Those who are fascinated with the idea of trading and Forex assume that the only way to make money out of Forex is a trade, but that’s not true. Trading is an exciting and lucrative way of getting familiar with Forex, but if you are down to this area and you want to make money using other financial professionals. Forex is the largest currency marketplace, which is open 24/7 and considered one of the most liquid markets in the world.

Forex is a risky business, and you need to have a high degree of skill, discipline and training to be a successful trader.

But what if you don’t want to participate in training and benefit from Forex? There are possibilities for non-traders to get involved in the market through other channels. Market research, account management, regulation, and software development are just a few Forex carriers you can think of. In the following, we will introduce five forex carriers that can be considered.

Table of Contents

Forex Markets

As mentioned above, the following small group is open 24 hours a day, five days a week, which provides you with strange work hours and different possibilities. In order to be successful in Forex, you need to have a great knowledge of regulations and transactions.

For those who know a foreign language and are familiar with Forex terminology and complexity, immigration is much simpler. So, if you know German, French, Arabic, Russian, Spanish, Korean, Mandarin, and Japanese, you might be able to find perfect positions in any country. As different countries might use different terminology to refer to the same job, we try to include different names for each career in the following.

1.Forex market analyst / Currency researcher / Currency strategist / certified financial analyst (CFA)

A Forex Market analyst, who might be known as a currency researcher, currencies strategist, or certified financial analyst, works for brokerage firms to research and analyze the market. This person will analyze the political and social issues on currency values Using Technical and fundamental analysis. These people help traders to keep pace with the fast-paced Forex Market.

Professional and amateur trader’s benefit from a farmer’s market analyst’s advice. The analyst can also conduct conferences and webinars to make more money out of his knowledge. In order to be a successful analyst, you need to establish yourself as a trustworthy source of Forex data. It is helpful to have a bachelor’s degree in economics, Finance or similar majors. On the other hand, a perfect analyst has a great knowledge of economics and international affairs with good communication and presentation skills.

read more: Trading platforms

2.Forex Account Manager/Professional Trader/Institutional Trader

Those who have been consistently profitable trading Forex can become a Forex account manager. Every currency mutual fund and hedge fund is in need of professional managers who have a great deal of experience trading forex and can make buy and sell decisions.

Market makers, including central banks and multinational corporations, are in need of a perfect Voice account manager to hedge against foreign currency value fluctuations. As an institutional trader, you can also work with individuals, make trading decisions, and execute trades based on your client’s goal and risk tolerance.

You need to present yourself as a trust for C Trader to acquire Traders Trust. You are responsible for a large amount of money, and you should be able to handle the funds perfectly.

You might be required to have experience using a specific trading platform. A Forex account manager is a professional trader who is effective in commodities, options, derivatives, and other financial instruments.

3.Forex Industry Regulator

As a Forex industry regular, you will be trying to prevent fraud in the industry, and you might be performing multiple roles. As a regulator, you need to hire different types of professionals, and you must countries operate in public. Government regulators and brokers are in need of hiring attorneys, auditors, economists, futures trading specialists, and management professionals as another child healing shows the compliance of Trades with regulations. As an economist, you are required to study the impact of rules on Forex.

As a future trading specialist, you will handle investigating alleged fraud and violations.

4.Forex Exchange Operations, Trade Audit Associate and Exchange Operations Manager

Forex brokers are in need of professional traders to service accounts. The next change operator will be in charge of processing new customer accounts, verifying the identities, processing customers, withdrawals, transfers and deposits and providing customer support. As the 4X exchange operator, you need to have a perfect understanding of financial markets and instruments and have high problem-solving and analytical skills.

5.Forex Software Developer

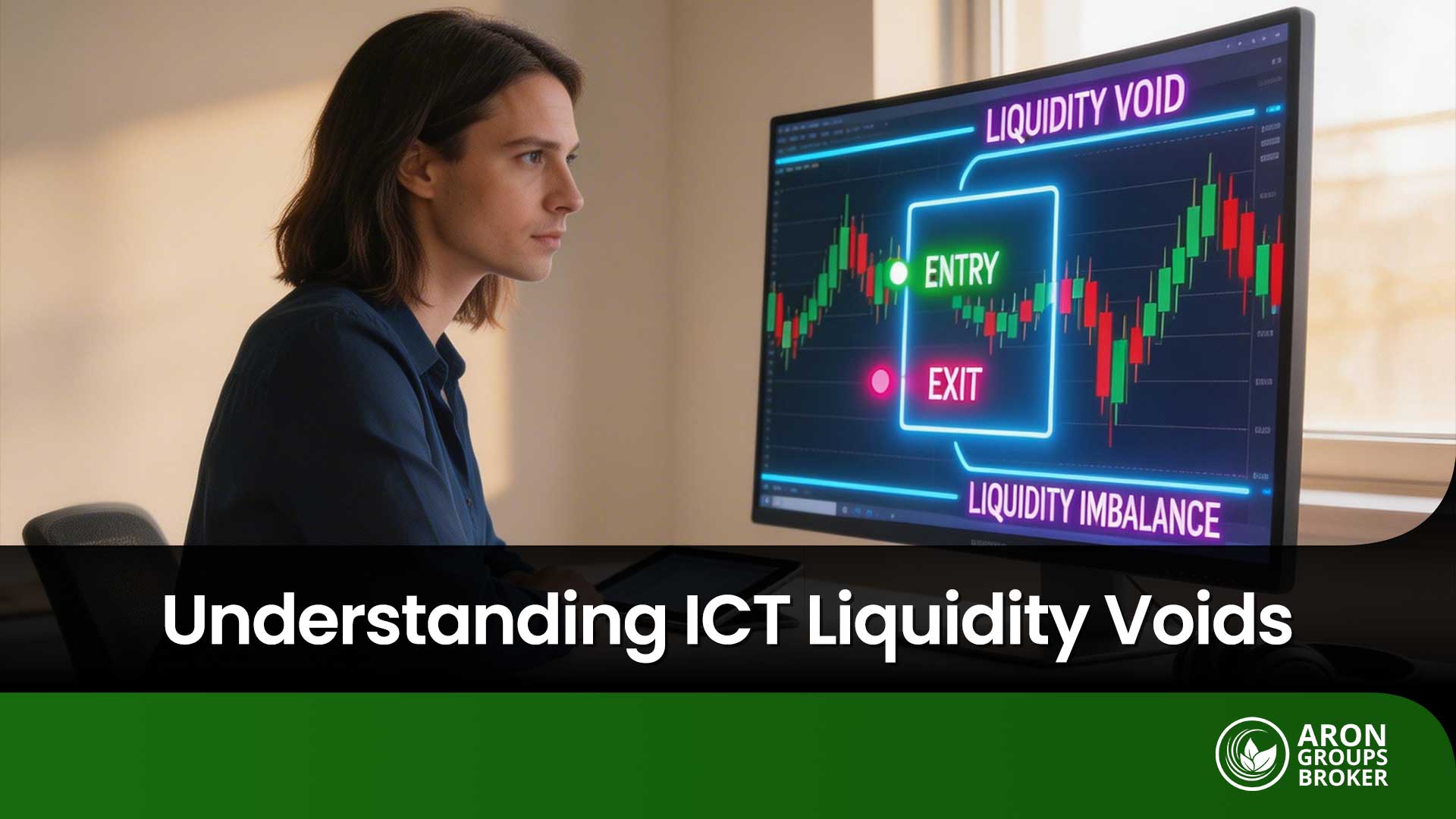

There are many software and platforms for trading forex. Traders are in need of trading platforms that provide the market with charts and indicators. Forex software is perfect for analyzing the market. In order to be successful in trading forex, you need to have a great knowledge of computers and other operating systems.

Besides, you need to have a knowledge of programming languages such as SQL, Python, and Ruby.

As a developer, you are not required to have financial trading experience. Although knowledge and experience in this field are a major advantage, they are not necessary.

Having access to trading platforms is vital for traders. Time is gold, and losing precious moments will result in failure. If you have experience in user-experience design, web development, and network and systems administration, you can start a career by developing forex software.

Jobs that do not trade

Aside from the specialized career we have talked about so far, Forex Brokers and companies are in need of professional Traders to fill human resources and accounting positions.

If you are attracted to Forex but not familiar with Forex Trading and don’t have the background or experience, you can participate in a general business position. Many Forex Brokers offer internships and help you learn more about the market.

Power excitement is a serious business. In order to be successful in it, you should have realistic expectations and a strategy.

The bottom line

Trading in Forex is not the only way to participate in the market and make money. RX is a lucrative business that provides you with numerous positions. If you don’t have to be a trader, you can make money by analyzing financials, working for a broker or a regulator, or trying to develop trading software.

It is interesting to know that you don’t have to have a background and experience in Forex to benefit from Forex careers; there are positions that do not require you to have trading experience, but being familiar with Forex would be an advantage. So, no matter how experienced you are, try to feel the market using a demo account before applying for Forex careers and positions.