Pending orders in forex are a powerful tool that allows traders to set up buy or sell orders at specific price levels. These orders are executed only when the market reaches the predetermined price, enabling you to enter trades without constant market monitoring. Pending orders in forex are particularly valuable for traders employing specific strategies, such as breakouts of support and resistance levels or combining with price action techniques. In this article, we will explore all aspects of pending orders in forex to help you utilize this tool effectively and optimize your trading performance.

Key Points:

|

What Are Pending Orders in Forex?

A pending order in forex is a conditional order that remains inactive until the market price reaches a predefined level. This type of order allows traders to plan future trades without the need for constant market monitoring. For example, if GBP/USD is currently trading at 1.3880 and you predict that the price will drop to 1.3800 before starting an uptrend, you can set a pending order to buy at 1.3800.

Once the price hits this level, the order executes automatically. Pending orders in forex are highly valuable for traders, as they enable automated market entry to capitalize on opportunities. This tool helps traders base their decisions on technical analysis, reducing impulsive, emotion-driven trades and enhancing strategic precision.

| According to BabyPips, over 70% of professional traders utilize pending orders in forex to manage their market entries. This highlights the critical role of this tool among the various types of orders in forex, enabling traders to reduce risk and execute trades with precision |

Difference Between Pending Orders and Market Orders in Forex

In forex trading, a market order simply means executing a trade immediately at the current market price. When you click the buy or sell button, the trade opens instantly without any additional conditions. This type of order suits traders who need to enter the market quickly but may face costs like spreads or slippage.

The primary difference between a pending order in forex and a market order lies in its conditional nature. A pending order is future-oriented, waiting until the price reaches a specific level before executing, whereas a market order triggers instantly without conditions. The meaning of pending in forex is precisely this: waiting for ideal conditions, offering traders greater control over their entry points.

For instance, during major news events like the Non-Farm Payroll (NFP) report, a market order might execute with a 5-pip slippage, resulting in an unfavorable entry price. In contrast, a pending order activates precisely at the pre-set level, aiding in risk management to minimize unexpected losses.

The advantages of pending orders in forex include precise control over entry prices and reduced emotional decision-making, while market orders, particularly in high volatility, carry risks of slippage and wider spreads. In calm markets, market orders act faster, but in turbulent conditions, pending orders are safer.

The table below provides a clear comparison:

| Feature | Market Order | Pending Order |

| Execution Speed | Instant and Immediate | Conditional, After Reaching Level |

| Price Control | Limited (Current Price) | Precise (Specified Level) |

| Risk | High (Slippage in Volatility) | Low (Controlled) |

This comparison highlights how choosing the right order type can optimize your trading strategy.

Types of Pending Orders in Forex

In the forex market, a pending order refers to orders that remain inactive until the market price reaches a specified level. This type of order allows traders to enter trades at the right moment without constantly monitoring the market. On trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), there are six main types of pending orders in forex, each with its unique application.

Buy Limit

A buy limit is an order to purchase a currency pair at a price lower than the current market price. It enables traders to buy when the price dips and then rises, potentially maximizing profits. For example, if EUR/USD is trading at 1.2200 and you predict it will drop to 1.2100 before climbing, you can set a buy limit at 1.2100. Once the price hits this level, your buy order executes automatically.

Sell Limit

A sell limit works oppositely, allowing you to sell a currency pair at a price higher than the current market. It activates when the market reaches a higher level, anticipating a subsequent decline. For instance, if GBP/USD is at 1.3800 and you expect it to rise to 1.3850 before falling, you can place a sell limit at 1.3850 to trigger a sell order automatically.

Buy Stop

A buy stop is a buy order set at a price above the current market level. It activates when the price reaches your specified level, expecting the upward trend to continue. For example, if USD/JPY is at 135.00 and you believe a break above 136.00 will signal a strong uptrend, set a buy stop at 136.00 for an automatic buy when the price hits that level.

Sell Stop

A sell stop, similar to a buy stop, is a sell order placed below the current market price. It triggers when the price falls to your set level, anticipating further declines. For instance, if EUR/USD is at 1.1200 and you predict a drop to 1.1150 will lead to a larger fall, a sell stop at 1.1150 will activate your sell order automatically.

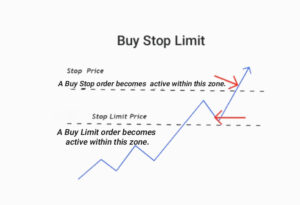

Buy Stop Limit

A buy stop limit combines features of a buy stop and a buy limit. You set a stop price to activate the order above the current market and a limit price to execute the buy at a specific or better price. This helps traders enter precisely at potential pullback points after a breakout, offering greater control in volatile markets.

Sell Stop Limit

Similar to a buy stop limit, a sell stop limit merges a sell stop and a sell limit. You set a stop price below the current market to activate the order and a limit price to execute the sell at a specific or better price. This allows traders to avoid sharp price swings and enter sales at optimal moments.

Practical Differences Between Limit and Stop Orders in Various Strategies

The core distinction between limit and stop orders lies in their use: limit orders target buying at lows or selling at highs for reversal strategies, while stop orders focus on entering after breaking support or resistance for trend-following strategies. For example, in range trading, pending orders in forex, like limit orders, target range boundaries, whereas stop orders capture breakouts in trending markets.

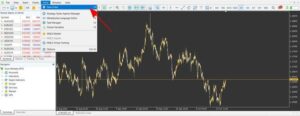

How to Set Up Pending Orders in MetaTrader

To utilize pending orders in forex on MetaTrader 4 or 5 (MT4/MT5), a few straightforward steps allow you to set buy or sell orders at your desired price levels. This enables market entry without constant price monitoring. The process is similar for both MT4 and MT5.

Step-by-Step Guide:

- Open the Order Window: Double-click your preferred symbol, such as AUD/USD, in the Market Watch window, press F9, or select New Order from the Tools menu.

- Select Pending Order: In the Type section, choose Pending Order. From the dropdown menu, specify the type of pending order in forex, such as Buy Limit or Sell Stop.

- Enter Details: Select the symbol and trade volume. Input the entry price, and if desired, add a Stop Loss to limit potential losses and a Take Profit to secure gains. You can also set an expiry time for the order to cancel automatically.

- Confirm the Order: Click the Place button. Your pending order in forex will appear in the Trade tab of the terminal, awaiting the specified price level.

To speed up order placement, enable One-Click Trading, which allows you to place orders with a single click. For further guidance on mastering pending orders in forex on MetaTrader, refer to resources on MetaTrader tutorials. Always practice in a demo account to build confidence.

How to Set Up Pending Orders in TradingView

TradingView does not directly support placing pending orders in forex, but its “Alerts” feature allows you to receive notifications when a price reaches a specific level, helping you stay informed without constant market monitoring. This enables timely trade entries.

To set an alert, select your desired symbol, such as EUR/USD, and open its chart. Right-click on the chart or click the alert icon in the toolbar, then choose “Add Alert.” In the alert window, define your conditions, such as when the price hits a specific level (e.g., crossing 1.1000 for a sell stop).

Next, choose how to receive the alert. TradingView offers options like mobile app notifications, email, or audio alerts. After configuring, click “Create” to activate the alert.

| Note that TradingView does not execute trades directly. To place the actual pending order in forex, you must use a broker’s platform integrated with TradingView or manually execute the trade when alerted. |

Advantages and Disadvantages of Using Pending Orders

Pending orders in forex are a valuable tool that allows traders to plan trades without constantly monitoring charts. One of the greatest advantages is automation; you can set an order to execute when the price hits your desired level, saving time and allowing focus on analysis rather than impulsive decisions. Additionally, pending orders in forex prevent emotional trading by following a pre-planned strategy, ensuring disciplined execution.

However, pending orders in forex have drawbacks. If the price never reaches the set level, the trade won’t execute, potentially causing missed opportunities. In volatile markets, such as during news events, orders may execute at a slightly different price (slippage), reducing profits. Accurate predictions are also crucial; a wrong forecast could lead to poorly timed entries. Combining pending orders in forex with price action can mitigate this by helping identify more precise levels.

| The drawbacks of pending orders become more pronounced in ranging markets, as orders often do not get triggered. However, this can also serve as a filter to avoid unnecessary trades. |

Trading Strategies Based on Pending Orders in Forex

The meaning of pending in forex lies in its ability to manage market entries and exits with precision while minimizing emotional influences. This tool is especially valuable for traders who cannot constantly monitor charts. Below, three simple and practical strategies using pending orders in forex are introduced, designed to be accessible and executable for novice traders.

Using Pending Orders for Breakouts of Support and Resistance Levels

One of the most popular strategies in forex involves using pending orders to enter the market after a breakout of support or resistance levels. When the price approaches these key levels, you can set a Buy Stop or Sell Stop to trigger a trade once the level is breached. For example, if USD/JPY nears a resistance at 136, you can place a Buy Stop just above this level. As soon as the price breaks through, your order activates, allowing you to capitalize on the upward momentum.

Combining Pending Orders with Price Action and Candlestick Patterns

In this strategy, pending orders are used in conjunction with price action analysis and candlestick patterns. For instance, if you spot a pin bar or an engulfing pattern near a key support or resistance level, you can set a buy limit or sell limit order at that point. This approach enables traders to enter the market at optimal levels and capitalize on potential price reversals. By combining these tools, traders can make more precise entries while reducing overall risk.

Setting OCO Orders for News or Volatile Market Conditions

The OCO (One-Cancels-Other) strategy is ideal for volatile markets or during major economic news releases. You set two opposing pending orders in forex, such as a Buy Stop above the current price and a Sell Stop below it. If one order triggers, the other cancels automatically. For example, during an NFP report, you might place a Buy Stop above and a Sell Stop below the current EUR/USD price. This approach allows you to capture market movements in either direction without predicting the outcome, maximizing opportunities in volatile conditions.

Differences in Execution of Pending Orders Across Broker Types

The execution of pending orders in forex depends on the broker type, impacting the speed, accuracy, and outcome of trades. The meaning of pending in forex refers to an order that waits until the price reaches a specified level, but its execution varies across brokers. Some brokers process orders quickly and transparently, while others may introduce delays or errors. Below, three key aspects of these differences are explained simply for beginners to facilitate choosing the right broker.

Execution Differences in ECN, STP, and Market Maker Brokers

ECN and STP brokers send pending orders in forex directly to the global market, ensuring fast and transparent execution. ECNs connect to banks, executing orders with minimal interference and high speed (often under 50 milliseconds). STPs operate similarly but may source prices from multiple providers, potentially causing slight delays. Conversely, market makers process pending orders in forex internally, acting as the counterparty, which can lead to price adjustments or delayed execution due to their conflict of interest.

Why Some Brokers Execute Pending Orders with Delays or at Unfavorable Prices

Delays or execution of pending orders in forex at suboptimal prices often stem from low liquidity or high market volatility. During major news events, like economic reports, prices move rapidly, and brokers may struggle to fill orders instantly. Market makers might intentionally delay to protect their profits. For example, a Sell Stop pending order in forex for GBP/USD at 1.3500 might execute at 1.3495 in a busy market. To mitigate this, choose brokers with No Dealing Desk (NDD) execution and set orders with a safety margin.

Role of Slippage in Pending Order Execution and Its Impact on Entry Accuracy

Slippage occurs when a pending order in forex executes at a different price than intended. For instance, during news events, a Buy Stop for USD/JPY set at 110 might execute with a 1-3 pip difference due to rapid market movements. Stop orders, executed like market orders, are more prone to slippage, while limit orders are more precise, filling only at the desired or better price. Market gaps, such as Monday openings, exacerbate slippage. For better accuracy, use limit orders in calm markets and keep trade volumes low. ECN brokers reduce slippage, though it’s never fully eliminated.

| According to EarnForex: In MetaTrader, when setting a Buy Stop Limit, you should place the limit price below the stop price to prevent the order from being executed at higher prices due to gaps or market delays. |

Conclusion

Pending orders in forex are a vital tool that automates trading, enabling traders to enter or exit at desired prices without constant market monitoring. The meaning of pending in forex lies in its precision and ability to reduce emotional decisions, boosting profitability. For success, combine pending orders in forex with technical analysis and practice in a demo account. By selecting a reputable broker and mastering this tool, you can navigate the growing forex market with over 7.5 trillion dollars in daily trading volume with confidence and maximize your profits. Start today and execute your strategies with assurance!