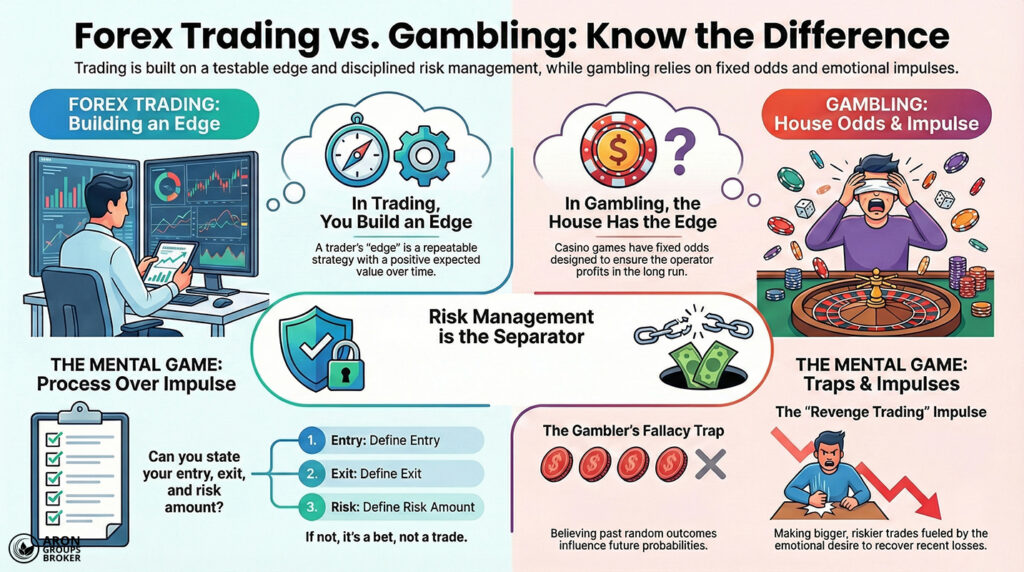

Forex trading and gambling both involve risking money under uncertainty, with no guaranteed outcomes. The key difference lies in the decision-making process before, during, and after each trade.

In Forex Trading vs Gambling, the key separator is having a measurable edge, controlled risk, and rules you follow after losses. Gambling relies on fixed odds and emotion-driven repetition, while trading can be built on probability, testing, and disciplined risk management.

This guide explains the Difference Between Trading and Gambling, shows how Trading Psychology vs Gambling Psychology shapes decisions, and flags key risks.

- In gambling, odds are fixed; in forex, costs and liquidity change your effective odds trade by trade.

- Leverage is the silent accelerator of ruin; regulators cap it because small moves can wipe accounts fast.

- Your edge is measurable only if you can estimate expected value and survive variance long enough to realise it.

- If trading becomes mood control, not decision-making, treat it like a behavioural risk, not a “discipline problem”.

What Do “Forex Trading vs Gambling” Definitions Really Mean?

The debate usually collapses into one question: do you control the odds, or do the odds control you? Clear definitions help you stop arguing and start diagnosing your own behaviour.

What is Gambling?

As explained in Investopedia, gambling is staking money on a contingency with an uncertain outcome, where chance dominates the result. In most casino games, the rules and payouts are designed so the operator keeps a statistical advantage.

That built-in advantage is why expected outcomes tend to be negative for players over time. You can win sessions, but the system is engineered to win the long game.

What is Forex Trading?

Forex is an over-the-counter market, not a single central exchange, with prices formed across interconnected participants. It is also huge in scale, with global daily turnover measured in trillions of dollars.

Your cost of doing business is not a house edge, but trading frictions like the spread and commissions. Execution can also differ from the price you expected, which is called slippage.

Key Insight

In Europe, many retail traders access FX via CFDs, where rules require providers to include provider-specific loss percentages in risk warnings.

Q: Do forex trades settle instantly, like a casino bet?

A: Spot FX typically settles in two business days, while CFDs often avoid delivery because they are derivative contracts.

When Does Forex Trading Become Gambling?

Forex Trading vs. Gambling becomes personal when a trade lacks a thesis, an invalidation point, and a predefined risk. At that point, the market is not the problem; your process is.

- A simple tell: if you cannot explain entry, exit, and risk in plain language, you are guessing.

- Another tell: if position size changes because you “feel it,” you are betting, not trading.

What Is the Difference Between Trading and Gambling in the Maths of the “Edge”?

The cleanest Difference Between Trading and Gambling is whether the numbers can favour you after costs. That is what “edge” means: positive expectancy, not confidence.

Why Do Casinos Have a Built-In House Edge?

Casinos set game rules and payouts so the house edge produces predictable profit over time. Even “good-looking odds” include a margin that favours the bookmaker or casino.

This is why many gambling situations are described as negative-expected-value for the player. You may win short-term, but the structure works against you long-term.

How Do Traders Build Positive Expectancy?

In forex trading, you cannot remove costs, but you can design rules that outperform costs over many trades. That means testing a method, then executing it consistently, without “freestyle” exceptions.

Better to Know

Expected value is the average outcome across many trials; if your method cannot beat costs in EV terms, it is entertainment.

Risk asymmetry matters: small, controlled losses and occasional larger wins can create positive expectancy. A stop-loss is one of the simplest tools to cap downside and reduce emotion during execution.

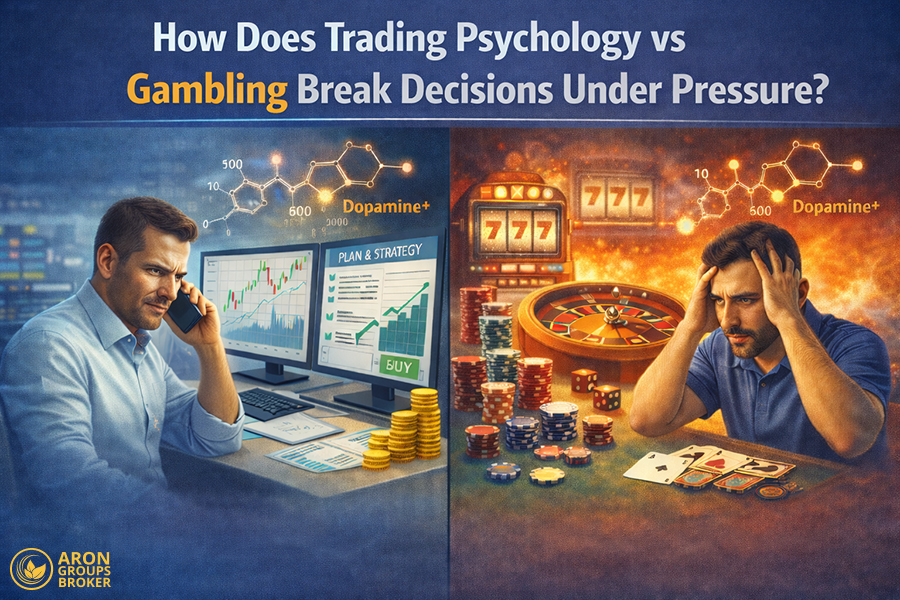

How Does Trading Psychology vs Gambling Break Decisions Under Pressure?

Trading Psychology vs Gambling Psychology is not about being calm; it is about being rule-governed under stress. Both activities trigger strong reward responses, especially when outcomes are fast and variable.

The Reward Loop (Dopamine, Near-Misses, and “One More Trade”)

Variable rewards push people towards repetition, because the brain learns “maybe the next one pays.” That loop shows up in day trading when you chase the feeling of action, not the quality of setups.

A near-miss is especially dangerous because it feels like skill, even when it is mostly noise. This is how a session turns into “just one more trade,” then another, then another.

Loss Aversion and Revenge Trading

Loss aversion means losses feel heavier than equivalent gains, which distorts decision-making under pressure. It often fuels the urge to “get back to even,” which is a psychological trap.

Behavioural finance describes how investors hold losers too long and sell winners too quickly, called the disposition effect. In trading, that can morph into revenge trading: bigger size, worse entries, and broken risk limits.

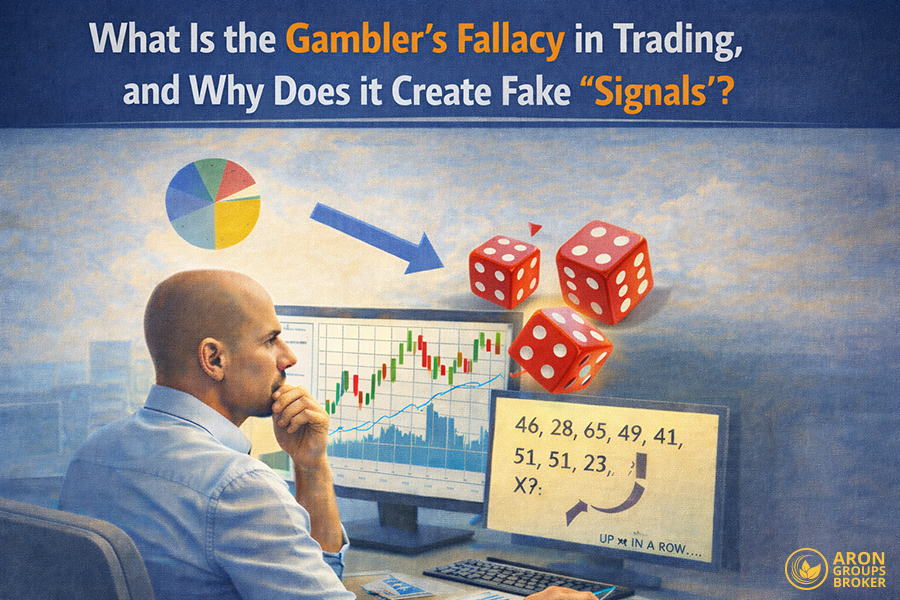

What Is the Gambler’s Fallacy in Trading, and Why Does It Create Fake “Signals”?

The Gambler’s Fallacy in Trading is a classic error that treats random sequences as if they have memory. It feels logical, but it is mathematically wrong in independent events.

How the Gambler’s Fallacy Works (Randomness Does Not Have Memory)

The gambler’s fallacy is believing past outcomes change future odds, even when each event is independent. Roulette does not “owe” red, and a coin does not “need” tails.

Markets are not pure coin flips, but many short-term streak stories are still narrative glue, not evidence. If your only signal is “it has dropped five days,” you are guessing with a spreadsheet on top.

How It Shows Up in Forex (Martingale, Averaging Down, and Over-Leverage)

Martingale-style sizing assumes a reversal is “due,” so you increase size after losses to recover quickly. That behaviour often turns normal drawdowns into account-ending events through leverage and compounding losses.

Averaging down can be valid in some strategies, but it becomes gambling without a tested model and strict risk limits. If your risk expands as price moves against you, your thesis is not improving; your hope is.

What Is the Casino Mindset in Trading, and When Does It Make You Bet?

Casino Mindset in Trading occurs when the goal becomes excitement, identity, or a quick win rather than a repeatable process. It often appears in specific situations, not as a permanent personality trait.

Social Proof and FOMO

Social proof makes you trade because others are trading, especially when stories sound easy and urgent. FOMO pushes you to enter late, size too big, and ignore the conditions that made the move possible.

If your “analysis” is mostly screenshots, group chats, and emotional certainty, treat it as a warning sign. In practice, crowd energy is not a strategy, and hype is not a risk plan.

“News Roulette” and Volatility Chasing

Big headlines create fast movement, but they also widen spreads and increase slippage risk. If you trade news without rules, you often pay higher costs for less control.

Professional traders often reduce risk around uncertain events because the distribution of outcomes becomes wider. Chasing volatility for adrenaline is a casino impulse, even if the chart looks “technical.”

How Does Risk Management in Forex Separate Skill From Gambling?

Risk Management in Forex is where “I think” becomes “I can survive being wrong.” Without risk controls, even a good idea can be wiped out by one oversized mistake.

Key Point

EU measures cap retail CFD leverage (e.g., 30:1 on major FX) and include protections like negative balance protection and margin close-out rules.

Position Sizing and Risk of Ruin

Position sizing is the practical way to control how much damage a single trade can do to your account. It matters because the risk of ruin is the probability of losing so much capital that recovery becomes unrealistic.

Small, consistent risk per trade lowers the chance that variance kills you before your edge can play out. Big size makes outcomes depend on luck, which is exactly what you are trying to avoid.

Stop-Loss Discipline

A stop-loss order can limit maximum loss and reduce emotional spirals after price moves against you. The key is placing it where your trade idea is invalidated, not where you “feel pain.”

Loss-limiting rules exist because losses are normal, even for skilled traders, and survivability is the real objective. If you move stops to avoid being wrong, you are not managing risk; you are negotiating with reality.

Q: Why do regulators cap leverage for retail FX CFDs?

A: Because leverage magnifies small price moves, rules restrict leverage and add protections to limit catastrophic losses.

What Are Trading Addiction Symptoms, and When Does Trading Stop Being a Choice?

Trading Addiction Symptoms look like compulsion: trading becomes mood regulation, not decision-making. This is not about “being passionate”; it is about losing control and paying real-life costs.

Key Trading Addiction Symptoms

Warning signs resemble problem gambling patterns: preoccupation, hiding behaviour, and escalating time or money spent. Another sign is irritability or restlessness when you try to stop or reduce the behaviour.

According to NCP, Financial red flags include chasing losses, borrowing, and breaking rules you set when calm. If trading becomes your main source of emotional relief, the risk is no longer only financial.

What Helps

Start with friction: reduce leverage, cap daily loss, and limit screen time using platform controls and routines. Remove triggers like late-night trading, social media hype, and impulsive “revenge” sessions.

If you recognise persistent loss of control, consider professional support, just as you would for problem gambling. Treat it as a health-and-finance combination, because it usually damages both.

Is Forex Haram or Halal, and What Framework Can You Use to Decide?

Is Forex Haram or Halal depends on the structure, intent, and whether the trade contains prohibited elements. This section is a decision framework, not a religious ruling for every person.

Key Terms Often Discussed

- Riba is commonly used for interest or unjust gain from lending, and it is prohibited under Islamic law.

- Gharar refers to excessive uncertainty or ambiguity in contracts, which Islamic finance seeks to avoid.

- Maisir (also spelt maysir) refers to gambling or wealth created from chance, and it is prohibited in Islamic finance.

A useful summary: gharar is uncertainty, maisir is gambling/speculation, and riba is usury/interest.

Practical Checks Before You Trade

- Check swaps:

Many forex accounts apply overnight financing, which can resemble interest depending on the structure. If your broker offers “swap-free” accounts, examine the fees carefully, because costs may be repackaged. - Check uncertainty:

Are you trading a transparent spot FX product, or a highly leveraged derivative with unclear terms? If the trade is mostly guesswork for thrills, it moves closer to maisir than to disciplined commerce.

Q: Does a “swap-free” forex account automatically make forex halal?

A: Not automatically; check whether costs are repackaged, and whether the structure resembles spot exchange or embedded interest.

Are You Trading or Gambling, and How Can You Test It Fast?

A fast self-test beats self-deception, especially after a win or a loss. If you fail the test, pause before you place another trade.

The 60-Second Process Test

- Write one sentence each: why enter, where you are wrong, and how much you lose if wrong. If you cannot write them, you do not have a trade; you have a feeling.

- Then check size: does the loss fit your plan, or does it threaten your ability to keep trading tomorrow? If it threatens survival, it is gambling dressed as confidence.

The Evidence Test

A trading journal is not therapy; it is quality control for decision-making. Track set-ups, outcomes, and rule breaks, then review patterns weekly.

If results depend on “hot streaks” and stories, you are not measuring an edge. If results depend on process adherence, you are building a tradable system.

Conclusion

Forex Trading vs Gambling is not decided by the asset class; it is decided by expectancy, risk control, and behaviour. If you trade with rules, position sizing, and defined exits, you are managing uncertainty rather than betting on it.