Do you want to entrust your trades to an automated and precise system? MetaTrader Auto Trading allows you to execute your strategies automatically using algorithms and trading robots, without the need for continuous supervision.

If you’re looking to leverage this advanced technology to enhance your trading performance, stay with us as we dive deep into the complete process of activating and operating Auto Trading in MetaTrader, its advantages and disadvantages, and how to install and use Expert Advisors (EAs).

- By using Expert Advisors (EAs), you can customize your trading strategies and manage your risk by adjusting parameters such as stop loss and take profit.

- Before executing your strategies in the live market, test them using the MetaTrader Auto Trading backtest feature to ensure their proper performance.

- Choosing the right broker with features like support for reputable platforms, fast order execution, and low trading costs is crucial for success in MetaTrader Auto Trading.

What is Auto Trading in MetaTrader and How Does It Work?

According to Quantified Strategies, Auto Trading refers to the process of using trading algorithms and trading robots to execute transactions in various financial markets. Platforms like MetaTrader offer traders the ability to execute automated trades.

Auto Trading in MetaTrader relies on the use of algorithms and Expert Advisors (EAs) to carry out trades automatically. The trading algorithm, based on predefined rules and market data analysis (such as price fluctuations, technical indicators, volume patterns, and news), identifies buy and sell opportunities. The Auto Trading system in MetaTrader then executes these signals.

This feature in MetaTrader allows traders to completely remove human emotions and cognitive biases from their trades, enabling them to execute strategies faster, more accurately, and efficiently. Moreover, this system is highly beneficial for those who don’t have enough time to analyze the market, as it allows traders to take advantage of market opportunities 24/7 without fatigue.

Advantages and Disadvantages of Auto Trading in MetaTrader

The Auto Trading system in MetaTrader offers many benefits to traders but also comes with its drawbacks and limitations. Let’s take a closer look at both the advantages and disadvantages of auto trading in MetaTrader.

Advantages of Auto Trading in MetaTrader:

According to LinkedIn, the benefits of Auto Trading in MetaTrader include:

- Increased Efficiency and Time Savings: Auto Trading allows you to capitalize on trading opportunities 24/7 without the need for constant supervision.

- Elimination of Human Errors and Cognitive Biases: Trading robots, due to the absence of human intervention, offer higher accuracy and help prevent emotional decisions and mistakes caused by fear or anxiety.

- Increased Accuracy in Trade Execution: In MetaTrader auto trading, trades are executed with the assistance of trading robots, ensuring precision that humans cannot match, especially in volatile markets where timing is critical.

- Execution of Complex Strategies: Auto Trading enables the implementation of more complex strategies that would be time-consuming and difficult for humans to execute manually.

- Access to a Broader Range of Markets: With auto trading, you can easily access various markets such as Forex, cryptocurrencies, stocks, and commodities at any time, from anywhere.

- Customizable Trading Algorithms: Auto trading in MetaTrader provides many customization options for Expert Advisors (EAs), allowing traders to adapt to different market conditions and strategies.

Disadvantages of Auto Trading in MetaTrader:

- Need for Periodic Supervision: Even though Auto Trading operates automatically, periodic monitoring of the robots’ performance is necessary to prevent issues from arising.

- Dependence on Pre-Defined Strategies: The performance of Expert Advisors is entirely reliant on pre-set strategies, and if market conditions change, their effectiveness may diminish.

- Lack of Flexibility in Unusual Market Conditions: During periods of extreme market volatility, trading robots might struggle to adapt quickly to new conditions, potentially resulting in significant losses.

By carefully weighing these pros and cons, traders can make more informed decisions when implementing MetaTrader auto trading in their strategies.

How to Activate and Set Up Auto Trading in MetaTrader 4 and 5

To activate Auto Trading in MetaTrader, follow these steps:

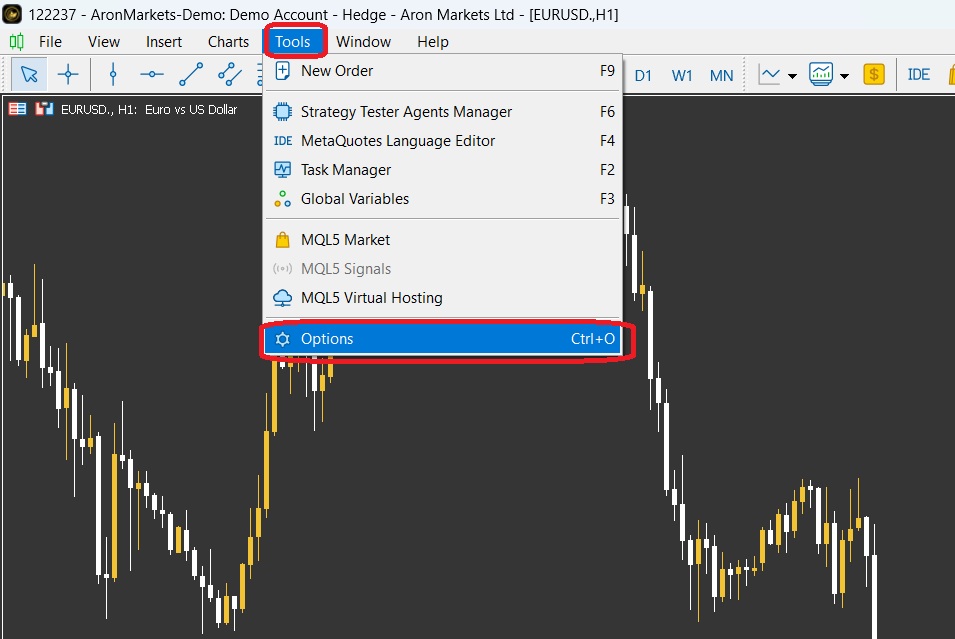

- In the top menu of the platform, go to Tools > Options.

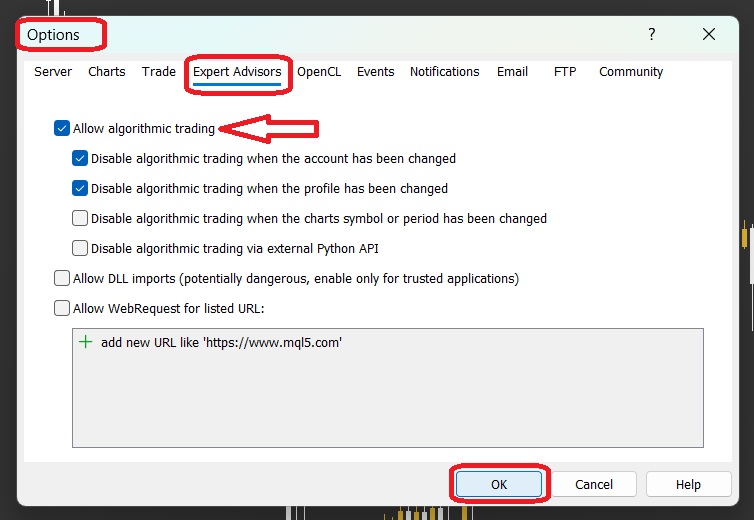

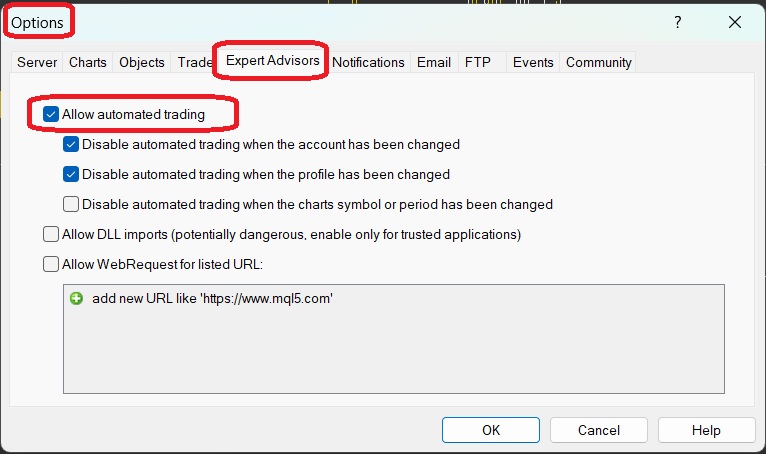

- In the opened window, navigate to the Expert Advisors tab.

- Enable the Allow Algorithmic Trading in MetaTrader 5, and the Allow Automated Trading in MetaTrader 4.

- To ensure the proper functioning of Expert Advisors, also enable the options Allow DLL imports and Allow import of external experts.

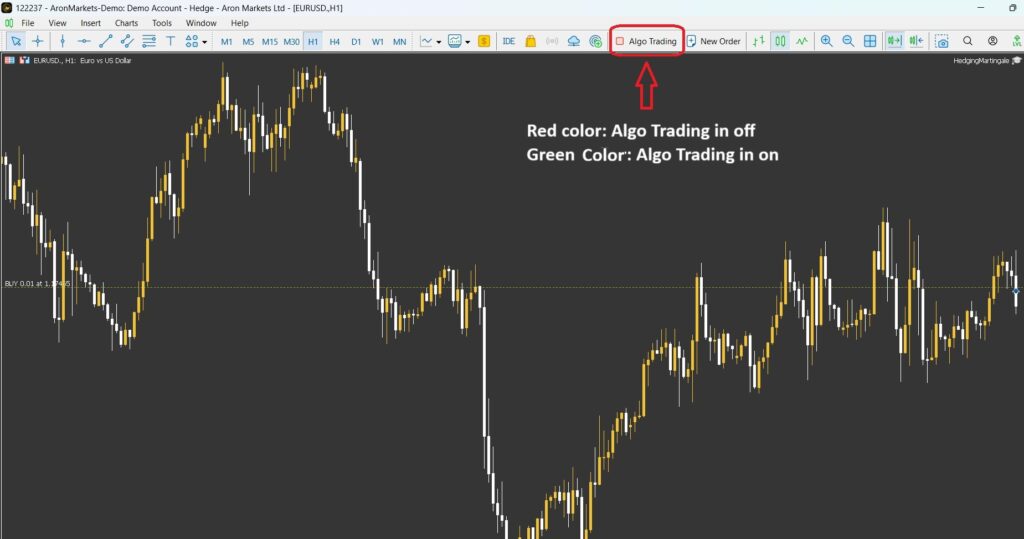

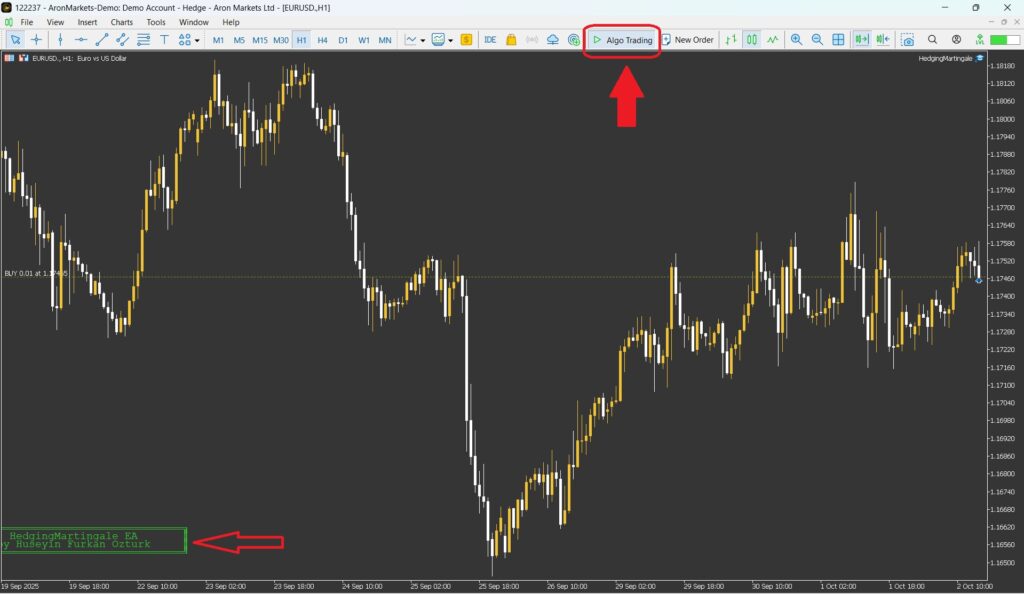

- After making these settings, ensure that the AlgoTrading icon in MetaTrader 5 (or Auto Trading in MetaTrader 4) turns green in the toolbar at the top of the platform. If this icon is red, Auto Trading is disabled.

A shortcut to activate the auto trading option in MetaTrader is by clicking on the Algo Trading icon in the top toolbar of MetaTrader 5 (or Auto trading in MetaTrader 4).

Expert Advisors (EA) and Their Role in MetaTrader Auto Trading

In the world of automated trading, using Expert Advisors (EAs) on trading platforms like MetaTrader is an essential tool for traders. These EAs automatically execute trades in various markets based on pre-programmed algorithms. In this article, we will explore the role of Expert Advisors in MetaTrader auto trading and discuss how to install and use them effectively.

What is an Expert Advisor (EA) and What Role Does It Play in MetaTrader?

An Expert Advisor (EA) is an automated program designed for use on MetaTrader trading platforms. These programs can fully automate buying and selling actions, executing trades based on predefined strategies. The primary applications of Expert Advisors in MetaTrader include:

- Executing Complex Strategies: EAs can automatically implement complex strategies that require rapid market analysis, something humans may find difficult to execute in real time.

- Reducing Human Errors: EAs prevent errors arising from emotional decision-making or human mistakes, ensuring a more consistent and rational approach to trading.

- Speed of Execution: EAs can process multiple trades within a fraction of a second, something that would be impossible for human traders, especially in fast-moving markets.

After writing your trading algorithm, use the Expert Backtest feature in the MetaTrader strategy tester to evaluate the performance of your trading strategies without risking real capital.

Steps to Install and Run an Expert Advisor in MetaTrader 4 and 5

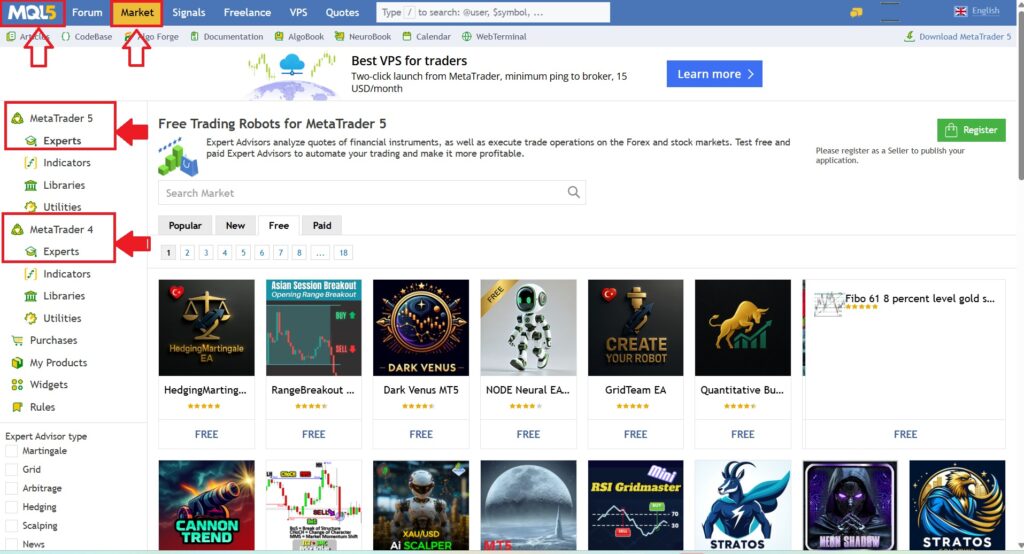

To install and run an Expert Advisor (EA) in MetaTrader, follow these steps:- Download the Expert Advisor file with the extension .ex4 for MT4 or .ex5 for MT5 from reputable sources such as the MQL5 Market.

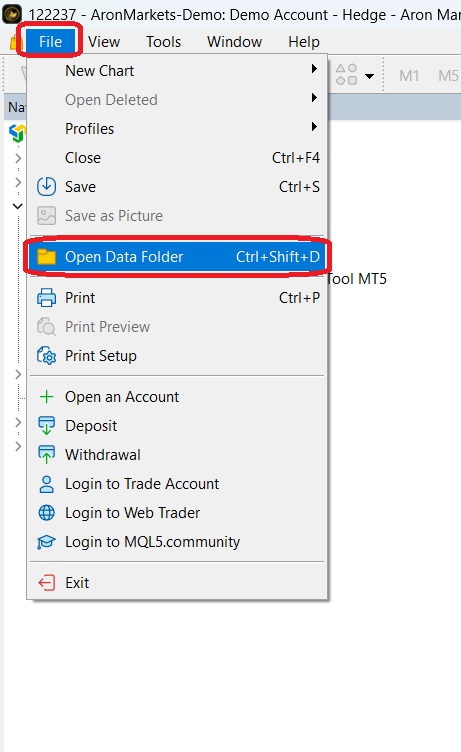

- Go to File > Open Data Folder.

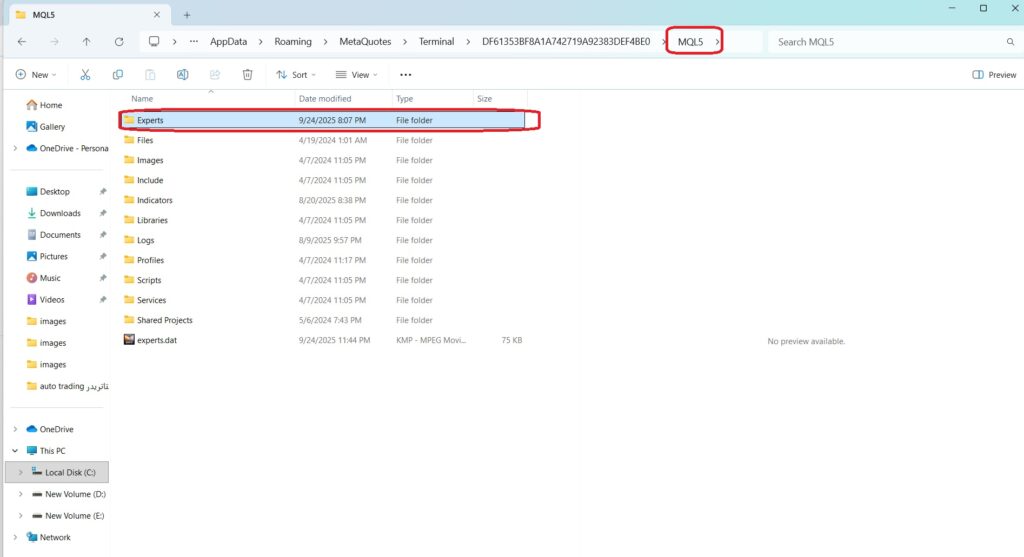

- In the open window, navigate to MQL4 > Experts for MT4 or MQL5 > Experts for MT5.

- Copy the Expert Advisor file into this folder.

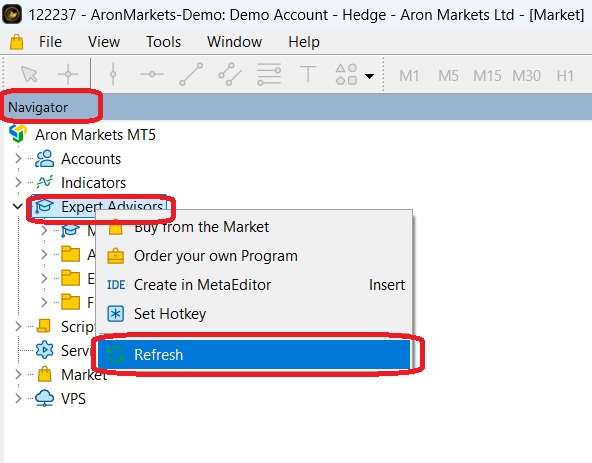

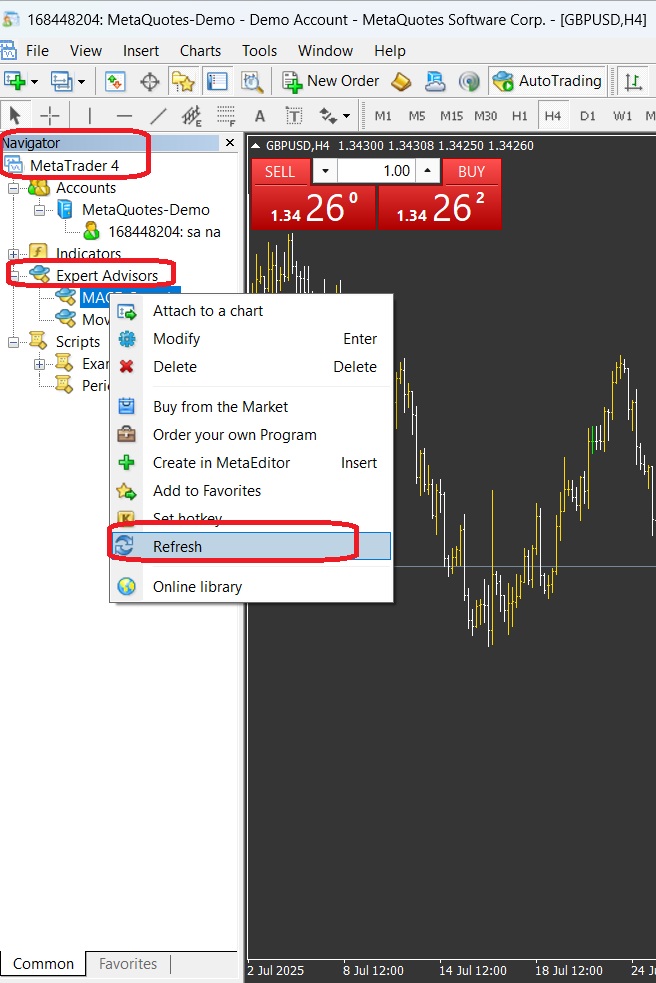

- Restart the MetaTrader platform or, in the Navigator window, right-click on Expert Advisors and select the “Refresh” option.

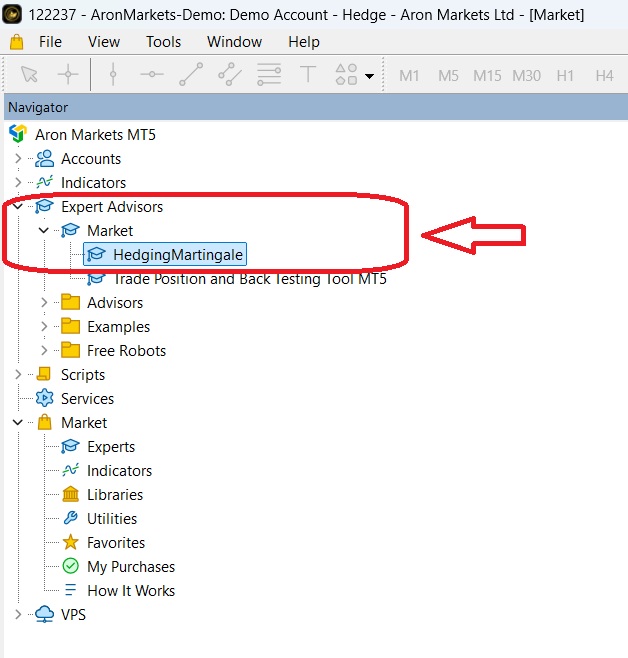

- Now, the Expert Advisor is visible in the Expert Advisors section. Drag and drop it onto the desired chart.

Initial Expert Advisor Settings Guide

The initial settings for each Expert Advisor may vary depending on your strategy, but the common settings that most Expert Advisors require are as follows:

In MetaTrader 5:

- Double-click on the Expert Advisor to open the settings window.

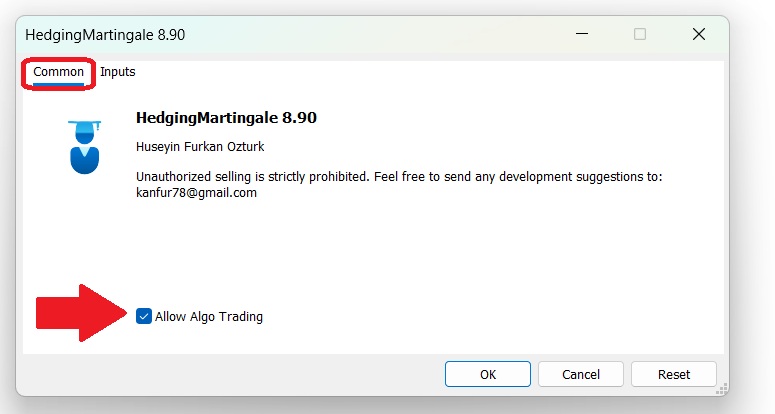

In the Expert Advisor settings window, under the “Common” tab, enable the “Allow Algo trading” option.

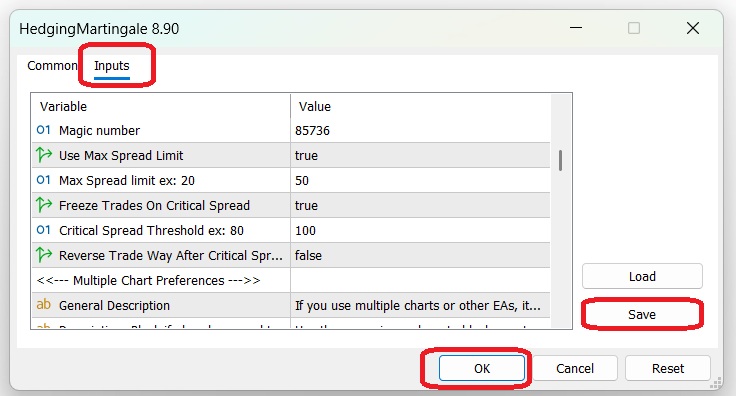

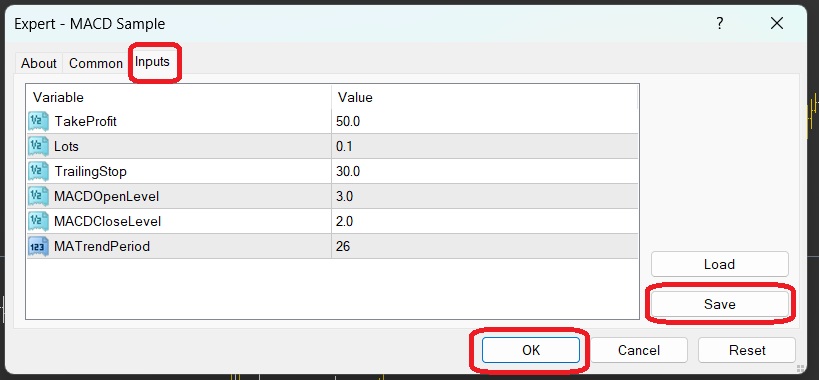

- In the Inputs tab, set the desired parameters such as trade volume, stop loss, take profit, and others.

- In the same tab, you can adjust settings like Trailing Stop and Break Even to optimally manage risk and prevent large losses.

- Once the settings are configured, click Save to store the changes.

- Afterward, click OK to apply the settings.

If everything has been set up correctly, the Algo trading icon in the top toolbar will turn green, and the name of the Expert Advisor will be displayed in the bottom left corner of the chart.

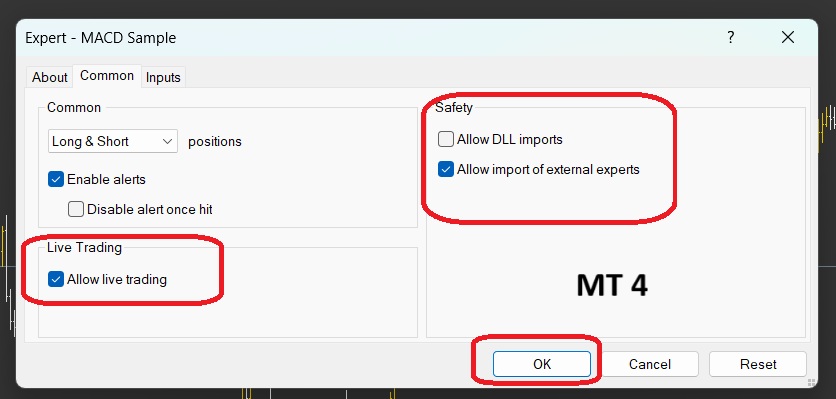

In MetaTrader 4:

- Double-click on the Expert Advisor to open the settings window.

- In the Expert Advisor Settings window, under the Common tab, enable the Allow Live trading option.

- If necessary, also check the Allow DLL Imports option.

- In the Inputs tab, apply the necessary changes such as take profit, stop loss, lot size, trailing stop, etc., click Save, and finally press the OK button.

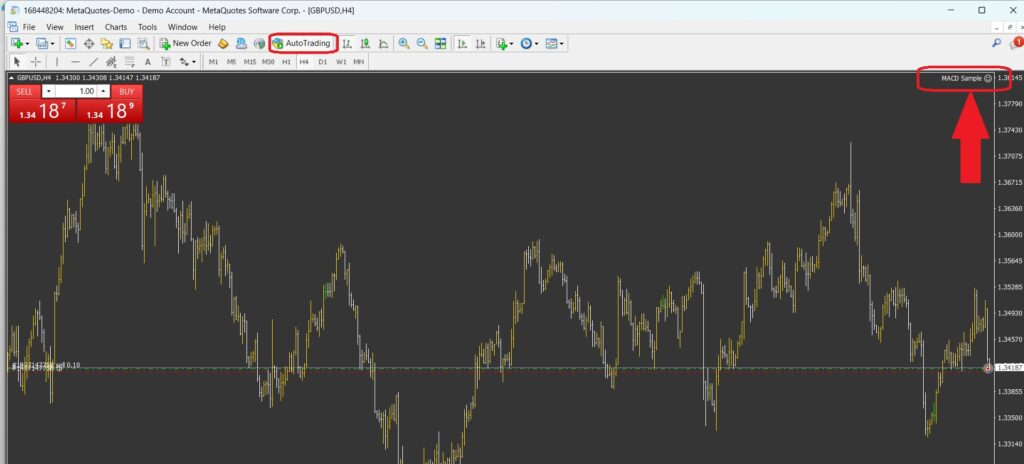

If all steps have been completed correctly, a smiling face icon will appear in the top-right corner of the chart, indicating that the Expert Advisor is active on the chart.

Read More: MT4 Vs. MT5

Popular Trading Strategies in MetaTrader Auto Trading

Some of the most commonly used trading strategies in MetaTrader Auto Trading include:

Trend Following Strategy

This strategy is designed around identifying market trends and following them. In this approach, algorithms use indicators such as moving averages to detect upward or downward trends and open buy or sell positions accordingly.

This strategy is ideal for markets with strong trends.

Mean Reversion Strategy

The Mean Reversion strategy is based on the belief that prices tend to revert to their historical average. Algorithms following this strategy identify price deviations from the mean and open buy or sell positions.

This strategy is suitable for markets that are in neutral or volatile phases.

Before using any strategy, it is recommended to test it on a demo account and ensure its performance. Additionally, risk management and setting an appropriate stop loss are of paramount importance.

Arbitrage Strategy

In this strategy, the price difference of an asset across different markets is identified and exploited for profit. Algorithms following the arbitrage strategy make simultaneous trades in multiple markets, capturing profits from price differences.

This strategy requires high-speed execution and precision, making it nearly impossible to execute without Expert Advisors.

News-Based Trading Strategy

This strategy is based on the analysis of economic and political news and their impact on financial markets. Algorithms identify significant and influential news, predict market reactions, and open trading positions accordingly.

News trading is suitable for professional traders who have the ability to analyze news effectively in the Forex market.

Scalping Strategy

Scalping involves making trades in very short timeframes (within minutes) and earning small profits from each trade. Algorithms open and close positions by identifying small price fluctuations. This strategy also requires high-speed execution and precision, making it one of the ideal strategies for Auto Trading in MetaTrader.

Using a VPS (Virtual Private Server) can help ensure the uninterrupted and fast execution of trading algorithms.

Criteria for Selecting the Best Broker for Auto Trading in Forex

For successful Auto Trading in Forex, selecting the right broker is crucial. A broker with the right features can help you implement your trading strategies and prevent potential issues. Below are key criteria for choosing the best broker for Auto Trading in Forex:

- Support for Popular Trading Platforms

Choose a broker that supports reputable platforms like MetaTrader or TradingView. These platforms offer powerful tools for developing and executing Expert Advisors (EAs) or trading robots. - Fast and Slippage-Free Execution

Fast order execution is essential for success in Auto Trading. Brokers using ECN (Electronic Communication Network) usually offer faster execution and reduce the likelihood of slippage. - Competitive Trading Costs

Trading costs can significantly impact the profitability of automated strategies. Brokers with low spreads and no additional commissions can be good options.

Read more: Brokers with Lowest Spread - Support for VPS (Virtual Private Server)

To run trading robots 24/7, using a VPS is crucial. Some brokers offer Forex-specific VPS services, which help reduce delays in order execution. - Regulation and Security

Ensure that the broker is regulated by reputable financial bodies such as the UK’s FCA, Australia’s ASIC, or Cyprus’s CySEC. This helps protect your funds and ensures transparency in trading operations. - Customer Support and Educational Resources

A broker with strong customer support and educational resources can be highly beneficial in resolving issues and improving your trading skills.

Conclusion

Auto Trading in MetaTrader is a powerful tool that allows traders to execute trades automatically without constant monitoring. By leveraging Auto Trading in MetaTrader and using appropriate strategies and settings, you can enhance your performance in financial markets. Given the advantages and disadvantages of this system, special attention should be paid to selecting the right strategies and broker to achieve the best results.