Many traders spend years placing trades without ever knowing whether their approach has a real advantage. A trading edge is the factor that separates random outcomes from a process with long-term potential, even when individual trades fail. In simple terms, the edge meaning in trading relates to having a clear reason why a method can work more often than it fails over time.

Understanding the trading edge’s meaning helps traders shift focus from predictions to decisions based on probability and risk control. Rather than relying on indicators or short-term success, trading with an edge requires clarity, patience, and realistic expectations.

Keep reading to discover how a trading edge is formed, why it matters more than accuracy, and how you can begin finding an edge in trading that suits your style.

- A trading edge becomes more reliable when it is tested across different market regimes, not just one favourable period.

- Execution quality, including order type and timing, can materially change results even when the underlying logic stays the same.

- Regular performance reviews prevent silent degradation of an edge before losses become obvious.

- The strongest edges align with a trader’s operational limits, reducing decision fatigue and long term behavioural errors.

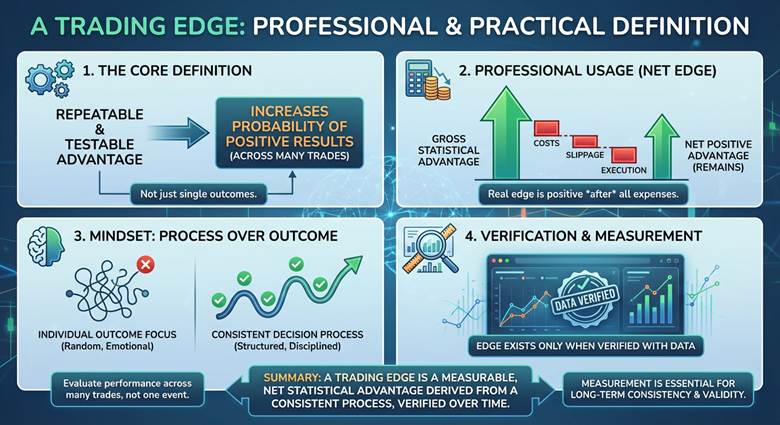

Trading Edge Meaning: A Professional and Practical Definition

A trading edge is a repeatable and testable advantage that increases the probability of positive results across a large number of trades. In professional usage, the trading edge refers to a statistical advantage that remains positive after costs, slippage, and execution are included.

This trading edge definition shifts attention from individual outcomes to the consistency of the decision-making process. To understand what edge means in trading, traders must prioritise process over outcome and evaluate performance across many trades.

An edge only exists when results can be verified with data, making measurement essential for long-term consistency. This requirement forms the basis of a clearly measurable edge.

Costs and slippage can turn a paper edge into a losing system, even when the logic appears reliable.

What Makes a Trading Edge Measurable

A trading edge becomes measurable when it is evaluated using objective performance metrics.

These typically include expectancy, average win and loss size, win rate, drawdown, and total trading costs.

Together, they determine whether a trading edge exists beyond short-term randomness.

- Measurement matters because it supports objective decision-making.

- When traders rely on data, they reduce emotional bias and improve consistency.

- This approach reinforces a practical understanding of the trading edge’s meaning.

Q: What is a trading edge in simple terms?

In simple terms, what is a trading edge refers to having a repeatable advantage that works over many trades. The edge, meaning in trading, is based on probability rather than prediction.

According to Wikipedia, even a statistically valid advantage can vanish in highly efficient markets where pricing adjusts quickly, underscoring that edges are about probability, not certainty.

What a Trading Edge Is Not: Common Misconceptions Explained

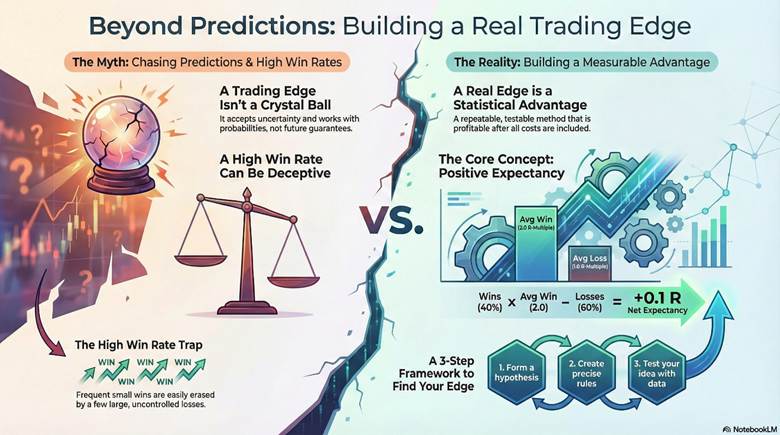

A proper understanding of the trading edge meaning begins by clarifying what an edge does not represent in real trading practice. A trading edge is not a signal, a prediction tool, or a guarantee of certainty about future price movements.

Trading with an edge accepts uncertainty and works within probability rather than attempting to eliminate risk. An edge is also not defined by a high win rate alone, nor is it created by relying on a single indicator.

Many systems appear successful because they win often, yet fail when losses are larger than gains. Trading with an edge does not imply consistent monthly profits or uninterrupted performance.

Key Insight:

A system can win often and still have negative expectancy.

Why a High Win Rate Can Still Lose Money

A high win rate can hide a poor risk–reward structure, where occasional large losses erase many small gains. In such cases, overall results deteriorate despite frequent winning trades.

This outcome highlights why expectancy matters more than accuracy.

Key factors that cause this imbalance include:

- Small average wins combined with large average losses

- Inconsistent stop placement

- Ignoring transaction costs and slippage

Without balanced risk and reward, even trading with an edge can fail over time.

Q: Can you trade with an edge and still have losing streaks

Yes, trading with an edge can include losing streaks, because probabilities unfold across many trades rather than individual outcomes.

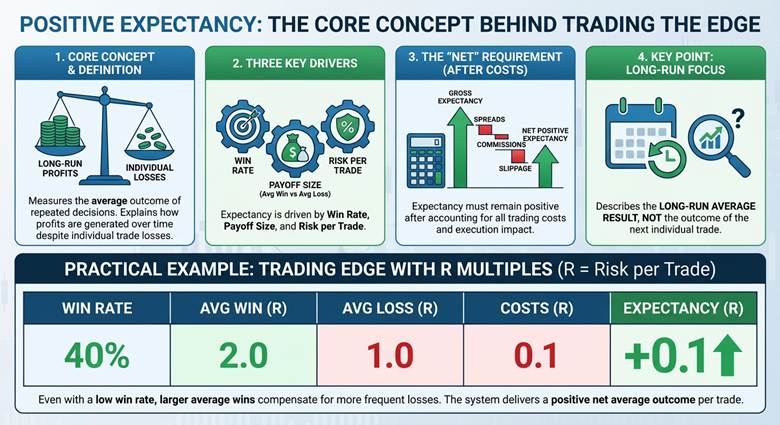

Positive Expectancy: The Core Concept Behind Trading the Edge

Positive expectancy explains why a method can generate profits over time, even though individual trades may produce losses. In professional trading, expectancy measures the average outcome of repeated decisions and defines the real edge in trading.

Without positive expectancy, no trading edge can survive costs, volatility, or long-term execution. Expectancy is driven by three connected factors: win rate, payoff size, and risk per trade.

According to fxreplay: Expectancy does not act alone; combining it with reward-to-risk ratios and drawdown behaviour gives a better picture of long-term viability than expectancy alone.

Trading the edge works when the value of winning trades exceeds the impact of losing trades after all costs. For this reason, expectancy must remain positive after spreads, commissions, and slippage are accounted for.

Key Point:

Expectancy describes the long-run average result, not the outcome of the next trade.

A Simple Trading Edge Example Using R Multiples

A practical trading edge example can be illustrated using R multiples, where one R represents the predefined risk per trade. This method allows traders to compare performance consistently, regardless of market or position size.

The example below shows how a low win rate can still produce positive expectancy.

| Win Rate | Avg Win (R) | Avg Loss (R) | Costs (R) | Expectancy (R) |

|---|---|---|---|---|

| 40% | 2.0 | 1.0 | 0.1 | +0.1 |

In this case, larger winning trades compensate for more frequent losses. After costs are applied, the system still delivers a positive average outcome per trade. This illustrates why trading the edge depends on structure rather than frequent winning trades.

Q: What does positive expectancy mean for real trading?

Positive expectancy means a method produces favourable average results over time, despite drawdowns and short term losing periods.

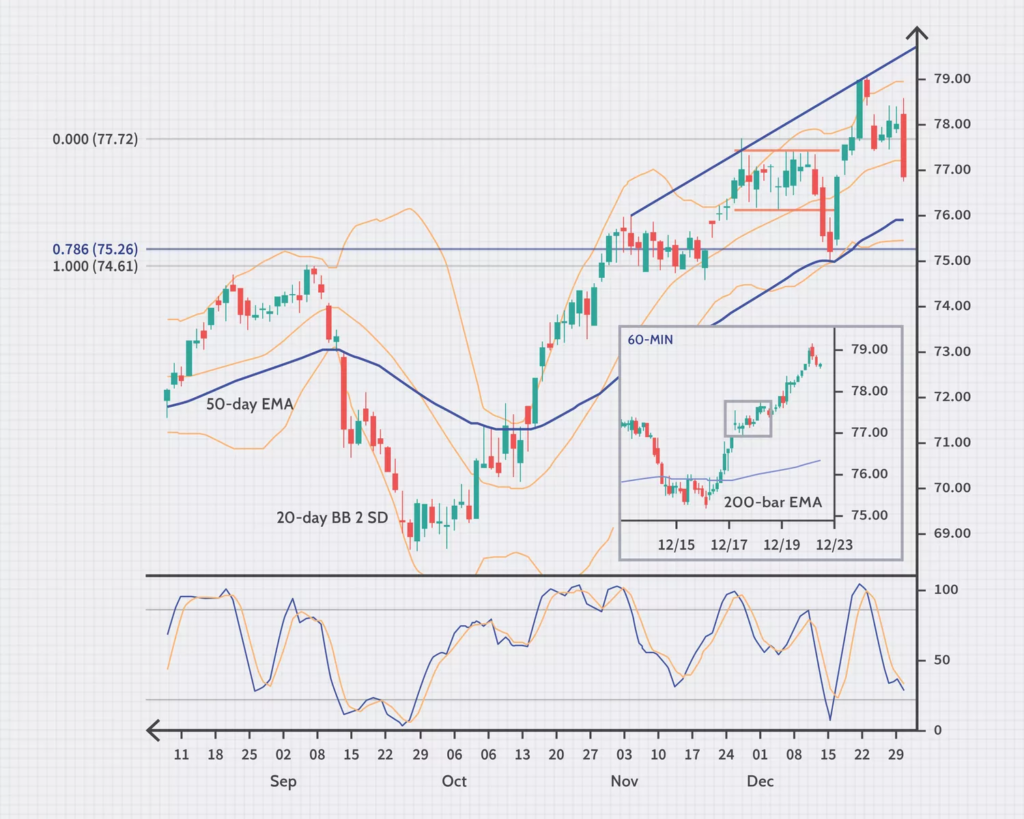

Where Trading Edges Come From: Understanding Market Inefficiency

Trading edges often develop from market inefficiency, where prices temporarily fail to reflect information, behaviour, or liquidity conditions accurately. In this context, the edge meaning in trading relates to identifying repeatable patterns caused by delayed reactions, behavioural bias, or shifting market regimes.

These inefficiencies may create opportunity, but they never eliminate uncertainty or trading risk. Market structure plays a critical role in shaping how edges appear and disappear.

Behavioural responses, liquidity imbalances, and execution constraints can distort prices for short periods.

Because these factors change, trading edges must be monitored and adjusted over time.

Edges vary across markets due to differences in participants, costs, and microstructure.

A forex trading edge is often influenced by spreads, rollover, trading sessions, and global liquidity flows.

In contrast, a day trading edge depends more heavily on execution quality, slippage, and time-of-day effects.

Key market differences that shape trading edges include:

- Transaction costs and spreads

- Liquidity distribution across sessions

- Speed of price reaction to information

Risk Management and Position Sizing: Protecting the Edge

A trading approach only works when risk is controlled, because even a strong method can fail without proper capital protection. Trading with an edge requires defining risk per trade, managing drawdowns, and prioritising survival over short-term returns.

This discipline is essential to build a sustainable edge and to optimise your trading edge across different market conditions. Position sizing converts an idea into real results by controlling how much capital is exposed on each trade.

Common approaches include fixed fractional risk and volatility-based sizing, both designed to keep losses proportionate. Consistency matters because irregular sizing increases drawdowns and undermines long-term performance.

Q: Why does position sizing matter if my entries are good?

Because trading with an edge still involves losses, position sizing determines whether your account can survive inevitable drawdowns.

How to Find Your Trading Edge

Finding a trading edge starts by working within clear constraints rather than chasing complex ideas or popular setups. Time availability, chosen market, and preferred trading style define what is realistic and repeatable. This mindset forms the foundation of finding an edge in trading that can be executed consistently.

To understand how to find your trading edge, traders should follow a structured discovery process instead of indicator hunting.

A simple loop helps filter ideas and reduce randomness:

- Form a clear hypothesis based on observable market behaviour

- Convert the idea into precise trading rules

- Test the rules across a meaningful sample size

- Review results and refine only when evidence supports change

This process explains how to find a trading edge without relying on intuition alone.

A Step-by-Step Edge Finder Framework

A practical framework focuses on clarity and measurement:

- Choose one market and timeframe to limit noise

- Define objective entry and exit rules

- Include all costs, such as spreads and commissions

- Collect enough trades to evaluate performance reliably

- Review key metrics like expectancy, drawdown, and consistency

Following these steps improves decision quality and supports long-term development.

Key Point:

The most reliable way to learn how to find a trading edge is by testing simple, rule-based ideas and validating them with data.

Trading Edge Backtesting and Validation: How to Test an Edge Properly

Trading edge backtesting is the process of testing a trading idea against historical data to evaluate whether it shows consistent performance. The primary goal is not to prove profitability, but to determine whether an idea has structure, stability, and repeatability over time.

Backtesting helps traders separate luck from logic before risking real capital. However, backtesting has clear limitations.

- Historical results depend heavily on data quality, realistic cost assumptions, and disciplined rule application.

- Ignoring spreads, commissions, or execution delays can turn an apparent edge into an illusion.

- Another key limitation is the gap between tested results and real trading.

Paper results assume perfect execution, while live trading introduces slippage, latency, and emotional pressure.

For this reason, results from trading edge strategy software should always be treated as estimates, not guarantees.

More Info:

Validation methods such as out-of-sample testing and walk-forward analysis reduce the risk of random success.

Backtesting Pitfalls That Create False Confidence

False confidence often comes from common testing mistakes rather than from the strategy itself. Curve fitting occurs when rules are excessively adjusted to past data, producing impressive results that fail in new conditions. This issue is especially dangerous when traders optimise parameters without understanding why they work.

Another frequent problem is using too small a sample size. A handful of trades cannot represent different market conditions, volatility regimes, or drawdowns. Ignoring spread and slippage further distorts results, especially in active or short-term strategies.

Q: How many trades do I need to trust a backtest?

For trading edge backtesting, a meaningful evaluation usually requires dozens to hundreds of trades across different market conditions, not short test periods.

Conclusion

Professional trading improves when focus shifts from short-term results to decision quality, learning routines, and consistent review of performance. Maintaining a journal, reviewing trades on a fixed schedule, and refining rules over time helps strengthen a trading edge without chasing constant changes. This mindset prioritises survival, disciplined execution, and controlled risk, allowing probability to unfold gradually rather than forcing outcomes.