If you want to know whether your trading strategy truly works before risking real money, the Backtest Expert Advisor in MetaTrader 4 and 5 is the perfect place to start. In this article, we’ll walk you through everything you need to know about the Backtest EA, its role in trading, how to install and use it in MetaTrader 4 and 5, the common errors you might encounter, and how to fix them.

- When using the Backtest Expert Advisor, test across multiple timeframes to evaluate the robustness of your strategy.

- In the Backtest EA, set realistic values for spread, commission, and execution delay to ensure the results are closer to real market conditions.

- Keep your strategy parameters to a minimum when backtesting; added complexity often increases the risk of overfitting.

What Is a Backtest Expert Advisor and How Is It Used in Trading?

According to EarnForex, a Backtest Expert Advisor is a trading robot designed to test a trading strategy in the Strategy Tester of MetaTrader 4 and 5 by simulating the strategy’s performance on historical data.

In this process, the Expert Advisor you have developed for your trading strategy is run on past candlesticks or ticks, recording entries and exits as if they were taking place in real market conditions.

The final output of the Backtest EA includes statistical reports, balance/equity charts, and detailed trade-by-trade results. This allows traders to gain a relatively accurate assessment of how their strategy might perform in live market conditions; before risking real money.

Despite the many advantages of using a Backtest Expert Advisor, always remember that past performance is not a guarantee of future results. Therefore, before committing real capital, make sure to thoroughly complete both the forward testing and demo trading phases.

The Most Important Applications of a Backtest Expert Advisor

- Quickly validate trading ideas across multiple timeframes and instruments without spending months in live trading.

- Identify coding bugs and unwanted behaviors in a trading Expert Advisor before deploying it on a live account.

- Generate essential performance statistics and reports such as profit-to-loss ratio, drawdown, number of trades, win rate, and more to evaluate risk-to-reward potential.

- Optimize parameters and conduct forward testing to avoid the pitfalls of overfitting.

Difference Between a Backtest Expert Advisor and Trading Expert Advisors (EAs)

A Backtest Expert Advisor is used to measure and validate a trading strategy on historical data, while a Trading Expert Advisor (or trading robot) is designed to automatically execute that same strategy in live market conditions.

Other key differences between Backtest EAs and Trading EAs include:

- Execution Environment: Backtesting is performed in the Strategy Tester of MetaTrader on historical data, whereas a Trading EA runs on live charts connected to the broker.

- Market Conditions: Backtesting works with simulated spreads and slippage (which can be configured), while a Trading EA faces real conditions such as variable spreads, slippage, and execution delays.

- Risk: Backtesting involves no direct financial risk, while a Trading EA interacts with real account funds and carries actual trading risk.

- Capabilities: A Backtest EA offers parameter optimization, forward testing, and stress testing, whereas a Trading EA focuses on live order execution and real-time risk management.

- Symbol Coverage: In MetaTrader 5, a Backtest EA can be run on multiple symbols simultaneously. A Trading EA can also be attached to several live charts, but is still subject to broker and server limitations.

- Output: The output of a Backtest EA consists of reports, equity curves, and performance statistics; the output of a Trading EA is the actual trade history and financial results.

Comparison Table: Backtest EA vs. Trading EA

| Comparison Dimension | Backtest Expert Advisor | Trading Expert Advisor (EA) |

|---|---|---|

| Purpose | Validating and analyzing a strategy’s performance on past market data | Automating the execution of a strategy in real-time |

| Execution Environment | MetaTrader 4 & 5 Strategy Tester | Live chart connected to a broker |

| Data/Conditions | Historical data/simulated ticks; configurable spread and slippage | Live data with variable spreads, real slippage, and execution delays |

| Financial Risk | None (purely a simulation) | Yes (runs on demo or live accounts) |

| Key Features | Strategy optimization, forward testing, stress testing | Order placement/management, real-time risk management |

| Symbol Coverage | Multi-symbol capability, especially in MT5 | Can run simultaneously on multiple charts, subject to broker/server limits |

| Output | Reports, statistics, equity charts | Trade history and actual financial results |

| Primary Use Case | Designing and fine-tuning a strategy before live trading | Executing a validated strategy in the live market |

Advantages and Importance of Using a Backtest Expert Advisor for Traders and Strategy Developers

If your trading strategy is coded as an Expert Advisor (EA), backtesting is the fastest and most cost-efficient way to evaluate the idea, detect coding bugs, observe how the strategy behaves in different market phases (trending or ranging), and generate key performance statistics such as profit/loss, drawdown, win rate, and more.

MetaTrader provides a straightforward, step-by-step environment for strategy testing, allowing you to run your EA across different instruments and timeframes to assess its real potential.

Speed and Time-Saving Benefits of Backtesting Trading Strategies with an EA

Backtesting reduces the time needed to validate a trading idea from weeks or months in live markets to just a few minutes in the Strategy Tester.

With a Backtest EA, running one year of data in a matter of seconds is possible; making it an excellent tool for filtering trading ideas and quickly comparing different strategy versions.

In MT5, you can even accelerate the optimization process by using the MQL5 Cloud Network, which distributes the workload and makes scanning thousands of parameter combinations significantly faster.

With the help of a Backtest Expert Advisor, you can test far more scenarios in less time (such as changes in spread, stop-loss/take-profit levels, and market session filters) and quickly eliminate weaker versions of your strategy. This is something that is practically impossible to achieve through manual testing.

Reducing Human Error and Improving Accuracy in the Backtesting Process

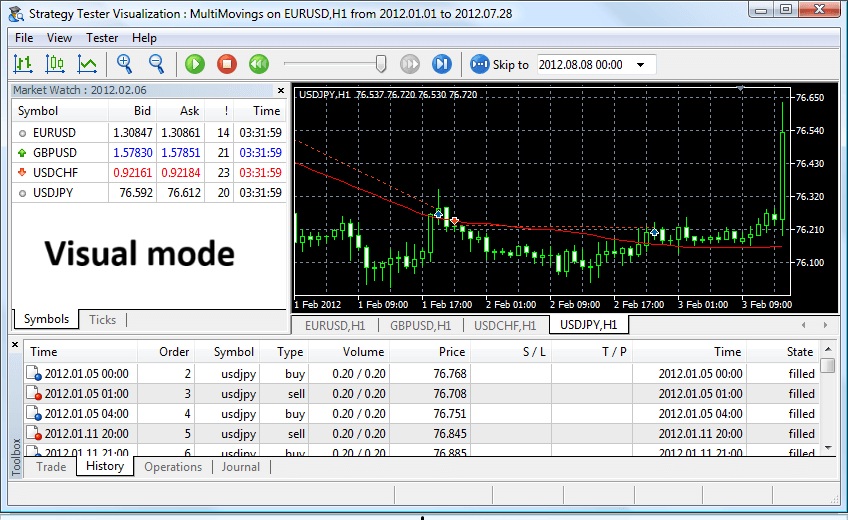

In manual testing, errors in trade logging, fatigue, and psychological biases are common. By contrast, the Strategy Tester automates all calculations and generates standardized reports without human intervention. In addition, the Visual Mode feature allows you to observe trades on the chart in real time, making it possible to verify the logic behind entries and exits.

To further improve accuracy, the Every Tick mode delivers the most realistic simulation. In MT4, by importing high-quality tick data, traders can achieve up to 99% modeling accuracy. Moreover, the forward testing option helps reduce the risk of overfitting by separating optimization data from validation data.

Testing and Evaluating Strategies Across Different Timeframes and Instruments in MetaTrader 4 and 5

In MT4, you can select the Expert Advisor, trading symbol, timeframe, and historical period directly from the Strategy Tester window and generate results for any chosen dataset. This flexibility is essential for assessing the consistency of a strategy under different market conditions.

MT5 takes it a step further by supporting multi-currency and multi-symbol testing within a single scenario; particularly useful for trading robots designed to analyze and trade multiple instruments simultaneously.

How to Download, Install, and Run a Backtest Expert Advisor in MetaTrader 4

In this section, you will learn step by step where to find the MT4 Backtest Expert Advisor, how to correctly place it in the MQL4/Experts folder, and finally, how to run a backtest using the Strategy Tester.

Reliable Sources for Downloading MT4 Backtest Expert Advisors

The most trusted source for downloading Expert Advisors is the MQL5 Market, which is the largest official marketplace for MetaTrader.

Another reliable source is the MQL5 CodeBase in the MT4/Experts section, where thousands of open-source Expert Advisors written in MQL4 are available for learning, testing, and further development.

How to Add Backtest Expert Advisor Files to the MQL4 Folder

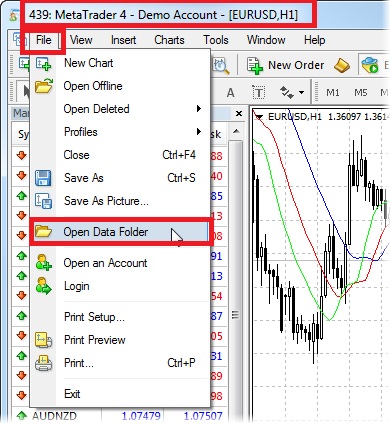

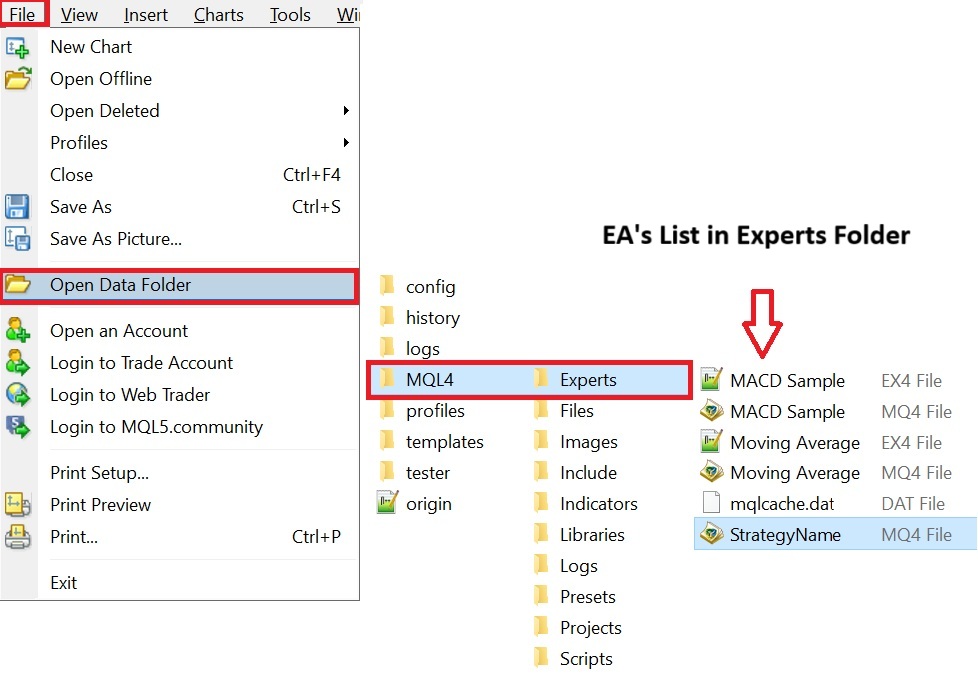

To add a Backtest Expert Advisor to the MQL4 folder, follow these steps:

- First, open MT4 and navigate to the Windows Data Folder by going to File → Open Data Folder.

- From there, go to MQL4 → Experts.

- Place the Expert Advisor file with the extension .ex4 or .mq4 into the Experts folder.

- Then restart MT4, or simply right-click on Navigator > Expert Advisors and select Refresh.

- From the Navigator, drag and drop the Expert Advisor onto the chart.

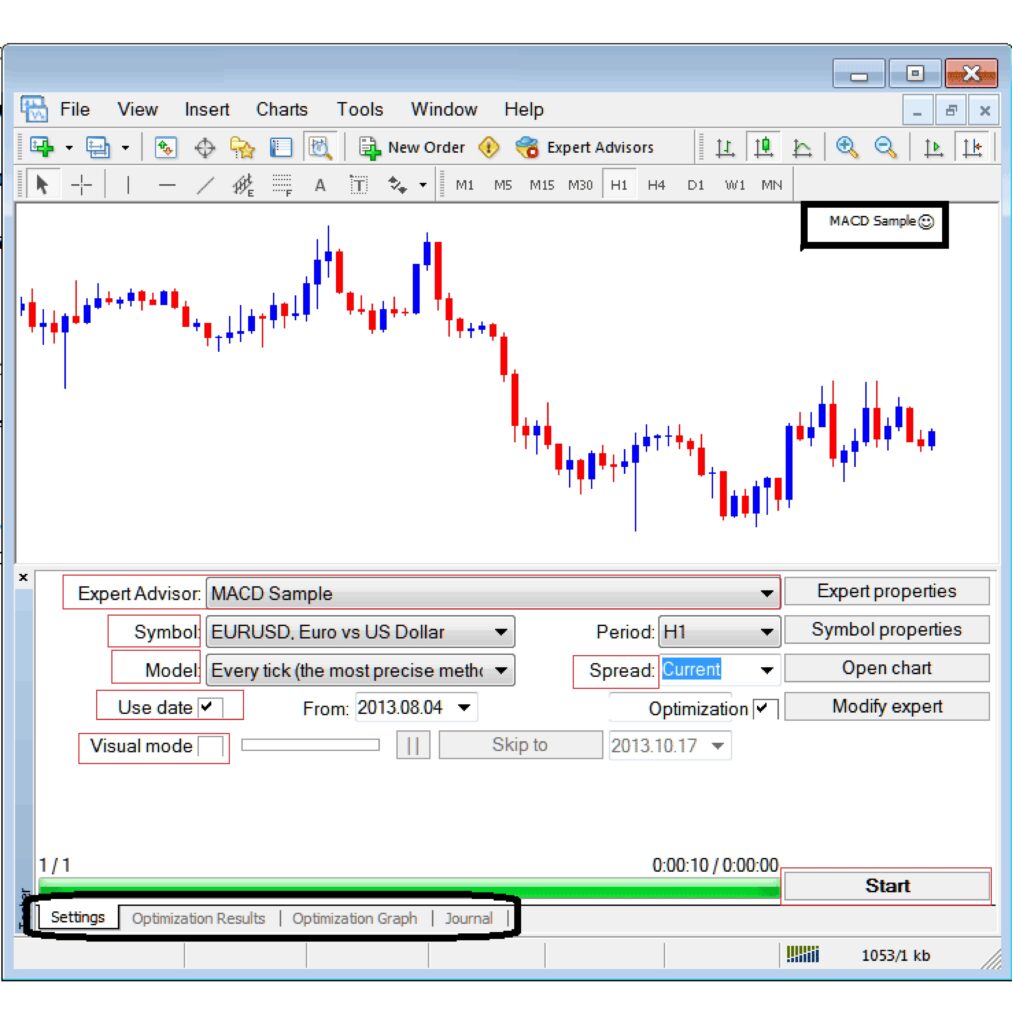

Configuring the Strategy Tester to Run a Backtest in MT4

After adding the Backtest EA to the chart, set up the following configurations:

- Open the Strategy Tester window using the shortcut Ctrl+R.

- From the Expert Advisor list, select your EA.

- Configure the symbol, timeframe, spread, and the date range you want the EA to be tested on.

- Under Expert Properties, define the Inputs; and under Testing, set the initial deposit, account currency, and leverage.

- Choose the backtest model as follows:

- Every tick: The most accurate mode (based on lower timeframe data), suitable for tick-sensitive strategies such as scalping. Slower but more realistic.

- Control points: A medium-speed, medium-accuracy option for faster evaluations.

- Open prices only: Very fast, best suited for strategies that only trade at the open of a candle.

- To watch the trades being executed on the chart, enable Visual Mode, then click Start.

- The results of the Backtest Expert Advisor can be viewed and saved in the Results, Graph, and Report tabs.

If the Expert Advisor does not appear in the Navigator after copying the file, first refresh MetaTrader. If it still does not show up, compile the .mq4 file from MetaEditor and make sure you are in the correct MQL4\Experts folder.

How to Download, Install, and Run a Backtest Expert Advisor in MetaTrader 5

In this step-by-step guide, you will learn where to find a suitable Backtest Expert Advisor for MT5, how to place the file into the MQL5/Experts folder, and then how to run a backtest using the Strategy Tester either in standard mode or in Visual Mode, and finally, how to save the test report.

Reliable Sources for Downloading MT5 Backtest Expert Advisors

The most trusted sources for downloading Backtest EAs in MetaTrader 5 are:

- The MQL5 Market; the largest official marketplace for trading robots and indicators for MetaTrader 5.

- The official MQL5 CodeBase; an open-source library with thousands of Expert Advisors, indicators, and scripts for MetaTrader 5.

If your goal is simply to quickly evaluate the logic of a strategy, free samples from the CodeBase are a good option. However, if you need more advanced features and professional support, the official MQL5 Market is the better choice.

How to Add Backtest Expert Advisor Files to the MQL5 Folder

To add Backtest Expert Advisor files to the MQL5 folder, follow these steps:

- From the File → Open Data Folder menu, navigate to the platform’s Data Folder.

- Go to MQL5 → Experts and place the Expert Advisor file with the extension .ex5 or .mq5 that you previously downloaded or created into this folder.

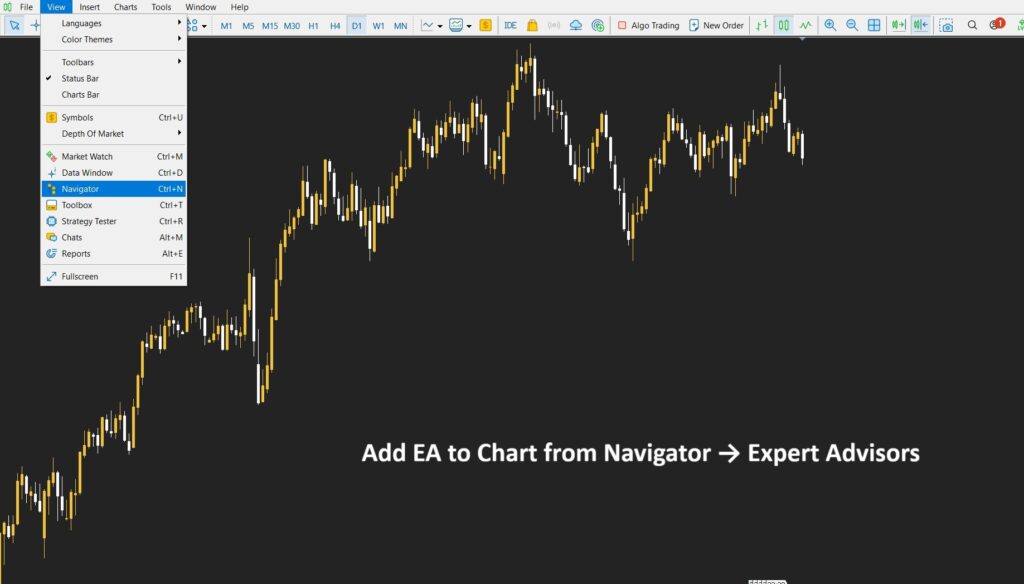

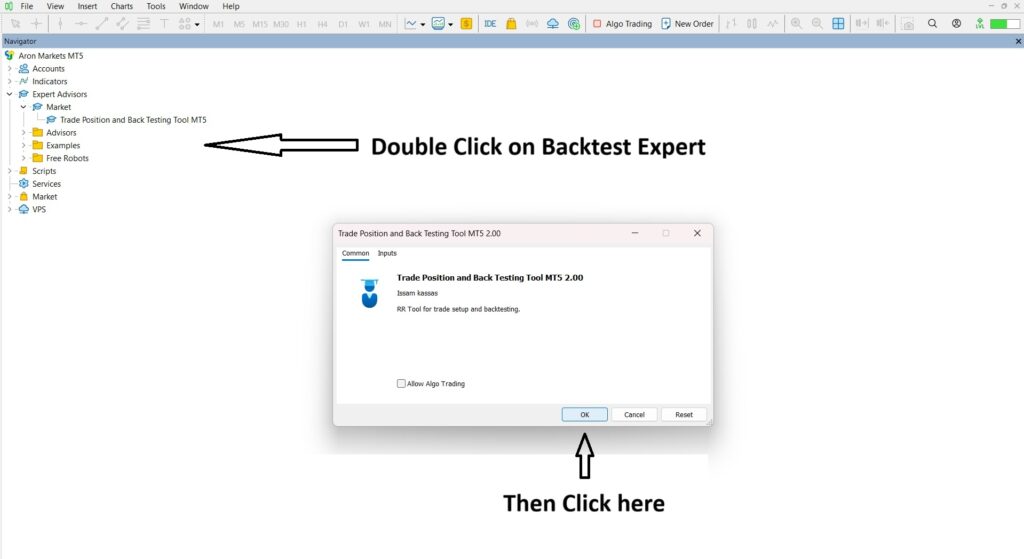

- Restart MT5 so that the EA appears under Navigator → Expert Advisors.

- Now, locate the Backtest Expert Advisor under Expert Advisors and double-click on it.

- In the window that opens, click OK to add the EA to the chart.

For running a backtest in the Strategy Tester, enabling Algo Trading is usually not required.

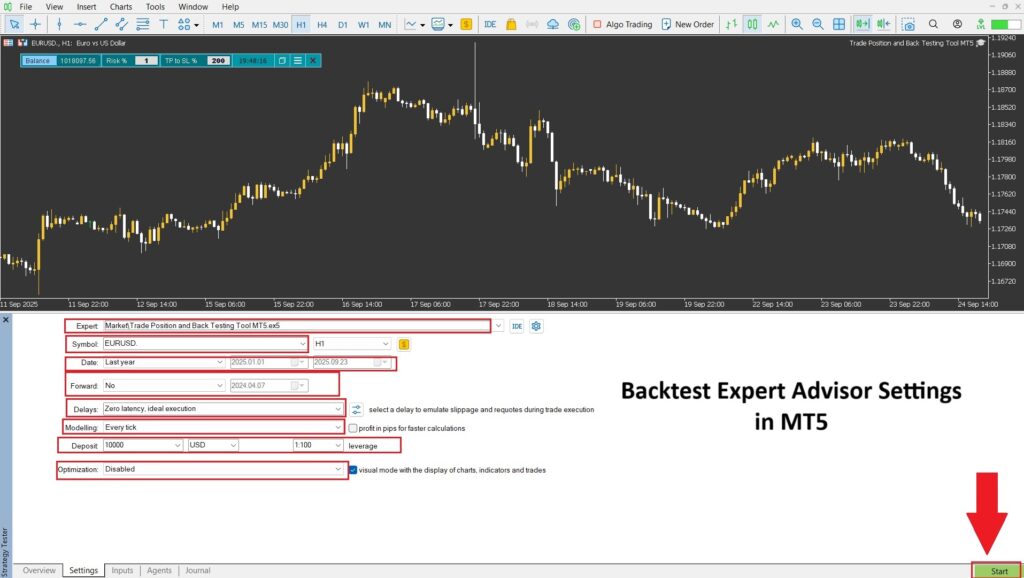

Configuring the Strategy Tester to Run a Backtest in MT5

After adding the Backtest Expert Advisor to the chart, you need to configure its settings as follows:

- First, open the Strategy Tester from View → Strategy Tester or use the shortcut Ctrl+R.

Now, in the Settings tab:

- Under Expert, select the Expert Advisor you want to test.

- Under Period and Symbol, choose the trading instrument and timeframe for the test.

- Under Date, specify the historical range to run the backtest.

- Under Modeling, select the price modeling method.

- Under Delay, set the desired execution delay (it is recommended to use a realistic value).

- Finally, click Start to begin the test.

If you enable the Optimization option (which is used to find the best parameters based on historical data), make sure to also select the Forward option. This will test those same parameters on a separate portion of data not used during optimization, allowing you to confirm that the strategy is more realistic and robust.

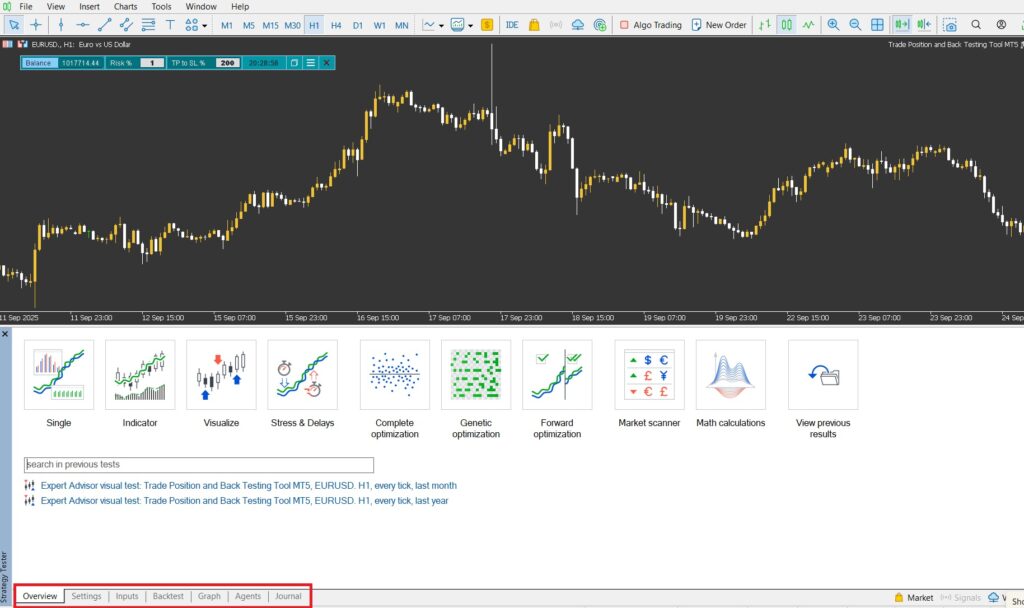

Running a Backtest in Visual Mode and Saving Reports

Visual Mode allows you to watch trades, indicators, and the behavior of the Expert Advisor directly on the chart in real time. You can speed up or slow down the playback and even pause at specific events. To enable it, simply check the Visual Mode box and then click Start.

- The outputs are displayed in the Backtest/Graph/Inputs/Visualization tabs.

- In the Backtest/Graph tab, review the equity/balance curve along with the key statistics.

- To save the report, right-click on the backtest results and select Save Report. In MT5, you can export the report in both HTML and Open XML formats.

Essential Points Before Starting a Backtest in MetaTrader

Before pressing Start in the MetaTrader Strategy Tester, you need to pay close attention to three key factors that shape your results:- The quality of historical data

- Accurate configuration of trading costs

- Choosing the right timeframe/date range

Checking the Quality and Completeness of Historical Price Data

When reviewing the quality and completeness of historical data, consider the following:- Remove or correct gaps, spikes, and faulty candles: Poor-quality data can significantly distort results.

- For tick-sensitive strategies: In MT5, use Real Ticks; in MT4, use precise tick data in formats compatible with MetaTrader 4 such as FXT/HST.

- Choose the modeling method according to your strategy: Use Every tick for maximum accuracy, and OHLC/Open prices for faster evaluations.

Configuring Spread, Commission, and Trading Account Parameters

- Set the spread to a realistic value (using a fixed, non-realistic spread will lead to overly optimistic results).

- Always include commission and swap costs, as they have a direct impact on profit factor, Sharpe ratio, and drawdown.

- Document the account size, leverage, and lot size, and make sure to export an HTML/XML report from each test.

Choosing the Right Timeframe and Date Range for Backtesting

- Select a period that includes strong trends, prolonged ranges, high-impact news volatility, and low-volatility phases. This helps reduce the risk of overfitting.

Difference Between Backtesting in MetaTrader 4 and 5

MT5 is the newer generation of MetaTrader, offering faster and more accurate backtesting, while MT4 is simpler but usually requires importing high-quality tick data to achieve comparable accuracy.

In the following section, we will review some of the key differences between backtesting in these two platforms.

If you are a scalper or your strategy is highly sensitive to tick timing, MT5 is the more reliable choice. However, if your goal is simply to quickly assess the overall logic of a strategy, MT4 will also do the job.

Difference in Testing Engine and Data Modeling Accuracy

- MT5 includes the mode “Every tick based on real ticks”, meaning backtests are conducted using actual tick data, making the results much closer to real market conditions.

- MT4 provides three classic modeling methods:

- Every tick: more accurate but slower.

- Control points: medium speed and medium accuracy.

- Open prices only: very fast, suitable for strategies that trade only at candle opens.

- Every tick: more accurate but slower.

- In MT4, to achieve high accuracy, it’s recommended to import precise tick data in FXT/HST format. In MT5, this step is generally unnecessary.

Multi-Symbol Support and Multi-Core Optimization in MT5

- MT5 is multi-threaded and multi-symbol, utilizing all CPU cores and leveraging the MQL5 Cloud Network to complete backtests much faster.

- MT4 is single-threaded and runs tests on only one symbol at a time.

As a result, if you need extensive optimization, forward testing, and robustness checks across multiple symbols, MT5 makes the process significantly easier.

According to MetaTrader 5, with the MQL5 Cloud Network, instead of running thousands of tests solely on your own CPU, the workload is distributed across hundreds or even thousands of “agents,” making the process of obtaining results several times faster.

Common Issues When Transferring an Expert Advisor from MetaTrader 4 to MetaTrader 5

- Differences in language and trade logic: Order and position management in MT5 is different; therefore, when transferring an EA between the two platforms, certain functions must be rewritten.

- Account type: In MT5, position management can vary depending on the broker’s account type.

- Differences in backtest results: Since data modeling and tick generation differ between the two platforms, the outputs may not be identical. If you have used custom tick data in MT4, you need to replicate similar conditions in MT5 for comparable results.

If your trading ecosystem is based on MT4, you can still obtain reliable backtests by using high-quality tick data and selecting the appropriate modeling method.

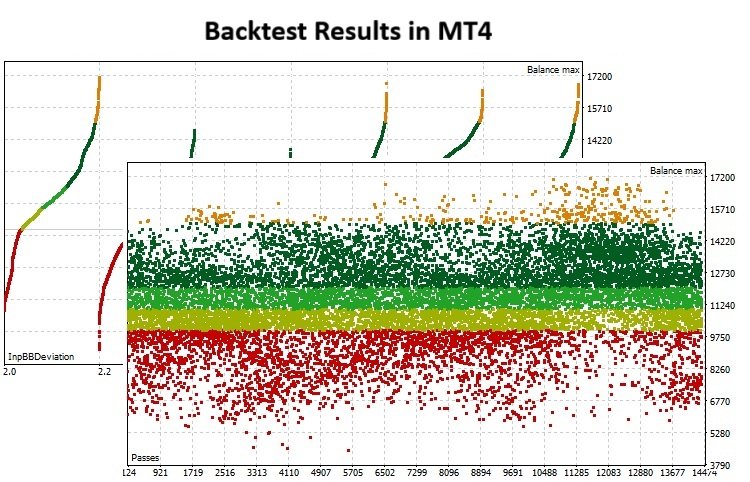

Methods of Strategy Optimization with a Backtest Expert Advisor

Optimization means running dozens or even thousands of backtests with different parameter combinations to find the best setup, without falling into the trap of overfitting. In MT5, this process is much faster and more systematic compared to MetaTrader 4, thanks to its multi-threaded engine, genetic algorithms, forward optimization, and detailed reporting.

Key Metrics and Indicators for Evaluating Backtest Results

When reviewing backtest results, make sure to check the following:

- Profit Factor (PF): The ratio of gross profits to gross losses. A value greater than 1 indicates a profitable strategy.

- Maximum Drawdown: The most important risk metric; a deep drawdown can wipe out otherwise solid returns.

- Recovery Factor: The ratio of net profit to maximum drawdown. It shows how well a strategy recovers from losses.

Additional complementary metrics for assessing profit quality and strategy robustness include the Sharpe Ratio, Expected Payoff, and Win Rate, all of which are displayed in MetaTrader reports.

When evaluating backtest results, don’t rely on a single number. Instead, consider the Profit Factor alongside drawdown and the Sharpe Ratio, while also accounting for trading costs such as spread, commission, and swap.

Optimizing Strategy Parameters and Preventing Overfitting

1. Choosing the Right Optimization Method (Genetic) Instead of Testing Every Combination

- Rather than testing all possible parameter combinations one by one, use a genetic algorithm to reach the “good” ranges much faster.

- Before starting, clearly define your objective. for example, maximizing Profit Factor (PF) while ensuring drawdown does not exceed X%.

2. Forward / Out-of-Sample Testing

- Split your historical data into two sets: training and validation.

- Find the parameters on the training set, then test those same parameters on the validation set without any adjustments.

- If the performance is also solid in the second set, it means the model isn’t just “memorizing the past” and is more robust.

3. Keep the Model Simple and Check Stability

- Minimize the number of parameters; the more parameters, the higher the risk of overfitting.

- Look for parameter ranges where small changes still produce good results, rather than sharp, accidental peaks.

- Test the final parameters across multiple timeframes and symbols; accept only those solutions that perform consistently in most scenarios.

Running Additional Tests: Forward Testing and Monte Carlo Simulation

For more reliable results, perform additional validation tests:

- Forward Testing: After optimization, run the strategy on future data to evaluate its real stability. This feature is built into the MT5 Strategy Tester.

- Monte Carlo Simulation: By generating hundreds or even thousands of random scenarios (e.g., shuffling trade sequences, introducing random variations in slippage/spread), Monte Carlo testing evaluates how resilient your strategy is against “unfavorable but plausible” market conditions.

Common Problems and Errors in Backtest Expert Advisors and How to Fix Them

In MT4/MT5 backtesting, issues usually fall into three categories: installation/execution errors, problems with historical data (especially tick data), and version/language incompatibilities between MQL4 and MQL5. Below are the most common errors and practical solutions for each.

Frequent Errors in Installing or Running a Backtest EA and Their Solutions

- EA not visible in Navigator

Solution: Check the file path (MQL4/Experts or MQL5/Experts); compile the file in MetaEditor and restart the platform. If necessary, review your Expert Advisors settings. - Backtest stops running / error messages in Journal

Solution: These are typically logical errors and need to be fixed through proper coding. - No trades executed during the test

Solution: Inputs, spread, commission, or symbol settings may not be configured correctly. Start by testing with simpler settings (e.g., Open prices only) to validate basic logic, then move to more accurate modes.

Issues with Historical Data and Tick Reconstruction

- Low-quality data, gaps, and spikes

Solution: Gaps and faulty candles can distort results. In MT5, the Every tick based on real ticks mode provides the most accurate simulation. In MT4, to achieve high modeling quality, you need to import high-quality tick data in FXT/HST format. - Installing and exporting tick data for MT4

Solution: Use tools like StrategyQuant/QuantDataManager to download tick data and export it directly into the FXT/HST format for MT4. These tools also allow you to review and fix gaps and spikes. - Failure to auto-load data in MT4

Unlike MT5, the MT4 Strategy Tester does not automatically pull data from other symbols. Before running a test, make sure the symbol data and historical range are fully loaded.

Version Incompatibility and Converting MQ4 to MQ5

- Differences in language and trading model (MQL4 ↔ MQL5)

Order/position structures, certain trading functions, and event handling are different in MQL5. Direct conversion is not always possible and often requires partial code rewriting. - Conversion references and sample code

The MQL5 website provides reference articles and forum threads with function mapping from MQL4 to MQL5 and migration guidelines. Using these resources can significantly reduce conversion time. - Differences in backtest results between MT4 and MT5

Because of variations in tick modeling, multi-symbol handling, and the testing engine, Backtest EA outputs may differ across platforms. If you used custom tick data in MT4, be sure to replicate similar conditions (spread, commission, time range, data source) in MT5.

Key Tips for Safely Downloading and Choosing a Backtest Expert Advisor

When looking for a Backtest EA, your priority should be security, transparency, and reproducibility; not just impressive-looking results. The following steps will help you select a reliable, safe EA without unnecessary risks.

Verifying Source Credibility and File Security

- Download Backtest EAs only from reputable sources or well-known developers’ websites.

- Check the developer’s profile and track record, user ratings, and update history.

- Scan .ex4/.ex5 files with antivirus software.

- Any request for DLL access must have a clear technical reason; if it’s unclear, treat it as a red flag.

Clear documentation and access to the .mq4/.mq5 source code are strong positives for a Backtest EA.

Testing the EA on a Demo Account Before Live Use

Always test any EA (including Backtest EAs) on a demo account first. When testing on demo:

- Observe the EA’s real behavior under spreads, slippage, and execution delays.

- Test the EA across multiple symbols, timeframes, and different market conditions.

- Configure spread, commission, and swap costs in line with your broker’s settings.

- Save an HTML/XML report and take screenshots of your settings for each test.

Understanding Licensing and the Risks of Cracked Versions

Before running a Backtest EA, make sure to review the following:

- Read the license terms and activation conditions, including limits on the number of devices and accounts.

- Purchase a legitimate version that comes with updates and support.

- Cracked versions not only lack updates and support but also carry risks of malware, instability, and legal issues.

- Treat the absence of a demo version—or a provider’s refusal to offer one—as a serious red flag.

Conclusion

A Backtest Expert Advisor shortens the gap between idea and execution by testing strategies on historical data. However, everything depends on the quality of your data, proper configuration of trading costs, and avoiding overfitting.

By complementing backtests with forward testing on a demo account and leveraging advanced MT5 tools such as Real Ticks and Optimization, you can build a more reliable and sustainable trading strategy.

FAQ

1. Is a backtest result a guarantee of profitability in a live account?

No. Backtests only simulate past conditions. Changing market environments, slippage, variable spreads, and real execution can all affect outcomes. For greater confidence, always perform forward testing on a demo account and out-of-sample testing.

2. How can I increase the accuracy of a backtest?

Use clean and complete historical data, choose an appropriate modeling method, set realistic spreads, commissions, swaps, and execution delays, and avoid overfitting by applying Forward/Out-of-sample tests and testing across multiple timeframes.

3. Can I run a backtest on tick data?

Yes. In MT5, the Every tick based on real ticks mode uses actual tick data. In MT4, you can achieve tick-based backtesting by importing high-quality tick data (FXT/HST exports from tools like QuantDataManager).