In trading, success isn’t solely dependent on theoretical knowledge and practical analysis. A significant portion of it hinges on a deep understanding of your own personal and financial characteristics. One of the most crucial of these characteristics is Risk Tolerance.

Risk Tolerance is an individual’s psychological and emotional capacity to cope with potential losses in an investment. It indicates how calm we can remain in the face of market fluctuations. According to Merrill Lynch, risk tolerance involves both your feelings about market ups and downs and your capacity, determined by financial situation, goals, cash needs, and time horizon. Understanding this trait is the cornerstone of a successful and sustainable investment strategy

In this article, we will help you become familiar with the concept of Risk Tolerance, its importance, and how to manage it to achieve your financial goals.

- Risk tolerance is not limited to price volatility; it also includes other risks, such as inflation risk (loss of purchasing power) or liquidity risk (the inability to sell an asset quickly).

- Typically, as people age and approach retirement, their risk tolerance decreases. This is due to a shorter time horizon for recovering from potential losses.

- A significant past loss can permanently lower an individual's risk tolerance, even if their financial situation has not changed.

- Herd behavior and market emotions can temporarily influence your risk tolerance, pushing you toward irrational decisions.

What Is Risk Tolerance?

Risk tolerance refers to an individual’s willingness and ability to accept potential investment losses in exchange for the possibility of higher returns. This is a highly personal concept influenced by factors like age, financial situation, investment goals, and even past experience. According to Investor.gov, the answer depends on when you will need the money, your goals, and whether you will be able to sleep at night if you purchase a risky investment. For a better understanding, it’s essential to distinguish it from two similar concepts:

- Risk Capacity: Risk capacity refers to an individual’s financial ability to withstand risk. For example, a young person with a stable income and no debt has a higher risk capacity than a retiree with limited savings, regardless of their psychological tolerance for risk.

- Risk Appetite: Risk appetite refers to the overall inclination of an organization or individual to take on risk to achieve strategic objectives. It represents a general approach to risk-taking, whereas risk tolerance is a deeper psychological trait that manifests in day-to-day financial decisions.

Based on the CFI, risk tolerance is not just a psychological trait; it is a combination of three factors: your attitude toward risk, your financial situation, and your knowledge of financial markets as a trader or investor.

The Importance of Understanding Risk Tolerance in Investing

Understanding your risk tolerance is the backbone of a successful and sustainable investment journey. Ignoring it can lead to emotional decisions and undesirable outcomes.

Preventing Emotional Decisions and Investment Mistakes

If you don’t know your risk tolerance, you might make poor decisions driven by fear or greed during periods of high market volatility.

For instance, an investor with low risk tolerance might sell their stocks at a loss at the first sign of a market downturn. This action not only prevents future gains but also damages their principal capital. Understanding your risk-taking ability helps you remain calm in these situations and stick to your long-term plan.

Aligning Your Investment Strategy with Your Financial Personality

Every investor has a unique financial personality that directly corresponds to their risk tolerance. For success, your investment strategy must align with this personality.

For example, for a risk-averse individual, investing in the volatile stocks of technology companies can be stressful and unbearable. In contrast, for a high-risk-taker, the same investment seems completely logical and appealing.

Increasing the Likelihood of Reaching Long-Term Financial Goals

Risk tolerance helps us properly design long-term investment strategies.

For example:

- If your goal is to retire early, you’ll likely need to accept more risk to achieve a higher expected return.

- However, if your goal is simply to preserve the value of your money for the near future, you’ll need less risk.

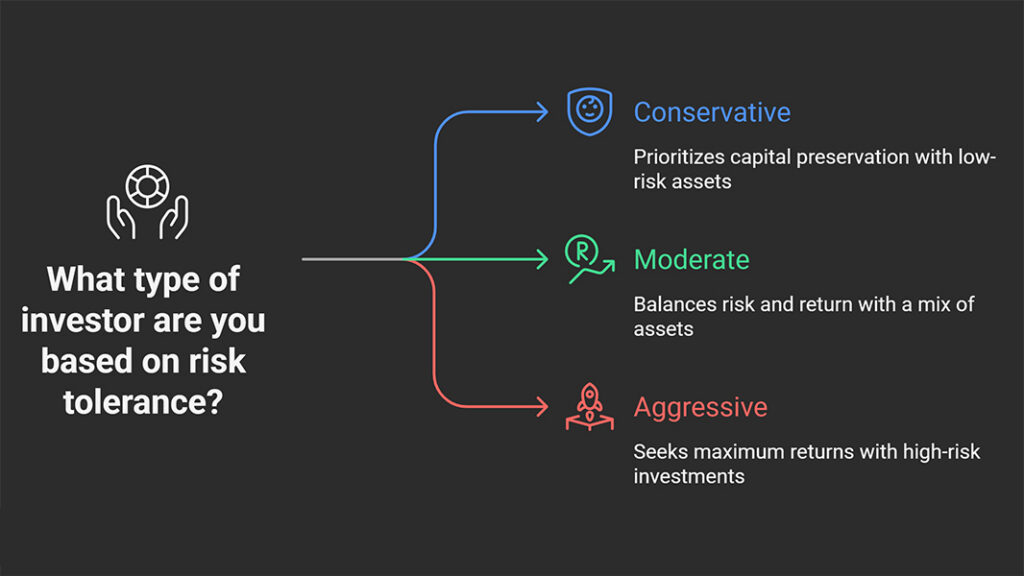

Types of Investor Risk Tolerance

Investors can be broadly categorized into three types based on their risk tolerance.

Conservative

These investors prioritize capital preservation above all else. They aren’t looking for high returns and are highly sensitive to market fluctuations. Their portfolios primarily consist of low-risk assets such as government bonds, bank deposits, and fixed-income funds. For these individuals, portfolio diversification means minimizing volatility as much as possible.

Example:

Imagine Mary, who is 55 and nearing retirement. Her main goal is to protect the savings she’s accumulated over the years so she can use them comfortably during her retirement.

Mary can’t tolerate the volatility of the stock market, and even a small loss would make her anxious. Because of this, she places most of her money into low-risk assets like government bonds and bank deposits.

For Mary, diversifying her portfolio means choosing options that minimize risk and guarantee the safety of her capital. This approach makes her a conservative investor.

Moderate

This group seeks a balance between risk and return. They’re willing to expose a portion of their capital to risk to achieve a reasonable return, but they avoid extremely high-risk investments. Their portfolios are a blend of low-risk assets (like bonds) and medium-risk assets (like stocks from large, stable companies).

Example:

Consider John, a 40-year-old with a stable income who is investing to cover his child’s college tuition in 15 years. He knows his money needs to grow to reach his goal, but he doesn’t want to jeopardize his principal with excessive risk. So, he decides to build a balanced portfolio.

John invests half of his capital in low-risk assets such as government bonds and the other half in the stocks of large, stable companies. This strategy balances security and growth, making him a moderate investor.

Investors with lower cognitive biases, such as fear of loss or overconfidence, tend to have a more accurate assessment of their risk tolerance.

Aggressive

These investors aim for maximum returns and are willing to take on significant risks. They view sharp market fluctuations as opportunities rather than threats. Their portfolios often include stocks of startup companies, high-risk investments like cryptocurrencies, and high-risk investment funds.

Example:

Imagine Ali, a 30-year-old, single individual with a high-paying job and no debt. He believes he can accumulate significant wealth quickly by taking risks. As a result, he invests most of his capital in volatile tech startups and cryptocurrencies. Even during a sharp market downturn, he isn’t afraid; instead, he sees it as a chance to buy more.

Ali is an aggressive investor because he seeks the highest possible profit and isn’t afraid to take on significant risks.

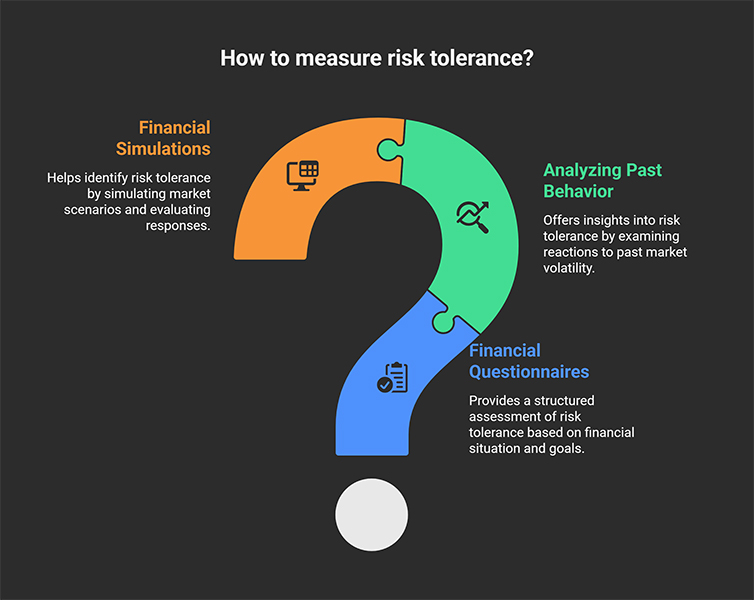

How to Measure Your Risk Tolerance

Assessing your risk tolerance is a personal, multi-step process.

Standardized Financial Questionnaires and Tests

Many financial advisors and online investment platforms offer standardized questionnaires that evaluate your risk tolerance by asking about your financial situation, goals, and reactions to various market scenarios. These risk assessment tests are great tools for getting started.

Analyzing Past Investment Behavior

Look to your past. Did you feel extreme anxiety and want to sell during a stock market decline? Or, did you see it as a buying opportunity? Examining your reactions to past market volatility can provide deep insight into your risk tolerance.

Using Financial Simulations and Scenarios

Ask your financial advisor to run various scenarios with you. For instance, ask, “How would I feel and what would I do if my portfolio’s value dropped by 10% in a single year?” Reviewing your responses to these scenarios can help you identify your true level of risk tolerance.

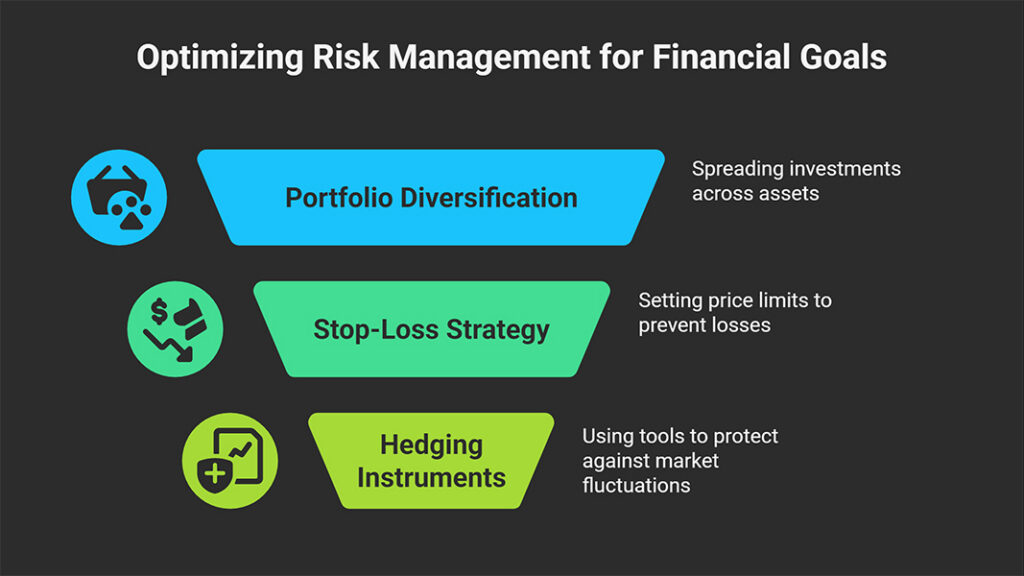

How to Optimize Risk Management Based on Personal Risk Tolerance

Understanding your risk tolerance is only the first step. The next step is to optimize your risk management to achieve your financial goals.

Intelligent Portfolio Diversification to Reduce Investment Risk

Portfolio diversification means spreading your investments across different assets rather than putting all your eggs in one basket. When one asset underperforms, another can help offset the loss. The goal is to reduce overall risk without sacrificing returns.

Your investment portfolio should include a mix of stocks, bonds, real estate, and even valuable commodities. For example, when the stock market is in a slump, the price of bonds or gold might rise, protecting your capital.

To do this intelligently, you can use quantitative tools to calculate portfolio risk. These tools help you ensure your assets are allocated in a way that provides you with an optimal risk level. This gives you peace of mind, knowing that unexpected events in one part of the market won’t jeopardize your entire capital.

Risk tolerance can vary depending on the type of asset; someone who is willing to take risks in stocks may act much more conservatively in real estate.

Setting a Proper Stop-Loss and Designing an Exit Strategy Based on Risk Tolerance

Before any investment, you should define your stop-loss. This means setting a predetermined price at which your asset will be sold automatically or manually if its value drops to that level. This strategy helps you prevent significant losses and keeps you from making emotional decisions driven by fear or false hope during critical moments.

For example, suppose you bought a stock at 100 units. If your risk tolerance is low, you can set a stop-loss at 90 units. This way, if the stock’s price falls to 90 units, it will be sold automatically, preventing further losses.

Measuring risk tolerance without considering your investment time horizon gives an incomplete picture.

To measure the effectiveness of your strategies, you can use advanced metrics like the Sortino ratio. Unlike other metrics that treat upward and downward volatility the same, the Sortino ratio only focuses on downside volatility (losses), showing you how much return you’ve earned for each unit of loss-related risk. This metric is especially useful for risk-averse investors.

Effectively Using Hedging Instruments to Protect Capital

For investors with a low risk tolerance, using hedging instruments is a key strategy for capital protection. These tools allow you to minimize the risk of loss from sharp market fluctuations.

For example, futures contracts and options give you the ability to benefit from the market’s potential returns while also protecting yourself against sudden price movements. By using these tools, you can invest with greater confidence and safeguard your principal capital from market turbulence.

Conclusion

Risk tolerance is a key concept in the world of investing. A proper understanding of it allows you to make informed decisions that align with your financial personality. By accurately assessing your risk tolerance, you can design a long-term investment strategy, avoid emotional decisions, and ultimately achieve your financial goals with greater peace of mind.

Remember, success in investing is not a sprint; it’s a marathon where consistency and perseverance in making the right decisions are paramount. By knowing yourself, you pave the way for a secure financial future.