The forex market operates 24 hours a day, allowing traders to place and manage positions at almost any time. However, not every hour offers the same liquidity, volatility, or trading conditions for reliable execution. The New York session is one of the most important trading sessions, due to high volume and sharp price swings.

In this article, we cover its key features, trading hours, active instruments, and the main opportunities it creates.

- New York liquidity is not constant; the cleanest moves often appear in the first 90 minutes after the session opens.

- Avoid “dead zones” around lunch hours, because ranges tighten and false breaks become more common in many pairs.

- Use limit orders near key levels during high volatility, because market orders can suffer slippage at the open.

- Cut position size before major data, because spread widening can turn a valid setup into a negative expectancy trade.

New York Session Trading Hours

The New York session is one of the most important and most liquid forex sessions, shaping global price moves. In winter, it runs from 8:00 a.m. to 5:00 p.m. EST, while in summer it runs from 9:00 a.m. to 6:00 p.m. EST.

In the table below, New York session hours are shown across key time zones, including Tehran, in both seasons.

| Season | Start (EST) | End (EST) | Start (UTC) | End (UTC) | Start (Tehran) | End (Tehran) |

|---|---|---|---|---|---|---|

| Winter | 08:00 | 17:00 | 13:00 | 22:00 | 16:30 | 01:30 (next day) |

| Summer | 09:00 | 18:00 | 14:00 | 23:00 | 17:30 | 02:30 (next day) |

Key Insight:

Daylight Saving Time (DST) is a clock-adjustment system used in some countries to get more daylight in the summer months. In this system, clocks are usually moved forward by one hour, meaning official time temporarily runs one hour ahead.

In the table below, you can also see the overlap hours between the New York and London sessions across time zones. The London-New York overlap is popular in forex because liquidity is high and spreads are often tighter.

London and New York Session Overlap Hours

| Season | EST | UTC |

|---|---|---|

| Winter | 08:00–12:00 | 13:00–17:00 |

| Summer | 09:00–13:00 | 14:00–18:00 |

Key Insight:

Eastern Standard Time (EST) is a time zone used in the western hemisphere, mainly in eastern parts of the US and Canada. EST is five hours behind UTC, so it is written as UTC−5.

Why Is the New York Session the Most Important Forex Trading Session?

The New York session is one of the most important and volatile forex sessions, with several clear drivers. Key reasons for the New York session’s importance in forex include the following factors.

Wall Street’s Central Role

Wall Street is widely regarded as a global financial hub in New York, home to major exchanges and institutions. It hosts the New York Stock Exchange (NYSE), NASDAQ, and large financial firms that influence global market flows.

Because New York session hours overlap with Wall Street activity, forex liquidity and volatility often rise significantly.

Q: How does the US equity market behaviour influence forex price action during the New York session?

A:During the New York session, forex price action is often indirectly driven by flows originating in US equity markets. When US indices open strongly risk-on, capital typically rotates out of safe-haven currencies (like JPY and CHF) and into higher-yielding or risk-sensitive pairs.

Conversely, sharp equity sell-offs can strengthen the USD selectively or boost safe-haven demand. Monitoring S&P 500 futures or the Nasdaq open helps forex traders anticipate directional bias before it fully appears in currency pairs.

The Role of the US Dollar

The US dollar is the base currency of the forex market, and major USD flows are routed through US financial centres.

A large share of USD trading happens during the New York session, when US market participation is at its peak. During this time, key USD-related data and headlines often hit the tape, triggering sharp forex moves.

Release of High-Impact Economic News

Major US reports, such as unemployment rate, GDP, inflation data, and interest-rate decisions, are often published in New York hours. These releases can materially shift forex pricing, especially when results differ from market expectations.

On NFP days or other top-tier releases, volatility can spike quickly, creating both opportunity and execution risk.

Q: Why do some USD pairs move strongly during the New York session even without scheduled economic news?

A: Strong moves without scheduled news often result from order-flow imbalances rather than new information. These include large institutional position adjustments, option-related hedging near key strike levels, or repositioning after Asian and London session mispricing.

In such cases, price movement reflects liquidity-driven execution rather than fundamental surprise. Traders who understand this dynamic avoid overinterpreting these moves as trend shifts and instead focus on structure, volume expansion, and follow-through quality.

The Most Important Economic News That Moves the Market During the New York Session

In this section, we list major reports usually released in New York hours and explain each one’s potential market impact.

Non-Farm Payrolls (NFP)

The NFP report is released monthly by the US Bureau of Labour Statistics and tracks employment outside agriculture. It is a key gauge of US economic momentum and often drives sharp moves across USD pairs.

- If NFP is far above forecasts, the US dollar often strengthens as growth looks stronger and unemployment falls.

- If NFP misses forecasts, the dollar may weaken, and markets may price higher odds of Fed rate cuts.

Consumer Price Index (CPI)

CPI is a major US inflation indicator published monthly by the Bureau of Labour Statistics that measures changes in consumer prices. Because inflation shapes interest-rate expectations, CPI surprises can quickly reprice the dollar.

- If CPI is above expectations, inflation pressure looks stronger, and the Fed may lean toward higher rates, boosting USD.

- If inflation is below expectations, rate-cut odds often rise, and the dollar can weaken as yields reprice lower.

Federal Reserve Rate Decisions (FOMC Meeting)

The Federal Open Market Committee meets eight times per year to set US interest rates and the direction of monetary policy. Because Fed policy anchors global rates, its statements can move forex, equities, and commodities in minutes.

- A rate hike typically supports the dollar, as tighter policy signals strength and commitment to controlling inflation.

- A cut, or a dovish hold, can weaken USD and lift demand for risk assets like stocks and commodities.

Gross Domestic Product (GDP)

GDP is released quarterly and is one of the most important indicators for assessing overall economic performance. Strong or weak GDP prints can shift recession risk pricing and change how traders value the dollar.

- If GDP beats expectations, the dollar often firms, and confidence in risk markets can improve.

- If growth undershoots, USD may fall, and recession concerns can increase, raising volatility across major pairs.

Retail Sales

Retail Sales is a monthly US report that measures consumer spending through retail sales. Because consumption is a large part of GDP, this release can influence growth expectations and USD pricing.

- Rising retail sales can signal stronger demand and support the dollar via improved growth outlook.

- Falling retail sales point to weaker consumption and can pressure the USD if the risk of a slowdown rises.

Unemployment Rate

The unemployment rate is released monthly and shows the share of the labour force without a job. It is a core labour-market metric and heavily influences how traders interpret the Fed’s next steps.

- A lower unemployment rate can support the USD, as it implies stronger labour conditions and healthier growth.

- A rising unemployment rate can hurt confidence, weaken the dollar, and increase fear of an economic downturn.

Trading Characteristics of the New York Session

The New York session is a major forex window because of high volume and its strong influence on global price action. A key feature is its overlap with the London session, which runs from 1:00 p.m. to 4:00 p.m. UTC.

This overlap increases trading volume and volatility, creating frequent intraday opportunities for active traders. Many day-trading strategies are designed specifically to capitalise on the overlap between the London and New York sessions.

What usually drives volatility

- Major US economic releases and corporate financial headlines often hit during New York session hours.

- These events can trigger sharp moves, especially when the market’s expectations are mispriced or crowded.

- Quarter-end earnings season can move US equities and shift overall risk sentiment across currencies and gold.

- Traders should monitor the economic calendar and live headlines closely during New York hours.

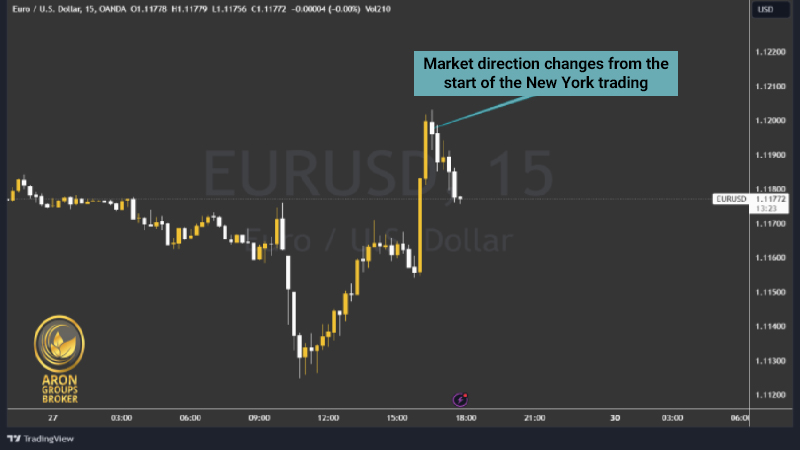

New York Kill Zone in ICT Trading

In ICT (Smart Money) trading, traders focus on specific time windows that often coincide with fresh liquidity entering markets. One key window is the New York Kill Zone, usually defined as the first one to three hours after New York opens.

What traders look for

In this period, late London flows and US participation combine, leading to liquidity jumps and strong directional moves. Many ICT traders believe market makers use fast, sometimes deceptive moves to set up the day’s primary direction.

These moves may include liquidity sweeps above recent highs or below recent lows, before the true move begins.

Why it matters

- Higher-quality entries often appear here, aligned with the daily bias or after key structure breaks.

- A trader may enter after confirming a liquidity grab or a liquidity breakout within this window.

- For that reason, many ICT playbooks treat the New York Kill Zone as a top daily execution window.

The Golden Trading Window: Full Analysis of the London-New York Overlap

When London and New York are both active, forex liquidity rises sharply, and volatility often increases across major markets. This period, often called the “golden trading window,” offers strong opportunities for day traders and scalpers.

Why Do Liquidity and Volatility Increase During the Overlap?

Several factors combine to increase volume and speed during the overlap of the London and New York sessions.- Institutional order flow aligns: European and US institutions place large orders during this shared trading window.

- High-impact US news releases: Reports like NFP, CPI, GDP, and Fed speeches often hit during overlap hours.

- Algorithmic and HFT activity rises: More liquidity and fresh data activate automated strategies and accelerate price movement.

- Europe vs US sentiment can clash: Differing expectations can cause sharp swings and fast reversals in major USD pairs.

Best Pairs to Trade During the London-New York Overlap

During the overlap, pairs tied directly to Europe and the US usually see the highest volume and cleanest setups.- EUR/USD: The most traded pair globally, with deep liquidity and consistently active order flow.

- GBP/USD: Highly responsive to both UK and US news, often producing strong intraday moves.

- USD/CHF: Often technical and flow-driven, with safe-haven dynamics influencing direction and volatility.

- USD/CAD: Sensitive to oil prices and North American data, especially when the US releases surprise markets.

- XAU/USD (Gold): Gold often moves sharply here, due to Fed-related pricing and central-bank activity.

High-Volatility Instruments in the New York Session

According to BabyPips, instruments that include the US dollar (USD) often see the highest volatility during New York hours. Major pairs like- EUR/USD,

- GBP/USD,

- USD/JPY,

- and USD/CAD

How Gold (XAU/USD) Behaves During the New York Session

Gold (XAU/USD) is one of the key instruments during the New York session because it often becomes highly active. Gold is considered a safe-haven asset, and its price reacts directly to the US dollar and major economic developments. For example: US real interest rates often show an inverse correlation with gold, meaning higher real yields can pressure gold. During the New York session, especially during the London overlap, gold frequently experiences larger intraday swings. US economic news, particularly inflation data, interest-rate signals, and other major indicators, can strongly move XAU/USD.Trading Strategies Tailored to the New York Session

Higher liquidity and institutional participation create many opportunities to capture strong price moves during New York hours. In this section, we introduce two simple but effective strategies designed specifically for this time window.New York Open Breakout Strategy

This strategy uses the surge in volume and volatility at the New York open to capture early-session momentum moves. It helps traders benefit from the powerful first push that often appears when US participants enter the market.Step-by-step execution

- Identify the London session range: In the late London hours (15:00 to 16:30 Tehran time), mark the tight consolidation area on your chart. This range usually shows a temporary balance between buyers and sellers before the next liquidity expansion.

- Wait for the New York session to open: When New York opens at 16:30 Tehran time, trading volume often jumps, and a strong breakout can occur.

- Enter the breakout direction: If price breaks above the range high with strength, open a long position in the breakout direction. If price breaks below the range low with strength, open a short position in the breakout direction.

- Manage risk properly: Place your stop-loss on the opposite side of the range to limit damage if the price snaps back. Set take-profit using a risk-to-reward ratio like 1:2, or target the next key technical level.

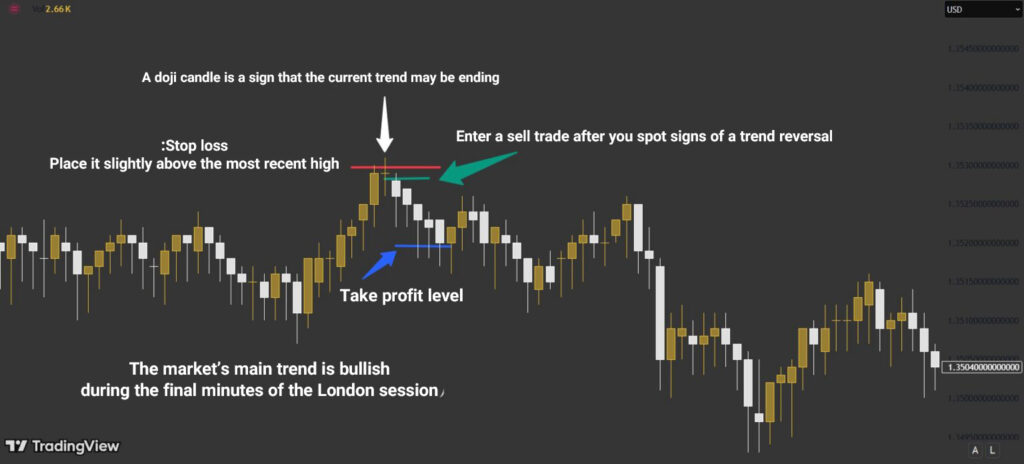

London Close Strategy

Near the end of the London session, many European traders close positions, which can reduce liquidity temporarily. This position-closing flow can trigger short reversals or corrective moves, especially after a strong earlier trend.Core logic of the strategy

- When European traders close trades, opposite orders can hit the market and change the short-term direction.

- This often creates a brief correction against the main trend, which can be tradable with tight risk rules.

- The goal is a quick, controlled move, not a long swing trade that depends on hours of follow-through.

Step-by-step execution

- Define the main trend: Before London closes, identify the dominant direction, such as a clear intraday uptrend or downtrend.

- Wait for reversal clues near the close: Around 18:30 to 19:30 Tehran time, look for weakness signals like doji candles or RSI/MACD divergence.

- Enter against the earlier trend: If the earlier trend was bullish and reversal signs appear, consider a short entry on a pullback. If the earlier trend was bearish and reversal signs appear, consider a long entry on a pullback.

- Risk management and exit rules: For shorts, place the stop slightly above the latest swing high and keep the profit target modest. For longs, place the stop slightly below the latest swing low and keep the profit target modest. A typical target is 15 to 30 pips, because London-close corrections are often short-lived and fast.

Trading Tips for the New York Session

- Trade your best setups early, because liquidity and momentum often peak near the open and overlap.

- Avoid forcing trades mid-session, because choppy ranges can increase false breaks and reduce reward potential.

- Keep a release plan, including “no-trade minutes,” because spreads and slippage can distort entries and stops.

- Review spreads per pair, because some instruments stay liquid while others become expensive during spikes.

Conclusion

The New York session is where USD flows, institutional activity, and economic news collide, so the price often moves with intent. If you align your timing with the session structure and manage execution risk, New York becomes more tradable and less chaotic. Focus on liquid instruments, treat major releases as a separate regime, and keep risk rules tight around the open.