Due to its 24-hour nature, the Forex market exhibits unique characteristics at any given time of day. The market’s liquidity and volatility are directly dependent on the active trading session (such as London, New York, or Tokyo), and understanding this dynamic is essential for every trader. The session indicator is an efficient visual tool that highlights these timeframes on the chart, helping traders gain a better understanding of the current market conditions.

In this comprehensive guide, we will explore this indicator in full detail.

- Be mindful of Daylight Saving Time (DST) changes; the start and end times of sessions shift twice a year.

- Use this indicator for backtesting to determine which trading session yields the best performance for your strategy.

- The end of the New York session on Friday and the start of the Sydney session on Monday helps in anticipating potential weekend price gaps.

- The session indicator helps you precisely observe the impact of major news releases within the context of their respective sessions as they happen.

What is a Market Session Indicator and How Is It Used in Trading?

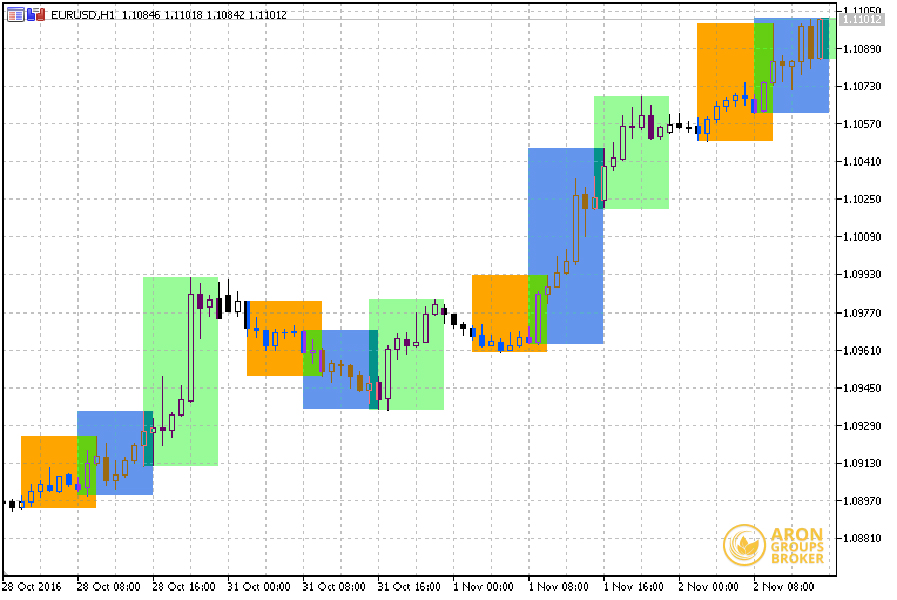

The Forex session indicator is a visual tool that overlays on a price chart to highlight the timeframes of the major Forex trading sessions, typically using different colors for each session. The primary applications of this indicator are to help you:- Identify periods of peak liquidity. When two major sessions overlap, such as London and New York, trading volume increases significantly. This indicator helps you pinpoint these optimal trading windows.

- Avoid trading during low-volume periods. At certain times, the market becomes quiet with low volatility. By visualizing these periods on the chart, you can avoid entering trades with limited profit potential.

- Optimize your trading strategy. Certain strategies perform better during the London session, while others are more effective during the New York session. The indicator allows you to align your trading strategy with the specific market characteristics of each session.

How to Add and Configure the Session Indicator in TradingView

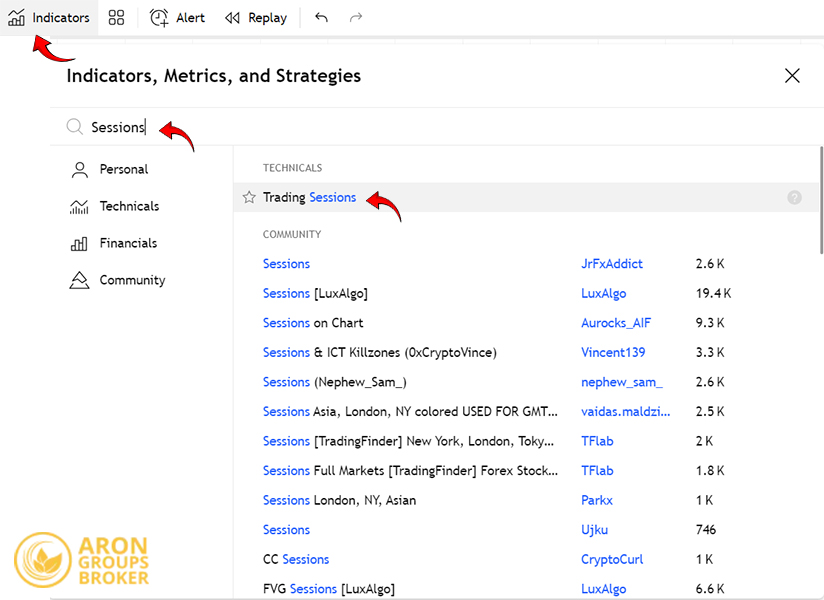

The TradingView platform makes this process very straightforward. To add the session indicator to your chart, simply follow these steps:- Open the Indicators Menu: On the top toolbar of the chart, click the “Indicators” button.

- Search for the Indicator: In the pop-up window, type “Sessions” into the search bar. A list of available indicators will appear. You can select an option, such as “Trading Sessions,” to add it to your chart.

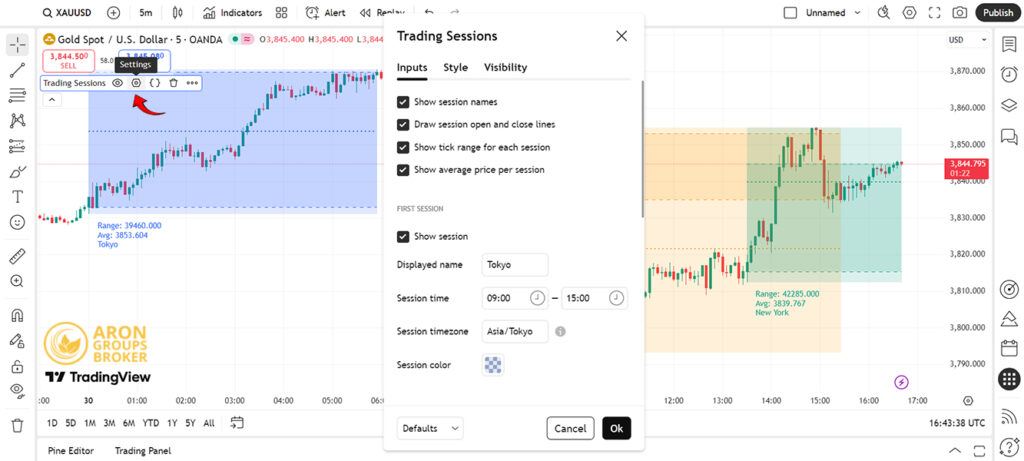

- Configure the Settings: Once the indicator is on your chart, hover your mouse over its name in the top-left corner and click the gear icon to open the settings panel.

- Style: This tab allows you to customize the background color for each session (Tokyo, London, New York, etc.). Adjusting the colors can significantly improve your chart’s readability.

- Inputs: This section is critical. You must ensure the Timezone is set correctly. If this setting is inaccurate, the indicator will display incorrect session times, rendering it unreliable.

Best Free Session Scripts and Indicators on TradingView

TradingView’s Community Scripts library offers a wide variety of excellent, user-created indicators. In addition to popular options from publishers like LuxAlgo, you can explore others such as “FX Market Sessions” or “Auto Session.” It is recommended to browse the official section for session scripts on TradingView. There, you can find the best option for your needs by filtering and sorting based on user ratings and the number of downloads, which reflects their popularity and community trust.Session Indicator for MetaTrader 5 (MT5)

If you use the MetaTrader platform, powerful session indicators are readily available. The installation process is slightly more manual than on TradingView, but it is very straightforward.Steps to Install and Launch the Session Indicator in MetaTrader 5

- Download the Indicator. First, download the indicator file (which will have an .ex5 or .mq5 file extension) from a reputable source. The official MQL5 Marketplace and established forums like Forex Factory are excellent resources.

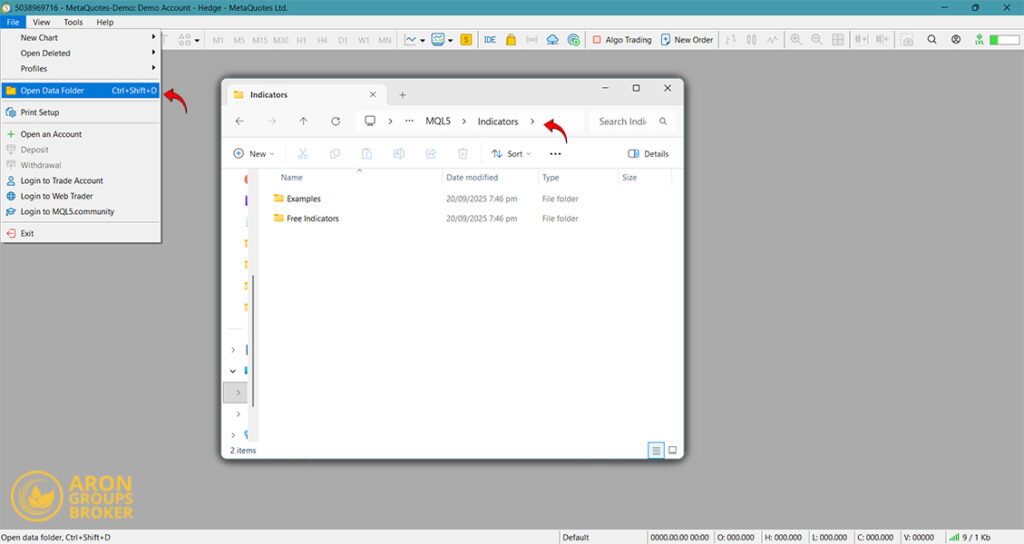

- Open the Data Folder. In your MT5 platform, navigate to the top menu and click File → Open Data Folder.

- Copy the Indicator File. A new window will open showing the MT5 system files. Navigate to the MQL5 folder, and then into the Indicators subfolder. Paste the file you downloaded in the first step into this directory.

- Refresh MetaTrader. Return to the MT5 platform. In the “Navigator” window (usually on the left side), right-click and select “Refresh.” Alternatively, you can simply restart the platform.

- Add the Indicator to a Chart. The new indicator will now appear in the list within the Navigator window. To activate it, simply drag and drop it onto the desired price chart.

Differences Between Session Indicators for MT4 and MT5

The primary difference between session indicators for MetaTrader 4 and MetaTrader 5 lies in their file formats. MT4 indicators use the .ex4 (executable) or .mq4 (source code) extensions, whereas MT5 indicators use .ex5 or .mq5.

These two versions are not cross-compatible, so it is crucial to download the version that matches your platform. The installation process is nearly identical for both, with one key difference: for MT4, you must copy the indicator file into the MQL4 folder instead of the MQL5 folder.

Finding the Best Forex Session Indicators for MetaTrader 5

Excellent resources for finding the best session indicators include:

- The MQL5 Marketplace: This is the official store for MetaTrader, offering a vast selection of free and paid indicators. Advanced indicators, such as “Sessions Pro,” often include powerful features like the ability to display the Profit/Loss (P/L) for each trading session.

- The Forex Factory Forum: As one of the largest online communities for traders, its “Indicators” section contains a wealth of high-quality, free, and custom-built indicators shared by developers and fellow traders.

The Main Forex Sessions and Their Role in Trading Strategy

(This section provides a brief overview. For more in-depth analysis, please refer to dedicated articles on the topic.)

To use the session indicator effectively, you must be familiar with the characteristics of the Forex sessions themselves. Below is a brief description of each.

The Sydney Session

The Sydney session officially kicks off the Forex trading week. As the Sydney market opens, U.S. markets have just closed, and Europe is still inactive. Consequently, the Sydney session is typically the quietest trading period.

- Key Characteristics: It is defined by lower liquidity and trading volume, which often leads to wider spreads (the difference between the bid and ask price) and less pronounced volatility.

- Key Currencies: The primary focus is on currency pairs involving the Australian Dollar (AUD) and the New Zealand Dollar (NZD).

- Best Suited For: Traders who prefer quieter markets with slower trends, or those looking to test early-week breakout strategies.

The Tokyo Session

As the first major Asian financial center to open, the Tokyo session brings an increase in trading volume and liquidity compared to Sydney, representing the bulk of Asian trading activity.

- Key Characteristics: While volume is higher than in Sydney, it is still considered calmer than the London and New York sessions. Price action during this period often remains within a relatively tight range (consolidation).

- Key Currencies: The Japanese Yen (JPY) is the main focus. Pairs like USD/JPY and EUR/JPY experience significant activity. Major economic data from Japan is also released during these hours.

- Best Suited For: Traders who focus on JPY pairs or employ range-bound trading strategies.

The London Session

The market dynamics change completely when the London session begins. As the world’s largest financial hub, London is the heart of the Forex market, accounting for approximately 40% of all daily transactions.

- Key Characteristics: This session is marked by a massive influx of liquidity, resulting in tighter spreads and a sharp increase in volatility. The main trends of the day often establish themselves during these hours.

- Key Currencies: All major currency pairs are highly active, especially the Pound Sterling (GBP), the Euro (EUR), and the Swiss Franc (CHF).

- Best Suited For: Due to its high volatility, this session is ideal for most trading strategies, particularly day trading and scalping.

The New York Session

The New York session is the second-largest market in the world. Its significance peaks during the overlap with the London session, creating the most active and volatile period of the entire trading day.

- Key Characteristics: The release of major economic data from the United States (such as the Non-Farm Payrolls (NFP) report and interest rate decisions) at the start of this session can cause explosive market movements.

- Key Currencies: The US Dollar (USD) is the central focus, and all major pairs experience heightened volatility.

- Best Suited For: This session, especially during the London overlap, presents the best opportunities for traders seeking large, rapid price swings and those who trade based on economic news releases.

Session Overlaps and Their Impact on Trading Volume

When the London and New York sessions are open simultaneously (typically for about four hours), the market reaches its peak activity and volatility. This window offers the best opportunities for traders seeking significant and fast-paced price movements. A session indicator helps you to precisely visualize this critical timeframe on your chart.

Combining the Session Indicator with Trend Indicators

The market session indicator does not generate buy or sell signals on its own; rather, it is a contextual tool used to understand the underlying market environment. Its true power is realized when you combine it with other technical indicators.

For example, imagine you use two moving averages for trend identification. You could establish a trading rule for yourself such as:

“I will only consider entering a trade on a moving average crossover signal if it occurs during the high-volume, high-volatility hours of the London-New York session overlap.”

This approach helps you filter out weak signals generated during quiet market periods and can increase your probability of success.

Conclusion

Using a session indicator, whether on TradingView or MetaTrader, is an intelligent step toward enhancing your market analysis and trading performance. This simple yet powerful tool helps you to better understand market dynamics, improve your trade timing, and ultimately become a more disciplined and informed trader. Consider adding it to your chart to see the significant impact it can have on your trading.