If you’re seeking a strategic way to profit from financial markets without requiring deep technical expertise or a significant time commitment, you’ve likely encountered two popular methods: PAMM accounts and Copy Trading. Both approaches allow you to entrust your capital to professional traders, but the key distinctions between them can fundamentally alter your investment journey.

In this article, we tackle the critical question: PAMM account or Copy Trading, which is the superior choice? By closely examining the structure, advantages, risks, and operational mechanics of both methods, we will help you make an informed decision aligned with your financial goals. If you’re looking for a hands-off investment approach in Forex or other financial markets, this comprehensive guide is essential reading.

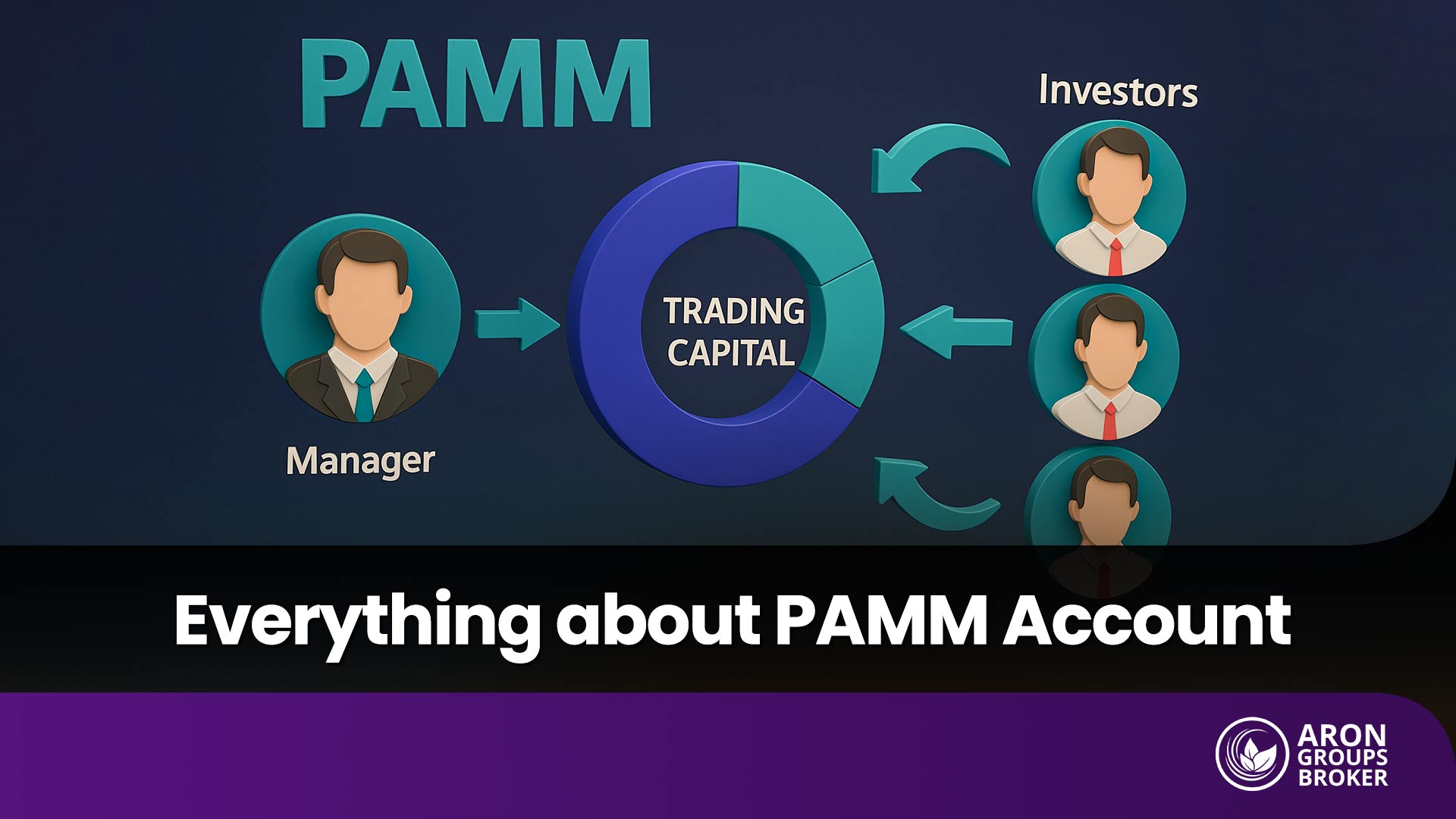

- A PAMM account is a Forex investment method where capital from multiple investors is pooled together and managed by a single professional trader.

- In a PAMM account, order execution priority may sometimes be set to favor the manager over the investors. In contrast, with Copy Trading, every order is executed specifically in the investor's name.

- Synchronization delays (slippage) in Copy Trading, especially during high market volatility, can lead to different execution prices compared to the master trader. This is generally more controlled within a PAMM system.

- Some brokers limit visibility into the PAMM manager's full risk details or open trades, whereas Copy Trading platforms often offer greater transparency.

What is a PAMM (Percent Allocation Management Module) Account?

PAMM stands for “Percent Allocation Management Module.” This system is an advanced type of investment account primarily offered by brokers in financial markets, such as Forex. Essentially, a PAMM account is a technical and contractual solution that allows a professional trader (Manager) to manage their own capital along with the pooled funds from multiple other investors within a single, unified account. The core concept of a PAMM account is “percent allocation.” This means that the profits or losses (P&L) resulting from trades executed by the Manager are distributed not as fixed amounts, but on a percentage basis, proportional to each individual’s (the Manager and the investors) share of the total account equity. This mechanism ensures that every investor, regardless of their capital size, shares in the profits and losses commensurate with their participation. To better understand how a PAMM account functions, we must be familiar with its three main pillars:- The PAMM Manager (or Master): An experienced trader with a defined strategy who is responsible for executing trades using the total funds in the PAMM account. The Manager typically invests their own capital into the account as well, demonstrating commitment and aligning their interests with those of the investors.

- Investors (or Followers): Individuals who wish to leverage the Manager’s expertise deposit their capital into the PAMM account. They do not trade directly; instead, they share in the trading results based on the pre-defined terms of the investment contract (the “Offer”).

- The Broker: The financial institution that provides the technical and software infrastructure for the PAMM system. The broker is responsible for managing funds, calculating and executing the precise percentage allocation of profits and losses, overseeing the investment agreement between the manager and investors, and providing performance reports.

How Does a PAMM Account Work?

As discussed previously, the PAMM account structure allows investors to share in the profits and losses of a professional trader by allocating a percentage of their capital to them. Within this framework, all management, execution, and settlement processes are handled automatically by the broker, requiring no direct intervention from the investor.

To join a PAMM account, investors must sign an investment agreement (often called an “Offer”) that outlines the terms of collaboration, such as the manager’s performance fee and the profit distribution method. This contract also typically defines the limitations on investor control (meaning they cannot interfere in trading activity). However, investors can monitor the account’s performance via the broker’s user interface. These portals provide transparent data, such as returns, open positions, and the manager’s historical performance, aiding investors in their selection process.

Brokers typically stipulate a minimum deposit to join a PAMM account, which can range from a few hundred to several thousand dollars. Compared to other Forex account types, such as Standard or ECN accounts, this system enables investors to participate in the market without requiring in-depth trading knowledge.

Some PAMM managers may use sub-accounts or obscured hedging strategies, masking the true risk profile from investors. Therefore, evaluating a manager’s drawdown history and consistency is far more critical than focusing on short-term profits.

How Profit and Loss (P&L) are Distributed in a PAMM Account

A PAMM account merges Forex investing with professional management, but understanding its P&L distribution is vital for investors. In this system, profits and losses are calculated and allocated based on each participant’s percentage stake in the pooled fund. This means every individual, including the Manager and the investors, shares in the trading results proportionally to their capital contribution. This method ensures that returns and risks are distributed equitably, but it relies on the PAMM account’s transparency to maintain investor confidence.

For a clearer explanation, assume a PAMM account with $15,000 in total capital is formed by four participants:

- PAMM Manager: $6,000 (40% share);

- Investor 1: $4,500 (30% share);

- Investor 2: $3,000 (20% share);

- Investor 3: $1,500 (10% share).

If the Manager generates a 30% profit during a trading period, the total profit will be $4,500. After deducting the Manager’s performance fee (e.g., 20% of the profit, which is $900), the remaining net profit of $3,600 is distributed as follows:

- Manager (Share + Fee): $1,440 (from 40% share) + $900 (fee);

- Investor 1 (30% share): $1,080;

- Investor 2 (20% share): $720;

- Investor 3 (10% share): $360.

Conversely, if the account incurs a 20% loss in the next period (a $3,000 loss), this loss is also distributed proportionally (note: performance fees are not paid on losses):

- Manager (40% share): $1,200 loss;

- Investor 1 (30% share): $900 loss;

- Investor 2 (20% share): $600 loss;

- Investor 3 (10% share): $300 loss.

Keep in mind that risk management is critical in a PAMM account. Tools like a stop-loss on the PAMM investment itself can prevent catastrophic losses. To mitigate risk, some brokers permit investors to define a maximum loss level for their investment. For instance, they might allow an investor to set a 30% loss ceiling. If the account’s drawdown causes the investor’s equity to hit this threshold, their investment is automatically liquidated from the PAMM to prevent further losses.

Is a PAMM Account Legal?

PAMM accounts are legal in many jurisdictions, particularly when offered by brokers licensed by reputable regulatory bodies such as the FCA (UK), CySEC (Cyprus), or ASIC (Australia). These organizations help secure investments by overseeing broker activities. However, in some countries, especially regions with less stringent financial oversight, PAMM-related fraud can occur. Therefore, to ensure the security of a PAMM account, selecting a credible, licensed broker is essential.

To mitigate these risks, investors should use brokers that perform thorough identity verification (KYC/AML) for their traders. Verifying a broker’s license through the official websites of regulatory bodies and reading user reviews can help identify reputable firms. Furthermore, ensure your chosen broker has transparent policies for managing PAMM accounts and protecting client funds.

Advantages and Disadvantages of a PAMM Account

A PAMM account offers a straightforward path to Forex investing without requiring personal trading expertise. However, like any investment vehicle, it has distinct advantages and disadvantages. We will explore these pros and cons to assist you in your decision-making process.

Advantages of a PAMM Account

- Profit Potential: Offers the potential for returns without requiring personal trading experience, leveraging professional management.

- Diversification: Provides the ability to allocate capital among multiple managers, mitigating PAMM-specific risk.

- Professional Management: Trades are executed by seasoned specialists, making it ideal for novices who lack market expertise.

Disadvantages of a PAMM Account

- Associated Risks: Poor performance by the manager can lead to significant investor losses.

- Additional Costs: Management and performance fees can erode net profitability.

- Lack of Direct Control: Investors have no direct input on trading decisions and must place their full trust in the manager’s strategy.

| Advantages | Disadvantages |

|---|---|

| Profit potential without trading expertise | Risks tied to the manager's performance |

| Investment diversification | PAMM-related costs (e.g., management fees) |

| Professional capital management | Lack of direct control over trading decisions |

| Saves time and effort | Potential for PAMM-related fraud |

| Access to diverse trading strategies | Requires thorough due diligence on traders and brokers |

A comparison with other investment methods reveals that PAMM accounts are a suitable option for individuals lacking the time or expertise for direct trading. Nonetheless, careful attention to PAMM risk and the implementation of sound money management principles are essential for risk mitigation.

The Best Broker for a PAMM Account

Selecting the best broker for a PAMM account is critical for investment success. Key criteria include holding valid licenses from reputable bodies, such as the FCA or CySEC, ensuring transparency in trade performance reporting, and providing robust technical support to resolve potential issues.

Well-known brokers such as FXOpen and Dukascopy are often highlighted for their user-friendly platforms and rigorous oversight systems. These brokers ensure transparency by providing detailed statistics on manager performance and full monitoring access, though the final choice depends on your specific needs.

The broker’s role in a PAMM account extends beyond merely providing a platform. They are responsible for the security of funds and preventing abuse. Reputable brokers maintain segregated client accounts and utilize advanced monitoring tools. Before committing, verify that the broker’s technical support is both responsive and effective.

What is the Difference Between PAMM, MAM, and LAMM Accounts?

PAMM, MAM, and LAMM accounts are all capital management tools that allow investors to participate in financial markets without needing direct trading expertise. However, they have key differences in how they distribute profits and losses (P&L), the level of investor control, and their management structure.

In a PAMM (Percent Allocation Management Module) account, investors allocate their capital to a professional trader, and P&L is calculated based on each individual’s percentage (pro-rata) share of the total equity.

- Example: Assume you invest $10,000 in a PAMM account. The manager’s total fund is $100,000, meaning your capital represents 10% of the pool. If the manager generates a 10% profit ($10,000), you receive 10% of that profit, which is $1,000. In this system, P&L is distributed proportionally based on each investor’s stake.

A MAM (Multi-Account Manager) account allows a manager to handle multiple investor accounts simultaneously, often with greater flexibility, such as applying different strategies or risk parameters to different sub-accounts. P&L is then calculated separately for each investor.

- Example: Now, assume you are in a MAM system with $5,000 invested, while the manager oversees $50,000 total from investors. In this system, different strategies might be applied to individual investors. If you request a strategy that is separate from the master strategy, your results can be calculated independently.

A LAMM (Lot Allocation Management Module) account also allows a professional manager to execute trades, but it differs in its allocation of trade volume. Each investor receives a specific trade volume (lot size) based on their settings, not necessarily their equity percentage.

- Example: In a LAMM account, the manager might be trading $20,000, and you have $5,000. In this structure, your trade volume could be set to 25% of the manager’s total volume, and your profit or loss is allocated proportionally to that volume.

PAMM is ideal for beginners seeking a passive investment; MAM is suited for investors with more experience who desire limited control; and LAMM is often for high-capital individuals who want to manage risk using precise lot allocations.

Therefore, the choice between these three account types depends on the investor’s specific needs, desired level of control, and risk management preferences.

The following table provides a clear comparison:

| Feature | PAMM Account | MAM Account | LAMM Account |

|---|---|---|---|

| Structure | Pooled (Single Fund) | Hybrid (Separate Accounts) | Separate (Trade Copying) |

| Investor Control | Low (No interference in trades) | Medium (Can modify settings) | High (Selects lot size) |

| P&L Distribution | By % Equity Share | By % or Custom Settings | By Fixed Lot Size |

| Risk Level | Medium (Manager-dependent) | High (Due to flexibility) | Variable (Depends on lot selection) |

What is Copy Trading and How Does It Work?

Copy Trading is an innovative investment method that allows users to automatically duplicate the trades of experienced traders in real-time. This method is a component of “Social Trading,” a broader concept where investors interact, share strategies, and learn from the performance of others via specialized platforms.

Unlike a PAMM account, where capital is pooled and entrusted to a manager, in Copy Trading, you retain full control of your capital within your own personal account. You are simply “following” and executing the same strategies as the successful traders you choose. This provides an accessible entry point into the financial markets, especially for beginners who lack trading knowledge.

The Difference Between Automated and Manual Copy Trading

Automated Copy Trading refers to a system where the trades of professional traders are duplicated in an investor’s account automatically, without any manual intervention. This approach is ideal for beginners as it does not require in-depth market knowledge or a significant time commitment for analysis. With Automated Copy Trading, trades are executed instantly with high speed and precision, which reduces the potential for human error. Compared to a PAMM account, where capital is entrusted to a manager, this method offers the investor greater control, as they can select which traders to follow and can stop copying at any time.

Conversely, Manual Copy Trading allows investors to observe the trades of others and then manually decide which ones to replicate. This method is better suited for experienced traders who want granular control over their strategy and wish to align copied trades with their own personal analysis.

However, manual copying can be slower, as it requires active decision-making, and there is a greater risk of error in trade selection or timing. Compared to PAMM, both forms of copy trading offer more flexibility, but Manual Copy Trading demands a higher level of experience.

In terms of speed, automated copy trading has the edge due to instant execution. In contrast, manual copy trading offers greater precision in selecting which specific trades to execute. If you are a beginner or have limited time, automated copy trading is more appropriate. However, if you are an experienced trader and want to customize your trades, manual copy trading is the superior option.

In Copy Trading, if your account size or leverage does not align with the master trader's account, your profit and loss (P&L) ratios may differ significantly. Always review and configure your account's technical settings before you begin.

How Profit and Loss (P&L) is Distributed in Copy Trading

In Copy Trading, P&L distribution is proportional to the Master Trader’s performance. Whenever the Master Trader enters a position, that same trade is executed in the followers’ accounts, typically at a proportional ratio. Thus, if the trader profits, investors profit in proportion to their allocated capital; if the trader incurs a loss, investors lose by that same proportion.

For example, if you allocate $1,000 to copy a trader who then makes a 20% profit, $200 is added to your account. Conversely, a 20% loss would result in a $200 loss. This transparency makes Copy Trading appealing, but diligent risk analysis is essential to prevent significant losses.

It is crucial to note that platforms use different models to calculate commissions and fees. For instance, the Master Trader typically receives a percentage of the investor’s net profit, known as a Performance Fee. This fee usually ranges from 10% to 30% and is only applied to profitable returns. Furthermore, some brokers or platforms deduct ancillary costs from the copier’s account, such as monthly subscription fees, wider spreads, or even withdrawal fees.

Therefore, before committing to copy trading, a thorough review of the fee structure and P&L terms is essential to gain a clear understanding of your potential net returns and associated costs.

To mitigate risk, tools such as setting a lower leverage (e.g., 1:5) can help limit potential losses. In comparison to a PAMM account, Copy Trading offers greater flexibility, as you can switch or stop following a trader at any time; however, it requires more active monitoring.

Advantages and Disadvantages of Copy Trading

Copy trading is one of the most popular methods for entering the financial markets, allowing investors to duplicate the trades of professionals, either automatically or manually. While this approach is particularly suitable for newcomers, like any financial instrument, it carries its own specific advantages and disadvantages.

Advantages of Copy Trading

- Flexibility: Users can change the trader they are following or stop their investment at any time, free from the structural limitations found in methods like PAMM accounts.

- Learn While Investing: By following the trading strategies of successful traders, investors have the opportunity for practical, hands-on learning and experience.

- Greater Control: Unlike a PAMM account, where capital is transferred to a pooled fund, in copy trading, the capital remains in the investor’s personal account, giving them complete authority over it.

Disadvantages of Copy Trading

- Dependence on the Trader: The account’s performance is directly tied to the ability of the selected trader. If the trader incurs a loss, the investor also loses.

- Monitoring Required for Manual Copying: In non-automated versions, the investor must dedicate more time to reviewing signals and executing trades.

- Risk of Poor Selection: Relying solely on a trader’s past profit chart while ignoring other key metrics increases the probability of making a poor choice and suffering losses.

The following table summarizes these advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Flexibility to select and switch traders | Complete dependence on the trader's performance |

| Simultaneous learning while investing | Requires monitoring (in manual copy trading) |

| Greater control over capital and trades | Risk of poor selection based on superficial history |

| No need to transfer capital to a pooled account | Requires more mental engagement than a PAMM account |

PAMM vs. Copy Trading: Understanding the Key Differences

To choose between a PAMM account and Copy Trading, understanding their fundamental differences is critical. Below, we examine three important aspects of these distinctions.

1. Difference in Management Structure and Level of Control

In a PAMM account, management is centralized under a single manager. Investors pool their capital into a joint account and have no direct involvement or interference in the trading process. This model is ideal for individuals who lack trading expertise or prefer to delegate all decision-making to a professional.

In contrast, with Copy Trading, the investor retains greater control. They can decide which traders to follow, how much capital to allocate to each, and can stop the process or switch traders at any moment. This structure offers significantly more flexibility but also demands greater personal oversight.

This difference in control is an advantage for some and a disadvantage for others. If an investor seeks simplicity and complete delegation, a PAMM account is a more “hands-off” option. However, if they prefer active management and continuous monitoring, Copy Trading will be more appealing.

2. Difference in Profitability Models and Risk Exposure

In the PAMM model, profits and losses (P&L) are distributed based on each investor’s pro-rata (percentage) participation in the total fund. Therefore, if the entire account profits or loses, each individual is impacted proportionally to their share. This method is transparent, and risk is managed collectively for the entire fund.

In Copy Trading, however, P&L is a direct reflection of the trader’s performance on your allocated capital. If a trader opens a position, that trade is duplicated in the investor’s account. This means the specific risks of that trader’s strategy (e.g., opening a high-lot position) are transferred directly to your account.

In a PAMM account, risk parameters like a maximum drawdown (stop-loss) are often set at the fund level by the manager or broker to prevent catastrophic losses. In Copy Trading, such limits are entirely dependent on your personal settings. This necessitates a precise understanding of risk management rules and the trader’s methodology.

3. Comparison of Fee Structures and Transparency

In a PAMM account, compensation is typically a performance fee (a percentage of profits) paid to the manager. This model aligns the interests of the investor and the manager, as the manager only earns income on profitability.

Conversely, Copy Trading fees might include monthly subscriptions or commissions, which, in some cases, may be charged regardless of performance (profit or loss).

Regarding transparency, both methods provide detailed performance data. However, PAMM accounts generally offer more comprehensive reports on P&L, maximum drawdown, and overall rate of return, allowing the investor to conduct a more thorough analysis.

Conclusion

The answer to whether a PAMM account or Copy Trading is better depends entirely on your priorities, risk tolerance, and investment expectations.

If you are seeking a structured, transparent, and hands-off (non-interferable) method, a PAMM account may be the more suitable choice. Your capital is managed holistically by a professional, and performance is based on the entire pooled fund.

However, if you prefer to have greater control over your portfolio, the selection of traders, and the ability to stop or switch investments instantly, Copy Trading’s high flexibility makes it the appropriate option for you.

The most critical step is to define your capital, time horizon, acceptable risk level, and market understanding before you begin. In your investment journey, the tools are important, but the wisdom in selecting the right tool is paramount.