Gold scalping in Forex is a method of capitalizing on small, rapid price movements. This trading style demands speed, focus, and strict discipline. For these reasons, some traders find it exciting and profitable, while others find it challenging and high-risk. In the following, you will learn the details of this strategy and the essential points you need to know before you begin.

- When scalping gold, always prioritize brokers with the lowest transaction costs (spreads and commissions), as your profit per trade is only a few pips.

- The best time to scalp gold is during the London-New York session overlap, which is when the market experiences the highest volatility.

- Set a stop-loss for every single trade; this is the most critical rule for survival in scalping.

- Find a simple, well-defined strategy (such as one based on a specific chart pattern or technical indicator) and focus exclusively on mastering it.

- In scalping, discipline and emotional control are far more crucial than the trading strategy itself.

What Is Gold Scalping in Forex?

Gold scalping is a short-term trading strategy where traders aim to profit from very small fluctuations in the price of gold. To put it simply, imagine being in a bustling marketplace; instead of waiting for a major sale, you capitalize on minor, rapid price differences between vendors.

The same logic applies to gold scalping. Traders, known as scalpers, seek to capture small profits by repeatedly entering and exiting trades on extremely short time frames, such as one-minute or five-minute charts.

A scalper might execute tens or even hundreds of trades within a single day, closing their positions for a profit of just a few pips. Although these individual gains may seem insignificant, their cumulative effect can lead to a substantial return over time.

This trading style demands high precision, rapid decision-making, and strict discipline in trade management. Consequently, gold scalping is best suited for traders who can maintain intense focus and react swiftly to changing market conditions.

The Pros and Cons of a Gold Scalping Strategy

Like many trading strategies in the financial markets, scalping is a double-edged sword. A clear understanding of this method’s strengths and weaknesses helps traders determine if the style is compatible with their temperament, skill set, and personal circumstances.

Advantages of Gold Scalping

- Numerous Trading Opportunities: The primary advantage of gold scalping is the high frequency of entry and exit signals. On very short time frames (such as one-minute or five-minute charts), the market generates dozens of potential trading setups each day. As a result, traders do not need to wait long to find a suitable opportunity.

- Lower Risk Per Trade: Due to the short duration of scalping trades, capital is not exposed to unforeseen events like major economic news releases or volatility from political developments for extended periods. Scalpers minimize their risk by capturing small profits and exiting the market quickly.

- Fast and Consistent Profitability: Although the profit from each individual trade is modest, their accumulation throughout the day can result in a significant return. This feature makes gold scalping an attractive strategy for capitalizing on daily market fluctuations.

- No Need for Complex Fundamental Analysis: Scalpers primarily focus on technical analysis, price patterns, and immediate price action. Therefore, they do not need to analyze macroeconomic trends or comprehensive financial reports, allowing them to profit solely from short-term price movements.

- Effectiveness in Various Market Conditions: Scalping can be profitable whether the market is in a clear uptrend or downtrend, or even when it is consolidating within a range between support and resistance levels.

Disadvantages of Gold Scalping

- High Stress and Mental Pressure: Gold scalping requires intense focus, rapid decision-making, and the simultaneous management of multiple positions. This can create significant mental pressure and may not be suitable for individuals with low stress tolerance.

- High Transaction Costs: Due to the high volume of trades, transaction costs such as spreads and commissions play a critical role in the net outcome. If these costs are high, they can erode profits or even turn a winning trade into a loss.

- Requires Discipline and Emotional Control: The slightest lapse in concentration or an emotional decision—such as improperly adjusting a stop-loss or closing a trade too late—can wipe out the profits from numerous successful trades. Strict adherence to the trading strategy is a prerequisite for success in gold scalping.

- Dependence on Broker and Internet Quality: Delays in order execution or an internet disconnection, even for a few seconds, can completely alter the outcome of a trade. Therefore, selecting a reputable broker with fast servers and having a stable, high-speed internet connection is essential.

- Time-Consuming: Scalping demands a constant presence at the trading screen. Unlike medium or long-term trading, one cannot simply open a position and attend to other matters. This style is effectively a full-time commitment.

Hallmarks of the Best Gold Scalping Strategies in Forex

A successful gold scalping strategy involves far more than simply recognizing a few chart patterns. Below, we will thoroughly examine the essential characteristics of a robust strategy.

Clearly Defined Entry and Exit Rules

This is the most critical principle. In scalping, there is no room for sentiments like “I feel the price is going up” or “I think it’s time to sell.” Your rules must be so mechanical and unambiguous that they could be executed by an algorithm.

For example: “I will only enter a long position if: first, the price on the 5-minute time frame is above the 20-period Moving Average; second, the current candlestick forms a bullish pin bar pattern; and third, the RSI indicator is below the 70 level.”

When your rules are this precise, you eliminate guesswork, stress, and emotional decision-making. You simply wait for all the predetermined conditions to be met and then execute the trade.

Precise Risk Management

In scalping, you are dealing with small profits, meaning a single large loss can easily wipe out the gains from dozens of successful trades. Risk management is your shield against unexpected market shocks.

- Setting a Stop-Loss Before Entry: The stop-loss is your non-negotiable red line. It is the point at which you accept that your analysis was incorrect and exit the trade with a minimal loss. This level should never be adjusted based on emotion.

- Setting a Realistic Take-Profit: You must know how much profit you expect from each trade. This practice prevents greed. Many scalpers close their positions as the price approaches their take-profit target, rather than waiting, in order to lock in their gains.

- Risk/Reward Ratio: This ratio compares the amount of potential profit you expect to the amount you are willing to risk. A logical risk/reward ratio for gold scalping could be 1:1.5. This means for every $10 you risk, you aim to make a $15 profit. This ensures that even if your win rate is only 50%, you will still be profitable over the long run.

Compatibility with Your Personality

Even the world’s best strategy will fail if it is not compatible with your temperament. Gold scalping is not suitable for everyone. Ask yourself:

- Can you handle high mental pressure? Scalping requires constant, rapid decision-making under pressure. If you are prone to anxiety, this style will lead to burnout.

- How much time can you dedicate to trading? Scalping is a full-time commitment. You must be fully focused on your screen during periods of peak market volatility (e.g., the London-New York session overlap). If you have a day job and can only trade at night, other strategies might be more suitable.

- Are you a disciplined person? Can you adhere to your rules, even after a series of consecutive losses? Gold scalping is not for undisciplined or impulsive individuals.

Your strategy should fit your personality and lifestyle like a custom-tailored suit.

In gold, liquidity traps often appear after a candle closes with a long wick on the 30-second chart. Seasoned scalpers typically use these setups to enter against the candle’s direction.

Simplicity and Understandability

A common mistake among novice traders is assuming that a more complex strategy with a cluttered chart is more professional. The opposite is true.

- Avoiding Analysis Paralysis: When you use five different indicators simultaneously, you will likely receive conflicting signals. One may indicate a buy, another a sell, and a third may suggest waiting. This situation leads to confusion and causes you to miss good opportunities.

- Focusing on Execution: A simple strategy with two or three clear rules that you deeply understand is far more effective than a complex system that you cannot execute quickly and confidently. In gold scalping, speed is critical, and simplicity enables that speed.

Suitable Indicators for Gold Scalping

Investopedia , a well-respected financial website, covers a wide range of technical analysis indicators, many of which are especially effective for gold scalping strategies.

Using Moving Averages (MA) to Identify Short-Term Gold Trends

The Moving Average (MA) is one of the simplest yet most effective indicators for identifying trend direction. In scalping, traders typically use two or three moving averages with short periods (e.g., a 5 MA, 10 MA, and 20 MA).

How to Use It

A buy signal can be generated when a faster moving average (e.g., the 5 MA) crosses above a slower moving average (e.g., the 20 MA). Conversely, a sell signal is generated when the faster MA crosses below the slower one. These crossovers indicate that short-term momentum is shifting in favor of either buyers or sellers.

Using the RSI to Identify Overbought and Oversold Levels in Gold Scalping

The Relative Strength Index (RSI) is an indicator that measures the speed and change of price movements. It oscillates between 0 and 100, helping traders identify overbought and oversold conditions in the market.

How to Use It

Traditionally, an RSI reading above 70 is considered overbought, suggesting a potential price decline (sell signal). A reading below 30 is considered oversold, suggesting a potential price increase (buy signal). For gold scalping, these levels can be adjusted to 80 and 20 to generate more reliable signals.

Using Bollinger Bands to Analyze Volatility and Reversal Points in Gold

Bollinger Bands consist of three lines: a simple moving average (the middle band) and two outer bands set at a standard deviation above and below the middle band. This indicator is excellent for measuring market volatility.

How to Use It

- When the bands contract or “squeeze,” it signals low volatility and suggests that a strong price move may be imminent.

- When the price touches the upper band, it may act as resistance, presenting a potential selling opportunity.

- When the price touches the lower band, it may act as support, presenting a potential buying opportunity.

Gold Scalping Without Indicators

Many professional traders believe that the best indicator is price itself. This methodology is known as price action trading. In this approach, you make trading decisions by analyzing candlestick patterns and market structure.

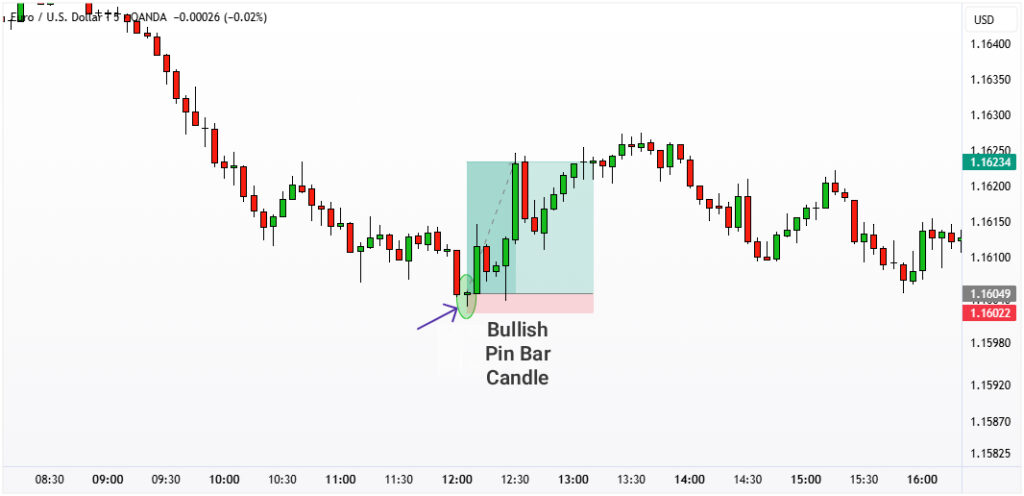

The Pin Bar Pattern and How to Identify It on the Gold Chart for Scalping

The pin bar is a powerful candlestick pattern that signals a price rejection from a specific level. This candlestick has a small body and a long wick (or shadow) that is at least twice the length of the body.

How to Identify and Use It

- Bullish Pin Bar: The long wick is at the bottom of the candlestick. This indicates that sellers pushed the price down, but buyers entered the market with force and drove the price back up. When this pattern appears in a support area, it is considered a buy signal.

- Bearish Pin Bar: The long wick is at the top of the candlestick, indicating a price rejection from a resistance level. This pattern is considered a sell signal.

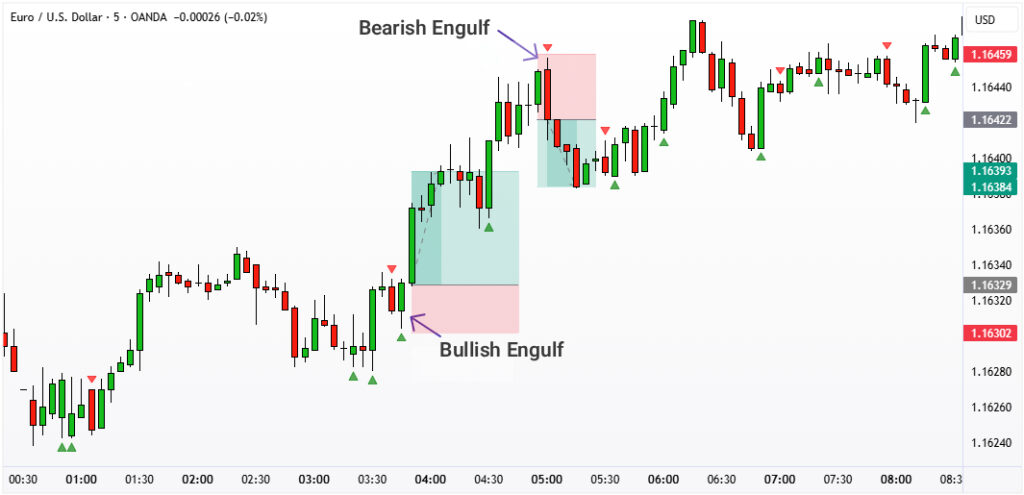

The Engulfing Candlestick Pattern for Quick Entry and Exit in Gold Scalping

The engulfing pattern occurs when the body of a candlestick completely covers, or “engulfs,” the body of the previous one. This pattern is also a strong reversal signal.

- Bullish Engulfing: A large bullish (green) candlestick completely engulfs the body of the previous bearish (red) candlestick. This pattern indicates that buyers are gaining strength and serves as a buy signal.

- Bearish Engulfing: A large bearish candlestick completely engulfs the body of the previous bullish one. This is a sell signal.

On short time frames, these patterns help scalpers identify quick entry and exit points with greater confidence.

Risk Management in Gold Scalping

Risk management is the most critical component of scalping. Since you are aiming for small profits, a single large loss can easily negate all of your accumulated gains.

- Always Use a Stop-Loss: Place your stop-loss at a logical distance from your entry point. This ensures that if the price moves against your analysis, you will exit the trade with a minimal, predefined loss.

- Maintain a Favorable Risk/Reward Ratio: Aim for a risk/reward ratio of at least 1:1.5 or 1:2. This means that for every $1 of risk you take on, your potential profit should be between $1.5 and $2.

- Control Your Position Size: Never enter a trade with a position size that is so large you cannot comfortably absorb the potential loss. A standard guideline is to risk no more than 1% to 2% of your total capital on any single trade.

Combining volume indicators with order flow in gold scalping is far more effective than relying solely on RSI or MACD, as it helps reveal sudden liquidity spikes.

What Is the Best Time Frame for Gold Scalping?

The core of a scalping strategy is speed and a high volume of trades. A gold scalper aims to profit from the smallest price movements. Longer time frames (such as the 4-hour or daily charts) do not display these minor fluctuations, often consolidating them into a single candlestick. On a 1-minute time frame, however, that same small movement appears as a series of consecutive candlesticks, creating numerous entry and exit opportunities.

A Comparison of Popular Scalping Time Frames

Each of these time frames has its own distinct characteristics, advantages, and disadvantages.

1-Minute Time Frame (M1)

- Pros: It provides the highest number of signals and trading opportunities. It is ideal for traders who thrive on high excitement and speed.

- Cons: This time frame is filled with market “noise.” Noise refers to small, random price movements that do not follow a clear trend and can easily mislead traders with false signals. The level of stress and pressure is at its peak during this time frame, leaving no room for hesitation.

5-Minute Time Frame (M5)

- Pros: Many scalpers consider this time frame to be the “sweet spot” of scalping. The M5 chart filters out some of the noise from the M1 time frame and provides clearer signals. At the same time, it is still fast enough to offer numerous trading opportunities throughout the day. It also allows more time for analysis and decision-making.

- Cons: It offers fewer trading opportunities compared to the M1.

15-Minute Time Frame (M15)

- Pros: This time frame provides a much clearer view of the short-term market trend. Candlestick patterns and price structures on the M15 chart are considered to have higher validity.

- Cons: It is generally too slow for direct scalping execution and offers significantly fewer trading opportunities.

| Time Frame | Pros | Cons |

|---|---|---|

| 1-Minute (M1) | Highest number of opportunities - Ideal for speed and excitement | High market noise & false signals - High stress and pressure |

| 5-Minute (M5) | Best balance of speed and clarity - Filtered, more reliable signals | Fewer opportunities than the M1 time frame |

| 15-Minute (M15) | Clearer view of the short-term trend - High validity of patterns | Too slow for pure scalping - Limited trading opportunities |

The Best Forex Brokers for Gold Scalping

(Note: This section describes the features of a suitable broker, without naming specific brands.)

Choosing the right broker plays a vital role in your success as a scalper. Below are the key features to look for in a Forex broker for scalping:

- Ultra-Low Spreads: Since your profit margin on each trade is small, a low spread (the difference between the bid and ask prices) is essential to maximize profitability.

- High-Speed Order Execution: Every second matters in scalping. The broker must execute your trades instantly and at the price you requested, with minimal latency and slippage.

- Fair Commissions: Look for brokers that have transparent and reasonable trading costs.

- Regulation and Reputation: Ensure your broker is regulated by a reputable regulatory authority. This is crucial for guaranteeing the security of your funds.

The Best Trading Account for Gold Scalping

Forex brokers typically offer several different account types. For gold scalping, ECN (Electronic Communication Network) or Raw Spread accounts are the best options. These accounts provide the lowest possible spreads (sometimes near zero) and, in return, charge a fixed commission per trade. This model is significantly more cost-effective for high-frequency traders like scalpers.

Conclusion

Gold scalping in Forex is an exciting and potentially profitable strategy, but it requires knowledge, practice, discipline, and sound risk management. There is no “magic strategy” that guarantees a win every time. The key to success is finding a system that is compatible with your personality, practicing it first on a demo account, and then implementing it in the live market with proper capital management.

Remember that on this journey, patience and consistency are your most important allies.