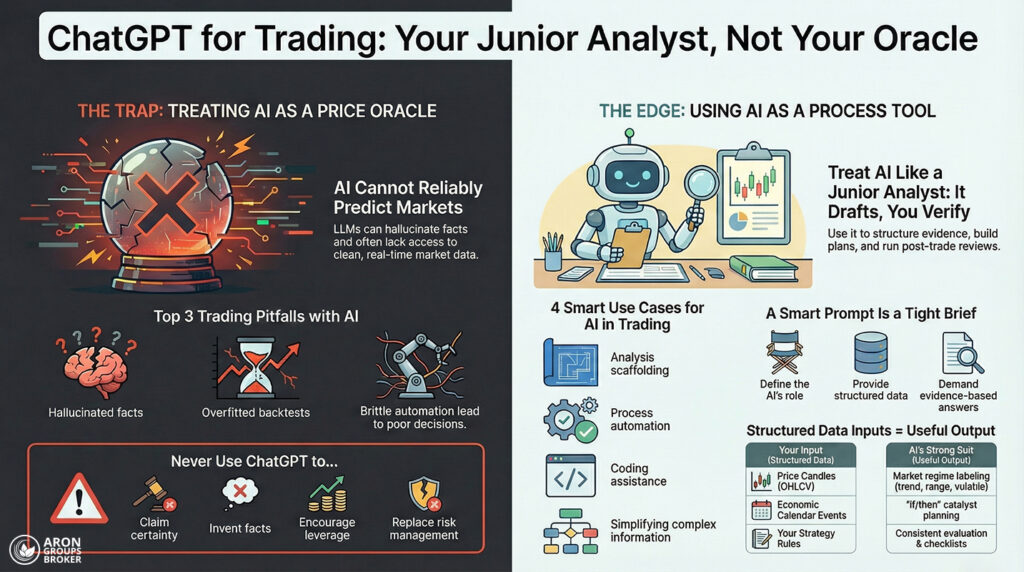

ChatGPT can help with trading, but not in the way most people expect. It is not a price oracle, and it cannot reliably generate trading signals on its own.

Used well, it works as a structure engine for analysis and execution. It turns messy inputs into a decision-ready narrative and a review checklist.

This guide explains how GPT can be used for trading across stock, crypto, and forex markets. It helps avoid traps such as hallucinated facts, overfitting, and fragile automation under changing conditions.

- GPT for trading works best as a research and process tool, not a signal generator.

- Backtests can lie through overfitting; use out-of-sample validation and realistic costs.

What does GPT for trading mean?

GPT for trading means using a large language model (LLM) like ChatGPT to support trading decisions by improving research, analysis structure, documentation, and workflow discipline. It does not mean the model can reliably predict prices.

In practice, ChatGPT trading usually falls into 4 buckets:

- Analysis scaffolding: summarise, compare, extract risks, and map scenarios.

- Process automation: create templates, journals, post-trade reviews, and checklists.

- Coding assistance: help you write and test scripts for data, backtesting, and alerts.

- Communication: translate complex market information into plain English.

QuantInsti frames this similarly; the model can assist the process, but it should not be treated as the decision-maker.

Key Point:

If your inputs are weak, GPT will produce confident nonsense faster. Your edge comes from evidence + process, not “more prompts”.

Can ChatGPT predict markets or generate reliable trading signals?

No, not reliably.

Two hard reasons:

- Data reality: Unless you explicitly feed it clean, current data, the model may not know the latest market state. Even with browsing/tools, you still need to verify.

- Hallucinations: LLMs can produce fluent statements that are unsupported or wrong. OpenAI researchers describe hallucinations as partly driven by incentives to guess rather than express uncertainty.

Fact:

Regulators keep warning that “AI” language is used to sell scams or fake trading platforms. For example, the SEC has recently brought cases involving purported crypto trading platforms promoted through social media.

What should ChatGPT be used for in trading (and what should it never do)?

ChatGPT should structure evidence into plans and reviews, and it must never invent facts or promise price certainty.What should ChatGPT for trading do?

- Turn your data into a regime label (trend/range/volatile) and a scenario tree.

- Convert research into a plan you can execute (entry logic, invalidation, risk limits).

- Force you to write a “what would change my mind” list before you trade.

- Help you run post-trade reviews, so you improve the process, not your excuses.

What should ChatGPT trading never do?

- Claim certainty: “This will go up tomorrow.”

- Invent facts: fake earnings numbers, fake central bank quotes, fake on-chain metrics.

- Encourage leverage by default.

- Replace risk management with vibes.

Learn more:

If you want a simple rule, treat GPT like a junior analyst. It drafts; you verify.

How can ChatGPT’s trading analysis be kept from hallucinating?

Hallucinations are not a rare glitch. They are a predictable failure mode. Your job is to design prompts and workflows that make hallucination expensive and obvious.

How do you force the model to separate facts from interpretation?

Use a two-column constraint:

- Facts (verbatim from inputs): only what you provided or what you can cite.

- Interpretation: clearly marked reasoning with assumptions.

Example prompt fragment:

Return two sections:

(1) Facts from my data only (no new claims).

(2) Interpretation with assumptions labelled.

How to make ChatGPT admit uncertainty?

Add a rule:

If the provided data does not support a claim, write: UNKNOWN and list what data would resolve it.

How to sanity-check outputs quickly?

Use the three-check:

- Numbers: Do they match your source?

- Causality: Did it confuse correlation with cause?

- Time: Is it mixing old and current information?

What market data should you feed GPT for trading?

A model can only be as good as the inputs you provide. Give it structured data, not messy screenshots.

| The input you provide | What GPT can do well | Common trap |

|---|---|---|

| OHLCV candles + timeframe | Regime labelling, scenario planning | Mixing timeframes without saying so |

| Key levels + why they matter | Cleaner invalidation logic | Levels with no rationale |

| Economic calendar events | “If/then” catalysts | Forgetting the time zone and release time |

| Earnings highlights/guidance | Risk mapping | Treating guidance as “truth.” |

| Rules of your strategy | Consistent evaluation | Vague rules = vague output |

| Trade journal snippet | Pattern detection in mistakes | Cherry-picked samples |

How can ChatGPT trading prompts produce decision-ready output?

Good prompts feel like a tight brief you would give to a human analyst.

A prompt template for GPT trading

Role: You are my risk-aware trading analyst. No hype. No predictions.

Objective: Turn my data into an execution plan and a review checklist.

Data:

– Asset + market: …

– Timeframe(s): …

– Price context (last X candles summary): …

– Key levels: …

– Volatility cues (ATR, IV, range %): …

– Events/catalysts: …

– My constraints: max risk per trade, session times, no-trade rules.

Tasks:

1) Label the market regime (trend/range/volatile) with evidence from the data.

2) Draft 3 scenarios (bull/base/bear) with:

– Trigger

– Invalidation

– Stop logic

– One risk warning

3) Output a trade checklist (max 7 bullets).

4) List UNKNOWNs + what data would confirm them.

Key Point:

The fastest way to improve outputs is to force structure and ban predictions.

Which prompt pattern works best for day trading with ChatGPT?

Use plan-first prompts:

- First output is the plan (rules, triggers, invalidation).

- Only then, allow ideas or optional setups.

That prevents the model from improvising hot takes and calling them analysis.

Can ChatGPT be used for stock trading without fooling yourself?

Yes, if you use it as a research compression tool and a discipline tool for risk framing.

How can ChatGPT help with stock fundamentals?

Ask it to summarise what matters from filings and calls:

- Revenue drivers and revenue quality

- Margin drivers (pricing, mix, cost structure)

- Cash flow vs earnings quality

- Balance sheet risks (debt maturities, covenants, dilution risk)

OpenAI models are often used for structured summarisation tasks, but you must still validate any extracted facts against primary documents.

Example

- Provide: the company’s latest guidance bullets, key segment notes, and cash flow summary.

- Ask GPT: “What are the top 5 swing factors that would change valuation assumptions?”

How to use ChatGPT prompts for stock trading to avoid confirmation bias?

Force it to argue the opposite:

- Write the bear case using only my data.

- List 5 reasons my thesis could be wrong.

- What would falsify this thesis within 90 days?

What should you not do when trading ChatGPT stock?

- Do not ask: Should I buy this stock today?

- Do not accept valuation outputs without your own model assumptions.

- Do not outsource position sizing to a chatbot.

How to use ChatGPT prompts for Forex trading without mixing up the market?

Forex is macro-heavy and structure-heavy. It rewards clean thinking, not clever phrases.

What facts about the FX market should you keep in mind?

The BIS reports that over-the-counter foreign exchange turnover averaged USD 7.5 trillion per day in April 2022, with FX swaps accounting for the largest share of turnover (about 51%). That matters because much forex trading content ignores the plumbing and funding mechanics behind price moves.

Fact box:

The BIS also notes that the US dollar is on one side of most FX trades, and the UK is one of the largest trading centres.

How can ChatGPT specifically help with forex trading?

- Translate macro events into “what changed” and “why price might react”.

- Build a scenario map around rates, inflation surprises, and risk sentiment.

- Draft a plan that respects your session (Asia/London/New York) and liquidity.

Q: What is a strong ChatGPT forex trading prompt?

A: Use a catalyst + reaction template:

Given this CPI surprise and central bank stance, list 3 plausible market reactions and the key invalidations for each.

How to use ChatGPT crypto trading workflows without ignoring exchange risk?

Crypto adds two layers that stocks and FX do not:

- Market structure: fragmented venues, different liquidity, different rules.

- Platform risk: custody, insolvency, withdrawal freezes, and fraud.

Crypto markets also trade 24/7, which changes how you define session, risk limits, and fatigue management.

More info:

In the EU, MiCA introduces a harmonised framework for many crypto-asset activities, with rules around authorisation and disclosures. Even so, regulators warn firms not to mislead customers about what is regulated.

How can ChatGPT for crypto trading help?

- Turn your on-chain / exchange metrics into a clean narrative.

- Write “risk-first” plans that include custody and venue assumptions.

- Create a monitoring checklist (fees, spreads, funding, volatility spikes).

Q: What should you watch for with ChatGPT crypto trading bot claims?

A: Scams often use AI language to sound legitimate. Recent SEC actions highlight fake platforms and investment clubs promoted via social media.

Can we use ChatGPT for options trading?

You can use it to explain trade structure and map risk, but options require precision.

How can ChatGPT for options trading help?

- Explain payoff shapes in plain language.

- Help you define the trade in terms of directional view, time view, and volatility view.

- Draft risk controls: max loss, adjustment rules, and exit conditions.

What should you never trust blindly?

- A generated options chain.

- Volatility claims without a source.

- Any “guaranteed hedge” language.

Can we build a ChatGPT trading bot?

Yes, you can use ChatGPT to help you build a trading bot. But that does not mean you should run it live straight away.

Most credible guidance on bot-building stresses the same thing: treat it as an engineering project, not a shortcut to profits.

The priority is process and testing clean data, clear rules, realistic trading costs, and strict risk controls. Even with solid development, a live bot may still fail to be profitable once market conditions change.

What is the minimum safe architecture for a trading bot with ChatGPT?

Think in modules:

- Data (clean, timestamped, survivorship-bias-aware);

- Signals (explicit, testable rules);

- Risk (position sizing, stops, max daily loss);

- Execution (orders, retries, slippage logic);

- Monitoring (logs, alerts, kill switch).

Key Point:

A bot without a kill switch is not automation. It is a liability.

A simple code for backtesting

# Educational skeleton: backtest structure, not a live bot.

# You still need proper data handling, costs, and validation.

import pandas as pd

def generate_signal(df: pd.DataFrame) -> pd.Series:

# Example rule placeholder: replace with your tested logic

return (df[“close”].pct_change(5) > 0).astype(int)

def backtest(df: pd.DataFrame, risk_per_trade: float = 0.01) -> pd.DataFrame:

df = df.copy()

df[“signal”] = generate_signal(df)

df[“ret”] = df[“close”].pct_change()

df[“strategy_ret”] = df[“signal”].shift(1) * df[“ret”] # naive; add costs/slippage

df[“equity_curve”] = (1 + df[“strategy_ret”]).cumprod()

return df

# Provide your own OHLCV DataFrame with datetime index and columns: open/high/low/close/volume.

Risk Warning:

This code is a structural template for educational purposes. It lacks the execution logic, slippage calculations, and error handling required for live markets.

How to avoid building a backtest that lies to you?

Backtests can lie when you overfit rules to history. This is where ChatGPT can accidentally lead you astray by “optimising” a strategy until it fits historical noise perfectly but fails in real-time.

Use these four defences to stay grounded:

- Walk-Forward Testing: Don’t just test on one block of time. Move your testing window forward in increments. To see if the strategy holds up in different market regimes.

- Out-of-Sample (OOS) Validation: Keep 20-30% of your data in a “black box” that you never look at during strategy development. Only run your final strategy on this data once.

- The “Cost of Doing Business”: Your backtest assumes perfect execution. In reality, you must subtract transaction costs, slippage (the difference between expected and executed price), and exchange fees.

- The Law of Parsimony: Every extra parameter or “indicator” you add increases the risk of overfitting. A strategy with 2 robust rules is usually safer than one with 10 hyperspecific conditions.

Which GPT is best for trading in practice?

There is no universal best. There is the best for your workflow.

What criteria actually matter?

- Reasoning quality: Does it follow constraints and avoid inventing facts?

- Tooling: Can it browse, read files, run code, and cite sources when needed?

- Stability: Does it behave consistently across sessions?

- Cost and limits: Can you use it at your required volume?

OpenAI’s model line-up and availability change over time (for example, the model picker and legacy models are explicitly managed and updated). ChatGPT trading often means using a higher-tier model, but you should check what your current plan offers and test it with your own prompts.

Key Point:

Best model matters less than best process. A great model with bad inputs still produces bad decisions.

How to evaluate AI trading bot apps and AI trading marketing claims?

Regulators have already taken action against firms for misleading AI claims (“AI-washing”). (Investopedia)

So treat marketing like a claim that needs evidence.

A quick due diligence table for AI trading tools

| Claim | What to ask for | Red flag |

|---|---|---|

| “Proprietary AI signals” | Full methodology + audited track record | Vague “black box” answers |

| “Guaranteed returns” | Nothing, walk away | Guaranteed anything |

| “Verified performance” | Independent verification, fees included | Only screenshots |

| “Low risk” | Risk metrics, drawdowns, scenario stress | No drawdowns shown |

| “Regulated” | Exact regulator + permissions | Misleading regulatory language |

Conclusion

Using ChatGPT for trading shifts focus from chasing signals to building a disciplined research and execution workflow. Strong traders use it to streamline documentation, spot biases, and improve testable code and checklists.

The model mirrors the quality of inputs and cannot replace validation, judgment, or risk management. Treat AI like a junior analyst, not a price oracle, and hype loses its power.

Across stocks, crypto, and forex, the durable edge is consistent evidence, checks and controlled risk.