EN

EN

EURO USD INDEX

Trade the world’s most popular currency pair and seize the best opportunities in the forex market.

-

HeadlineTechnical and Fundamental Analysis of the EUR/USD Pair Introduction to the EUR/USD Currency Pair The Importance of the EUR/USD Pair in the Forex Market Factors Influencing the EUR/USD Exchange Rate The Role of the European Central Bank and the Federal Reserve in the EUR/USD Exchange Rate Common Trading Strategies for EUR/USD Comparison of EUR/USD with Other Major Currency Pairs Historical Volatility of the EUR/USD Pair Key Points for EUR/USD Traders Final Recommendations for Successful EUR/USD Trading

Technical and Fundamental Analysis of the EUR/USD Pair

NOVEMBER 1, 2024

In this section, we provide the latest fundamental and technical analysis of the EUR/USD currency pair. Reviewing the following sections will help you gain a deeper understanding of the current analysis, enabling you to use it more effectively in your trading.

The euro is set to face Thursday’s inflation results, coming off strong performances from the Eurozone and Germany’s GDP—Germany being the economic heart of the region. Additionally, Germany’s higher-than-expected inflation figures have further bolstered the euro. Investors are now eagerly awaiting Thursday’s release of October’s Consumer Price Index (CPI) results. If these results confirm inflation persistence, we may see further growth in the EUR/USD pair.

On the other hand, the EUR/USD pair is also closely watching the busy economic days ahead in the United States. Upcoming PCE data, the controversial NFT report, employment numbers, the preliminary Q3 GDP estimate, performances of tech giants, oil majors, and election buzz are all shaping up to be eventful for the dollar and, consequently, the EUR/USD pair. Strong employment and inflation data, better-than-expected economic growth, Trump’s continued lead, and strong performances from mega-cap tech and oil stars could accelerate a dollar rally, putting additional selling pressure on EUR/USD.

From a technical perspective, the range between 1.07885 and 1.08630 is considered an important support zone for EUR/USD, which may slow down the pair’s momentum. If EUR/USD manages to hold above 1.08630, its next targets are 1.09011 and 1.09320. However, if it stabilizes below 1.07885, selling pressure could push it down to at least 1.07464 and 1.07316.

Introduction to the EUR/USD Currency Pair

The EUR/USD currency pair represents the value of the euro in comparison to the US dollar. This pair shows how many US dollars are needed to purchase one euro. For example, if this pair is trading at a rate of 1.70, it means that 1.70 US dollars are required to buy one euro.

Informally known as “Fibre,” the EUR/USD pair was introduced in 1999 when the euro replaced several European national currencies. The initial value of the euro against the dollar was based on the European Currency Unit, a symbolic currency tied to a basket of various European currencies. It is not mandatory for all European Union countries to adopt the euro; as of 2021, only 19 of the 27 EU member countries had accepted the euro as their official currency.

The Importance of the EUR/USD Pair in the Forex Market

The EUR/USD currency pair holds particular significance in global markets, including forex, as a symbol of the competitive economic relationship between the United States and Europe. Given that the US and Europe are two of the world’s largest economic regions, the EUR/USD pair is the most traded currency pair globally, attracting attention from a wide range of traders and investors, from retail participants to major institutions.

Factors Influencing the EUR/USD Exchange Rate

Any factor that affects the value of the euro and the US dollar relative to each other and to other currencies will impact the value of this pair. Influential elements include interest rate differentials between the European Central Bank (ECB) and the Federal Reserve (Fed), positive or negative news about the EU or US economies, news regarding government debt crises, monetary policies such as quantitative easing, migration programs, and more—all of which influence the EUR/USD pair.

For example, when the US aggressively pursued a bond-buying program, the European Central Bank refrained from implementing quantitative easing policies for several years. This led traders to favor buying the euro, strengthening it against the dollar. This trend continued until the Greek debt issue reached a critical point in October 2009, causing the euro’s value against the dollar to decline, as the ECB launched its quantitative easing program in January 2015.

Another example occurred in 2022 when the EUR/USD pair fell below 1.00 for the first time in history. This was due to rising interest rates in the US, which increased the dollar’s value, while the Ukraine war and the ensuing energy crisis placed severe pressure on the European economy.

The Role of the European Central Bank and the Federal Reserve in the EUR/USD Exchange Rate

The European Central Bank (ECB) and the Federal Reserve (Fed) play a fundamental role in determining the EUR/USD exchange rate, as their monetary policies directly impact the value of the euro and the dollar. For instance, when the Fed raises interest rates, investors tend to prefer the dollar over the euro due to higher returns, leading to an increase in the dollar’s value and a decrease in the EUR/USD rate. Conversely, if the ECB raises interest rates or reduces supportive policies like quantitative easing (QE), demand for the euro increases, causing the EUR/USD rate to rise.

Common Trading Strategies for EUR/USD

Scalpers hold their trades for a short period, usually only a few minutes

In this style, trades are held for several hours throughout the day and are closed by the end of the trading day

Swing traders aim to follow a weekly or monthly trend. They open trades when a clear trend is observed. However, this style is less common for EUR/USD compared to the previous two.

Comparison of EUR/USD with Other Major Currency Pairs

High trading volumes, strong liquidity, and solid economic backing are common traits among the major forex pairs, including GBP/USD (pound to dollar), USD/JPY (dollar to Japanese yen), and AUD/USD (Australian dollar to US dollar).

However, comparing their differences, the EUR/USD generally shows less volatility than the GBP/USD, as the Eurozone and US economies are closer in terms of economic stability. In contrast, GBP/USD may experience higher fluctuations due to political and economic events in the UK, such as Brexit.

The USD/JPY pair also experiences significant volatility due to the large differences in monetary policies between the Bank of Japan and the Federal Reserve. Japan’s low interest rates and expansionary policies often make USD/JPY a tool for carry trade strategies, benefiting from interest rate differentials—a feature rarely seen in EUR/USD due to smaller interest rate differences.

Additionally, the AUD/USD is heavily influenced by commodity prices and economic developments in China, as Australia relies on China as a major raw material buyer. In comparison, EUR/USD is more dependent on the monetary policies of the European and US central banks and the economic conditions in the Eurozone and the US.

Therefore, due to its stability and high trading volume, EUR/USD is often favored by global investors and serves as a valuable tool for analyzing broader economic trends.

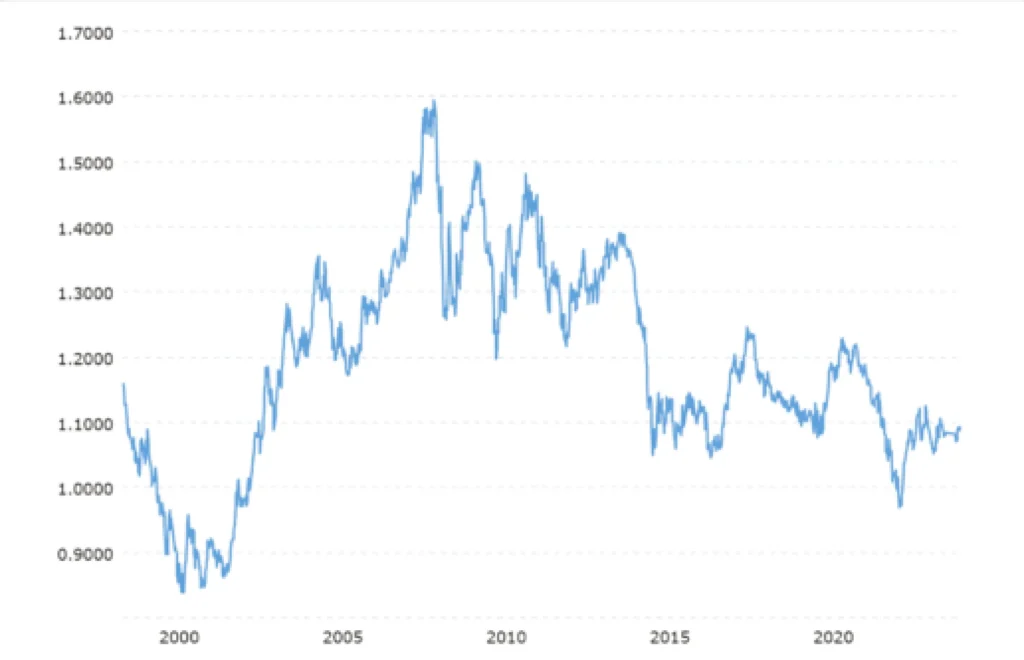

Historical Volatility of the EUR/USD Pair

Since its inception in 1999, the EUR/USD currency pair has experienced numerous ups and downs, some of which have been particularly noteworthy and memorable in the pair’s history. Key historical fluctuations include:

- The initial drop below 1.00 in 2000 due to low confidence in the euro;

- EUR/USD’s surge to a peak of 1.60 in 2008, driven by the US subprime mortgage crisis and the resulting decline in dollar value;

- A sharp decline in the euro’s value against the dollar in 2015 due to the European Central Bank’s reduction in quantitative easing;

- A notable drop in EUR/USD during the COVID-19 pandemic, influenced by extensive support policies and prevailing economic uncertainty.

As observed, these historical fluctuations provide valuable insights into economic conditions and macroeconomic events affecting the EUR/USD pair.

Key Points for EUR/USD Traders

Paying attention to subtle aspects of trading EUR/USD—the world’s most popular and liquid currency pair—can significantly improve traders’ performance and win rate. Consider the following points:

- Choosing the Right Trading Session: For EUR/USD day traders, the optimal trading window is from 7:00 to 20:00 GMT. During this period, there’s enough movement to cover spreads and commission costs and still make a profit. The best time to trade is between 13:00 and 16:00 GMT when both the London and New York markets are open. This overlap generates high trading volumes, providing ample profit opportunities and typically offering the tightest spreads of the day.

- Monitoring US and Eurozone Economic Data: Key economic data like interest rates, unemployment rates, Consumer Price Index (CPI), and Gross Domestic Product (GDP) directly influence the EUR/USD value. For professional traders, tracking the economic calendar and comparing forecasts with actual results can provide deeper insights into market reactions.

- Considering Market Sentiment: EUR/USD traders use sentiment indicators, such as the Commitment of Traders (COT) report and economic surveys, to gauge market sentiment. Understanding whether the majority of traders are inclined to buy or sell can help adjust trading strategies accordingly.

- Following the Latest Developments in ECB and Fed Policies: Changes in the European Central Bank (ECB) and Federal Reserve (Fed) policies, especially regarding interest rates and monetary easing or tightening, can greatly impact the EUR/USD rate. Professional traders closely analyze statements and press conferences from these central banks.

- Effective Use of Technical Analysis Alongside Fundamental Insights: Specific chart patterns, such as the head and shoulders or double-top and double-bottom patterns, frequently appear on the EUR/USD chart. Professional traders analyze these patterns across various timeframes and use them as signals for trend reversals or continuations. Additionally, proper use of other technical analysis tools helps traders identify optimal entry and exit points.

- Risk Management and Emotion Control: While risk management is essential in any trade, the EUR/USD pair, despite being a more liquid and analyzable market, requires particular attention to risk due to the multiple factors influencing its movements.

Final Recommendations for Successful

EUR/USD Trading

In summary, to succeed in trading the popular EUR/USD pair, understanding and focusing on its key driving factors can help traders make more informed decisions. Analyzing historical, fundamental, and technical data are all essential tools for understanding market trends and seizing trading opportunities in this pair. Furthermore, emphasizing sound capital management and the effective use of related tools are indispensable elements in this journey.