If you want to enhance your trading skills without any risk, demo trading on TradingView can be a great help. With this demo account, you can test different strategies and see how they perform in real market conditions. In this article, we will explain how to create and use a demo account step-by-step and in simple terms. This method gives you the opportunity to enter the real market with more confidence. So, stay with Aaron Groups until the end of the article.

- How to Demo Trade on TradingView allows you to practice your trading strategies and techniques in a risk-free environment, enhancing your skills in simulated market conditions.

- Using a demo account helps you get familiar with TradingView and its various tools, such as advanced charts, indicators, and technical analysis tools.

- After mastering How to Demo Trade on TradingView, you can confidently step into real trading, gaining experience and minimizing financial risks.

What is Demo Trading on TradingView and What Are Its Benefits?

If you want to enhance your trading skills without any financial risk, How to Demo Trade on TradingView is an excellent tool to get started. Demo trading on TradingView allows you to trade in simulated markets using virtual money, without the need for real capital. With the help of the TradingView platform, you can test various strategies and evaluate how they perform under real market conditions.

How to Demo Trade on TradingView has many applications. One of the key benefits is learning how to navigate the platform and use its various tools effectively. Additionally, you can test your trading strategies without worrying about financial losses. This feature builds your confidence and gradually helps you gain a better understanding of the market. Furthermore, this tool enables you to practice your risk management techniques in a fully controlled environment.

For Iranian traders, How to Demo Trade on TradingView is especially useful as it offers easy access, allowing you to benefit from simulated market data without the need for foreign brokers. This feature provides a great opportunity for practicing and learning trading skills.

Benefits of Using a Demo Account on TradingView for Traders

Using a demo account on TradingView offers many advantages that can improve trading performance and boost confidence in decision-making. Here are some of the most significant benefits:

- Risk-Free Practice

With a demo account, you can test your trading strategies without the worry of financial loss. This allows you to practice in the market with no risk and learn how to use the platform’s various tools effectively.

- Access to Real Market Data

One of the key features of TradingView is that even in the demo account, you have access to real market data. This feature allows you to practice in live market conditions and evaluate the performance of your strategies.

- 24/7 Practice

The demo account gives you the advantage of practicing at any time, 24/7. This helps traders to improve their skills without any time constraints, making it easier to practice at their convenience.

- Performance Analysis (P&L, Trade History)

The demo account enables you to easily review the performance of your trades. The trade history and Profit & Loss (P&L) data help you identify the strengths and weaknesses of your strategies, allowing you to refine them.

- No Stress

One of the main advantages of using a demo account is that you are not dealing with real money, so you experience less stress and psychological pressure. This helps you make better trading decisions without the emotional strain of real-money trading.

- Testing New Strategies and Tools

The demo account allows you to test new strategies and familiarize yourself with various TradingView tools. This feature helps you enhance your strategies and use the platform’s tools more effectively.

Here is a table that summarizes the benefits of How to Demo Trade on TradingView compared to real trading:

| Benefits | Demo Trading on TradingView | Real Trading |

|---|---|---|

| Risk-Free Practice | Practice without financial risk | Real money is at stake, risk of loss |

| Access to Real Market Data | Access to real market data with slight delay | Real-time market data with possible slippage |

| 24/7 Practice | Trade anytime, 24/7 | Limited by market hours and trading sessions |

| Performance Analysis (P&L, Trade History) | Review performance with detailed P&L and history | P&L data is live but includes real financial stakes |

| No Emotional Stress | No psychological pressure, trade with virtual money | Emotional pressure due to real financial stakes |

| Testing New Strategies and Tools | Test strategies and tools without financial risk | Testing strategies with real consequences |

According to Investopedia, demo trading without real risk can sometimes lead to distorted behaviors. For example, traders may double down on their losses in a simulation, while in real markets, cutting losses quickly is often a smarter approach.

Step-by-Step Guide to Creating a Demo Trading Account on TradingView

To begin How to Demo Trade on TradingView and practice trading without financial risk, there are simple steps that you can easily follow. These steps will help you strengthen your trading skills in a simulated environment using virtual money.

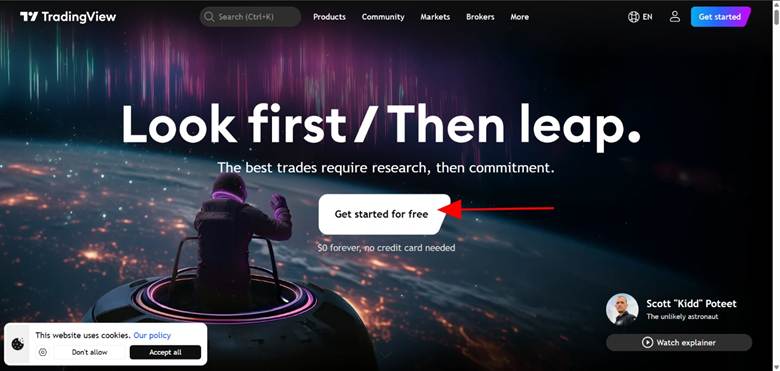

Sign Up or Log In

The first step in How to Demo Trade on TradingView is to log into the TradingView platform. If you don’t already have an account, you need to create a free one. To do this, click on “Sign Up” and enter your information. If you already have an account, simply log in.

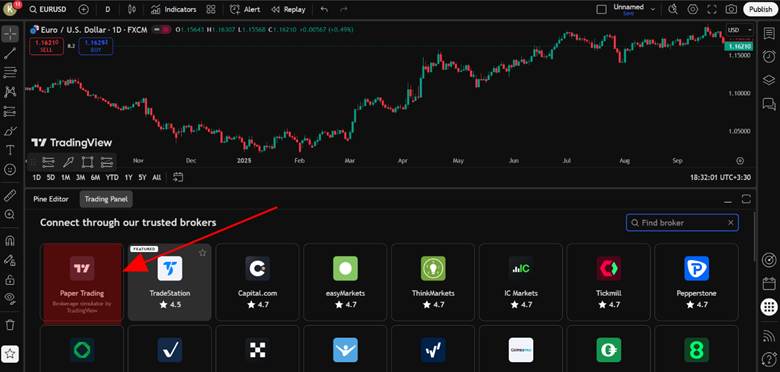

Open the Trading Panel

After logging in, go to the main page of TradingView. At the bottom of the page, you’ll find the “Trading Panel” option. This allows you to access the trading tools. Click on it to open the panel.

Select Paper Trading

In the trading panel, you will see an option called “Paper Trading.” This option allows you to activate your demo account and trade with virtual money. To connect to your demo account, click “Connect.” After this, you can easily start trading in simulated markets with virtual funds.

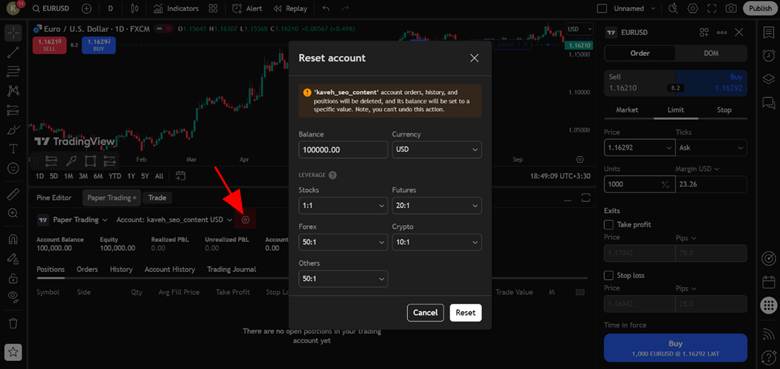

Set Initial Balance and Leverage

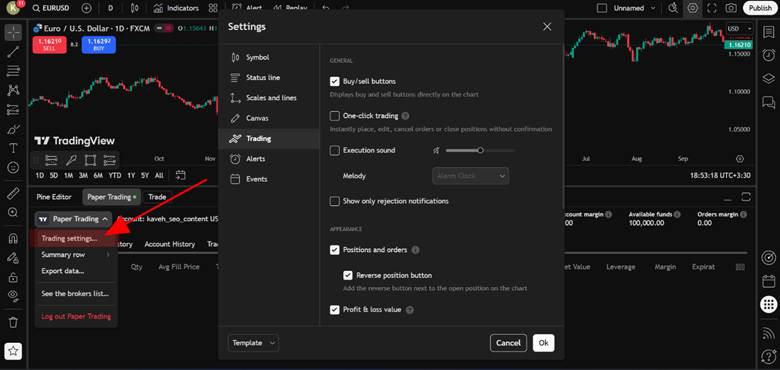

How to Demo Trade on TradingView allows you to adjust the initial balance of your demo account. By default, the demo account starts with a balance of $100,000, but you can change this. To do so, click on the settings icon next to your account name and select “Trading Settings.” In this section, you can adjust the demo account balance and leverage.

Customize Position Display

In How to Demo Trade on TradingView, you can customize the display of your positions, trade history, and orders to fit your preferences. To do this, go to the “Trading Settings” section and enable or disable the relevant options.

By following these simple steps, you can activate your demo account on TradingView and easily start practicing trading without any financial risk.

How to Open a Demo Position on TradingView

To open a demo position in How to Demo Trade on TradingView, the first thing you need to do is choose the trading pair you want to trade. For example, if you’re interested in trading BTC/USD, simply search for and select this pair. Next, scroll down to the bottom of the page and click on the “Trading Panel” to open it.

Within the trading panel, you’ll find three different types of orders available for use in How to Demo Trade on TradingView. The first is a Market Order, which will execute your trade immediately at the best available market price. The second is a Limit Order, where you set a specific price at which you want to buy or sell, and the order will only execute when the market reaches that price. The third option is a Stop Order, which activates when the price hits a certain level and then executes as a market order.

Based on your trading strategy, you can choose the direction of the trade. If you expect the price to rise, select Buy, and if you believe the price will fall, select Sell. Additionally, in How to Demo Trade on TradingView, you can set a Take Profit and Stop Loss to help manage your risk.

Difference Between Demo Trading on TradingView and Broker Demo Accounts

To compare the differences between demo trading on TradingView and broker demo accounts, we need to look at the features of each. This comparison will help you make the best choice for practicing and learning how to trade without financial risk.

| Features | Demo Trading on TradingView | Broker Demo Accounts |

|---|---|---|

| Cost | Free and no registration required | Usually free, but requires registration |

| Market Data | Real market data with delay | Real market data with or without delay |

| Order Types | Supports market, limit, and stop orders | Supports various types of orders |

| Market Simulation | Simple simulation with limited settings | More accurate simulation with advanced settings |

| Order Execution | No real execution of orders | Real order execution with possible slippage |

| Live Accounts | Does not connect to real live accounts | Connects to real broker live accounts |

| Risk Management | Limited risk management tools | Advanced risk management tools |

In How to Demo Trade on TradingView, you can test your strategies and use tools such as advanced charts and indicators for analysis. This platform helps you gain experience and improve your skills without any financial risk. However, in broker demo accounts, you’ll experience more realistic trading, as the market data is more accurate, and your orders are executed in real time.

Ultimately, both environments have their specific benefits. If your goal is to learn How to Demo Trade on TradingView and familiarize yourself with the platform’s tools, this option will be the best for you. However, if you want a more realistic experience of the market and test real trades, a broker’s demo account is more suitable.

It’s important to note that in both cases, risk management is a crucial aspect of the trading process, and you should pay close attention to it in both environments.

Common Issues with Demo Accounts on TradingView and Their Solutions

While learning How to Demo Trade on TradingView, you may encounter issues that could affect your trading experience. Below, we address some common problems and provide suggested solutions:

Error Connecting to Paper Trading Account

One of the most common issues is the inability to connect to the Paper Trading account. This problem typically occurs due to reasons such as browser cache or a closed Paper Trading account. To resolve this, try logging out of your account and then logging back in. Additionally, clearing your browser cache might help fix the issue. If your account has been closed, contact TradingView’s support to resolve the problem.

Disappearance of Demo Trade History

Another common problem in How to Demo Trade on TradingView is the disappearance of demo trade history. This issue usually arises when you switch accounts or connect to a new one. To solve this, check if your account is active in the “Accounts” section. You can also upload your trade history in CSV format to back it up.

Error Changing Trade Volume or Symbol

While using demo trading on TradingView, you might face errors when trying to change the trade volume or symbol. This issue is often caused by improper leverage settings or selecting an invalid symbol. To fix this, adjust your leverage to the appropriate amount and ensure you are selecting valid symbols for trading.

By following these solutions, you can improve your experience with How to Demo Trade on TradingView and continue practicing without interruption.

According to BabyPips, practicing in a demo account should be done with real trading strategies. This means you should use the same methods, entry and exit rules, and risk management strategies in your demo account that you plan to implement in your real account.

Conclusion

Ultimately, How to Demo Trade on TradingView allows you to enhance your trading skills without financial risk and test different strategies. This simulated tool provides an excellent opportunity for learning and practice, especially for those who are new to the world of trading. Create your demo account now and start practicing to gradually prepare for real trading.