If you’re the type of trader who doesn’t want to be glued to the charts all day but still wants to enter the market at a precise, predetermined price, then pending orders are your best tool. Buy Limit and Buy Stop are two key order types that allow you to automate your trade entries intelligently. They help you capitalize on opportunities without getting caught up in the emotional swings of the market.

In this guide, we’ll break down in simple terms what each order is, how they differ, and how you can leverage them to enhance your trading strategy.

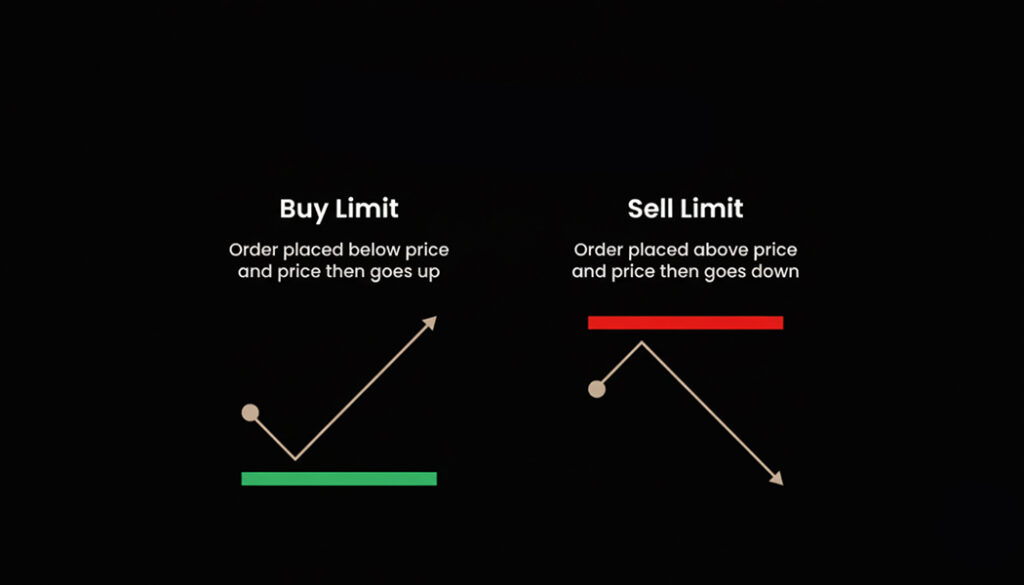

- Buy Limit is a predictive tool, placing orders at a lower price than the current market price, aiming to buy at a "discount."

- Buy Stop orders are placed above the current market price, anticipating a breakout above resistance and entering the market once momentum is confirmed.

- Buy Limit orders predict the market's move with the risk of a support break, while Buy Stop orders wait for confirmation but risk a false breakout and potential loss.

What is a Buy Limit Order?

A Buy Limit is an order to buy an asset at a price below the current market price. Traders use this order when they anticipate the price will first pull back to a key support level and then reverse its direction to start moving higher. Essentially, you are aiming to “buy the dip.”

Example: Let’s say the EUR/USD currency pair is currently trading at 1.1500. Your analysis indicates that the pair will first correct down to the support level of 1.1450 before resuming its upward trend. Therefore, you would place a Buy Limit order at 1.1450. If the market price falls to this level, your order will be automatically triggered, opening a long (buy) position for you.

Key Scenarios for Using a Buy Limit Order

A Buy Limit order is strategically used to enter the market at a more favorable, lower price. The three primary scenarios for its use are:

- Buying at Support Levels: You place your order at a key support level, a historical price floor where buying pressure is expected. The goal is to automatically enter a trade to capitalize on a potential bounce or reversal as the price reaches this level.

- Entering a Pullback: In an established uptrend, prices don’t move in a straight line; they make upward moves followed by temporary dips. This dip is known as a pullback or correction. You place a Buy Limit order at the expected end of this pullback to rejoin the main trend at a more advantageous price.

- Waiting for a Better Entry Price: This is a disciplined approach to avoid chasing a rising market or succumbing to FOMO (Fear Of Missing Out). Instead of buying at the current, potentially overextended price, you identify a lower, more reasonable entry point. By placing a Buy Limit order, you ensure that you only enter the trade if the market offers you that “discount,” preventing you from buying at an unfavorable peak.

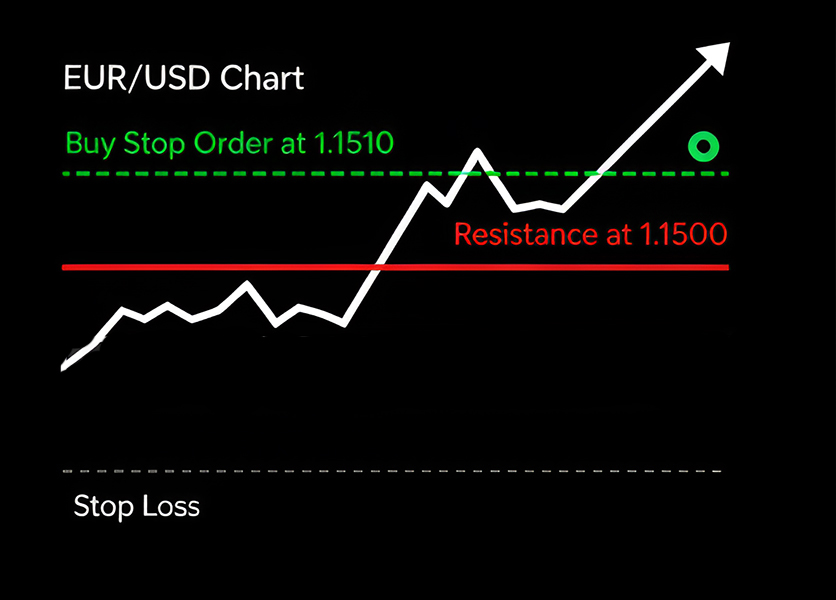

What is a Buy Stop Order?

A Buy Stop is an order to buy an asset at a price above the current market price. Traders use this order when they anticipate that the price will break out above a key resistance level and then continue a strong upward trend. In effect, you are looking to ride the momentum once the price breaks through a key barrier.

Example: Imagine the EUR/USD pair has been consolidating below a key resistance level at 1.1500 for some time. You anticipate that a breakout above this level will trigger a strong bullish move. Therefore, you place a Buy Stop order at 1.1510, just above the resistance level. As soon as the market price rises to 1.1510, your order will be triggered, opening a long (buy) position for you.

Key Scenarios for Using a Buy Stop Order

A Buy Stop order is used to enter a trade based on confirmation of market strength, rather than prediction. The three primary scenarios for its use are:

- Trading a Resistance Breakout: You place your order just above a key resistance level. If the price breaks through this barrier with sufficient momentum, your order is automatically triggered, allowing you to enter what could be the start of a new bullish move.

- Confirming Trend Continuation: Instead of guessing whether an existing uptrend has the strength to continue, you wait for confirmation. By placing a Buy Stop order above a recent high, you ensure that you only enter after the price has proven its momentum by making a new high, thus joining a confirmed trend.

- Executing a Trend-Following Strategy: The Buy Stop order is a cornerstone of trend-following strategies. These strategies don’t aim to predict tops or bottoms; instead, traders wait for a trend to establish itself and then use Buy Stop orders to enter the market and ride the prevailing momentum.

The Difference Between Buy Limit and Buy Stop Orders in Forex

Although both Buy Limit and Buy Stop orders result in a long (buy) position, the choice between them reflects two fundamentally different outlooks on the market. This difference can be summed up in one key distinction: prediction vs. confirmation.

Buy Limit: The Tool for the Predictive Trader

A trader who uses a Buy Limit order is fundamentally predicting future price action. Based on their analysis, they forecast that the price will pull back to a specific support level and then reverse its direction. This trader is essentially looking to “buy on sale,” acquiring the asset at a more favorable price than what is currently available.

- Core Logic: “I predict this support level will hold. Therefore, I will place my order there to get the most optimal entry point.”

- The Risk: If the prediction is wrong and the support level breaks, the trader is caught in a long position directly against a strong, developing downtrend.

Buy Stop: The Tool for the Confirmation-Based Trader

On the other hand, a trader using a Buy Stop is not interested in prediction. Instead, they wait for the market to confirm its strength and direction. This trader wants to see the price demonstrate enough momentum to break through a key barrier (the resistance level) before they join the move. They are effectively looking to “jump on a moving train.”

- Core Logic: “I will wait for the market to prove its bullish momentum by breaking this resistance. Only after I receive that confirmation will I enter the trade.”

- The Risk: If the breakout is a trap (a false breakout or “bull trap”), the trader enters a long position at the peak, only to be immediately caught in a reversal that puts the trade into a loss.

When to Use Buy Limit vs. Buy Stop

Choosing between these two orders depends entirely on market conditions. Understanding the different scenarios will help you select the right tool for the right moment.

1. In a Clear Uptrend

Using a Buy Limit

Buying the Dips (Pullbacks) A healthy uptrend doesn’t move in a straight line; it moves in waves, consisting of an upward impulse followed by a temporary rest or correction. This temporary dip is known as a pullback and presents a strategic buying opportunity. The best time to use a Buy Limit is at the anticipated end of this pullback, typically at a key support level. This allows you to rejoin the primary trend at a more favorable, lower price.

Using a Buy Stop

Joining the Trend After Confirmation: Think of a resistance level like a locked door. You place your Buy Stop order on the other side of that door. If the price is strong enough to break the lock and move through, your order is automatically triggered, and you join the next powerful move. This means you are waiting for confirmation of the market’s strength. By placing the order just above the barrier, you ensure you only enter the trade if the price has enough momentum to break out, confirming the trend’s continued strength.

2. During News Releases and High Volatility

Why is Using a Buy Limit Risky in These Conditions?

During news events, price movements can be unpredictable, and support levels can be easily shattered. Using a Buy Limit in this environment is like trying to catch a falling knife; the price can accelerate downwards through your entry point, leading to significant losses. Therefore, its use is generally not recommended under these conditions.

Why is a Buy Stop Useful but Dangerous?

A Buy Stop can quickly get you into a sudden, strong move triggered by news. However, this comes with two major risks:

- Slippage: Due to the high speed of transactions, your order may be filled at a significantly worse price than you intended.

- False Breakout (or “Fakeout”): The price might momentarily spike, trigger your order, and then immediately reverse direction.

Remember that Buy Limit and Buy Stop are both buy orders, and their strategic logic applies to uptrends. To enter sell trades in a downtrend, you must use their counterparts: Sell Limit and Sell Stop orders.

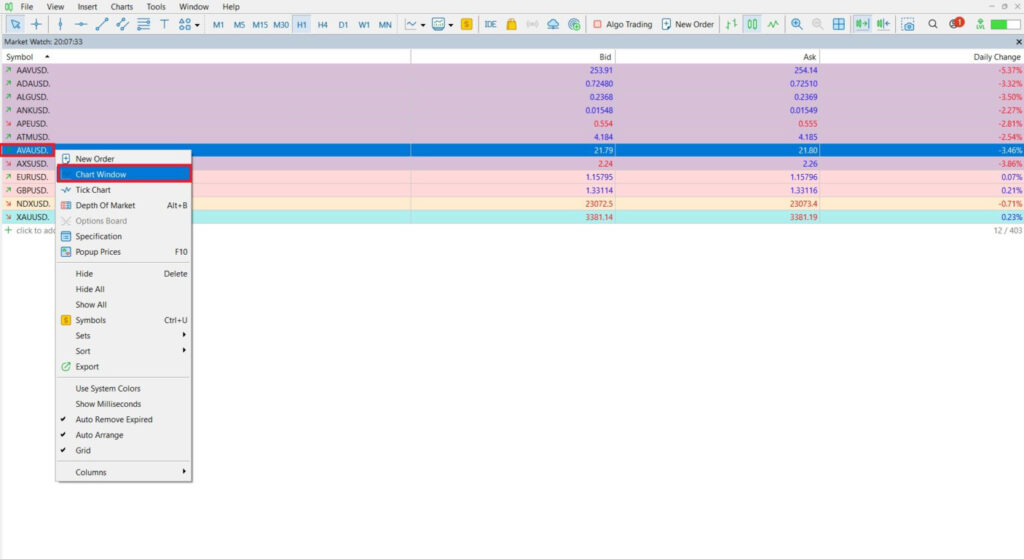

How to Place Pending Orders in MetaTrader

The process for placing pending orders like Buy Stop and Buy Limit is nearly identical in both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). The following is a step-by-step guide:

- Open the Chart for the Desired Instrument

First, open the Market Watch window and select the instrument you wish to trade (e.g., EUR/USD).

(Keyboard Shortcut: You can open the Market Watch window by pressing CTRL+M.)

- Next, right-click on the desired symbol within the Market Watch window and select ‘Chart Window’ from the pop-up menu to open its price chart.

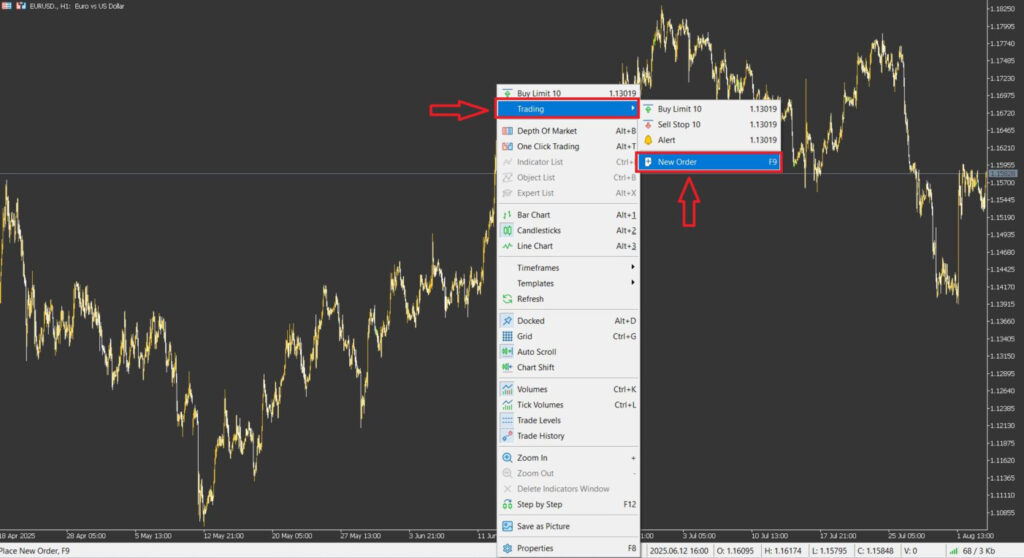

- Open the New Order Window

Right-click anywhere on the price chart, hover over the ‘Trading’ option in the context menu, and then select ‘New Order’.

(Shortcut: Alternatively, you can simply press the F9 key on your keyboard to open the New Order window directly.)

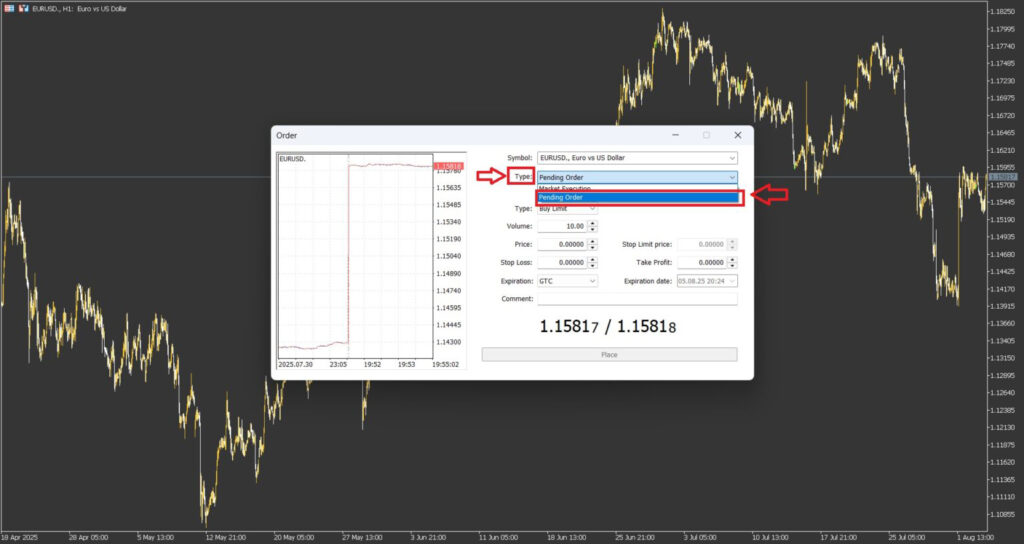

- Select the Pending Order Type

In the New Order window, locate the field labeled ‘Type’. Click the dropdown menu and change the selection from ‘Market Execution’ to ‘Pending Order’.

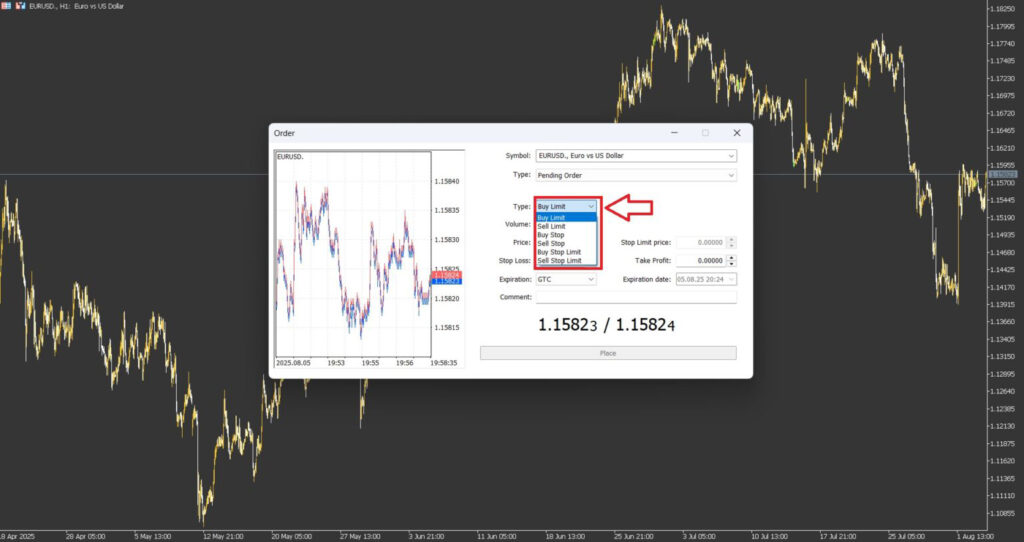

- Choose the Specific Order Type

A new dropdown menu will now appear. Based on your trading strategy, select the specific type of pending order you want to place. In this case, either ‘Buy Limit’ or ‘Buy Stop’.

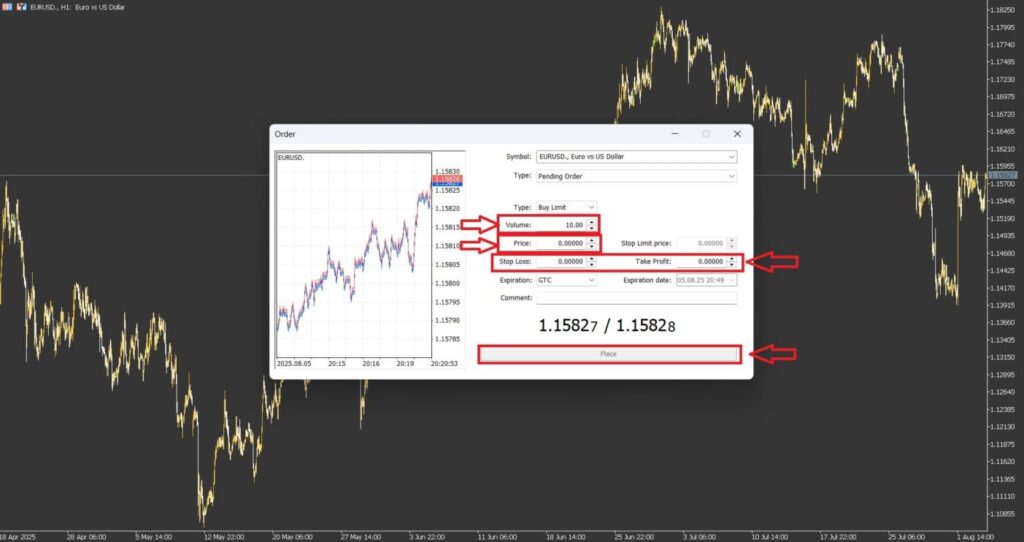

- Set the Entry Price

In the ‘Price’ field, enter the specific price at which you want your pending order to be triggered.

- Set the Position Size (Volume)

In the ‘Volume’ field, enter your desired trade size. This is typically measured in lots (e.g., 1.0, 0.1, etc.).

- Set Stop Loss (SL) and Take Profit (TP)

Optionally, you can set your risk management levels. Enter your desired price for the Stop Loss and Take Profit orders in their respective fields.

- Place the Order

Once you have entered all the required information and double-checked the details, click the ‘Place’ button to submit your pending order.

By following these steps, you can easily place various types of pending orders in MetaTrader.

7 Common Mistakes Traders Make When Using Buy Stop and Buy Limit Orders

While these orders are powerful tools, they can quickly turn into loss-making traps if used incorrectly. Here are seven common mistakes that traders, from novices to professionals, often make:

1. Choosing Weak and Unproven Levels

- The Mistake: Placing a Buy Limit order at the first visible support level, or setting a Buy Stop just above a minor, weak resistance.

- The Reality: Not all support and resistance levels are created equal. A weak level can easily break, putting your order in a losing position. Professional traders look for levels where the price has reacted multiple times in the past.

2. Ignoring False Breakouts (Fakeouts)

- The Mistake: Rushing to place a Buy Stop order just a few pips above a resistance level.

- The Reality: The market often executes a quick spike above a resistance level to trigger buy stop orders and hunt for liquidity. It then immediately reverses, trapping traders in a losing position. This false breakout is one of the most common reasons for losses in breakout strategies.

3. Forgetting or Neglecting to Set a Stop Loss

- The Mistake: Placing a pending order without a defined Stop Loss, assuming that “the price will surely reverse.”

- The Reality: This is the most fatal error a trader can make. The market has no obligation to reverse. A pending order without a Stop Loss is like writing the market a blank check and can quickly jeopardize your entire account.

4. The “Set and Forget” Trap

- The Mistake: A trader analyzes a level over the weekend and sets a Buy Limit order. On Monday, a major economic news release completely changes the market conditions, but the trader forgets to cancel or modify the pending order.

- The Reality: Market conditions are constantly changing. An order that seemed logical yesterday might be a dangerous trap today based on new information. Pending orders must be reviewed regularly.

5. Placing the Stop Loss Too Close

- The Mistake: Setting a Stop Loss extremely close to the entry point in an attempt to minimize risk.

- The Reality: This action, often driven by fear, can lead to being “stopped out” by normal market noise or minor fluctuations, only to then watch the price move in your analyzed direction. A Stop Loss should be placed at a logical level, outside the range of typical market volatility.

6. Ignoring the Spread

- The Mistake: A trader places a Buy Stop order at exactly 1.1500. They see the price candle on the chart reach 1.1499, yet their order is triggered.

- The Reality: Buy orders (like a Buy Stop) are triggered at the Ask price, which is always slightly higher than the price shown on the chart (the Bid price). Ignoring the spread, especially on pairs with a wide spread or during volatile times, can cause your order to be triggered prematurely.

7. Setting Orders in “No Man’s Land”

- The Mistake: Placing a Buy Limit or Buy Stop in the middle of a trading range, far from key support or resistance levels.

- The Reality: This offers no strategic advantage. Instead of being triggered by a valid technical signal, your order becomes a victim of random market noise and meaningless fluctuations. Pending orders should always be placed at critical market decision points.

Conclusion

Buy Limit and Buy Stop orders are powerful tools for the precise execution of trading strategies. Buy Limit is ideal for traders looking to buy an asset at a better price during pullbacks or reversals, while Buy Stop is for those who want to capitalize on market momentum following the breakout of key levels.

The intelligent choice between these two orders depends entirely on your strategy, market analysis, and risk tolerance, and it can have a significant impact on improving your trading results.