Trading is a decision-making sport played under uncertainty, where your real edge usually comes from the quality of your process rather than the quantity of information you have. Used correctly, Gemini for trading can sharpen how you structure ideas, weigh evidence, and manage risk. Used carelessly, however, it can quietly amplify errors and overconfidence at the same time. Ready to use it smarter? Start applying these principles to your next trade setup today.

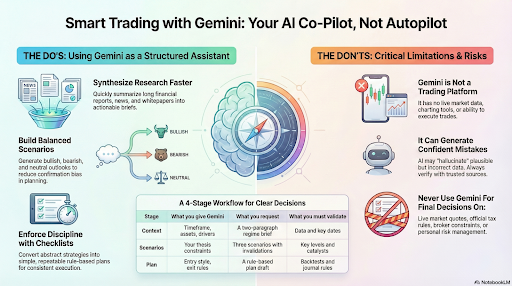

- Gemini for trading works best as a structured assistant for research, scenario planning, and disciplined decision-making, not a prediction engine.

- In Gemini AI trading, always verify outputs with trusted data sources, because confident answers can still be inaccurate.

- Trading with Gemini is most effective when you convert insights into rule-based plans with clear invalidations, risk limits, and review steps.

A Gemini AI trading bot is not automatic; it needs data like copy trading bots, APIs, backtesting, and robust risk controls beyond the AI assistant.

What Gemini Does in a Trading Workflow

Google describes Gemini as an AI assistant for planning and brainstorming, serving as a “second brain” for more efficient reasoning. It synthesises research and organises complex inputs, helping traders stress-test assumptions and generate alternative market scenarios.

Traders use it to summarise market context into briefs, turn notes into trade plans, and draft checklists for post-trade reviews. The assistant also converts conceptual ideas into structured rules and includes a “Double-check response” feature using Google Search for corroboration.

Is Gemini a trading platform or a crypto exchange?

A: No, according to Gemini.google, Gemini is an AI assistant for thinking and drafting, not a terminal for execution or a cryptocurrency exchange.

What Gemini Can not Do for Traders

The most important trading skill is mastering boundary management to prevent any tool from being misused. A well-designed workflow makes it difficult to rely on Gemini in ways it was never meant to handle. Gemini cannot reliably replace real-time market data feeds with audited pricing, a broker’s order-management system, or your own accountability, discipline, and risk limits.

It can also generate confident-sounding mistakes, as independent UK testing revealed that major chatbots often provide inaccurate financial guidance.

Key Insight: AI answers may sound precise while being wrong or incomplete, so always verify outputs against trusted sources before acting.

You can use Gemini for trading to assist with thinking and drafting, but never for:

- Live market quotes or execution orders

- Official tax rules, allowances, or broker constraints

- Replacing your personal risk management decisions

The tool can produce confident mistakes, as independent testing shows chatbots often provide inaccurate or incomplete financial guidance. Traders must remember that AI answers sound precise while being wrong, so you should always verify information before acting.

Can Gemini confirm specific tax rules or broker constraints?

A: No. Treat those outputs as drafts and verify them against official sources and your broker's documentation.

A Practical Workflow for Market Analysis With Gemini

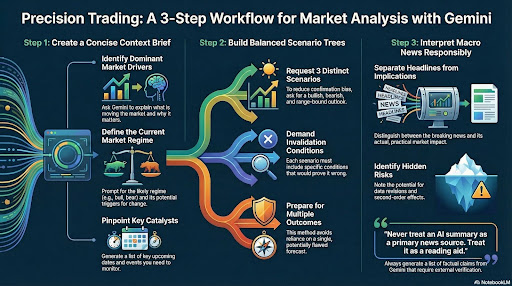

Market analysis is a sequence of compressions that turns raw inputs into a clear trading decision. A robust Gemini trading workflow follows four essential steps to maintain an edge and reduce bias. These steps are: provide inputs, structure scenarios, validate rigorously, and decide using your rules.

Turn market noise into a concise context brief.

Ask Gemini to summarise the current market regime in plain language while forcing it to state all assumptions and unknowns. Effective prompts should request dominant drivers, likely regimes, and specific key dates or catalysts that you need to monitor.

- Identify the dominant market drivers and explain why they matter.

- Define the likely market regime and what triggers would change it.

- List key upcoming dates and catalysts to watch for impact.

More Info: Use Double-check for factual statements, then open the cited pages yourself.

Build balanced scenario trees instead of single forecasts

Request three distinct scenarios (bullish, bearish, and range) to reduce one-way thinking and minimise harmful confirmation bias in your planning. Each scenario must include specific invalidation conditions, which makes your final trade plan significantly easier to review and adjust later.

This method ensures you are prepared for multiple outcomes rather than relying on a single, potentially flawed market forecast.

Interpret macro news responsibly with Gemini.

Gemini explains economic concepts well but may misunderstand timing or data revisions, so you must treat it as a reading aid. When interpreting macro news, insist on distinguishing between headlines and implications while listing every claim that requires manual verification.

- Distinguish between the “headline” news and its actual market implication.

- Identify the risk of data revisions and potential second-order effects.

- Generate a list of factual claims that must be externally checked.

Key Point: Never treat an AI summary as a primary news source. Treat it as a reading aid.

Stage | What you give Gemini | What you request | What you validate |

Context | Timeframe, assets, drivers | A two-paragraph regime brief | Data and key dates |

Scenarios | Your thesis constraints | Three scenarios with invalidations | Levels and catalysts |

Risks | Your account rules | Risk list and mitigations | Position sizing logic |

Plan | Entry style, exit rules | A rule-based plan draft | Backtests and journaling |

Q: Can Gemini provide real-time trade signals like a professional scanner? A: No, Gemini lacks native real-time market data; use it to interpret data you provide from your own reliable sources.

Using Gemini for Stock Trading Research

Stocks reward a deep understanding of business quality, and using Gemini for trading research accelerates the first pass of fundamental analysis. Use it to create structured company memos covering business models, revenue drivers, and the long-term durability of competitive moats.

A professional memo should also outline key risks, such as industry cyclicality, while defining exactly what would falsify your investment thesis.

Gemini for trading is particularly helpful for building repeatable checklists that reduce emotional decision-making during periods of high market volatility.

These checklists ensure a consistent research standard and help you avoid skipping critical due diligence steps when evaluating new opportunities.

Always reconcile AI-generated metrics with primary filings to ensure your data is accurate before making any final capital allocations.

- Business Model: Identify how the company generates revenue and its core value proposition.

- Competitive Moat: Analyse the strength and durability of the company’s specific market advantages.

- Risk Factors: List potential threats from industry cyclicality, new regulations, or disruptive competitors.

- Falsification Points: Define specific events or data changes that would prove your initial thesis wrong.

Key Insight: Always reconcile AI-generated metrics with primary filings or reputable data providers.

Crypto Research with Gemini for trading

Crypto research often fails because traders confuse hype with actual risk, but Gemini for trading helps separate narratives from structure. Use the tool to generate ecosystem maps, compare projects, and build tokenomics analysis frameworks that highlight potential red flags.

It is also effective for creating risk registers that track token unlock schedules, governance issues, and other critical project vulnerabilities.

Traders should keep all outputs conceptual and analytical, avoiding any requests for automated “buy” and “sell” signals from the AI. The FCA warns that many unauthorised “AI trader bot” promotions target UK consumers with misleading promises of guaranteed high returns.

Always treat AI as a research assistant that simplifies complex whitepapers rather than a definitive source for immediate trading actions.

- Ecosystem Mapping: Visualise how different protocols interact and identify the primary competitors within a specific niche.

- Tokenomics Analysis: Evaluate supply structures, inflation rates, and the impact of upcoming token unlock events on market price.

- Risk Management: Maintain a list of governance risks and technical vulnerabilities that could invalidate your long-term investment thesis.

How do I avoid being misled by aggressive crypto bot marketing?

Search official regulator warning lists and verify all corporate details and risk disclosures before committing any capital to a platform.

Writing Effective Prompts for Gemini in Trading

Prompt quality directly determines output quality, so creating auditable responses is essential for a professional and reliable trading workflow. A strong prompt should define a clear role, such as a market analyst, while setting strict constraints against price predictions.

By providing specific inputs and requesting structured formats like tables or checklists, you ensure the AI remains focused and practical.

Gemini for trading can "Double-check" factual claims using Google Search, but you must still read the sources for accuracy.

This verification step prevents the tool from hallucinating figures or misinterpreting complex financial data during your decision-making process. Clear instructions ensure the assistant uses only your provided data, keeping the analysis grounded in your specific market research.

Strategy Design with Gemini for trading

Converting abstract ideas into explicit rules is essential for creating testable strategies and reducing the risk of emotional overrides. Use Gemini for trading to define entry conditions with measurable triggers, profit-taking rules, and strict risk limits per session.

By asking the AI to rewrite these rules into a concise checklist, you create a protocol that is easier to follow. NIST guidelines emphasise that validation across the AI lifecycle is crucial for maintaining the discipline required in high-stakes trading environments.

Testing and human oversight ensure that your rule-based strategies remain robust even when market regimes shift or volatility increases unexpectedly. A well-structured checklist serves as a final barrier against impulsive decisions, ensuring every trade aligns with your pre-defined risk management logic.

Risks and Limitations of Using Gemini for Trading

A successful trader manages tool risk and also the advantages as carefully as market risk by recognising AI failure modes before they impact capital.

Benefits of Gemini for trading

Using Gemini for trading provides several strategic advantages that streamline your research and planning process:

- Faster Research Synthesis: Quickly summarises long financial reports, news articles, and whitepapers into actionable summaries.

- Emotion-Free Analysis: Helps reduce psychological biases by providing logical, data-driven reasoning for market scenarios.

- Structured Scenario Planning: Generates diverse bullish, bearish, and neutral outlooks with specific levels for invalidation.

- Repeatable Checklists: Translates complex trading strategies into simple, step-by-step checklists to ensure disciplined execution.

- Google Search Integration: Uses real-time web access to double-check factual claims and surface the latest market catalysts.

- Drafting Technical Logic: Assists in writing pseudo-code or Python scripts to help transition manual rules into automated designs.

Limitations and Risks

Traders must manage the specific boundaries and risks when integrating Gemini for trading into their workflow:

- Potential for Hallucinations: May generate plausible-sounding but factually incorrect data, such as wrong prices or nonexistent news.

- No Live Execution: Lacks the native capability to monitor real-time markets, connect to broker APIs, or execute actual trades.

- Lack of Native Charts: Cannot analyse live price charts or technical indicators directly without manual data input from the user.

- Privacy and Security: Sharing sensitive data like API keys or account numbers poses a risk, as human reviewers may see inputs.

- Static Data Gaps: Despite web access, the model may occasionally rely on training data that lags behind fast-moving market events.

- Regulatory Red Flags: Financial authorities warn against “AI washing” and unauthorised bots that promise guaranteed returns using AI.

conclusion

Used responsibly, Gemini for trading can act as a structured decision-support layer that improves clarity, scenario thinking, and trade documentation. It should complement your process, not replace your strategy, data, or execution platform.

Treat every output as a draft and verify key claims with trusted data and primary sources. When you pair that discipline with rule-based plans, clear invalidations, and consistent journaling, you reduce errors and trade more consistently.