When a country’s economy runs into trouble, people feel it through inflation, unemployment, and a decline in purchasing power. To measure this pressure more precisely, economists have designed a simple yet meaningful indicator: the Misery Index.

This index functions like a thermometer, showing how heavily economic problems weigh down society. It doesn’t matter how familiar you are with economic terminology; the Misery Index reveals the reality of people’s daily lives with a single number.

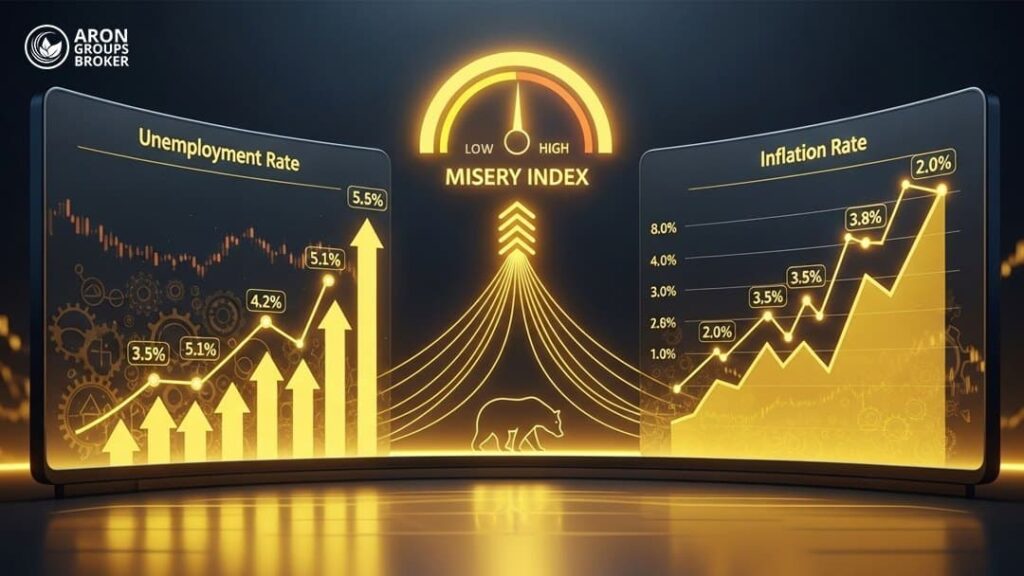

- In its simplest form, the Misery Index is the sum of the inflation rate and the unemployment rate, showing the level of economic pressure on households.

- The higher this index, the lower the level of welfare and the greater the economic dissatisfaction in society.

- The Misery Index helps policymakers determine whether to focus more on inflation or unemployment.

- A rising Misery Index can affect financial markets such as forex, equities, and cryptocurrencies, either negatively or as a trigger for “safe-haven” flows.

What Is the Misery Index and Why Is It Important?

The Misery Index is a simple number that shows how difficult people’s economic situation is in a given country. It is calculated from the sum of two variables: the unemployment rate and the inflation rate.

If people cannot find jobs (high unemployment) or prices keep rising (high inflation), life becomes harder. When both problems occur at the same time, financial pressure on households increases, and the Misery Index climbs.

The importance of the Misery Index is that it:

- Helps us understand the extent of economic stress people are under.

- Shows whether government policies have genuinely improved conditions.

- Allows policymakers, analysts, and investors to quickly and simply assess a country’s economic situation.

How Is the Misery Index Calculated?

The Misery Index is one of the simplest economic indicators, with a very straightforward formula. Over time, however, this formula has been refined. Below are the main versions.

Arthur Okun’s Misery Index

American economist Arthur Okun introduced the Misery Index in the 1970s. Its formula is:

Misery Index = Unemployment rate + Inflation rate

This index reflects the combined pressure of unemployment and inflation on society.

Robert Barro’s Misery Index

In 1999, Robert Barro, an economist at Harvard University, proposed an extended version of Okun’s index that includes more factors:

Barro Misery Index = Inflation rate + Unemployment rate + Long-term interest rate − Real GDP growth

This version aims to provide a more comprehensive picture of the overall economic situation by adding long-term interest rates and real GDP growth.

Steve Hanke’s Misery Index

Steve Hanke, an economist at Johns Hopkins University, introduced a global version of the Misery Index designed for international comparison:

Hanke Misery Index = Unemployment rate + Inflation rate + Bank lending rate − Real GDP per capita growth

This index is calculated and published annually for more than 150 countries.

Bitcoin Misery Index (BMI)

In the cryptocurrency world, analyst Tom Lee created a specific indicator to measure sentiment in the Bitcoin market:

Bitcoin Misery Index = Percentage of profitable trades + Bitcoin market volatility

This index helps traders identify potential entry and exit points in the Bitcoin market based on price behaviour and volatility.

The Misery Index alone does not provide a precise picture of income inequality, but when used alongside the Gini coefficient, it offers a deeper perspective on both economic pressure and inequality.

Misery Index with Higher Weight on Unemployment

Some studies show that unemployment has a stronger impact on people’s feelings of dissatisfaction than inflation. Based on this, a modified version of the Misery Index has been proposed that assigns a higher weight to unemployment:

Adjusted Misery Index = (1.7 × Unemployment rate) + Inflation rate

This version attempts to reflect the more severe real-world impact of unemployment on household welfare.

History of the Misery Index and Its Evolution in Periods of Inflation and Recession

The Misery Index was first introduced in the 1970s by American economist Arthur Okun. During that time, the United States was facing high inflation and economic slowdown. Okun was looking for a simple way to measure public dissatisfaction with economic conditions, and the combination of inflation and unemployment became the foundation of this index.

At that time, the US economy was experiencing stagflation, a period of high inflation and high unemployment. In such circumstances, the Misery Index quickly found its place in economic analysis because, in simple terms, it showed how much pressure people were under.

Over time, other economists refined and extended the index:

- Robert Barro proposed extended versions of the index that also took into account interest rates and real GDP growth.

- Steve Hanke of Johns Hopkins University used the index to compare countries and began publishing an annual list of countries with the highest economic pressure (Hanke’s Annual Misery Index).

- In the world of digital assets, Tom Lee developed a version called the Bitcoin Misery Index to identify potential entry and exit points for Bitcoin traders based on market sentiment.

When Does the Misery Index Rise?

The Misery Index rises when either the inflation rate or the unemployment rate, or both, increase. In this situation, prices rise rapidly, or many people lose their jobs; in both cases, economic pressure intensifies. For example, when a country enters a period of stagflation, economic growth has stalled while prices for goods and services continue to rise. In such conditions, people neither have sufficient income nor purchasing power. As a result, the Misery Index increases sharply. This is a clear sign of falling welfare, public dissatisfaction, and a decline in the quality of life. A higher Misery Index usually has several economic and social consequences:- It can reduce domestic and foreign investment because the economic environment appears unstable and risky.

- The value of the domestic currency can also fall in the forex market as confidence in the country’s economy deteriorates.

- At the same time, many people prefer to move their capital into safe-haven assets such as gold or Bitcoin to protect the value of their money.

- In extreme cases, severe economic pressure can even lead to rising crime and social instability.

The Role of the Misery Index in Economic Policy-Making

For economic policymakers, the Misery Index serves as a warning light. When the index rises, it means households are under financial stress. In such conditions, governments and central banks need to make urgent and targeted decisions to improve the situation.

- If the main driver of the increase is high inflation, the government and central bank may adopt contractionary monetary policy, for example, by raising interest rates or reducing liquidity to curb rapid price growth.

- If the main reason is high unemployment, policymakers are more likely to use expansionary monetary policy, such as injecting liquidity, cutting taxes, or increasing infrastructure and public projects to create more jobs.

By examining the Misery Index, policymakers can decide whether to prioritise inflation control or job creation. For this reason, the Misery Index is not just a simple number; it is a key indicator for steering a country’s monetary and fiscal policy.

Comparing the Misery Index Across Countries

The Misery Index is a global tool for measuring economic pressure on households, which is why countries are compared internationally using this number.

- Countries with stable economies, low unemployment, and controlled inflation usually have a low Misery Index.

- Countries facing economic crises, stagflation, or political instability are often at the top of the “misery ranking”.

Comparing this index across countries not only provides a clear picture of living standards and purchasing power, but also helps investors and analysts better understand the country risk of each jurisdiction.

Rising Misery Index values do not always mean that a government has “failed”; in some cases, they may be the side-effect of expansionary policies aimed at stimulating economic growth, which temporarily increase inflation or unemployment.

Which Countries Have the Highest Misery Levels?

According to the 2024 annual Misery Index published by economist Steve Hanke, the 10 countries whose citizens experience the highest economic pressure are:

| Rank | Country | Misery Index | Main Source of Misery |

|---|---|---|---|

| 1 | Sudan | 374.8 | Inflation |

| 2 | Argentina | 195.9 | Inflation |

| 3 | Syria | 188.3 | Unemployment |

| 4 | Yemen | 162.7 | Inflation |

| 5 | Türkiye | 120.6 | High interest rate |

| 6 | Venezuela | 118.2 | Unemployment |

| 7 | Zimbabwe | 109.1 | High interest rate |

| 8 | Lebanon | 87.7 | Unemployment |

| 9 | Malawi | 80.3 | High interest rate |

| 10 | Eswatini | 79.9 | Unemployment |

In 2024, Iran ranks 16th in the world with a Misery Index of 65.8. The main source of economic misery in Iran is identified as chronic high inflation, which has reduced purchasing power and intensified cost-of-living pressure on citizens.

Source: Independent.org

How the Misery Index Relates to Financial Markets: Forex, Equities, and Crypto

The Misery Index is not only a measure of the economic pressure on households; it also has significant effects on financial markets. Let’s see how this index influences different markets.

Impact of the Misery Index on the Forex Market

In the forex market, a rising Misery Index for a given country is usually interpreted as a sign of economic weakness. In such conditions, foreign investors lose confidence in the domestic currency and are less willing to hold it.

Higher inflation and unemployment, the core components of the Misery Index, fuel concerns about the country’s economic outlook. These concerns can trigger capital flight and reduce demand for the domestic currency, resulting in its depreciation against other currencies.

For example, if the Misery Index in Türkiye rises, investors may sell the Turkish lira and switch into US dollars. As a result, the USD/TRY pair tends to move higher when the dollar strengthens and the lira weakens.

Impact of the Misery Index on the Stock Market

The stock market is highly sensitive to the general economic environment and macroeconomic stability. A higher Misery Index can directly affect corporate performance and investor behaviour.

When the Misery Index rises:

- Households’ purchasing power declines.

- Companies face lower sales and weaker revenues.

- Profit margins and growth prospects come under pressure.

At the same time, rising unemployment further reduces overall consumption and slows down economic activity.

In such situations, investors tend to exit high-risk markets like equities and move towards safer assets such as bonds or gold. The result is a decline in stock indices, reduced foreign capital inflows, and a higher probability of recession in the capital market.

Impact of the Misery Index on the Cryptocurrency Market

Compared with traditional markets, the cryptocurrency market reacts differently to rising Misery Index levels. When this index rises, and people experience higher inflation, currency depreciation, or economic instability, public trust in the traditional financial system falls.

Under these conditions, many individuals seek alternative ways to preserve value, and one of the main options is cryptocurrencies such as Bitcoin or Tether (USDT).

To analyse sentiment in the crypto market, Tom Lee introduced the Bitcoin Misery Index (BMI), which measures investor optimism or pessimism towards Bitcoin based on price, trading volume, and volatility.

In countries such as Venezuela, Türkiye, and Argentina, which have faced high inflation and sharp depreciation of their national currencies, many people have significantly increased their purchases of Bitcoin, Tether, and other cryptocurrencies to protect their wealth. This pattern shows that in crises, digital assets can function as an accessible financial safe haven, relatively independent of government control.

As a result, in some countries, a rising Misery Index not only leads to capital flight from traditional markets but also increases demand for cryptocurrencies.

| Market | Impact of Rising Misery Index | Investor Action |

|---|---|---|

| Forex | Domestic currency weakens | Sell local currency, buy USD/Gold |

| Stocks | Lower sales & profits | Exit equities, move to bonds |

| Crypto | Increased adoption (Safe haven) | Buy Bitcoin/Stablecoins |

In the post-COVID period, some economists have even combined the Misery Index with variables such as labour force participation and working hours to get a more nuanced view of economic hardship.

Conclusion

The Misery Index is more than just an economic number; it offers a clear picture of the financial hardship people experience and of countries’ overall economic health. It can serve as a warning to governments to reassess their policies and as a guiding signal for investors to understand country-level risk better.

From currency depreciation in the forex market to capital outflows from stock exchanges and the growing appeal of Bitcoin, the implications of the Misery Index are visible across all markets. In a world where economic data can sometimes be confusing, this index provides a transparent and straightforward measure of whether the economy is supporting people or weighing them down.