are new or when market volatility is high, it is better to trade in smaller sizes.

When you trade small, even a string of consecutive losses is less likely to damage your account seriously. This supports better emotional control, prevents a loss of confidence, and gives you the time and space to review mistakes and improve your execution.

Contract size in the forex market

In forex, contract size refers to the number of units of the base currency that are traded in each trading unit (called a lot). These sizes are predefined so traders can operate in the market using consistent, standardised quantities.

Types of contract sizes in forex

To provide more flexibility and serve traders with different account sizes, the forex market offers several lot sizes:

1) Standard lot (Standard Lot)

The largest contract size, equal to 100,000 units of the base currency (the first currency in a pair). A standard lot has the highest profit and loss potential, so it is generally more suitable for experienced traders with larger capital.

In volatile markets like forex, reducing contract size during major economic events is a key protective strategy.

For major currency pairs (such as EUR/USD), the pip value (the smallest price change) for a standard lot is typically around USD 10 per pip. That means a 10-pip move can result in about a USD 100 change (profit or loss) in your account.

2) Mini lot (Mini Lot)

A mini lot equals 10,000 units of the base currency. It is one-tenth of a standard lot and carries lower risk, making it a solid option for traders with moderate capital or those who want to start more cautiously.

For major pairs, the pip value for a mini lot is typically around USD 1 per pip.

3) Micro lot (Micro Lot)

A micro lot equals 1,000 units of the base currency. It is ideal for beginners, traders with smaller capital, or anyone who wants to test strategies with minimal risk.

For major pairs, the pip value for a micro lot is typically around USD 0.10 (10 cents) per pip.

4) Nano lot (Nano Lot)

Some brokers also offer nano lots, equal to 100 units of the base currency. This is the smallest tradable unit, with a pip value of about USD 0.01 (1 cent).

These lot types allow you to choose an appropriate trade volume based on your capital size and risk tolerance.

Real example: how contract size changes risk in forex

Assume you have USD 1,000 in your forex trading account and you trade EUR/USD. The market suddenly moves 20 pips against your position (meaning price passes your assumed stop-loss level).

Scenario 1: You traded 1 standard lot

The pip value for EUR/USD with a standard lot is about USD 10 per pip.

Your loss:

20 pips × USD 10/pip = USD 200

That is 20% of your total USD 1,000 capital. A loss of this size can quickly put your account at risk and may even lead to a margin call or forced position closures.

Scenario 2: You traded 1 micro lot

The pip value for EUR/USD with a micro lot is about USD 0.10 per pip.

Your loss:

20 pips × USD 0.10/pip = USD 2

That USD 2 is only 0.2% of your USD 1,000 capital. A loss this small gives you room to recover, learn from mistakes, and continue trading to gain experience without destroying your account.

This example clearly shows why understanding contract size and applying risk management in forex is essential. Choosing the right contract size is one of the most effective ways to protect your capital from market volatility and helps you stay in the market longer, improving your chances of long-term success.

Contract size in futures trading

Futures trading means entering an agreement where you commit to buying or selling a specified quantity of an underlying asset, such as crude oil, gold, wheat, or a stock index, on a set date in the future, at a price agreed today.

Learn More:

In CFDs, “contract size” is broker-defined and can vary by platform, while the exchange standardizes futures contract specs. Always check the contract specification page before trading.

Below are a few common futures contract examples:

- Crude oil futures contract: On major international exchanges, one crude oil futures contract is typically equal to 1,000 barrels of oil. That means when you buy one oil contract, you are effectively trading 1,000 barrels.

- Gold futures contract: One gold futures contract is typically equal to 100 ounces of gold.

- S&P 500 index futures contract: These contracts are usually defined by a fixed multiplier (for example, USD 50 per index point). In that case, each 1-point move up or down in the S&P 500 changes your contract’s value by USD 50.

- Saffron futures contract in Iran: Each saffron futures contract may be equal to 100 grams of saffron.

Contract size in the stock market

In equities, the concept of contract size is slightly different from markets like forex or futures, but it still refers to a fixed quantity of an asset traded in each unit. In stock markets, these units are typically expressed as a share or a lot.

Types of lots in the stock market

There are two main lot types in equities:

1) Round lot

This is the most common and standard lot type and refers to blocks of 100 shares. Most stock trades are executed in round lots because it tends to improve execution efficiency and market liquidity.

If you buy or sell 100 shares, 200 shares, or any multiple of 100, you are trading a round lot.

2) Odd lot

An odd lot refers to any number of shares below 100 (for example, 1 share, 5 shares, 99 shares, etc.). Trading odd lots is possible in some brokers and specific markets, but it can come with challenges, including:

- Lower liquidity: It may be harder to find a buyer or seller for non-standard share quantities.

- Wider spread: The difference between the bid and ask price (the spread) can be wider for odd lots, which may increase trading costs.

Correlation between instruments should also be considered when choosing position sizes across multiple trades. Holding large positions in correlated assets such as gold and silver can multiply overall portfolio risk rather than diversify it.

Note:

Assets that look diversified can become highly correlated during risk-off events (e.g., panic moves), so “multiple positions” can suddenly behave like one big trade.

How to choose the right contract size

Choosing the right contract size plays a critical role in risk management and your long-term success in financial markets. There is no single “magic formula” that works for everyone. Instead, it is a personalised process that depends on a few key factors.

Here is a practical way to select an appropriate contract size:

1) Decide how much risk you are willing to take per trade

First, define the maximum amount you are willing to lose on a single trade. A common guideline is to risk only 1% to 2% of your total capital. For example, if you have USD 1,000, it is generally better not to risk more than USD 10-20 on one trade.

2) Set your stop-loss

You need to determine how many pips you will allow the market to move against your position before you exit. This level is called the stop-loss. For instance, you might decide to close the trade if the price moves 30 pips below your entry level.

3) Calculate the value per pip

Now divide your dollar risk by the number of stop-loss pips to find the pip value you can afford.

Example:

If you want to risk only USD 20 and your stop-loss is 20 pips, then:

USD 20 ÷ 20 pips = USD 1 per pip

4) Choose contract size based on the pip value

Once you know your pip value, you can determine what trade size to open. For major currency pairs, 1 standard lot is typically worth about USD 10 per pip. So if you want USD 1 per pip, you should trade 0.1 lot (one mini lot).

So, to choose the right contract size, you only need to know:

- How much are you willing to risk?

- How many pips is your stop-loss, and

- What position size keeps that risk under control?

With this approach, you not only limit potential losses but you also trade with more clarity and peace of mind.

Common mistakes traders make when choosing contract size

In forex and other financial markets, many traders suffer unnecessary losses because they choose the wrong contract size. These mistakes usually come from poor planning, weak risk management, or a misunderstanding of basic concepts.

Below are the most common ones:

1) Choosing a contract size that is too large

Many new forex traders assume that trading a larger size (for example, 1 lot or more) automatically increases their chances of profit. It sounds appealing because even a small move in your favour can generate a noticeable gain.

But the reality is simple: the larger the contract size, the more market fluctuations impact your account balance. In other words, higher profit potential comes with higher risk.

For example,

If you enter a large position with a small account, it only takes a few pips moving against you to wipe out a large portion of your capital or trigger a margin call. If you had used a reasonable size aligned with your capital, that same price move would have had a much smaller impact, giving you room to recover.

2) Using the same fixed size for every trade, ignoring market conditions

One of the most common mistakes, especially early on, is entering every trade with the same position size without adjusting for the stop-loss distance. Traders may think: “I made money last time with 0.5 lots, so I’ll use the same again,” even though every setup has different risk characteristics.

3) Setting contract size based on emotion, not logic

Some traders choose position size based on gut feeling instead of calculations, e.g., “I think this is the moment to enter with 1 lot!” This emotional, non-rational approach leads to decisions driven by excitement rather than sound money management.

4) Ignoring position sizing discipline in a demo account

Some users trade oversized volumes in a demo account without respecting the limits of real capital. This creates bad habits and leads to major mistakes in a live account, where risk management and emotional pressure work very differently.

Conclusion

In financial markets, mastering technical analysis and fundamental analysis is not enough. What separates professional traders from the rest is intelligent risk and capital management, and at the heart of that discipline sits contract size.

Ignoring this factor can lead to heavy losses even when your market analysis is correct. In contrast, choosing contract size logically and accurately gives you stronger control over risk, margin usage, and overall trading strategy.

Successful traders calculate contract size before entering the market, not emotionally, but based on logic, account size, and risk tolerance. This simple principle is a key driver of survival, growth, and long-term success on the professional trading path.