Many people searching for how to invest in Hulu in 2026 assume it’s as simple as a ticker search. It isn’t. Hulu is a major U.S. streaming platform known for on-demand TV, originals, and live TV options—but it doesn’t trade as a standalone stock. There is no Hulu ticker symbol, and Hulu is not publicly traded, which is precisely why investors continue to get misled.

This article shows the correct way to think about Hulu from an investor’s perspective: who owns it, how its performance shows up in financial reports, and how you can gain exposure through tradable parent-company shares. If you want to understand what you’re actually buying when you “invest in Hulu,” keep reading.

- There is no Hulu ticker symbol—Hulu is not publicly traded and cannot be bought directly.

- Disney is the primary proxy for Hulu exposure in 2026 because Hulu is consolidated into Disney’s DTC reporting.

- Comcast (CMCSA) is no longer a Hulu proxy after selling its remaining stake; evaluate CMCSA on its core telecom/media fundamentals.

- Streaming stocks are now judged on profitability, not just subscribers—focus on ARPU, churn, ad monetisation, and segment margins.

- Hulu-specific wins can be diluted by Disney’s broader business risks, so manage expectations and sizing.

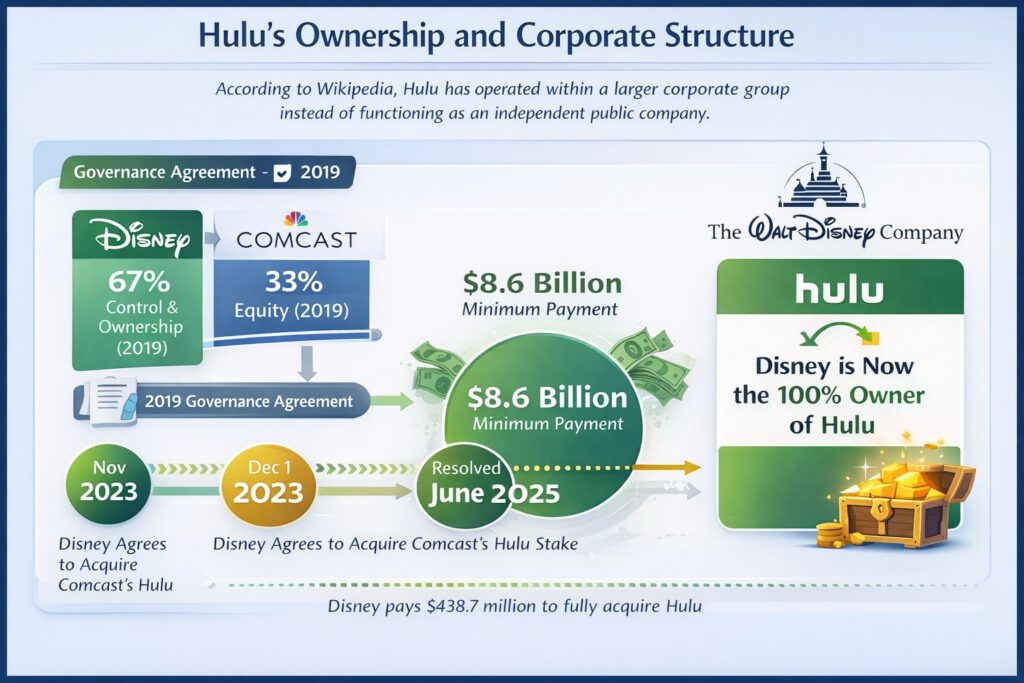

Hulu’s Ownership and Corporate Structure

Hulu has operated within a larger corporate group rather than as an independent public company.

According to Wikipedia, under the 2019 governance agreement between Disney and Comcast, Disney acquired a controlling 67% ownership stake and full operational control, while Comcast’s NBCUniversal retained the remaining 33% equity interest.

In November 2023, Disney initiated the process of acquiring Comcast’s stake in Hulu and paid the agreed $8.6 billion minimum floor price on December 1, 2023. After a valuation dispute, the deal was fully resolved in June 2025, with Disney paying an additional $438.7 million to complete the transfer of Comcast’s remaining stake.

As a result of this transaction, Disney is now the sole owner of Hulu, with full ownership and control consolidated under The Walt Disney Company.

Hulu as a Subsidiary of Major Media Conglomerates

Historically, Disney held roughly two-thirds of Hulu and Comcast held one-third, with Disney controlling operations and consolidating Hulu’s results into Disney reporting.

This matters because Hulu’s performance (subs, ARPU, ad load, content amortisation) influences Disney’s segment results and guidance rather than a separate Hulu share price. So, if you want “Hulu exposure,” the tradable instruments have been parent equities.

From a portfolio perspective, this structure makes Hulu exposure bundled with broader media drivers—parks, studios, sports rights, and consolidated leverage—so you cannot isolate Hulu-specific risk the way you can with a pure-play streaming stock.

Scenario: The "Happy Meal" Problem Buying Disney (DIS) just to get Hulu is like buying a Happy Meal just for the toy.

The Toy (Hulu): Might be great and growing fast.

The Burger (Theme Parks): If a recession hits, park revenue drops.

The Result: DIS stock might fall because of the parks, wiping out your Hulu gains. You cannot buy the toy separately.

Hulu’s Role in the Streaming Wars

In 2026, Hulu functions less like a standalone “growth story” and more like a cash-flow and retention tool inside Disney’s Direct-to-Consumer (DTC) business.

The strategic backdrop is straightforward: As linear TV weakens, Disney leans on Hulu’s tiering, advertising, and bundling to support ARPU, reduce churn, and improve streaming margins.

According to thewaltdeisneycompany, recent earnings disclosures show Disney’s streaming operations (Disney+ and Hulu combined) have moved into meaningful operating profit territory, shifting investor focus from raw subscriber counts to margins and monetisation.

Q2: If Hulu’s performance improves, does that automatically mean Disney stock will rise?

A: Not automatically. Hulu can improve Disney’s Direct-to-Consumer margins and guidance, but DIS is also driven by other business lines (parks, studios, sports, broader market sentiment). Hulu is a lever—not the whole machine.

Is Hulu Publicly Traded? Understanding the Stock Situation

Hulu is not publicly traded, and this remains one of the most common points of confusion for investors researching how to invest in Hulu.

Despite its scale and brand recognition, Hulu does not have its own listing on any stock exchange. As a result, there is no direct way to buy Hulu shares, and any exposure to Hulu must come through its parent company’s equity. The misunderstanding largely stems from Hulu’s market visibility. Investors often assume that a platform with tens of millions of subscribers must have its own stock. In reality, Hulu has always operated within a parent-company structure, which removes the need—and in Disney’s case, the strategic incentive—for a separate public listing.

For anyone asking if Hulu is publicly traded, the answer is unequivocally no.

Hulu Ticker Symbol Explained

Hulu has never filed for an IPO, nor has it traded under a tracking stock or special class of shares.

because it was designed and operated as a strategic asset, not as an independent company meant for public markets.

When investors believe they have found “Hulu stock,” they are usually looking at:

- Disney (DIS), which consolidates Hulu’s financial results

- Media or streaming ETFs that include Disney as a constituent

This distinction matters for traders. Hulu-related news—such as subscriber growth, advertising performance, or pricing changes—does not move a Hulu chart. It moves Disney’s stock price, often through changes in Direct-to-Consumer guidance or margin expectations. Treating DIS as a proxy for a nonexistent Hulu ticker symbol is the only viable market approach.

Implications of Hulu Being Privately Held

Because Hulu is privately held, investors cannot access it through a standalone stock or isolate its performance through a dedicated market price. There is no independent valuation, no separate financial statements, and no direct exposure to Hulu-specific upside or downside. All financial results tied to Hulu are absorbed into parent-company reporting, primarily through Disney’s Direct-to-Consumer segment and, historically, through Comcast’s equity interest.

For traders, this structure limits the number of actionable signals. Hulu-related developments—such as subscriber growth, pricing changes, or advertising performance—do not trigger isolated price discovery.

Instead, their impact is diluted across much larger business lines, including theme parks, studios, cable networks, and broadband. This makes Hulu unsuitable for targeted trading strategies and positions it more as a long-term strategic component than a tradable asset.

How to Invest in Hulu Indirectly

The only way to gain exposure to Hulu is indirectly through the publicly traded parent company. This requires evaluating Hulu’s meaning within each parent’s overall business and the extent to which its performance influences consolidated earnings, guidance, and valuation.

Indirect exposure also means accepting bundled risk. Investors are not buying Hulu in isolation; they are buying into a diversified media and communications business where Hulu is only one of many contributing assets.

Buying Shares of Disney (DIS)

According to quantifiedstrategies, buying shares of The Walt Disney Company (DIS) is the primary and most direct way to gain exposure to Hulu. Disney has held majority ownership and full operational control of Hulu since 2019.

For investors, DIS provides the clearest proxy for Hulu performance, although that exposure remains blended with Disney’s parks, studio, and consumer products businesses.

Investing Through Comcast (CMCSA)

Historically, investors could gain limited Hulu exposure through Comcast (CMCSA) while NBCUniversal held a minority stake. However, this exposure was indirect and financial rather than operational. Hulu did not materially drive Comcast’s core valuation, which is dominated by broadband, cable, and infrastructure assets.

Following Comcast’s exit from Hulu, CMCSA no longer offers meaningful exposure to Hulu’s performance. As a result, Comcast should not be viewed as a proxy for Hulu investment in 2026. Investors considering CMCSA should evaluate it on its core communications and media fundamentals rather than any legacy association with Hulu.

Evaluating Hulu Within a Streaming Stock Portfolio

Because Hulu is fully consolidated within Disney, its contribution should be analysed as part of Disney’s Direct-to-Consumer segment rather than as an independent asset. For investors, this shifts the focus from price action to fundamentals—streaming margins, advertising monetisation, subscriber stability, and management guidance.

When evaluating Hulu within a broader streaming stock portfolio, the key question is not “How fast is Hulu growing?” but “How much does Hulu improve the quality and durability of Disney’s streaming earnings?” In a maturing streaming market, consistency, pricing power, and cash-flow visibility increasingly outweigh headline subscriber growth. Hulu’s hybrid model plays directly into that shift.

Best Streaming Stocks to Buy in 2026

In 2026, the streaming sector favours companies that have moved beyond aggressive subscriber acquisition and toward sustainable profitability. From a portfolio perspective, exposure to Hulu comes via Disney (DIS), which offers a blended profile of streaming, content ownership, and non-media cash flows.

Other streaming-related stocks often considered alongside Disney include:

- Netflix (NFLX), is a pure-play subscription platform with global scale

- Amazon (AMZN), where Prime Video supports a broader ecosystem rather than standalone profits

- Warner Bros. Discovery (WBD), with higher leverage and execution risk

Compared to pure-play streaming stocks, Disney’s Hulu exposure tends to reduce volatility but also caps upside. Investors prioritising stability may favour this structure, while those seeking higher beta may prefer standalone streaming names.

Analysing Market Trends and Subscriber Growth

When assessing Hulu inside a streaming-focused portfolio, it helps to separate macro demand from company-specific execution. One useful macro reference is the shift away from traditional cable (“cord-cutting”) and the projected expansion of the streaming market:

According to mavericktrading, one industry overview estimates the global streaming market at $42.6bn in 2019, forecasting growth to $184.2bn by 2027, equivalent to a 20.4% CAGR (2020–2027). You can cite that projection as the backdrop for why streaming remains a structurally growing segment even as competition intensifies.

From there, the analysis should narrow to the metrics that actually drive equity outcomes. Subscriber growth is still relevant, but in 2026 it should be interpreted alongside quality-of-revenue indicators:

- Net adds vs. churn: growth that comes with rising churn is usually expensive and fragile.

- ARPU and tier mix: ad-supported growth can lift scale, but must be tested against ARPU stability.

- Content efficiency: rising subscribers with worsening content cost intensity is not bullish.

- Guidance sensitivity: for Disney-linked exposure, focus on how subscriber trends translate into DTC margin and forward guidance.

Key Insight

In 2026, streaming stocks are judged less on subscriber headlines and more on ARPU, churn, ad monetisation, and segment profitability.

Key Risks for Hulu Investors

Hulu cannot be evaluated in isolation, and that alone is a risk factor for investors. Because Hulu is fully embedded within Disney, its performance is inseparable from broader corporate decisions, capital allocation priorities, and external pressures affecting the media industry. In 2026, the main risks tied to Hulu exposure are not about product viability but about regulation, competition, and the long-term economics of streaming.

Regulatory and Market Challenges

Regulatory risk remains a relevant consideration for Hulu-linked investments, particularly around content licensing, advertising practices, and data privacy. As governments increase scrutiny of digital advertising and consumer data use, ad-supported streaming services face higher compliance costs and potential restrictions. This is especially relevant for Hulu, where advertising is a core revenue driver.

Market challenges are equally significant. The streaming sector is crowded, pricing power is constrained, and customer acquisition costs remain elevated. Consumers are increasingly price-sensitive, leading to higher churn and greater reliance on discounted bundles. For investors, this creates uncertainty around:

- Sustainable ARPU growth

- Long-term subscriber retention

- The ability to pass rising content costs to users

These pressures directly affect Disney’s Direct-to-Consumer margins, which include Hulu’s results.

Future Prospects and Long-Term Strategy

Hulu’s long-term outlook depends less on rapid subscriber expansion and more on profitability and integration. Disney’s strategy has shifted toward optimising its streaming portfolio by tightening cost controls, improving ad monetisation, and deepening ecosystem integration across its platforms.

Prospects hinge on:

- Continued growth in ad-supported streaming demand

- More efficient content spending and licensing strategies

- Successful execution of bundled offerings that reduce churn

Key Point:

For investors, Hulu’s strategic value lies in its ability to support predictable cash flows and stabilise Disney’s streaming business rather than deliver standalone growth.

Conclusion

Hulu has no stock ticker because it is not a standalone public company. In 2026, the only realistic way to get Hulu exposure is through Disney (DIS), where Hulu’s performance shows up inside the Direct-to-Consumer results and management guidance. Treat Hulu as a driver of Disney’s streaming economics—not as an independent investment—and base your decision on profitability metrics like churn, ARPU, and segment margins rather than brand hype.