Have you ever entered a trade just because you didn’t want to miss an opportunity? If yes, you’ve probably experienced FOMO, a psychological concept that means “Fear of Missing Out.” In financial markets, it’s one of the most common mental traps traders fall into.

FOMO pushes you to make decisions without enough analysis, often based on pure emotion or what you see on social media. That’s how a damaging cycle can start.

In this Aron Groups Broker article, you’ll learn what FOMO really is, how it differs from concepts like FUD, why it becomes more intense in markets like crypto and forex, and how to control it through clear understanding and intentional planning.

- FOMO isn’t just a momentary reaction; it’s often rooted in deeper needs like seeking approval and fearing rejection.

- The 24/7 nature of crypto and forex can keep a trader’s mind in a constant state of anxiety.

- A loss caused by FOMO can pull you into a cycle of emotional, back-to-back trades.

- People who lack analysis skills and risk management are more exposed to rushed, emotional decisions.

What Is FOMO in Financial Markets?

According to CoinMarketCap, FOMO (Fear of Missing Out) is one of the most common psychological traps in financial markets. It happens when a trader feels they might miss a profitable opportunity, so they enter a trade just to avoid being left behind, without logical analysis or consideration of real market conditions.

In trading, FOMO usually shows up as rushed, emotional decisions. For example, when the price of a cryptocurrency or a stock is rising fast, you might think:

“If I don’t buy now, it’ll be too late!”

That feeling often pushes people to buy at the top of the move, exactly where the risk of a sudden drop is high.

What’s interesting is that FOMO isn’t limited to beginners. Even professional traders and experienced investors can be vulnerable to it. The difference is that professionals learn how to control emotions and stick to pre-defined strategies.

In the end, FOMO makes you trade based on feelings rather than analysis, such as greed, fear, or even envy. And that’s usually where losses begin. Successful trading isn’t built on excitement; it’s built on discipline, analysis, and emotional control.

FOMO is often triggered by price acceleration, not just price direction. Fast candles and sudden volume spikes make your brain treat “not entering” like a loss.

The Psychological Roots of FOMO

FOMO isn’t just a momentary reaction. It’s rooted in our psychological makeup and comes from basic human needs. This phenomenon is a mix of several psychological factors, which we explain below:

- The need for belonging and social acceptance;

- Social comparison;

- Low self-esteem and anxiety;

- Unmet psychological needs;

- The cybernetic model (mental evaluation process);

- Negative past experiences;

- The brain’s stress response;

- Personality types.

Next, we’ll explain each of these.

The Need for Belonging and Social Acceptance

Humans naturally want to be part of a group and feel like they’re not missing out on shared experiences. When we see others in situations where we’re not present (for example, a major price rally in the market or a special party), the brain can interpret it as “rejection” or “being left behind.” This feeling is one of the main foundations of FOMO.

Social Comparison

We unconsciously compare our lives to those of others. When we see on social media that others have made huge profits from trading or are experiencing special moments, our mind judges: “I’m falling behind.” This comparison is often unfair because we see only the polished highlight, not the full reality.

Low Self-Esteem and Anxiety

People with low confidence or chronic anxiety are more vulnerable to FOMO. In these conditions, even a small piece of news about others profiting can trigger the feeling that they are incompetent or that they’re “losing at the game of life.”

Unmet Psychological Needs

Sometimes FOMO signals that certain inner needs, like a sense of competence, independence, or emotional connection, aren’t being met. When these needs aren’t fulfilled in everyday life, a person is more likely to feel a sense of shortage and “falling behind” when they see others’ success or experiences.

The Cybernetic Model (Mental Evaluation Process)

The human brain is constantly evaluating: “Was my decision right or not?” Under FOMO, this evaluation system becomes disrupted. Instead of focusing on personal goals, the person gets stuck in thoughts like: “What if I chose the wrong path?” and that often leads to rushed decisions.

Negative Past Experiences

People who have experienced rejection, failure, or being excluded in the past tend to be more sensitive to similar situations in the future. So when they notice any sign of “missing out,” that old wound gets reactivated.

The Brain’s Stress Response

When we feel we’re losing something, the brain triggers a stress response. The amygdala, an area responsible for fear and anxiety, becomes active, and the body shifts into “fight or flight” mode: a state where logic turns down, and emotion turns up.

Personality Types

Psychology research suggests that people with personality traits like neuroticism and extraversion experience FOMO more than others. In contrast, those who are more conscientious and self-controlled are less likely to be affected by it.

Why Is FOMO Stronger in Crypto and Forex Markets?

FOMO exists in all financial markets, but in crypto and forex, it tends to be more intense and faster-moving. That’s because of a mix of these markets’ unique characteristics and the psychological reactions they trigger in traders.

Below are the main reasons why FOMO shows up more often in these two markets:

- Extreme volatility and the greed for quick profits;

- 24/7, nonstop trading;

- The strong influence of social media and influencers;

- Easy entry with little or no proper education;

- Limited oversight and information imbalance;

- Cognitive biases and emotional reactions.

Next, you’ll get a clearer look at how each factor fuels FOMO.

Extreme Volatility and the Greed for Quick Profits

Crypto and forex markets are highly volatile. A coin or currency pair can move several percent in just a few minutes, pushing the trader’s mind into excitement rather than analysis. This volatility makes people feel that if they don’t enter right now, they’ll miss a “golden opportunity.”

24/7, Nonstop Trading

Unlike traditional stock exchanges, forex and crypto run around the clock, even on holidays. This creates a constant feeling that a major move might happen while you’re sleeping or resting. That continuous pressure can keep the mind in an anxious state and lead to fast, emotional decisions.

The Strong Influence of Social Media and Influencers

On platforms like Twitter, Telegram, and Reddit, you’re constantly exposed to posts about big profits, “crazy signals,” and dramatic analyses. Much of this content is shared without serious verification, which makes traders think:

“Everyone is making money, why should I be the one left out?”

This noisy environment activates herd mentality, meaning decisions are made by copying others instead of thinking independently.

Easy Entry with Little or No Proper Education

Signing up for crypto exchanges or forex brokers is extremely easy, and you can often start with a small amount of capital. That attracts many beginners who still don’t understand basics like risk management or emotional control. These traders are far more likely to fall into the FOMO trap.

Limited Oversight and Information Imbalance

The crypto market in particular still lacks strict regulation in many areas. As a result, weak projects and even outright scams are common. Misleading marketing or unverified rumors can push people to buy without proper research, simply because they don’t want to “miss the opportunity.”

Cognitive Biases and Emotional Reactions

The desire for fast profit and the fear of missing gains are the two main engines behind FOMO. Confirmation bias leads traders to focus only on information that supports entering a trade, while ignoring warnings and risks.

Herd instinct also forces the mind into thinking:

“If everyone is buying, there must be a good reason.”

When in reality, it might be nothing more than a short-lived wave of hype.

Constant screen-checking increases “availability bias” (what you see most feels most important), which makes random moves look like “signals” and feeds impulsive entries.

The Negative Effects of FOMO on a Trader’s Decision-Making

FOMO is one of the most dangerous psychological traps in a trader’s journey. It pulls the mind away from logical analysis and pushes the person toward emotional, unstable, and sometimes high-risk reactions.

Below are the most important negative effects of FOMO on traders’ decision-making:

Rushing Into or Out of Trades

When FOMO kicks in, the trader enters a position without enough analysis simply out of fear of missing profits.

The result? Buying at the top or exiting too early from a profitable position.

In both cases, emotional decision-making replaces logic, increasing the probability of loss.

Ignoring the Trading Plan

Every professional trader knows that sticking to a personal strategy is the core of long-term success. But FOMO disrupts that discipline: risk management rules get ignored, stop-loss levels are forgotten, and pre-defined entry/exit points get abandoned. The outcome is messy, inconsistent trading with low profitability.

Overtrading

Fear of missing opportunities makes a person jump from one trade to another even when there’s no valid signal. This behavior not only increases trading costs (commission, spread, etc.) but also leads to serious mental fatigue and burnout.

Unrealistic Risk-Taking

FOMO can push a trader to open oversized positions or overuse leverage. These high-risk decisions, especially in volatile markets, can lead to heavy, sometimes irreversible losses.

Psychological Pressure and Mental Burnout

The feeling that you “must not miss out” keeps the mind in constant alert mode. The result is anxiety, regret, insomnia, and eventually reduced focus and weaker decision-making. This state can drag a trader into a cycle of repeated losses.

Confirmation Bias

Under FOMO, the mind unconsciously searches only for information that supports the emotional decision and ignores opposing evidence. This selective thinking weakens analysis and increases risk-taking.

Herd Mentality

Another consequence of FOMO is blindly following the crowd. “If everyone is buying, I should buy too!” This mindset fuels price bubbles and sudden crashes, and traders who enter late usually suffer the biggest losses.

Revenge Trading

When a trader loses due to FOMO, they may impulsively enter the next trade to “make the money back.” This revenge-driven trading is usually high-risk and low-focus, increasing the risk of even greater losses.

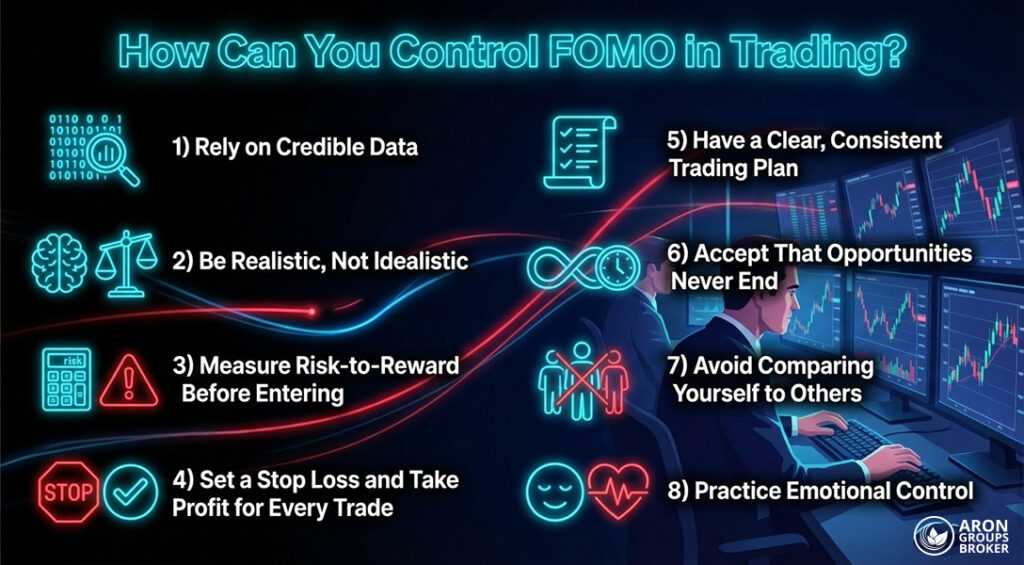

How Can You Control FOMO in Trading?

As explained by Oanda, to control FOMO in trading, the most important step is to separate emotions from decision-making and move forward based on logic, analysis, and planning. FOMO gains power when a trader enters the market without enough analysis purely out of fear or excitement.

The strategies below help you manage emotional reactions and trade more consciously:

1) Rely on Credible Data

Before making any trading decision, check information from official and reliable sources (such as trustworthy economic news or solid technical analysis). Avoid reacting quickly to tweets, Telegram rumors, or promotional posts. Analyze properly, don’t just copy others.

2) Be Realistic, Not Idealistic

Big profits don’t happen overnight. The market is a mix of wins and losses. Once you accept that reality, set realistic profit targets and risk levels, and remember that even the most professional traders take losses.

3) Measure Risk-to-Reward Before Entering

Before any trade, ask yourself: “If this goes wrong, how much of my capital am I willing to lose, and if it goes right, how much can I gain?” If the potential reward isn’t worth the risk, don’t take the trade even if the market is moving up.

4) Set a Stop Loss and Take Profit for Every Trade

Setting a Stop Loss and Take Profit is one of the most effective tools for controlling emotions. It prevents rushed decisions during volatility and helps you avoid impulsive behavior.

5) Have a Clear, Consistent Trading Plan

Write a plan that includes your goals, trade type, entry/exit strategy, and capital management rules. Then stick to it. If you don’t have a plan, you’re basically trading based on emotion.

6) Accept That Opportunities Never End

The market always offers new opportunities. If you missed one move, don’t panic. A trade taken with a proper plan is better than an emotional entry into a position you don’t fully understand.

7) Avoid Comparing Yourself to Others

Don’t measure your progress against other people’s wins. Someone may have made a huge profit, but you don’t know the full details of their trade. Staying focused on your own strategy and plan is the key to consistency.

8) Practice Emotional Control

Successful trading isn’t just about knowledge; it requires mental discipline. Every time FOMO shows up, pause, take a deep breath, and follow your logical checklist. Replace emotion with a solid plan.

A simple “cool-down rule” works: after seeing a hype move, wait one full candle on your trading timeframe (e.g., 15m/1h) before acting; many FOMO trades disappear with a little time.

The Difference Between Market Analysis and FOMO

In trading, two powerful forces influence your decisions: market analysis and FOMO. On the surface, they might look similar, but in reality, they’re worlds apart. One is driven by logic, the other by emotion.

Market Analysis: Logical Decisions Based on Data

Market analysis means carefully evaluating the condition of an asset or a market using clear tools and reliable information. It’s usually done in three ways:

- Technical analysis: Studying price charts, trading volume, and patterns to forecast future market behavior.

- Fundamental analysis: Evaluating an asset’s intrinsic value based on economic, financial, and news-related factors.

- Quantitative analysis: Using statistical and algorithmic models to find trading opportunities.

Market analysis helps a trader act calmly, with planning and forecasts not based on momentary emotions. The focus is on sustainable profit and capital preservation over the long term.

FOMO: Emotional Decisions Driven by Fear of Missing Out

FOMO is a form of anxiety that activates when you feel: “Everyone made money except me.” This fear often grows after reading hot news, seeing “success” tweets, or watching an asset’s price surge sharply.

FOMO triggers:

- Greed for big, fast profits

- Regret over missed opportunities

- Blindly following the crowd (herd behavior)

- The influence of social media and influencers

FOMO makes a trader forget their plan, skip placing a stop loss, and enter the market just to “not miss out” even though they’ve often arrived late, and the market may be ready to reverse.

| Feature | Market Analysis | FOMO |

|---|---|---|

| Decision basis | Data, logic, strategy | Emotion, excitement, market hype |

| Entry timing | After review and planning | Immediately, without review |

| Risk control | Strict capital/risk management | Ignoring stop loss and position sizing |

| Likely result | Sustainable, controlled profits | Sudden losses and unstable decisions |

| Trader’s mindset | Calm, focused, responsible | Anxious, rushed, crowd-dependent |

Conclusion

Ultimately, remember that controlling FOMO in trading is less a technical trick and more a psychological skill. By focusing on proper market analysis, sticking to your personal trading plan, and managing your emotions, you can escape rushed decision-making.

Successful trading stems from patience, discipline, and informed decisions, rather than emotional reactions to volatility or the collective noise created by others. New opportunities will always arise; what matters is staying prepared and rational enough to capitalize on them properly.