EN

EN

Forex

-

Master Overleveraging in Trading: Risks, Real Examples, and Smart Strategies

17 February 2026 , Abe Cofnas

In global markets, leverage is a powerful multiplier that allows traders to control large positions with minimal capital. However, over leveraging in trading occurs the moment a position size exceeds the account’s ability to absorb normal price swings. When exposure outpaces equity, leverage shifts from a growth tool to a primary financial threat. Mastering the […]

- Read more

-

Validate Your Trading Edge with Out-of-Sample Backtesting

16 February 2026 , Abe Cofnas

Most trading strategies look great on past data until you trade them live, when they fail out of sample backtesting fixes that by testing your strategy on unseen data. If it performs well there, too, your edge is more likely to be real.Whether you trade Forex, stocks, gold, or crypto, understanding how out of sample […]

- Read more

-

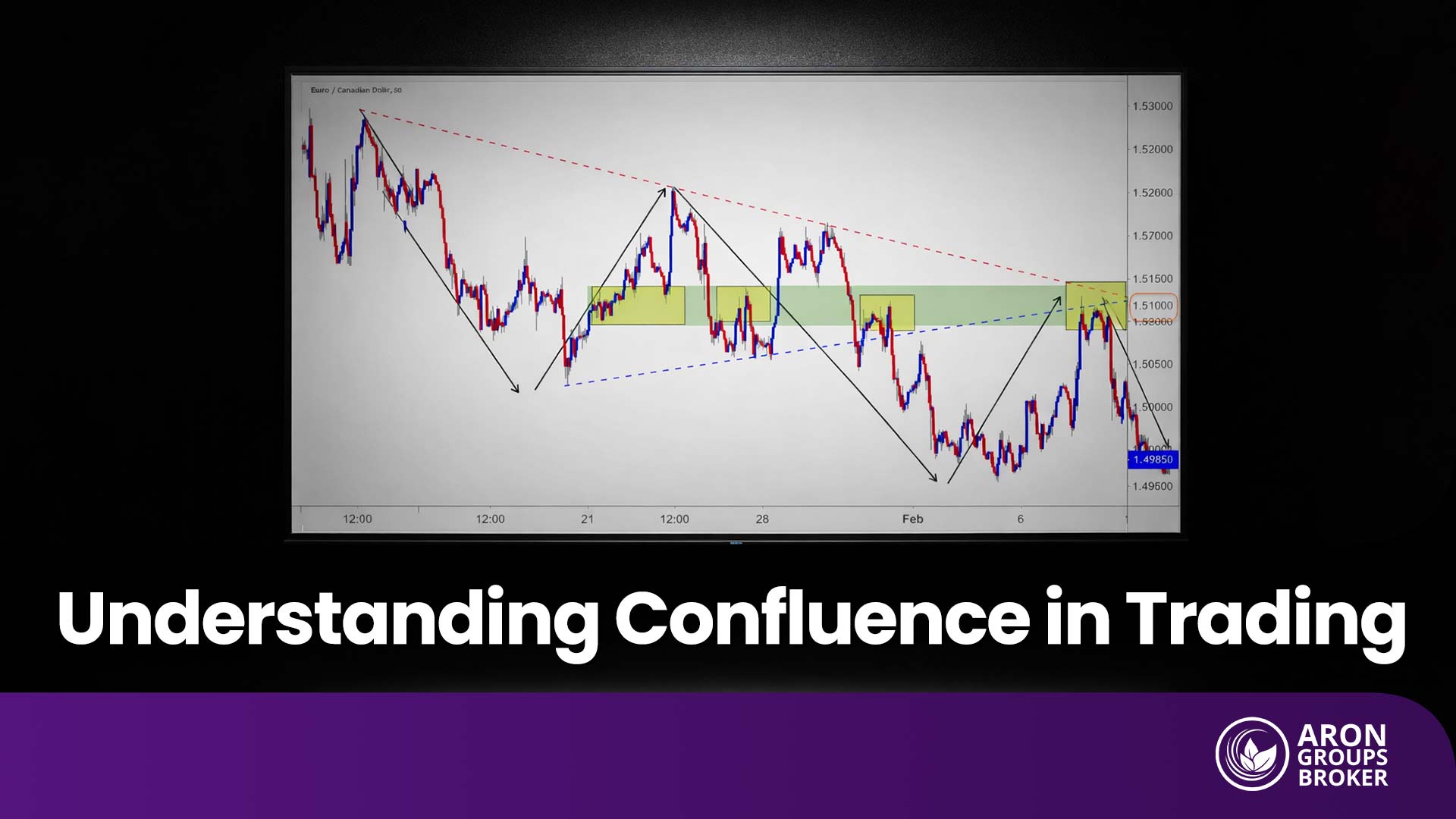

Mastering Confluence in Trading: How to Spot High-Probability Setups

15 February 2026 , Abe Cofnas

Confluence in trading is the point at which multiple, independent factors (such as technical indicators, market structure, and fundamental bias) align to confirm a specific trade idea. It moves a trader from relying on “hope” or single signals to relying on the “weight of evidence.” In this guide, we will break down how to apply […]

- Read more

-

How to Read and Trade the Market Facilitation Index (MFI) Like a Pro

14 February 2026 , Abe Cofnas

Most traders treat the Market Facilitation Index like a traffic light, green means go, red means stop. That’s exactly why they lose money with it. MFI doesn’t tell you when to trade. It tells you whether the market is actually doing anything useful with the price move you’re watching. A breakout might look perfect on […]

- Read more

-

Overfitting in Trading Systems: Impact on Backtests and Strategy Reliability

14 February 2026 , Abe Cofnas

The backtest results are deceptive. For example, in back-test results, the trading strategy looks perfect on historical data and yet the reality is quite different. If trading conditions are not right for a strategy, it can break down exceedingly quickly. Especially the case in forex and crypto, where spreads are widening, liquidity changes hands all […]

- Read more

-

Market Regime Trading: How to Identify, Classify, and Trade Different Market Conditions

12 February 2026 , Abe Cofnas

Trading performance is rarely determined solely by the design of a strategy. The same setup can produce stable returns in one environment and persistent losses in another, despite being executed with identical rules; what changes is not the signal, but the market conditions surrounding it. Market regime trading focuses on aligning decisions with those conditions. […]

- Read more

-

Your 2026 Guide to Hulu: Investment Routes and Stock Insights

12 February 2026 , Abe Cofnas

Many people searching for how to invest in Hulu in 2026 assume it’s as simple as a ticker search. It isn’t. Hulu is a major U.S. streaming platform known for on-demand TV, originals, and live TV options—but it doesn’t trade as a standalone stock. There is no Hulu ticker symbol, and Hulu is not publicly […]

- Read more

-

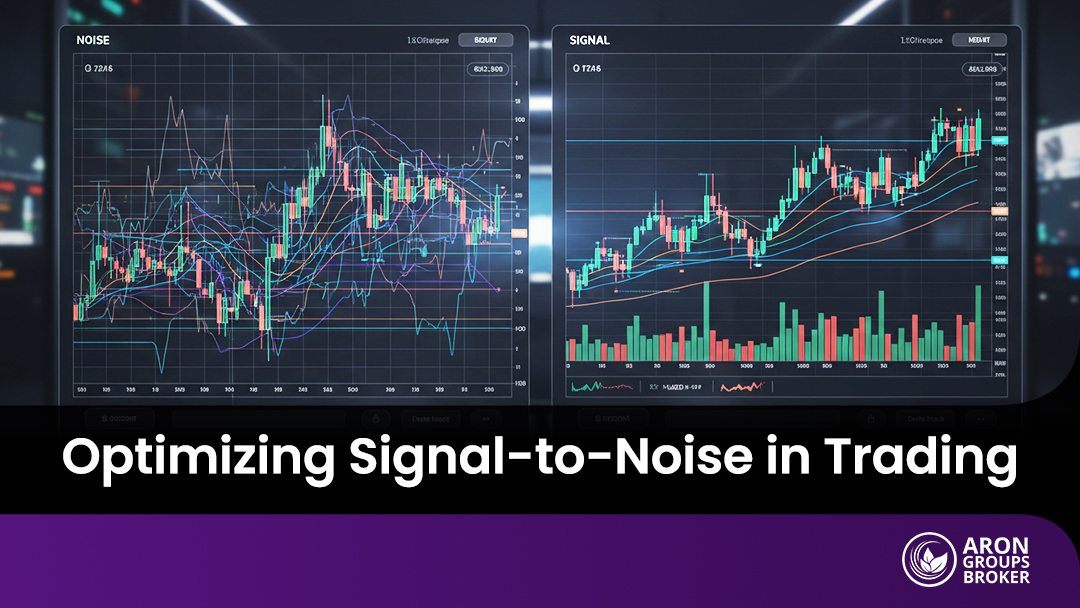

Trading with Confidence: Harnessing Signal-to-Noise Ratio for Better Decisions

12 February 2026 , Abe Cofnas

Many traders have seen a clean setup fail for no clear reason. Often, the issue is signal to noise ratio, meaning how much real information is inside the price moves. When market noise is high, even good ideas can turn into false trading signals. A simple signal to noise ratio approach helps you judge whether […]

- Read more

-

Complete Guide to Walk Forward Optimisation in Trading Strategy Development

12 February 2026 , Abe Cofnas

Most trading strategies don’t fail because the rules are “bad.” They fail because the parameters go stale, and the backtest is quietly curve-fitted to a single historical mode. Walk Forward Optimisation (WFO) fixes that by forcing your system to earn its keep through repeated out-of-sample tests, not a single flattering all-history report. If you want […]

- Read more

-

Equity Curve Trading Strategy Explained: Meaning, Drawdown Control, and Practical Techniques

12 February 2026 , Abe Cofnas

An equity curve trading strategy helps traders track performance trends and make smarter risk decisions over time. Instead of focusing only on entries, it highlights drawdowns, recovery strength, and consistency across changing market conditions. In Forex and other markets, an equity curve can reveal when to reduce exposure and protect capital before losses compound. If […]

- Read more