Have you ever entered a great trade with solid analysis, only to exit it with less profit than expected or even a loss? If so, you’re not alone. This is a common experience among traders, and the main reason is often poor management of open trades.

Especially in highly volatile markets, knowing how long to stay in a trade and when to exit can be the difference between a successful and an unsuccessful trader.

In this article, you’ll not only learn the concept of managing open trades, but also discover the techniques, tools, and psychological principles that underpin effective trade management—insights that can truly transform the way you trade in the Forex market.

- The most important factor in successfully managing open trades is sticking to a predefined plan and avoiding emotion-based decisions.

- Trade management software, daily checklists, and a trading journal can help traders maintain structure, make faster decisions, and improve accuracy.

- A professional trader must always be prepared to adjust or update their strategy based on new data, unexpected market events, or trend reversals.

What Is Open Trade Management and Why Is It Important?

Open trade management refers to the set of actions a trader takes after entering a position, with the goal of controlling risk, protecting profits, and avoiding unexpected losses. This process involves continuous market monitoring, analyzing technical and fundamental data, and adjusting trade parameters based on price movements and changing market conditions.

The importance of this concept lies in the fact that even the best analyses, especially in highly volatile markets such as Forex and cryptocurrencies, where conditions can quickly turn against a trader, can lead to losses without active management. Therefore, open trade management serves as both a defensive shield against market volatility and a strategic tool to capitalize on emerging opportunities.

Common Strategies for Managing Open Trades in Forex and Crypto

In highly volatile markets, professional traders use a combination of techniques to maintain a healthy balance between risk and reward. Open trade management strategies typically include tools such as stop-loss mechanisms, exit optimization, position sizing adjustments, and trend-following methods. The choice of the right approach depends on several factors, including the trader’s overall strategy, risk tolerance, and the type of asset being traded.

Below, we’ll look at some of the most common strategies for managing open trades, as highlighted by FasterCapital.

Using Stop-Loss Orders and Trailing Stops

A Stop-Loss order is an essential tool used to limit potential losses when the market moves against a trader’s position. In practice, if the price drops to a predetermined level, the trade automatically closes, preventing further loss beyond the set threshold.

Additionally, traders often employ a trailing stop-loss strategy. This technique involves adjusting the stop-loss level as market conditions change, effectively moving the exit point to a more optimal position. It is typically used when the price moves in the trader’s favor, allowing them to lock in profits or reduce exposure to risk while still keeping the position open to capture additional potential gains.

Setting Take-Profit Levels and Logical Exit Points

One of the most effective strategies for managing open trades is setting a Take-Profit (TP) level for each position. The Take-Profit is a predefined price level at which a trader closes the trade once the desired profit target is reached, thereby exiting the market automatically. When set correctly, it ensures that the trader secures a reasonable and achievable profit without relying on emotional decision-making.

Establishing appropriate Take-Profit levels and logical exit points requires a combination of technical analysis (such as identifying resistance zones and price patterns) and fundamental analysis, which involves trading based on major news releases or macroeconomic events. This strategy helps prevent excessive greed and ensures that profits are protected before the market reverses.

Trailing Stop Technique in Open Trades

A Trailing Stop is a dynamic tool used to protect profits by automatically moving the stop-loss level as the price moves in a favorable direction. This allows traders to lock in gains while still giving the trade room to grow as long as the trend continues.

Read more: Target Setting Tools in Tradingview

Adjusting Position Size Over Time

Position size adjustment refers to the process of increasing or decreasing the size of an open trade based on changing market conditions or modifications in the trader’s strategy. Reducing position size in uncertain conditions can help lower overall portfolio risk, while increasing it during a strong trend can maximize potential returns.

This technique requires precise capital management and strong emotional discipline to prevent impulsive or emotionally driven trading decisions.

Read More: Position Size calculator indicator

The Psychological Role in Managing Open Trades

Managing open trades is not merely a technical or analytical process — the trader’s psychology profoundly influences it. Fear, greed, and uncertainty are the three dominant psychological factors that can easily lead to poor decision-making.

For instance, the fear of losing profits may drive a trader to close a position too early, while greed for higher gains can cause them to stay in the market too long, ultimately leading to the loss of hard-earned profits. Successful traders minimize emotional interference by developing a well-defined trading plan and adhering to it strictly, making decisions based on data and logic rather than emotions.

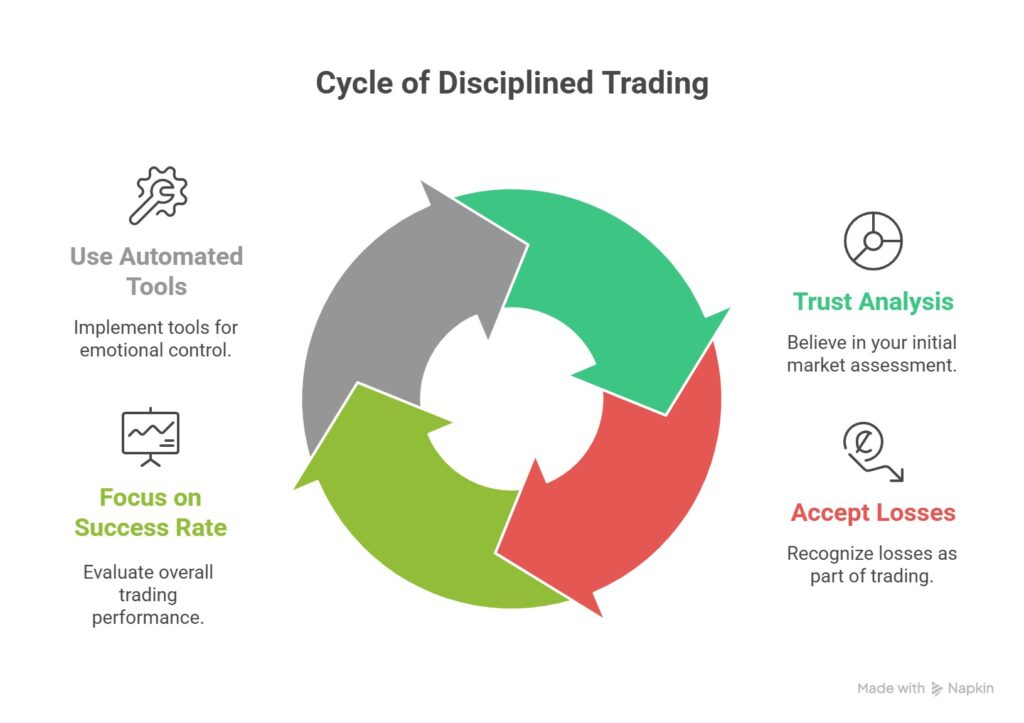

Some key psychological principles in managing open trades include:

- Trusting your initial analysis and avoiding impulsive or unplanned changes.

- Accepting losses as a natural and inevitable part of the trading process.

- Focusing on overall success rates rather than the outcome of a single trade.

Using automated tools such as stop-loss, take-profit, and trailing stop orders to reduce emotional bias and maintain discipline.

A key principle in the market states: the longer you keep your trades open, the greater your exposure to market risk becomes.

When Is the Best Time to Close an Open Trade?

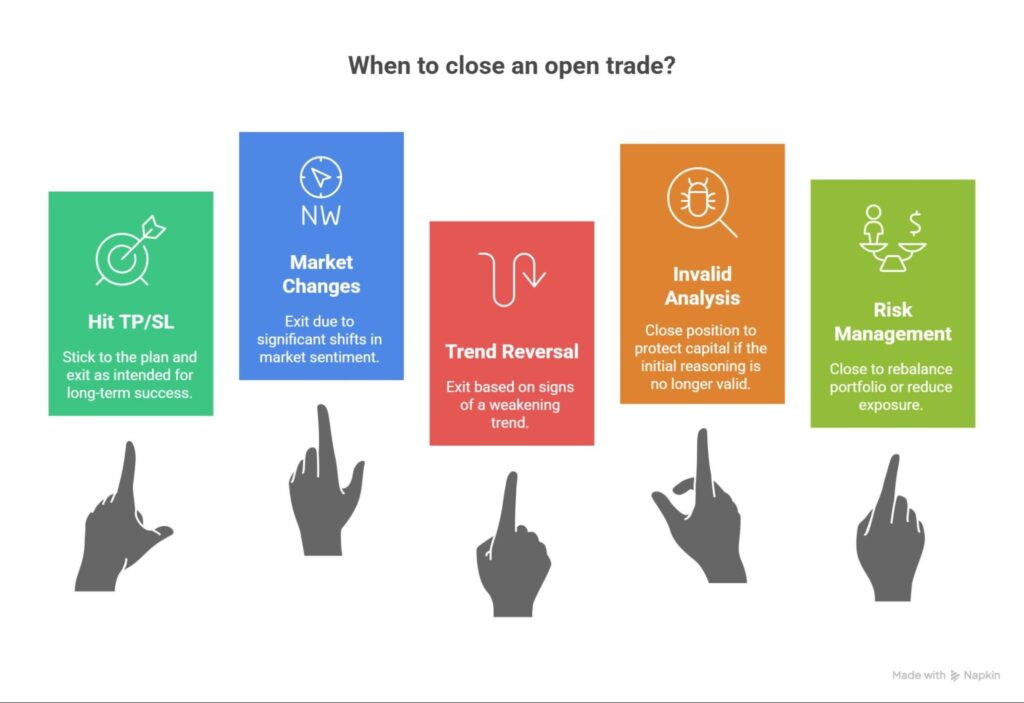

Closing an open trade is a crucial decision that can make the difference between profit and loss. The right time to exit a trade depends on several key factors:

- Reaching the predetermined Take-Profit or Stop-Loss levels:

If the price hits your Take Profit (TP) or Stop Loss (SL) levels, the best course of action is to stick to your plan and exit the trade as intended. Discipline in execution is vital for long-term success. - Changes in fundamental or technical market conditions:

Major economic news releases, shifts in monetary policy, or a breakout of key support or resistance levels can all signal a significant change in market sentiment—warranting an exit. - Signs of a trend reversal:

Clues such as reversal candlestick patterns, divergence in indicators, or declining trading volume may indicate a weakening trend and the possibility of a market turnaround. - Diminished validity of the initial analysis:

If the original reasoning behind your trade setup is no longer valid—regardless of whether the Stop Loss has been hit—it’s logical to close the position and protect your capital. - Portfolio risk management and capital preservation:

Sometimes, traders close positions not because of a faulty setup but to rebalance their portfolio, lock in profits, or reduce overall exposure to high-risk assets.

Common Mistakes in Managing Open Trades

Even experienced traders can make mistakes when managing open trades, and these errors can significantly impact their overall results. Such mistakes often stem from psychological factors, lack of discipline, or poor risk management practices. Recognizing and avoiding these pitfalls plays a crucial role in preserving profits and minimizing losses.

Moving the Stop Loss Without a Valid Reason

Although the Stop Loss (SL) is a critical tool for risk control, some traders, driven by fear or hope for a market reversal, move it without any logical justification. This behavior often leads to larger losses, as emotional decision-making replaces data-driven analysis.

Stop Loss adjustments should be made only when market conditions genuinely change or when there is a clear technical improvement in the trade setup, not merely to avoid a losing trade being closed.

Getting Mentally Locked into a Wrong Analysis

Sometimes, after opening a position, a trader becomes so attached to their initial analysis that they refuse to close the trade even when clear evidence contradicts it. This mistake, known as confirmation bias, can lead to missed opportunities and increased losses. A professional approach involves constantly reassessing your analysis in light of new data and adjusting your strategy if market conditions change.

As mentioned in an article on Babypips, if certain factors in your trading plan have changed but you still believe your analysis is valid, consider reducing your position size.

And if things are going better than expected, move your stop loss or take partial profits to secure gains.

If your position is in profit but market trading volume suddenly drops, it’s wise to secure a portion of your gains. A decline in volume can often signal that the market is approaching a correction phase or a potential fakeout.

Failing to Manage Position Size in Volatile Markets

Not adjusting position size according to market volatility is another common mistake among traders, particularly in highly volatile markets such as Forex or cryptocurrencies. Holding an overly large position during periods of sharp price fluctuations can significantly increase the overall portfolio risk and lead to substantial losses.

Conversely, reducing position size during high-risk conditions or increasing it when the market shows stronger directional confidence is a key element of professional open trade management.

| Common Mistake | Cause | Suggested Solution |

|---|---|---|

| Moving the Stop Loss Without a Valid Reason | Fear of closing a trade at a loss or hope for a price reversal | Stick to your original trading plan and adjust the stop loss only based on a new and valid market analysis |

| Getting Mentally Locked into a Wrong Analysis | Confirmation bias and refusal to admit error | Continuously reassess your analysis using updated market data and always have a backup trading scenario |

| Failing to Manage Position Size in Volatile Markets | Lack of awareness of market volatility or poor risk management | Use volatility indicators (such as ATR – Average True Range) and adjust position size based on current market conditions |

Supportive Tools for Professional Open Trade Management

Using supportive tools in open trade management can significantly enhance accuracy, speed, and trading discipline. These tools help traders distance themselves from emotional decision-making and operate based on structured, data-driven insights. Below are some of the most effective tools used by professional traders.

Using Trade Management Software

Trade Management software provides traders with the ability to manage their positions in an automated or semi-automated manner. These platforms offer powerful features such as automatic Stop Loss and Take Profit adjustments, Trailing Stop execution, multi-position management, and real-time alerts.

Popular examples include NinjaTrader, cTrader, MetaTrader, and TradingView, all of which are among the most widely used platforms for trade management. By leveraging such tools, traders can minimize human error, maintain consistency, and boost overall efficiency in their trading operations.

Daily Checklist for Reviewing Trade Status

A daily trading checklist helps traders systematically review their open positions and overall market conditions before and after each trading session. By following a structured routine, traders can maintain consistency, minimize emotional decisions, and improve overall performance.

A comprehensive daily checklist may include the following items:

- Reviewing key support and resistance levels;

- Going through the day’s major economic news releases;

- Assessing the performance of open trades;

- Ensuring that Stop Loss and Take Profit levels are correctly set and respected;

- Identifying new trading signals or potential trend reversals.

Adhering to a daily checklist strengthens trading discipline, fosters strategic thinking, and prevents impulsive or emotion-driven decisions in volatile market conditions.

In long-term open trades, always monitor the Swap rate; a strong profit can easily be eroded by just a few days of heavy negative swaps.

Recording and Reviewing a Trading Journal

A trading journal is a notebook or digital file where traders record all the details of their trades, including entry and exit times, traded instruments, position sizes, entry prices, and many other important data points.

Regularly reviewing this journal helps traders identify strengths and weaknesses in their strategies and uncover recurring behavioral patterns that may affect performance. Tools such as Excel spreadsheets or specialized journaling software can simplify the process of recording and analyzing data. However, even a simple notebook can serve as an effective trading journal if used consistently.

Conclusion

Managing open trades is the art of balancing risk and reward in the ever-changing and unpredictable environment of financial markets. It goes beyond trading techniques, requiring a blend of analytical knowledge, mental discipline, and the use of professional tools to achieve consistent success.