MyFxBook is one of the most reputable and widely used analytical platforms in the financial markets, especially the Forex market, designed to help traders review and analyse their trading strategies. This website allows users to view and comprehensively analyse their trades and the performance of their Forex accounts and serves as a powerful tool for evaluating trading strategies and comparing them with other traders.

- Analytical platforms like MyFxBook empower traders by turning raw trading activity into actionable insights.

- Access to transparent performance data helps traders make more informed decisions and avoid emotional or uninformed trading.

- Centralizing multiple tools such as analytics, community insights and market data creates a more efficient trading workflow.

- Using structured performance evaluation encourages traders to develop more consistent and disciplined long term strategies.

Introduction and Review of the MyFxBook Website

MyFxBook is an online platform created in 2009 by a group of professional traders and developers. The main purpose of this website was to provide a space for Forex traders where they could analyse the performance of their trading accounts and achieve more accurate and effective results in their trading strategies.

From the beginning, the goal of this platform has been to guide traders toward using more precise and scientific methods in Forex trading. In fact, this website was launched to promote transparency and improve trading processes, and it quickly gained a special position among Forex traders by offering a wide range of features.

MyFxBook is designed specifically for Forex traders, but due to the extensive features and capabilities it offers, it can also be used as a powerful tool for performance analysis across various financial markets.

One of the unique features of this website is its ability to automatically connect to popular trading platforms such as MetaTrader 4 and MetaTrader 5. This allows traders to have all their trades recorded and analysed in real time without the need for manual data entry. This feature enables users to track their trading performance with complete accuracy and without errors, and optimise their strategies accordingly.

MyFxBook allows traders to analyse every aspect of their trading accounts. Users can review profit and loss levels, win rate, maximum drawdown, and many other performance indicators. This data helps traders evaluate their real performance and identify the strengths and weaknesses of their trading strategies. In addition, MyFxBook allows traders to make their accounts public and share them with others. This feature helps traders gain better insight into the market and different strategies by comparing their performance with other traders.

Another notable feature of MyFxBook is its economic calendar. This calendar displays all major global economic events and helps traders anticipate their impact on the Forex market. MyFxBook also provides trading signals that allow users to benefit from the signals of professional traders or share their own signals with others.

Over time, MyFxBook has become one of the essential tools for professional traders. With advanced analytical tools and features such as trader rankings, historical data analysis, risk assessment, and participation in an active trading community, this website has evolved into a comprehensive platform suitable for every type of trader, from beginner to professional.

In conclusion, the primary goal of MyFxBook is to help traders improve their performance and adopt more successful and sustainable strategies by using accurate data and advanced analytics. By offering a wide range of tools and creating an environment for sharing knowledge and experience, this website has become one of the most popular and reliable analytical resources in the Forex market.

Introduction and Review of the Analytical Tools Available on the MyFxBook Website

MyFxBook provides traders with a collection of advanced analytical tools that help analyse trading account performance, manage risk, and improve trading strategies. Some of these tools include:

- Growth Chart;

- Balance Chart;

- Risk Analysis;

- Statistical Analysis;

- Account Comparison;

- Correlation Tool;

- Trading Signals;

- Volume Chart;

- Economic Calendar;

- Pip and Price Charts;

- Historical Data;

- Backtesting Tool.

Below is a brief introduction and review of each of these tools:

Growth Chart

The Growth Chart is one of the most important analytical tools in MyFxBook and visually displays the performance of your trading account over different time periods. This chart shows the percentage growth of your capital from the beginning up to the current moment. With this tool, you can observe positive and negative changes in profitability and improve your trading strategies based on this data.

Balance Chart

The Balance Chart is similar to the Growth Chart, but instead of focusing on percentage growth, it displays changes in the account balance over time. This chart shows your account balance after each trade and clearly reflects changes caused by profits and losses. Traders can use this chart to evaluate the overall performance of their account in terms of balance.

A key insight is that the Balance Chart helps traders detect when withdrawals or deposits artificially distort performance, ensuring they do not mistake cash adjustments for actual trading skill.

Risk Analysis

This tool helps you better understand and manage the level of risk in your trades. Through risk analysis, you can determine how much of your capital is exposed to risk and what levels of profit or loss are acceptable for you. This tool displays data such as drawdown, profit-to-loss ratio, and the average number of pips gained or lost.

Statistical Analysis

MyFxBook provides a complete statistical analysis of your trading performance. It displays comprehensive data such as average profit and loss per trade, winning ratio, and the number of winning and losing trades.

Account Comparison

The account comparison tool allows users to compare the performance of their different accounts or measure their accounts against other traders’ accounts. This feature is particularly useful for reviewing different strategies and evaluating their impact on trading profits and losses.

Correlation Tool

The Correlation Tool helps you identify correlations between different currency pairs. This tool shows traders how price movements in one currency pair can influence another. By using correlation data, traders can reduce risks caused by trading correlated pairs simultaneously and better adjust their strategies.

Correlation is a statistical measure that indicates the relationship between two or more variables. In Forex trading, correlation applies to the statistical relation seen between two or more currency pairs.

Trading Signals

MyFxBook provides access to trading signals. Users can view signals from other traders and use them for their own trades. This tool helps users benefit from the strategies and analyses of professional traders and make more informed trading decisions. Traders can also share their own signals for other users to see.

Volume Chart

This tool allows you to analyse the trading volume in the market. Studying trading volume helps traders better understand liquidity flow in the market. With volume analysis, you can identify suitable trading opportunities and make better decisions.

Economic Calendar

MyFxBook offers a comprehensive and up to date economic calendar that displays important economic and political events that influence the Forex market. Using this tool, traders can track upcoming events such as interest rate decisions, economic reports, and various economic indicators.

The economic calendar supports custom alerts, allowing traders to receive immediate notifications about high-impact events without constantly monitoring the market.

Pip and Price Charts

These charts help you analyse price fluctuations and pip changes in your trades. This tool is highly useful for technical analysis. Traders can use it to study market trends and forecast future movements.

Historical Data

The Historical Data tool allows you to review past market performance. Traders can use this tool to analyse historical price data and past events and use that information to study trends and anticipate future market behaviour.

Backtesting Tool

One of the most attractive tools in MyFxBook is the ability to backtest trading strategies. You can test your strategies using historical data to see if they would have been successful in the past. This tool helps traders predict the potential results of a strategy before using it in a live market.

MyFxBook, with its wide range of analytical tools, provides users the ability to perform accurate trade analysis, manage risk, and improve their trading strategies. By using these tools, traders can gain better insight into the performance of their trading accounts and make more informed decisions in the Forex market.

Step by Step Guide to Using the MyFxBook Website

To make the best use of the features offered by MyFxBook, you first need to go through the following steps:

Creating an Account

The first step to accessing MyFxBook’s features is creating a user account. The exact registration process is as follows:

- First, go to the website www.myfxbook.com.

- On the homepage, click the Sign Up option, which is usually located in the top corner of the page.

- A registration form will appear containing fields for Email, Username, and Password. Enter this information carefully.

- Check the box to agree to the website’s terms and conditions, and then click on Register.

- After registering, a confirmation email will be sent to your inbox. Open your email and click on the verification link to activate your account.

- You now have an active MyFxBook account.

Connecting Your Trading Account

Once your user account is created, you need to connect your trading account to MyFxBook so your trades can be automatically tracked and analysed. The steps are as follows:

- After logging into your MyFxBook account, go to the Portfolio section in the top menu.

- Select the option Add Account.

- MyFxBook supports several trading platforms, but the most popular ones are MetaTrader 4 and MetaTrader 5. Depending on which platform you use, select the corresponding option.

- After choosing the platform, you will be asked to enter your trading account details. This includes your account number, your Investor Password, and the server name. The Investor Password is a view-only password that you can create in MT4 or MT5 to allow MyFxBook to access your trading activity.

- After entering the required information, click on Connect.

- Once this process is completed successfully, your trading account will be linked to MyFxBook, and your trades will begin to appear automatically on the website. From this point on, you will be able to analyse your Account’s performance in detail.

Reviewing and Analysing Your Trading Account

After your trading account is connected, you can access detailed and comprehensive analyses of your account performance. To review and analyse your Account, follow these steps:

After logging into MyFxBook, go to the Portfolio section and select your trading account from the list. In this section, a detailed dashboard of your trading account will be displayed. This information includes:

- Gain, which shows how profitable your Account has been and is calculated as a percentage.

- Drawdown, which displays the maximum reduction in equity during the trading period.

- Trades that show the total number of executed trades.

- Win Rate, which displays the percentage of profitable trades.

Further down the page, you will find various charts, such as the Growth Chart and the Balance Chart, which visually display your Account’s performance over different time periods. You can adjust these charts based on specific dates to observe fluctuations and track your Account’s performance over time.

Additionally, you can view detailed information for each trade. By clicking on any trade, you can see details such as the opening and closing times, the currency pair, the profit or loss, and the risk level used. This section allows you to analyse each trade and refine your strategies using precise data.

By using these tools, MyFxBook helps you thoroughly review your trading account performance and optimise your trading strategies.

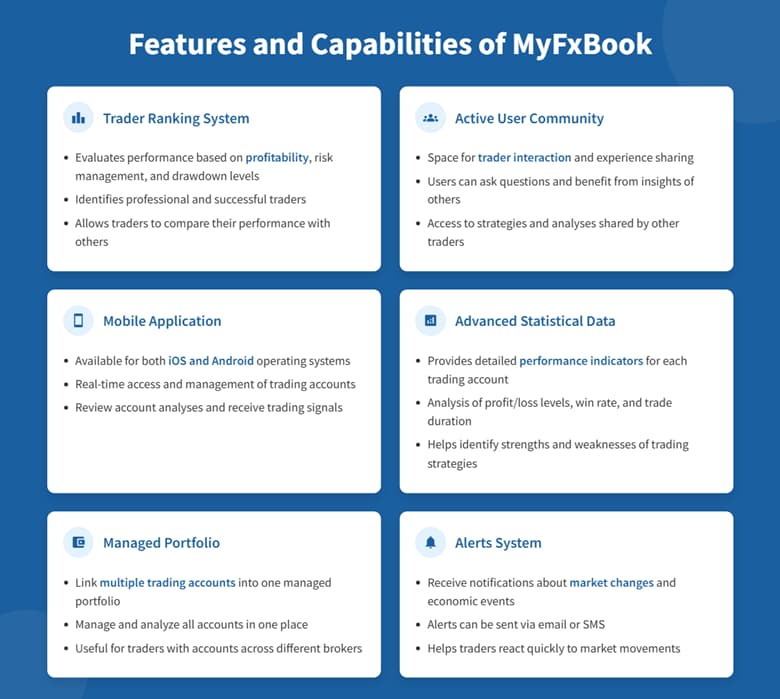

Familiarity with the Features and Capabilities of the MyFxBook Website

MyFxBook, as a comprehensive analytical platform in the Forex market, offers a wide range of features and capabilities for traders. Some of these features include:

- Trader ranking system;

- Active user community;

- Mobile application;

- Advanced statistical and analytical data;

- Managed portfolio;

- Alerts system.

This platform has become highly popular because it provides traders with diverse tools and advanced capabilities that help them analyse, manage, and improve their trading strategies. Below is a brief introduction and review of each MyFxBook feature:

Trader Ranking System

MyFxBook includes a comprehensive ranking system that evaluates traders’ performance across several criteria, including profitability, risk management, number of successful trades, and drawdown levels.

This system allows users to identify successful professional traders easily and benefit from their strategies. Traders can also evaluate their own performance by comparing their ranking with others and identifying the strengths and weaknesses of their trading strategies.

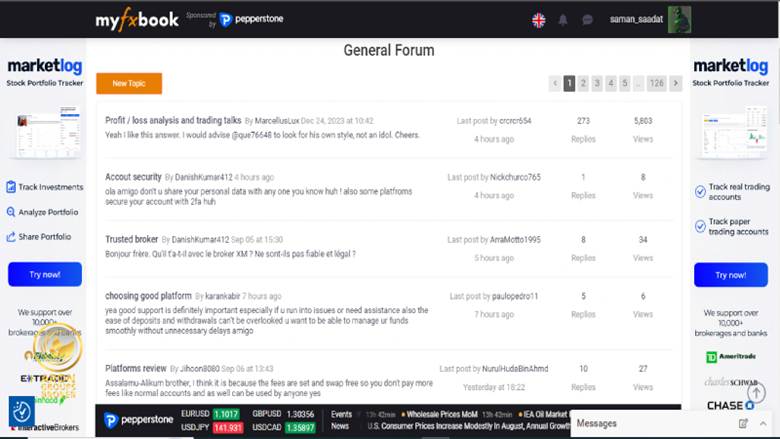

Active User Community

One of the major advantages of MyFxBook is its active user community. This platform provides a space for trader interaction where users can share their experiences, ask questions, and benefit from the insights of others. This community helps users refine and develop their trading strategies through discussions and idea exchange. Traders can also benefit from the strategies and analyses shared by other users and take advantage of better trading opportunities.

Mobile Application

In addition to the web version, MyFxBook offers a mobile app for iOS and Android. This mobile app allows users to access and manage their trading accounts in real time from anywhere. Through this application, users can review their account analyses, receive trading signals, and access various analytical tools.

Advanced Statistical and Analytical Data

MyFxBook provides a collection of advanced statistical and analytical data for each trading account. Users can view and analyse information such as profit and loss levels, win rate, average trade duration, and many other performance indicators. This data helps traders identify the strengths and weaknesses of their strategies and improve them.

Managed Portfolio

The MyFxBook platform allows users to link their trading accounts into a single managed portfolio, enabling them to manage and analyse all accounts in one place. This feature is especially useful for traders with multiple accounts with different brokers, allowing them to analyse and manage all their trades without having to access multiple platforms.

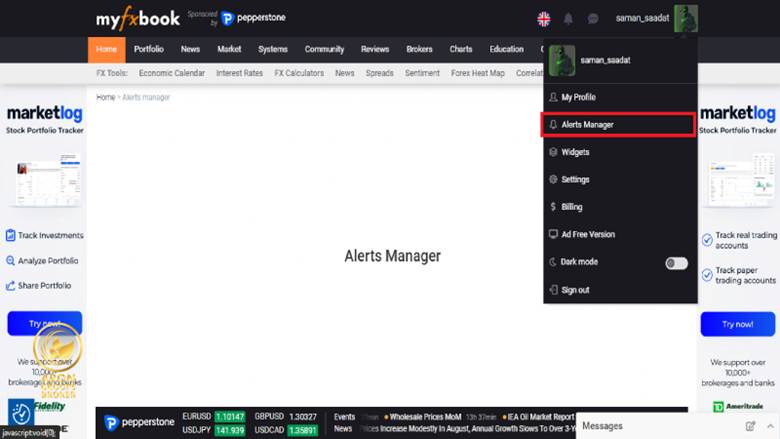

Alerts System

MyFxBook also offers an alerts system that lets users receive notifications about market changes, their trades, and economic events. These alerts can be sent via email or SMS. With this feature, traders can react more quickly to market movements and identify better trading opportunities.

Conclusion

MyFxBook is a powerful tool for Forex traders that enables them to analyse and optimise their trades. From automatic account integration to providing trading signals and an economic calendar, this platform covers all the needs of a professional trader. By using MyFxBook, traders can easily improve their performance and implement more effective trading strategies.