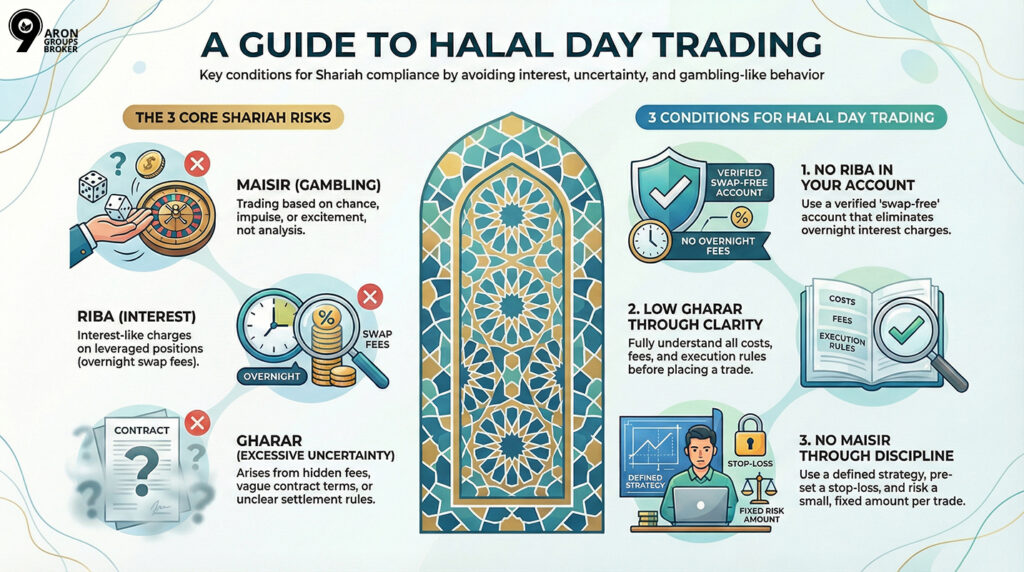

Many Muslims ask, “Is day trading haram?” because modern trading can include interest-like charges and unclear contract terms. Day trading is not gambling when it is driven by analysis, a defined method, and disciplined risk control.

The ruling usually depends on structure, costs, and execution, not on speed alone.

- Day trading is not Maisir when decisions are based on analysis, rules, and controlled risk.

- The main Shariah risk in retail trading is Riba through swap or rollover charges on overnight positions.

- Intraday trading reduces Riba exposure, but accidental overnight holds can still trigger swap fees.

- A swap-free account helps only if it removes interest without replacing it with time-based “admin” fees.

What Is Day Trading and How Does It Actually Work?

Based on the dailyforex website, day trading means you open and close a position within the same trading day. You do not carry the position into the next trading day under your plan. This matters because many interest-like costs are charged when you hold positions overnight.

In practice, an intraday trade can last minutes or hours. The defining feature is the absence of planned overnight holding. If you accidentally hold overnight, costs and compliance questions can change.

The Halal Trading Filter. Before you place a trade, pass it through this 3-step check:

- No Riba: Is the account swap-free?

- No Maisir: Is the trade based on analysis, not luck?

- No Gharar: Do you own the asset (or contract) with clear terms?

Why Do Some People Call Day Trading Gambling (Maisir)?

The confusion usually stems from leverage, rapid decision-making, and emotional behaviour. Gambling is driven by chance. Trading should be driven by informed judgment. Speed does not automatically equal Maisir, but reckless speed often does.

Comparison table

| Feature | Gambling (Maisir) | Trading (structured) |

|---|---|---|

| Basis of decision | Chance and impulse | Analysis and rules |

| Risk control | Often absent | Defined risk per trade |

| Repeatability | Entertainment-driven | Process-driven |

| Expected edge | None | Tested, probabilistic edge |

If your method has rules and consistent risk limits, it does not resemble gambling. If you “click and hope”, it does.

Is Day Trading Still Maisir If It Uses Technical or Fundamental Analysis?

Using analysis does not guarantee permissibility, but it changes the nature of the act. Analysis estimates probabilities using market information and logic, not luck.

Day trading becomes gambling-like when behaviour is uncontrolled and rule-free.

Common red flags include:

- Entering trades with no setup or invalidation level.

- Doubling in size after losses to “get it back”.

- Trading for excitement rather than process.

- Using leverage as a shortcut instead of a risk tool.

A Shariah-compliant mindset requires intention, method, and restraint. Without these, the activity resembles Maisir even if charts are used.

Key Point

Maisir risk increases sharply when you trade around high-impact news without a pre-defined “no-trade window”.

Which Shariah Principles Decide Whether Day Trading Is Halal?

Most practical questions fall under Riba and Gharar. There are also concerns around fairness, transparency, and avoidable harm. Day trading is assessed through these lenses.

Q: What is Riba in trading terms?

A: Riba is interest or interest-like gain tied to time and debt. In retail trading, the main issue is overnight financing on standard accounts. If you pay or receive interest for holding, the structure is problematic.

Q: What is Gharar in trading terms?

A: Gharar is excessive uncertainty and unclear contracting. In trading, this often shows up as hidden fees, vague terms, or unclear execution. If you cannot understand the cost and settlement logic, Gharar risk rises.

Are Swap and Rollover Fees Riba, and Why Do They Matter Even for Day Traders?

A “swap” or “rollover” fee is typically charged when a position stays open overnight. It reflects financing between currencies or leveraged exposure to an instrument. Many scholars treat this interest-like overnight charge as Riba.

Day traders still must care because the market does not always follow your plan. A delayed exit can push you into overnight holding and trigger a swap.

Why does accidental overnight holding happen

- Platform cut-off times differ by broker and instrument.

- A weekend rollover can be applied to a specific weekday.

- Volatility can prevent exits at intended prices.

If a standard account charges overnight interest, it creates a clear Riba problem. This is why “halal or haram” often depends on account fees.

Key Point

Some brokers apply a “triple swap” on a specific weekday to account for weekend settlement, even if markets are closed. If you trade late in the day, that timing detail can create unexpected Riba exposure.

What Is a Swap-Free (Islamic) Account and What Does It Change?

A swap-free account removes the typical overnight interest charge. That addresses a central Riba issue for many retail traders. However, it does not automatically make every trade halal.

| Feature | Standard Account | Swap-Free (Islamic) Account |

|---|---|---|

| Overnight Fees | Interest-based (Swap). | $0 (or fixed Admin Fee). |

| Riba Risk | High (Automatic). | Low (Removed). |

| Hidden Costs | Usually none. | Watch for wider spreads or "Admin Fees". |

| Suitability | General Traders. | Muslim Traders observing Shariah. |

What a swap-free account usually fixes

- No standard overnight financing charge.

- Reduced exposure to interest-based rollovers.

- Clearer alignment with “no interest” expectations.

What a swap-free account may not fix

Some forex brokers replace swaps with other charges. Those charges may still raise Riba-like or Gharar concerns, including:

- “Administration” fees that scale with time held.

- Wider spreads that are not clearly disclosed.

- Restrictions that apply only to certain instruments.

If you are searching for the best Islamic forex broker 2026, focus on terms, not marketing labels. A label is not evidence of Shariah compliance.

What Conditions Make Day Trading Halal in Practice?

Day trading can be permissible when the structure avoids Riba and reduces Gharar. It must also avoid Maisir through a disciplined process and risk management. This section is where “rules” become practical.

Condition 1: No Riba in account structure

Use a structure that avoids overnight interest. That often means a verified swap-free account for leveraged products. If you cannot avoid interest-like charges, do not trade that structure.

Condition 2: Low Gharar through clear costs and execution

You should understand the product, pricing, and all fees before trading. Execution rules must be clear, including stop-loss behaviour in fast markets. Avoid contracts you cannot explain in plain language.

Condition 3: No Maisir through a disciplined method

A halal approach requires a repeatable process. This is where halal trading strategies for beginners should be simple and controlled.

- Trade fewer instruments you understand well.

- Use defined entry criteria and a pre-set stop-loss.

- Risk a small fixed amount per trade, not a feeling-based amount.

- Stop trading after a daily loss limit is reached.

Self-Check: Am I Trading or Gambling?

- Plan: Did I define my entry and exit before clicking buy?

- Risk: Is my risk less than 2% of my account?

- Reason: Can I explain why I took this trade to a mentor?

- Emotion: Am I calm, or am I trying to "revenge" a previous loss?

These rules reduce impulsive behaviour and protect capital. They also separate trading from entertainment.

What Mistakes Commonly Make Day Trading Haram?

Most failures are not theological. They are structural and behavioural. People ignore fees, then discover the issue after losses. Others trade like a game, then call it “day trading”.

Common mistakes include:

- Treating trading as luck, not a controlled decision process.

- Holding overnight unintentionally on a standard account with swap charges.

- Using high leverage without risk limits and stop-loss discipline.

- Trusting “Islamic” labels without checking the fee structure.

One mistake can turn a compliant plan into a non-compliant outcome. This is why verification matters.

Key Point

Overtrading is often driven by platform “gamification” cues, like streaks, confetti, and constant alerts. Disabling these triggers can reduce impulsive behaviour that pushes trading toward a Maisir-like pattern.

Conclusion

Day trading becomes a Shariah issue only when the transaction involves interest-linked costs or the terms are not fully transparent.

A practical approach is to treat compliance as a pre-trade filter, not a debate after losses. Choose an account structure that does not generate swap, confirm how the broker replaces that revenue, and document the terms.