Many traders eventually realize that the type of trading account they choose can have a significant impact on their profits and losses. Among the different options available, the ECN account stands out thanks to its lower spreads, faster execution speed, and greater transparency. Traders who initially start with a demo account or even a standard account often move on to brokers that provide ECN accounts in order to experience a more professional trading environment. If you are also looking to gain a deeper understanding of this type of account and learn how it differs from other options, stay with us until the end of this article.

- An ECN account provides access to a network of liquidity providers, allowing trades to be executed faster and at more accurate market prices.

- Thanks to its high speed and low costs, an ECN account is the best choice for experienced traders and scalpers who rely on short-term strategies.

- Checking the broker’s regulation and fee transparency is essential to ensure the true performance of an ECN account and to protect your capital.

- Using a demo account before switching to an ECN account helps traders become familiar with its complexities and manage risk more effectively.

What is an ECN Account and How Does It Work?

When it comes to choosing a forex trading account, one of the most important options for professional traders is the ECN account. According to Investopedia, this type of account creates an electronic communication network (ECN) that connects traders’ orders directly to liquidity providers such as banks and financial institutions. In this setup, there is no dealing desk, and the broker’s role is limited to providing the trading platform and routing the orders. As a result, prices are displayed without manipulation, and trades are executed with greater transparency and speed.

When you place an order, the system automatically matches it with the best available price in the market, which leads to lower spreads and faster execution. To access such accounts, popular trading platforms like MetaTrader 4 and MetaTrader 5 are commonly used, as they can connect directly to the ECN network and display the real market liquidity.

According to CFI, an ECN account allows traders to execute orders without requotes, since all trades are routed directly to the market and execution delays are minimized.

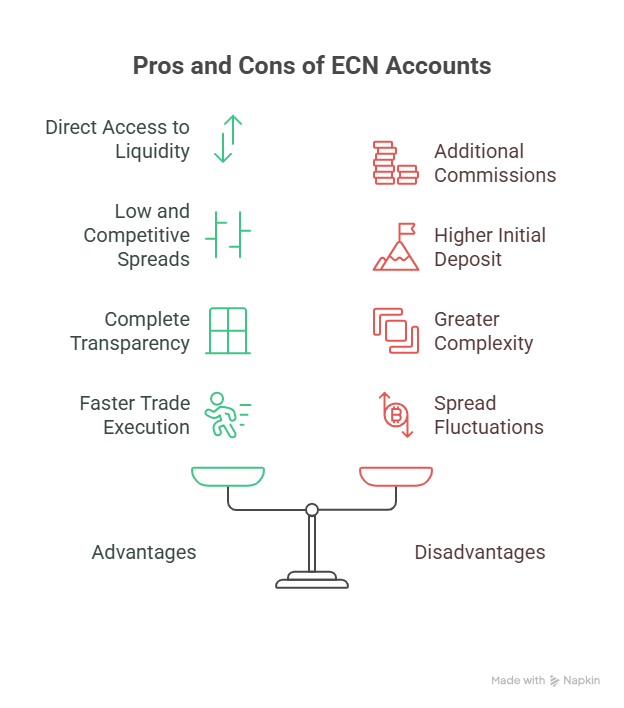

Advantages of an ECN Account for Traders

Opening an ECN account can transform the trading experience for professional market participants. It allows traders to access real market prices, minimize costs, and enjoy faster execution. These features make ECN accounts one of the most appealing options in forex trading.

Direct Access to Interbank Liquidity

An ECN account connects orders directly to the core market without intermediaries. Traders can place transactions with leading banks and financial institutions while also viewing market depth. This direct access creates a highly liquid trading environment.

Extremely Low and Competitive Spreads

One of the most attractive features of an ECN account is its very tight spreads, which in some cases can even approach zero. This is especially valuable in popular currency pairs such as EUR/USD, helping traders reduce costs significantly, particularly those who use short-term or high-frequency strategies.

Complete Transparency in Pricing

Prices are quoted directly from the market with no interference or manipulation. This level of transparency reassures traders that every trade is executed at genuine market rates and that performance is entirely dependent on real market conditions.

Faster Trade Execution

By eliminating the dealing desk, ECN accounts ensure orders are processed with minimal delay. Speed of execution is critical for strategies such as scalping or other short-term approaches, allowing traders to manage entries and exits with greater accuracy.

Disadvantages and Limitations of an ECN Account

Although an ECN account is highly attractive for many traders, it is important to be aware of its limitations before making a decision. Understanding these drawbacks will help you choose the type of account that best suits your trading style and financial situation.

Additional Commissions on Top of Spreads

Unlike standard accounts, an ECN account usually charges a separate commission in addition to the spread. For traders who place a high volume of trades or execute multiple transactions per day, these fees can add up and increase overall trading costs.

Higher Initial Deposit Requirements

Opening an ECN account often requires a larger minimum deposit compared to a standard account. This higher entry barrier can be a challenge for beginners or traders with limited starting capital.

Spread Fluctuations During Certain Market Hours

Spreads in an ECN account are usually very tight, but they can widen during specific times such as major news releases or near the end of the trading day. These spread fluctuations can make short-term trading strategies more difficult to manage.

Greater Complexity for Beginners

Managing an ECN account requires more knowledge and experience compared to standard accounts. For novice traders, this complexity can be overwhelming. That is why many beginners prefer to start with a demo account before moving on to live ECN trading, giving them time to learn how to handle real market conditions and risk management effectively.

Comparing an ECN Account with Other Types of Trading Accounts

When choosing the right trading account, it is essential to understand how an ECN account differs from other options such as a Standard account or an STP account. Below, we break down the main differences.

ECN Account vs. Standard Account

In the ECN model, trades are executed without the direct intervention of the broker, and orders are routed straight to the interbank market or other participants. By contrast, in a Standard account the broker acts as the counterparty and directly fills your orders. An ECN account typically offers floating, very tight spreads along with an additional trading commission. A Standard account, however, often comes with fixed or wider variable spreads and usually no separate commission. For this reason, Standard accounts are generally more suitable for beginners entering the forex market.

ECN Account vs. STP Account

Both ECN and STP accounts operate on a no-dealing-desk model, but they are not identical. An ECN account connects to a broader network of liquidity providers and usually offers much lower spreads. An STP account may have fewer liquidity providers, which can lead to slightly higher spreads.

Leverage and margin play important roles in both types of accounts. High leverage in an ECN account can amplify both profits and losses, making precise margin management crucial. STP accounts may provide more flexibility in leverage but often with less transparency compared to ECN accounts.

Who Should Use an ECN Account?

Traders who prioritize fast execution and lower trading costs generally prefer an ECN account. It is the right choice for professional traders and scalpers who rely on tight spreads and high transparency. On the other hand, beginners or those who prefer longer-term strategies often find simpler options like a Standard account or even an Islamic account more suitable.

An important point to keep in mind is that trading with an ECN account can be challenging without a clear strategy and proper risk management. For this reason, it is generally recommended for traders who already have sufficient experience in the market.

Key Factors in Choosing a Broker with a True ECN Account

Selecting a reliable broker to open an ECN account can significantly impact the quality of your trading. To ensure that the conditions you receive are genuine, it is important to pay attention to several key factors.

Real ECN Account vs. Simulated ECN

Some brokers advertise accounts under the name of ECN, but in practice, they do not route orders directly to liquidity providers. In a genuine ECN account, trades are entered directly into the network, and prices reflect the actual conditions of the market.

Regulation and Broker Credibility

Having a license from reputable authorities such as the FCA, ASIC, or CySEC ensures that the broker adheres to strict industry standards. As noted by Investopedia, “credible regulation is one of the most important indicators of a broker’s legitimacy.” Proper regulation provides traders with the confidence to invest with greater peace of mind.

Fee Structure and Commission Transparency

One of the hallmarks of a true ECN account is the broker’s full transparency in disclosing fees and commissions. Without this clarity, traders cannot effectively manage their trading costs or assess the real value of the services they receive.

Supported Platforms and Trading Tools

A high-quality ECN account should be backed by advanced trading platforms such as MetaTrader 5 and provide access to a wide range of instruments including currency pairs, metals, and even cryptocurrencies. This flexibility allows traders to diversify their strategies and operate in multiple markets with greater efficiency.

Most reputable brokers offering an ECN account also provide segregated accounts, which keep your funds separate from the broker’s own assets.

Conclusion

In the end, it is clear that an ECN account, with its low spreads, high transparency, and fast execution, is an attractive choice for professional traders. However, the presence of separate commissions, higher initial deposit requirements, and the complexity of risk management show that this type of account is not suitable for everyone. Choosing a regulated and trustworthy broker, along with having a well-defined strategy, plays a key role in achieving success.

It is also recommended to practice with a demo account before moving to a live ECN account, as this helps you gain the necessary experience and confidence. Taking the time to research and evaluate your options further will provide a more reliable path toward making the most of an ECN account.

source: dailyforex