In every transaction between a buyer and a seller, there is always some hidden benefit that often goes unnoticed. Part of this benefit belongs to the buyer, who pays less than the value they believe the product is worth, while another part goes to the seller, who sells it for more than the cost of producing it. Economists call these benefits consumer surplus and producer surplus. Understanding these two ideas helps us see what drives satisfaction or dissatisfaction in the market and why changes in prices or government policies can raise or lower people’s overall well-being. If you want to learn more about Consumer and Producer Surplus Explained and how these concepts shape market behavior, stay with us through the end of this article.

- Consumer and producer surplus reflect not only the individual gains of buyers and sellers but also serve as a key measure of how efficiently a market allocates its resources.

- Government actions such as taxes, subsidies, and price controls can eliminate part of a market’s potential gains and create deadweight loss (DWL), so their impact on total surplus should always be considered in policy analysis.

- A higher total surplus does not always mean greater fairness. When surplus is distributed unequally, it can lead to economic inequality even if the market appears more efficient.

- In markets affected by monopoly power or asymmetric information, the share of benefits between producers and consumers changes, reducing total surplus. This makes analyzing market structure essential for understanding true economic welfare.

What Is Consumer Surplus?

To understand what consumer surplus means, imagine buying something that you value more than the price you actually pay for it. The difference between the amount you are willing to pay and the amount you spend is the extra benefit or satisfaction you gain from the purchase. In economics, this benefit is called consumer surplus.

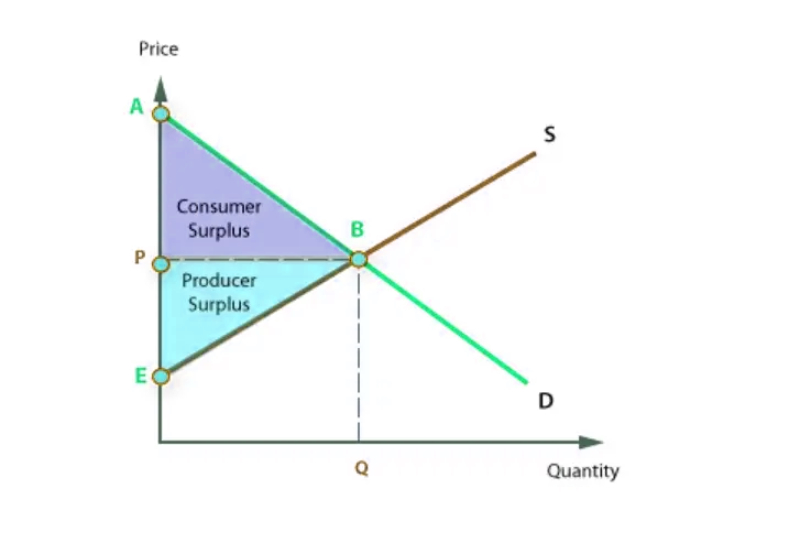

On a supply and demand graph, this area appears as the space between the demand curve and the market price line. For example, if you were willing to pay $50 for a movie ticket but bought it for $30, your consumer surplus would be $20. This simple concept helps us understand how much real value and satisfaction buyers receive from each transaction.

According to Khan Academy, consumer surplus is the difference between the actual price paid and the highest price a consumer is willing to pay.

What Is Producer Surplus?

To understand what producer surplus means, it helps to know that this concept shows how much a seller gains from selling a product for more than the minimum price they were willing to accept. For example, if a seller was ready to sell their product for $30 but managed to sell it in the market for $50, they earned a $20 producer surplus.

On a supply and demand graph, this surplus is represented by the area between the market price line and the supply curve. It reflects the additional profit producers gain from participating in a competitive market.

Why Are Consumer and Producer Surplus Important for Economic Welfare and Policy?

When a product or service is traded in the market, the total of consumer and producer surplus shows how much benefit society as a whole gains from that exchange. A larger total surplus means resources are being used more efficiently and social welfare is higher. Economists use these measures to understand how policies such as taxes, subsidies, and price controls affect the economy.

For instance, when the government introduces a tax that reduces the level of trade, both surpluses decrease and overall welfare falls. In the same way that fundamental analysis helps investors study how economic decisions influence stock values, looking at changes in consumer and producer surplus gives a clearer view of the real condition of the economy.

The Role of Supply and Demand in Shaping Consumer and Producer Surplus

The relationship between supply and demand determines how much buyers and sellers gain from each transaction in a market. The demand curve shows the maximum price consumers are willing to pay for different quantities of a product, while the supply curve represents the minimum price producers are willing to accept to produce and sell it.

For example, suppose the equilibrium price of apples in the market is $20. Some buyers were willing to pay $30, so they enjoy a $10 consumer surplus. On the other hand, some sellers were ready to sell at $15, but since the market price is higher, they earn a $5 producer surplus. This simple example shows how the balance between supply and demand creates benefits for both sides of the market.

How Do Equilibrium Price and Quantity Determine the Size of Consumer and Producer Surplus?

At the point where the equilibrium price and quantity meet in the market, both consumer surplus and producer surplus reach their maximum levels. Suppose the equilibrium price of a cup of coffee is $5. If the price rises to $6, some buyers will no longer want to purchase it, and the consumer surplus will shrink.

On the other hand, if the price drops to $4, producers will earn less profit, and the producer surplus will also decrease. In both cases, the total benefit for buyers and sellers becomes smaller than it was at equilibrium. Therefore, the equilibrium point represents the most efficient state of the market, where economic welfare is at its highest level.

The Impact of Price Elasticity of Demand and Supply on Changes in Consumer and Producer Surplus

Price elasticity shows how strongly buyers and sellers respond to changes in price, and this directly affects how consumer surplus and producer surplus change. When demand for a product is elastic, meaning consumers are sensitive to price changes, even a small price increase can lead to a sharp drop in quantity demanded, quickly reducing consumer surplus.

In contrast, for essential goods such as medicine, demand is inelastic. Even if prices rise, consumption changes very little, so the consumer surplus remains almost the same. On the supply side, when producers can quickly adjust their output in response to price changes, producer surplus fluctuates more noticeably.

To better understand these relationships and measure how price movements affect purchasing power, economists use the Consumer Price Index (CPI), which tracks changes in the cost of living and overall economic welfare.

How to Calculate Consumer Surplus in Economics

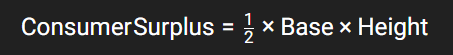

To calculate consumer surplus, economists usually use a simple triangular formula:

In this formula, the base (Q) represents the quantity traded, and the height is the difference between the highest price consumers are willing to pay (Pₘₐₓ) and the actual market price (Pₑₓ).

For example, suppose the demand curve shows that someone is willing to pay $100 for a product, but the equilibrium market price is $50, and the quantity traded is 50 units. In that case:

- Base = 50

- Height = 100 − 50 = 50

- Consumer Surplus = 0.5 × 50 × 50 = $1,250

This calculation shows that consumers collectively gain $1,250 more in value than what they actually pay to the market. a benefit that isn’t reflected directly in the price but represents the extra satisfaction they receive.

How to Calculate Producer Surplus in Economics

To calculate producer surplus, economists use a simple triangular formula:

In this formula, the base represents the quantity supplied in the market, and the height shows the difference between the market price and the minimum price producers are willing to accept. For example, imagine a market where producers are willing to sell their goods starting at $20, while the equilibrium market price is $50, and the traded quantity is 50 units. In this case, the base is 50 and the height is 30, so the producer surplus equals 0.5 × 50 × 30, which is $750.

This result shows how much extra benefit producers gain by selling at a price higher than their minimum acceptable price. In other words, producer surplus measures the profit or economic advantage that sellers receive from participating in a competitive market.

According to Investopedia, producer surplus is also calculated using the same triangular structure, where the base represents the quantity supplied and the height is the difference between the market price and the minimum price producers are willing to accept.

The Impact of Economic Policies on Consumer and Producer Surplus

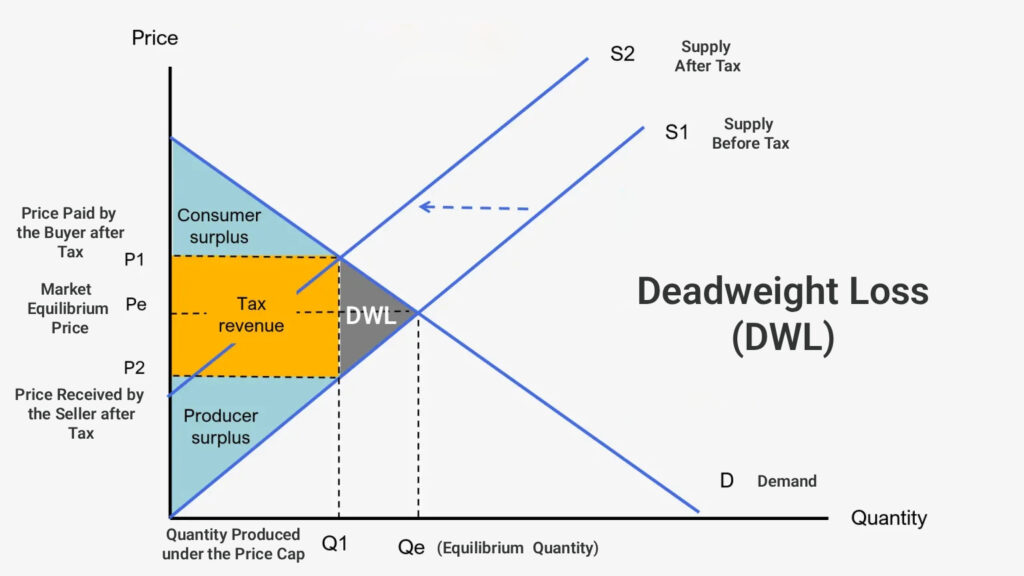

Economic policies such as taxes, subsidies, and price controls have a significant effect on consumer and producer surplus because they change the natural balance of the market. When the government interferes with prices or quantities, the benefits that buyers and sellers gain from transactions are altered. Sometimes these policies can improve overall welfare, but in other cases, part of the market’s potential benefit disappears, creating what economists call deadweight loss (DWL). Understanding these effects helps policymakers make decisions that promote greater economic welfare for society.

How Taxes Affect Consumer and Producer Surplus

When the government imposes a tax on a good or service, the price paid by consumers increases while the price received by producers decreases. As a result, the quantity traded in the market falls, and both consumer surplus and producer surplus decline. For example, if the government places a tax on gasoline, consumers will buy less of it and producers will sell less, meaning both sides lose part of their gains from trade.

The Role of Subsidies in Changing Consumer and Producer Surplus

A subsidy works in the opposite way. When the government provides a subsidy for a product, the price paid by consumers falls and producers earn more revenue. This leads to an increase in both consumer and producer surplus. However, subsidies are costly for the government, and if they are not well targeted, they can waste valuable resources. For instance, agricultural subsidies can encourage farmers to produce more while allowing consumers to purchase food at lower prices.

The Effect of Price Controls on Consumer and Producer Surplus

Sometimes the government sets price controls to protect certain groups. When a price ceiling is established, meaning prices cannot rise above a specific limit, consumers may initially benefit, but shortages often occur as supply decreases. Conversely, when a price floor is set, such as a minimum wage, producers or sellers may benefit while demand falls. In both cases, part of the total market surplus is lost, and the natural equilibrium of the economy is disrupted.

What is Deadweight Loss (DWL) and How Does It Affect Consumer and Producer Surplus?

Deadweight loss (DWL) refers to a situation in which the overall welfare of society decreases. In this case, the total benefits of consumers and producers are lower than they would be under a free-market equilibrium.

Put more simply:

Deadweight loss means a portion of economic benefits is wasted due to inefficient market interventions, such as taxes, subsidies, price ceilings or floors, monopolies, or structural inefficiencies.

For example:

- when the government imposes a tax on a good, some buyers refrain from purchasing it, and some sellers reduce their production. The portion of transactions that no longer takes place represents the welfare loss.

- In monopoly markets, since the price is higher and production is lower than the optimal level, part of the consumer’s welfare is lost and does not go to anyone’s pocket. In other words, this portion of welfare is destroyed rather than transferred.

According to Wikipedia, DWL is part of the potential benefits of the market that is lost when the market fails to reach its equilibrium point, leading to a decrease in total surplus.

Distributional Justice and the Limitations of Consumer and Producer Surplus

In economics, the total of consumer and producer surplus might seem high, but this does not always indicate an increase in fairness or true welfare in society. While the total surplus may be large, much of it could go to a specific group, leaving others with little benefit from the market. For this reason, economists not only examine the size of surpluses but also focus on how they are distributed among different groups to get a more accurate picture of economic welfare.

Why Increasing Total Surplus Does Not Always Lead to True Economic Welfare

An increase in total surplus may seemingly indicate a rise in welfare, but if its distribution is unfair or accompanied by negative externalities, actual welfare can decline. For example, higher industrial production might boost producer surplus, yet simultaneously impose environmental pollution and health costs on society. Therefore, growth in surplus, without accounting for distributional and environmental effects, is not a comprehensive measure of economic welfare.

When Measuring Consumer and Producer Surplus Is Meaningless

The consumer and producer surplus indicators are only reliable when the market operates under conditions of perfect competition and prices truly reflect preferences and costs. In many real-world markets, this assumption does not hold, resulting in a misleading measure of economic welfare.

For example, in the market for essential medicines, patients are forced to purchase drugs even if the price is several times higher than the production cost. On the surface, consumer surplus appears small, but in reality, the welfare gained from saving patients’ lives far exceeds the amount paid. This means that the surplus indicator cannot capture the true value of consumption in such a market.

The same problem arises in educational and healthcare services. An individual may pay a small amount for vaccination or schooling, but the subjective and social value of these services far exceeds their market price. Therefore, calculating surplus using classical methods underestimates the actual welfare of society.

In monopolistic markets, such as electricity in certain regions, prices rise due to lack of competition, and a large portion of consumer surplus is transferred to the producer. In this case, an increase in producer surplus does not necessarily indicate a rise in welfare, but rather reflects an unfair distribution of economic benefits.

Policy Tools and Indicators for Analyzing the Distribution of Surplus Among Different Groups

To analyze the fair distribution of surplus among groups, various tools are used. Policies such as progressive taxes and targeted subsidies can help ensure that market benefits are more equitably distributed. Economists also use indicators like the Gini coefficient and other distributional welfare indices to measure inequality and assess the fairness of surplus distribution. These methods help policymakers better understand whether increasing surplus truly leads to an improvement in overall welfare.

The Impact of Market Structure and Asymmetric Information on Consumer and Producer Surplus

When a market does not operate in a perfectly competitive manner, the distribution of profits between buyers and sellers changes, and this affects both consumer surplus and producer surplus. In such markets, prices are no longer determined purely by supply and demand, and one party typically has more power to set the terms of the transaction. Additionally, if one party has more information than the other, decision-making becomes more difficult for both sides, and part of the overall market benefits are lost.

How Monopoly and Oligopoly Markets Affect Consumer and Producer Surplus

In a monopoly market, a company or producer has more control over pricing. They usually set the price higher than the cost of production to increase profits, while the quantity of goods sold decreases. As a result, consumer surplus shrinks because buyers are forced to pay higher prices or forgo the purchase entirely. On the other hand, producer surplus increases as the producer takes a larger share of the market’s profit.

However, part of the beneficial transactions is lost, and total surplus decreases. This lost surplus is referred to as deadweight loss (DWL). For example, if in a competitive market the equilibrium price of a product is $5, but in a monopoly market the same product is sold for $7, some buyers will no longer be able to afford it, and part of the overall welfare is lost to society.

In an oligopoly market, a few large producers manipulate prices by controlling supply. For example, in the global oil market, coordinated decisions by countries (OPEC) regarding supply directly affect price levels and the global consumer surplus.

The Effect of Asymmetric Information on Consumer and Producer Surplus

In some markets, one party has more information than the other. This is called asymmetric information. For example, in the used car market, the seller knows more about the condition of the car than the buyer. As a result, the buyer might be unwilling to pay a high price due to the fear of buying a defective car.

This behavior leads to a reduction in the number of transactions, and both parties lose part of their surplus. The same happens in the insurance market, where an insurance company may not know how risky a customer is and might set higher rates. In these situations, both consumer surplus and producer surplus decrease, and part of the market’s welfare is lost, creating deadweight loss again.

Conclusion

Understanding the concepts of consumer surplus and producer surplus helps us identify the factors that increase or decrease welfare in the market and how economic policies can impact the behavior of buyers and sellers. These two indicators are essential tools for economic analysis as they show how the real benefits from trade are divided among different groups and how changes in price, taxes, or subsidies affect overall social welfare.

For practical use of these concepts, it is recommended that when analyzing any market, we not only focus on the financial gains or losses but also pay attention to the distribution of benefits among different groups. This approach allows for a more accurate assessment of economic efficiency and fairness.