The forex market, with a daily trading volume of more than $ 6 trillion, is one of the largest and most active financial markets in the world. To begin trading in forex, having a clear understanding of the concepts of Buy and Sell, and of how to enter and exit positions, is essential. This article explores the concepts of Buy and Sell, the different types of orders, and the best times to enter and exit trades.

- Understanding how different order types interact with market depth helps traders anticipate liquidity pockets and potential price accelerations.

- Choosing between Maker and Taker behaviour can influence execution quality, especially during volatile conditions or major news events.

- Strategic order placement allows traders to automate entries that match their trading logic rather than reacting emotionally to price movements.

- Mastery of MetaTrader order functions enables precise control over risk positioning and execution flow which is essential for consistent long-term performance.

The Concept of Buy and Sell in Forex

According to an article on Investopedia about buying and selling in forex, entering a Buy position in the forex market means you expect the price of a currency pair or asset to increase. In forex trading, currency pairs are always displayed as base currency/quote currency. In a Buy position, you purchase the base currency and sell the quote currency.

For example, suppose the GBP/USD pair is priced at 1.3200. This means each one pound is equal to one point thirty two dollars. If you expect the pound to strengthen against the dollar, you enter a Buy position on this pair.

In a Sell position, you expect the price of a currency pair or asset to decrease. In this case, you sell the base currency and buy the quote currency.

For example, if GBP/USD is trading at 1.3200 and you expect the price to decline, you enter a Sell position. If the dollar strengthens against the pound, the price of the pair will fall, and you profit from this decrease.

Traders placing “maker” orders (limit orders that add liquidity) often benefit from lower fees or rebates, whereas “taker” orders (market/stop orders that consume liquidity) typically incur higher fees.

When Should We Place a Buy or Sell Order?

To determine when to buy or sell, it is essential to analyse the market from different angles, including both technical and fundamental analysis. Below are several key strategies for entering and exiting trades, as discussed in an article on the Pippenguin website about buying and selling in forex:

Trend Trading

In trend trading, the trader uses technical indicators such as moving averages or the Relative Strength Index RSI to identify the market’s direction. If the market is in an uptrend, you enter a Buy position, and if it is in a downtrend, you enter a Sell position.

In this scenario, Buy Stop or Sell Stop orders are often the best choice because you only want to enter a position when the price breaks above a previous resistance level or below a previous support level, and the trend continues. For example, if the market is moving upward, placing a Buy Stop above the most recent high ensures that you only enter the trade if the uptrend truly continues.

Trend Reversal Strategy

This strategy is used when the trader expects the current trend to reverse. If a currency pair is in an overbought or oversold condition, a potential reversal may occur, and you should consider buying or selling based on these signals.

For example, in the chart below, the MACD indicator shows signs of a possible reversal at the end of a downtrend, such as:

- The signal line and the MACD line start moving closer together.

- The histogram bars below the zero line begin to shrink.

Under these conditions, the trader can anticipate that the downtrend is coming to an end and, after a few bullish candles appear, enter a Buy position.

In such situations, using Buy Limit or Sell Limit orders is more logical because you expect the price to reach a certain level and then reverse. For instance, if the MACD indicates that the downtrend is weakening, you can place a Buy Limit slightly below the support level so that you enter the market on the first bullish pullback.

Range Trading Strategy

This strategy is used when the market has no clear trend and the price moves within a defined range. If the price reaches the top of the range, you can enter a Sell position, and if the price is at the bottom of the range, you can enter a Buy position.

In this strategy, using Limit Orders is particularly effective.

Specifically, you can use a Sell Limit at the top of the range and a Buy Limit at the bottom. These types of orders allow you to enter the market precisely at key levels and benefit from price reversals at those points.

For example, if a currency pair is fluctuating between 1.1000 and 1.1200, you can place a Sell Limit near 1.1200 and a Buy Limit at 1.1000 so that every time the price reaches these levels, your trades are triggered automatically.

One of the best indicators to use with this strategy is the Bollinger Bands indicator.

How to Place Orders in MetaTrader

After becoming familiar with the concepts of buying and selling, the next step is to learn how to place orders on the MetaTrader trading platform. To submit an order, follow the steps below:

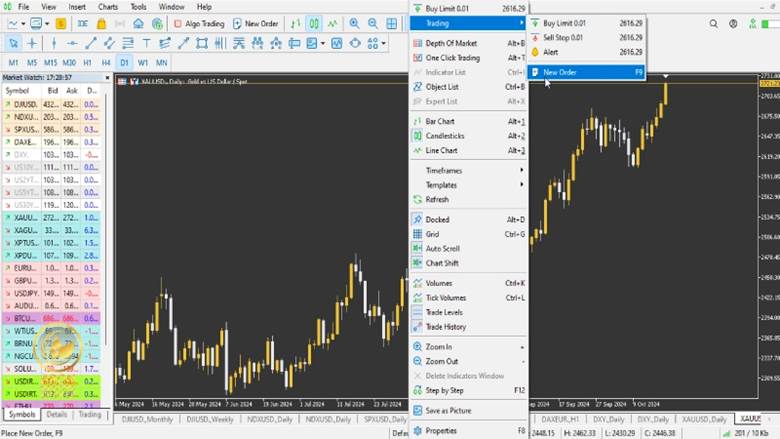

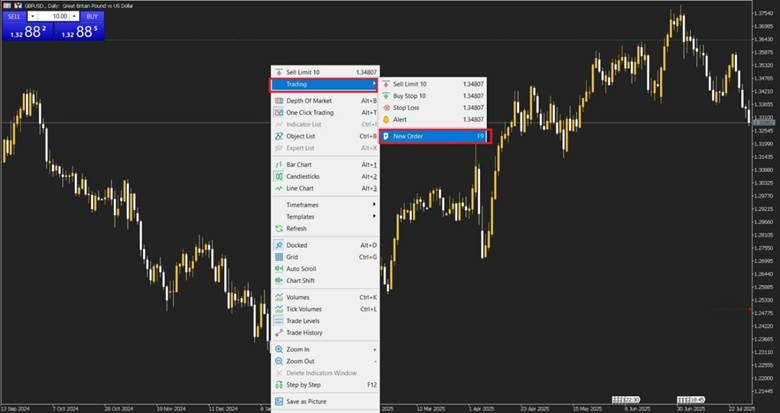

Right-click on the price chart and select Trading, then choose New Order. You can also press the F9 key to open the New Order window.

Next, in the window that appears, select the order type and the trade volume. In MetaTrader, there are two main types of orders:

- Market Execution: The order is executed at the current market price.

- Pending Order: You can set your order at a specific price, and it will be triggered when the market reaches that price.

At this stage, you can also set your Stop Loss and Take Profit levels. These tools allow you to automatically close your trade at predetermined prices to secure profits or limit losses.

Finally, after setting all the details, click the Buy or Sell button to submit your order.

Introduction to the Main Types of Orders in Forex

As mentioned above, there are two primary types of orders in forex:

- Market Orders;

- Pending Orders.

Below is a brief explanation of the main order types in forex.

Market Orders

Market orders are executed immediately at the best available price in the market. In other words, these orders are filled at the current market price as soon as they are submitted, with no delay.

This type of order is suitable when:

- The trader wants to enter or exit a position instantly and take advantage of rapid price movements

- The trader believes the price has reached an optimal level.

- The trader prioritizes guaranteed execution over the precise execution price.

Market orders are especially useful in situations where fast execution and minimal delay are crucial, such as day trading or during highly volatile market conditions.

Although market orders guarantee that the trade will be executed, there is no guarantee regarding the exact price at which the execution will occur.

Pending Orders

Pending orders are orders that are set to be executed in the future when the price reaches a specific level. These orders are used when the trader wants not only to execute a trade but to enter the market at a particular price.

The types of pending orders, which we will explain in detail throughout this article, include: Buy Limit, Sell Limit, Buy Stop, Sell Stop, Buy Stop Limit, and Sell Stop Limit.

| Feature | Market Orders | Pending Orders |

|---|---|---|

| Order Execution Time | Executed immediately as soon as the order reaches the market | Executed when the price reaches the specified level |

| Type of Trade | Instant buy or sell at the current market price | Buy or sell at a desired future price |

| Best For | Traders who want to enter or exit a trade quickly | Traders who want to enter or exit at a specific price |

| Use Case | Suitable for fast and highly volatile market conditions | Used for entering and exiting at precise price levels |

By selecting pending orders (buy limit, sell stop etc.), traders can predefine their trade conditions and remove the urgency of real-time decision-making.

Types of Buy and Sell Orders in Forex

In addition to market orders, MetaTrader also allows you to place pending orders. These orders enable you to enter the market at specific price levels. According to an article on investor.gov that explains different types of buy and sell orders in financial markets, the main types of pending orders are:

- Buy Limit;

- Sell Limit;

- Buy Stop;

- Sell Stop;

- Buy Stop Limit;

- Sell Stop Limit.

Buy Limit Order

If you expect the price to drop first and then rise, you can use a Buy Limit order. This order is placed below the current market price. For example, if the current price of EUR slash USD is 1.1200 and you expect the price to bounce after reaching 1.1150, you can place a Buy Limit order at 1.1150.

Sell Limit Order

If you predict that the price will rise first and then fall, you use a Sell Limit order. This order is placed above the current market price. For instance, if the current price of EUR slash USD is 1.1200 and you expect the price to drop after reaching 1.1250, you can place a Sell Limit order at 1.1250.

Buy Stop Order

If you expect the price to rise above the current level and continue upward, you can use a Buy Stop order. This order is placed above the current market price. For example, if the current price of EUR slash USD is 1.1200 and you expect a stronger uptrend once the price breaks above 1.1250, you can set a Buy Stop at 1.1250.

Sell Stop Order

If you expect the price to fall and continue declining after breaking a specific level, you use a Sell Stop order. For example, if the current price of EUR slash USD is 1.1200 and you expect a stronger downtrend once the price breaks below 1.1150, you can place a Sell Stop order at 1.1150.

Buy Stop Limit Order

A Buy Stop Limit order is a combination of a Buy Stop and a Buy Limit. This type of order includes two price levels. First, the price must reach the stop level, and then the buy order is executed at the limit level. For instance, if the current EUR slash USD price is 1.1200 and you want the order to activate at 1.1250 but execute the buy at 1.1230, you would place a Buy Stop Limit order with a stop at 1.1250 and a limit at 1.1230.

Sell Stop Limit Order

A Sell Stop Limit order is a combination of a Sell Stop and a Sell Limit. This order also includes two price levels. The price must first reach the stop level and then execute the sell order at the limit level. For example, if the current EUR slash USD price is 1.1200 and you want the order to activate at 1.1150 but execute the sell at 1.1170, you would set a Sell Stop Limit order with a stop at 1.1150 and a limit at 1.1170.

Comparison of Key Differences Between Pending Order Types

Pending orders allow traders to enter or exit the market under specific conditions based on their analysis. In this section, we compare these orders based on two key criteria:

Placement relative to the current price

Trader’s expectation

Overall, Buy Limit and Sell Limit orders are suitable when the trader expects the price to reach a certain level and then reverse direction.

Meanwhile, Buy Stop and Sell Stop orders are used when the trader expects the price to break a specific level and continue into a new trend.

Below is a detailed comparison table:

| Order Type | Placement Relative to Current Price | Trader’s Expectation |

|---|---|---|

| Buy Limit | Below the current market price | The trader expects the price to fall below the current level and then trigger a buy order on the reversal. |

| Buy Stop | Above the current market price | The trader expects the price to rise above the current level and continue into an uptrend. |

| Sell Limit | Above the current market price | The trader expects the price to rise above the current level and then trigger a sell order on the reversal. |

| Sell Stop | Below the current market price | The trader expects the price to fall below the current level and continue into a downtrend. |

Other Important Order Types and Instructions in Forex

In the forex market, in addition to the pending order types mentioned above, other orders and instructions help traders take advantage of opportunities more effectively and manage their risk. Below are explanations of these instructions.

Stop Loss

A Stop Loss is a conditional order used to limit losses in a trade. This order automatically closes the position when the price reaches a specific level, and its purpose is to prevent large losses.

Take Profit

Take Profit is similar to a Stop Loss but is used to lock in profit. This order closes the trade once the price reaches the desired profit level and prevents small or missed profits.

Trailing Stop

A Trailing Stop is a dynamic Stop Loss that automatically moves along with the positive price movement and closes the position if the price moves in the opposite direction. This instruction is especially useful for protecting profits during upward trends.

OCO Orders One Cancels the Other

An OCO order is a paired set of entry instructions placed as alternatives so that if one is triggered the other is automatically cancelled. This mechanism is useful when the trader does not know in which direction the price will break from its current range and wants to benefit from either scenario without opening both positions at the same time.

Example two sided entry with OCO

Suppose the EUR USD pair is fluctuating around 1.1250. You can place a Buy Stop at 1.1350 for entry on an upward breakout and a Sell Stop at 1.1200 for entry on a downward breakout as an OCO setup. If the price reaches 1.1350 and the Buy Stop is triggered the Sell Stop will be automatically cancelled and vice versa.

Role of Limit and Stop Orders in Market Depth

Market Depth shows how many buy and sell orders are queued at each price level. The fuller these queues are the higher the liquidity and the stronger the depth of the market.

Within this structure, orders play two different roles, which in trading terminology are known as Maker and Taker.

Limit Orders or Maker Orders liquidity providing orders

Orders such as Buy Limit and Sell Limit which are placed below or above the current price and remain pending until the price reaches them are considered Maker orders.

Since limit orders sit in the order book and wait until the price reaches the specified level they add fresh liquidity to the market and strengthen market depth.

Maker orders are executed with higher precision and lower risk of slippage, although if the price does not reach the desired level they might never be triggered.

In OTC forex Maker and Taker orders are stored on the broker’s server and are not necessarily visible in any global Order Book.

Stop Orders or Taker Orders liquidity consuming orders

Orders such as Buy Stop and Sell Stop that, upon reaching the specified level often convert into a market order fall into the Taker category.

Once triggered Taker orders are executed at the first available prices consuming the existing liquidity; therefore they play the role of liquidity consumer.

Taker orders especially during news releases and high volatility have a higher chance of slippage but they can trigger chains of stop orders and create faster price movements known as a Stop Run.

Simple Example

Suppose EUR USD is trading around 1.1200 and on the sell side there are five million units of Sell Limit orders.

- If you place a Buy Limit at 1.1195, your order is a Maker order because it stays in the order book until the price reaches it.

- If you place a Buy Stop at 1.1210, once the price breaks that level the order turns into a market order and consumes the available liquidity. If the depth is insufficient, your order may be filled at higher prices such as 1.1212 or 1.1214.

Understanding Maker and Taker is important in forex trading for the following reasons:

- Risk management, knowing where slippage is more likely stops orders and where execution is more precise limit orders.

- Strategy selection limit orders are better for reversals from key levels and stop orders are better for trading trends and breakouts.

- Understanding market behaviour explains why stop orders can move the market sharply during news and why limit orders can temporarily act as a barrier to price movement.

Guide with images and step by step instructions for placing pending orders in MetaTrader

In this section we explain how to place different types of pending orders in MetaTrader using screenshots and complete instructions. This tutorial applies to both MT4 and MT5 but the options Buy Stop Limit and Sell Stop Limit are only available in MetaTrader five. To begin:

- Right click on the chart you want to trade and select Trading, then New Order

- The order window will open

In the opened window:

- In the Type section select Pending Order so that the different types of pending orders become available below.

Buy Limit Order

A Buy Limit order is a conditional buy order placed at a price lower than the current market price.

To place it:

- In the order window set Type to Pending Order

- From the list select Buy Limit

- Enter the price below the current market price

- Set the volume Stop Loss and Take Profit

- Click the Place button

- If the market falls to your chosen price the order will be activated and the buy will be executed

Sell Limit Order

This order is used to sell at a price higher than the current market price so:

- Select Sell Limit

- Enter a price above the current market price

- Set the volume Stop Loss and Take Profit

- Click the Place button

- If the market rises to your chosen price the order will be activated and the sell will be executed

Buy Stop Order

This order is used to buy at a price higher than the current market price, so:

- Select Buy Stop.

- Enter a price above the current market price.

- Set the remaining details and submit the order.

- If the price reaches the selected level, the buy order will be executed.

Sell Stop Order

This order is used to sell at a price lower than the current market price, so:

- After selecting Sell Stop, enter a price below the current market price.

- Set the remaining details and submit the order.

- If the price falls to the desired level, the sale will be executed.

Buy Stop Limit Order

This Type of order is used when you think the Price will rise to a certain level and then pull back slightly, creating a good buying opportunity.

To place this order:

- In Type, select Buy Stop Limit.

- Two price fields will appear in which you enter the following prices:

o Price: the Price at which the order becomes active, and which is higher than the current market price

o Stop Limit Price: the Price slightly lower than the Price at which the buy will be executed

- Set the rest of the information and submit the order

Sell Stop Limit Order

In this Type of order, if the Price falls to a specific level, then a sell order is placed at a lower level. To set a Sell Stop Limit, follow the steps below:

- In Type, select Sell Stop Limit.

- Two price fields will appear in which you enter the following prices:

- Price: the Price at which the order becomes active, and which is lower than the current market price.

- Stop Limit Price: the Price slightly above the current market Price and lower than the current market price at which the sell will be executed.

Enter the remaining details and submit the order. If the Price falls to the specified levels, the order will be activated; otherwise, it will not.

Conclusion

In this article, we first became familiar with the concepts of Buy and Sell in forex and then examined how to place orders and the different types of buy and sell orders. Using this information, you can gain a better understanding of the right time to enter and exit trades and manage your positions more effectively by using the tools available in MetaTrader.