In global markets, leverage is a powerful multiplier that allows traders to control large positions with minimal capital. However, over leveraging in trading occurs the moment a position size exceeds the account’s ability to absorb normal price swings.

When exposure outpaces equity, leverage shifts from a growth tool to a primary financial threat. Mastering the balance between capital and exposure is essential for long-term survival in forex, stocks, and crypto.

- Leverage does not scale linearly with safety; doubling your leverage often more than doubles the statistical probability of a total account wipeout.

- Lower leverage buys you the time to be wrong and wait for a recovery, whereas overleveraging forces you to be right immediately or face liquidation.

- Remember that margin requirements exist to protect the broker’s capital, not yours; they will close your trade to save themselves without hesitation.

- High leverage in a volatile market is a "tax" on your margin that is collected the moment price spreads widen or markets gap.

What Is Over leveraging?

Over leveraging in trading occurs when your position size exceeds your account’s ability to absorb price fluctuations. While you might survive in a stagnant market, over-leverage means you lack the capital buffer to withstand “market noise,” widened spreads, or price gaps. In its simplest terms, over-leverage turns an ordinary market move into a terminal account event.

Understanding Over Leverage vs Normal Leverage

The difference between healthy and dangerous leverage isn’t just a ratio; it’s a question of sustainability:

“Can you withstand an adverse price move without triggering a margin call or losing a disproportionate share of your capital?”

Use the table below to audit your current exposure:

| Normal Leverage | Over Leverage | |

|---|---|---|

| Position size | Proportionate to account size and risk tolerance | Exceeds what the account can sustain |

| Adverse move | Manageable within your risk limits | Triggers a margin call even on small moves |

| Key risk | Controlled loss | Forced liquidation |

Pro Tip:

The leverage ratio on your dashboard (e.g., 50:1) is just a maximum limit. What actually determines your risk is the Effective Leverage: the total value of your open trades divided by your total account equity.

Common Misconceptions About Overleveraging

Three beliefs lead traders into overleveraging in trading more often than any technical error.

Misconception 1: A high leverage ratio always means overleveraging.

Not accurate. What matters is position size relative to account equity, not the ratio itself.

| Scenario | Leverage Ratio | Position vs Margin | Over-leveraged? |

|---|---|---|---|

| Large, well-funded account | 50:1 | Small position | Not necessarily |

| Smaller account | 5:1 | Consumes 80% of the margin | Yes |

A large account using 50:1 on a modest position may carry less real risk than a small account using 5:1 on a position that absorbs most of its available margin.

Misconception 2: Overleveraging is a beginner’s mistake.

Experienced traders fall into this pattern too often after a winning streak. Consecutive profits can create overconfidence, leading to position sizes that exceed the trader’s usual risk limits without the trader noticing.

Misconception 3: You can monitor your way out of a bad position.

In fast-moving markets, prices can move past a stop-loss order before it executes. This is called slippage, the difference between the intended exit price and the actual fill price. Close monitoring does not eliminate this risk.

Q: If a high leverage ratio (like 100:1) doesn’t always mean I’m over-leveraged, why do brokers offer it?

A: Brokers offer high leverage to attract smaller accounts, allowing them to open positions they otherwise couldn’t afford. It is a tool for capital efficiency, not a requirement to trade large. A professional might use 100:1 leverage to control a small position while keeping 99% of their capital in a high-yield savings account, effectively managing risk while maximising utility.

Why Overleveraging Can Be So Risky

Over-leveraging removes the margin for error required for any strategy to succeed. It introduces technical risks that can bypass even the most accurate market analysis:

- Intolerance to Correction: Routine price retracements, temporary dips can wipe out the account before the market has a chance to move in your favour.

- The Spread Trap: During high volatility, spreads widen. For an over-leveraged trader, this widening can trigger a liquidation even if the market price never hits their stop-loss.

- Execution Slippage: In fast-moving markets, prices can “gap” past your stop-loss. If you are over-leveraged, this slippage can result in a loss that exceeds your total account balance.

The Role of Margin and Leverage

Margin acts as the “security deposit” for your leverage. Understanding the mechanics of how brokers use this collateral is the only way to predict and prevent account wipes.

How Margin Works in Trading

Margin is the collateral (not a fee) required to keep a leveraged position open. It is the skin in the game that protects the broker from your losses.

- The Mechanics: If you control a $100,000 position with $1,000 of your own funds, you are using 1% margin (100:1 leverage).

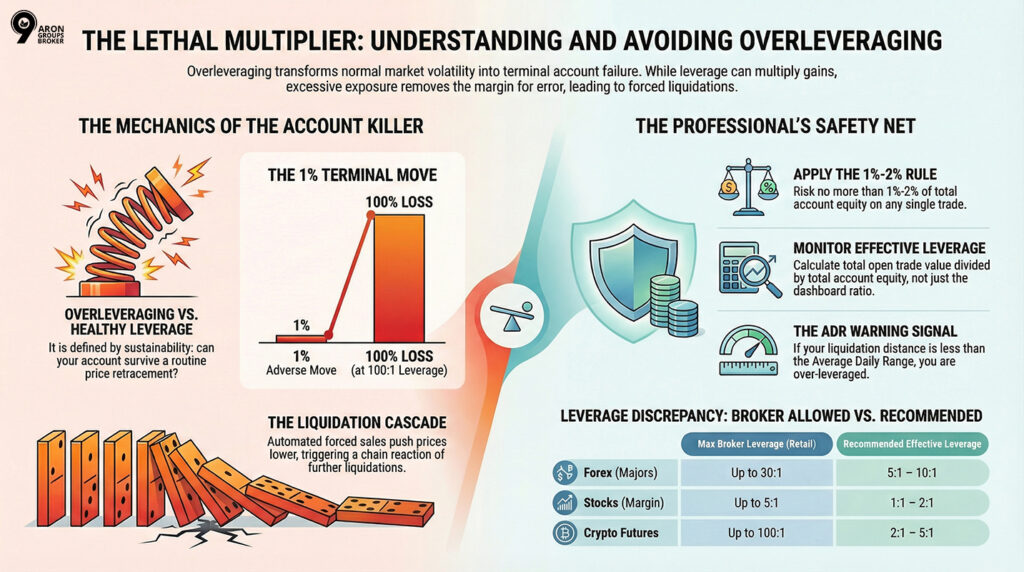

- The Math of Overleveraging: High leverage drastically compresses your response time. At 100:1 leverage, a 1% adverse move in the market results in a 100% loss of the margin used for that trade.

Margin Exposure: The Health Monitor

This metric tracks how much of your total account is “locked” in trades:

| Margin Exposure | Risk Level | Market Impact |

|---|---|---|

| Below 20% | Low | Sufficient buffer to survive daily volatility. |

| 20% - 50% | Moderate | Limited room; significant news could breach limits. |

| Above 50% | High | Over-leveraged. Minor moves trigger broker intervention. |

Margin Calls and Forced Liquidation Explained

When your Margin Exposure hits the critical ceiling, the broker intervenes to protect their lent capital. This process is automated and indifferent to your trading strategy.

The Execution Sequence:

- Margin Call: The broker notifies you that your equity has dipped below the maintenance level.

- Funding Window: You are typically given a very short window to deposit more cash or close positions manually.

- Forced Liquidation: If the threshold is breached, the broker closes your positions at current market prices without your consent.

The Systemic Cascading Effect:

Forced liquidation prioritises the broker’s recovery, often resulting in exits at the worst possible prices. When this happens to thousands of traders simultaneously, the massive sell-off pushes prices down even further, triggering a liquidation cascade that can crash entire markets in minutes.

Amplifying Losses Through Excessive Leverage

Excessive leverage works against the trader by simultaneously magnifying losses and compressing response time. This “lethal combination” is what defines an over-leveraged state: maximum exposure with minimum time to act.

| Adverse Price Move | Leverage Ratio | Loss as % of Margin |

|---|---|---|

| 1% | 10:1 | 10% (Manageable) |

| 2% | 50:1 | 100% (Full margin lost) |

| 1% | 100:1 | 100% (Full margin lost) |

At moderate leverage, a 2% move is a setback; at 50:1, that same move is terminal. The position is eliminated before you have any opportunity to add funds, reduce size, or wait for a price reversal.

Real-World Examples of Overleveraged Trades

History and daily market data prove that leverage kills accounts regardless of the trader’s intent. Whether it’s a retail forex account or a multi-billion-dollar fund, the physics of leverage remain the same.

Step-by-Step Forex Scenario

Forex overleveraging rarely makes headlines, but the mechanics are identical to any institutional collapse, just at retail scale.

The setup:

| Account Detail | Figure |

|---|---|

| Account balance | USD 2,000 |

| Leverage used | 50:1 |

| Position opened | USD 100,000 EUR/USD |

| Margin committed | USD 2,000 is the entire balance |

What happens next:

The price moves 1.5% against the position.

Loss = USD 1,500

75% of the account is gone in a single move. Broker issues a margin call.

No funds deposited → position force-closed

The same trade at responsible leverage:

| Leverage | Position Size | Same 1.5% Move | Loss | Outcome |

|---|---|---|---|---|

| 50:1 | USD 100,000 | 1.5% against | USD 1,500 | Margin call |

| 10:1 | USD 20,000 | 1.5% against | USD 300 | Recoverable |

One number changes. The outcome changes entirely.

Overleveraged Stock Trades Explained

As explained in Wikipedia, in March 2021, Archegos Capital Management collapsed, wiping out billions in equity within days. This case serves as a masterclass in how hidden leverage creates terminal risk.

- The Build-up: Archegos used Total Return Swaps (TRS) derivatives where banks hold the shares and pay the client the return. Because the banks owned the shares, Archegos’s massive exposure remained off public filings.

- The Exposure: Archegos built a $100 billion portfolio at roughly 5x leverage, but because the exposure was spread across multiple banks, no single broker knew the true size of the total position.

- The Collapse: When a few key stocks fell 30%, Archegos couldn’t meet the margin calls. The resulting “fire sale” by banks caused stocks like ViacomCBS to crater 27% in a single session.

Archegos Capital Management: Losses by Institution

The table below outlines the massive financial impact on global banks following the forced liquidation of Archegos’s over-leveraged positions.

| Prime Broker | Reported Loss |

|---|---|

| Credit Suisse | $5.5 billion |

| Nomura | $2.85 billion |

| Morgan Stanley | ~$911 million |

| UBS | $774 million |

The Lesson:

A lack of diversification, combined with leverage that leaves no room for a 30% drawdown, is a recipe for total liquidation.

Crypto Trade Gone Wrong: A Case Study

According to SSRN, the May 2021 Bitcoin crash remains one of the most documented examples of over leveraging in trading at a global scale.

- The Event: Following a regulatory ban in China, Bitcoin plummeted 53% ($43k to $30k) in just 48 hours.

- The Fallout: Over $10 billion in leveraged positions were wiped out.

- The Velocity Gap: Crypto liquidations happen at a speed traditional markets cannot match.

| Feature | Forex / Stocks | Crypto |

|---|---|---|

| Trading Hours | Set sessions / Daily close | 24/7, no pause |

| Circuit Breakers | Built-in trading halts | Rare or absent |

| Margin Call Notice | Hours or days | Seconds |

| Liquidation Trigger | Broker notification | Automated engine |

The Self-Reinforcing Feedback Loop:

- Price Drop: Initial decline hits the first wave of liquidation levels.

- Forced Sale: Automated engines dump assets at market price.

- Pressure: The sudden supply pushes prices lower.

- Cascade: The new low price hits the next wave of liquidations, repeating the cycle until leverage is exhausted.

Risks of Overleveraging Across Markets

Different asset classes have different “fail points.” A trader must recognise that volatility isn’t just a number; it is the primary consumer of your margin buffer.

Market Volatility and High Leverage Exposure

Volatility measures the speed and intensity of price fluctuations. In a leveraged environment, volatility acts as a consumer of your “margin buffer.

- The Volatility Trap: A leverage ratio that feels secure in a quiet market can become a liquidation trigger during high-impact events like central bank announcements or geopolitical shocks.

- The Inverse Rule: As volatility increases, the safety distance between your entry price and your liquidation price shrinks. Therefore, higher volatility requires lower leverage to maintain the same level of account safety.

Systemic Risks in Stocks, Forex, and Crypto

Excessive leverage is a systemic risk because one trader’s forced liquidation can trigger a chain reaction that destabilises the entire market.

- The Contagion Mechanism: When a large, over-leveraged participant is forced to sell, it creates downward price pressure. This price drop hits the margin thresholds of other traders, forcing them to sell as well.

- Crowded Trades: The 2008 financial crisis showed how over-leveraged positions in mortgage-backed securities could freeze global credit markets once the underlying asset values dipped.

- Liquidity Shocks: In times of stress, over-leveraged participants all rush for the exit simultaneously. If there are no buyers for the massive volume being liquidated, prices gap or crash, causing losses to spread far beyond the original over-leveraged accounts.

More Info:

The 2008 Financial Crisis, often called the Great Recession, was a global economic collapse triggered by the burst of the United States housing bubble. For traders, it remains the ultimate cautionary tale of how overleveraging in trading, from individual homeowners to global investment banks, can destroy a financial system.

How Leverage Amplification Impacts Your Trades

Leverage magnifies emotional pressure just as much as capital. When exposure is too high, the fear of a total wipeout leads to destructive behavioural patterns:

- The “Hold and Hope” Trap: Watching a position move against you creates immense pressure to hold a deteriorating trade with insufficient margin, often resulting in forced liquidation at the worst possible price.

- Impulsive Decision-Making: The stress of high leverage leads to panic-closing trades too early or revenge trading to recoup losses quickly.

- Long-Term Trauma: The consequences go beyond a single loss; over-leveraging fuels deep-seated loss aversion, making it difficult for a trader to execute even a low-risk strategy in the future.

Spotting Overleveraged Positions

Early detection is the difference between a controlled loss and a total wipeout. You must look beyond your broker’s dashboard to see the real risk.

Using Leverage Ratio as a Warning Signal

To determine if you are over-leveraged, you must calculate your liquidation distance relative to the asset’s Average Daily Range (ADR).

The Workflow:

- Check ADR: Find the average number of pips/points the asset moves in a day (e.g., 80 pips).

- Find Liquidation Distance: Calculate how many pips the market must move against you to trigger a margin call (e.g., 20 pips).

- The Warning: If your liquidation distance < ADR, you are almost certainly over-leveraged. You are essentially betting that the market won’t perform even a standard daily fluctuation.

What Counts as Overleveraged?

Over-leveraging isn’t a fixed number; it depends on your asset class, account size, and market volatility. Use these professional standards to determine your limits:

The “1%-2% Rule”

Professional risk managers define over-leveraging based on Total Account Equity:

- The Limit: Risk no more than 1%-2% of your total account on a single trade.

- The Test: If your stop-loss is hit and the loss exceeds this 2% threshold, your position size is too large for your account.

Regulatory Caps

To protect retail traders, many jurisdictions enforce strict leverage ceilings. A common benchmark (under ESMA guidelines) includes:

- Major Forex Pairs: Capped at 30:1.

Note:

These caps exist specifically to prevent the rapid account depletion caused by excessive leverage.

Monitoring Your Exposure Across Accounts

Traders with multiple open positions must monitor their total exposure rather than just individual position sizes.

- Correlated Markets: Holding two or three positions in assets that move together (e.g., similar currency pairs) can combine to create the risk of a single, massive, over-leveraged position.

Brokers typically track your account health using the Margin Level formula:

Key Liquidation Thresholds

- Below 100%: Your equity has fallen below your total required margin.

- Margin Call: Most brokers issue a warning at a predefined threshold (commonly 100% or 50%).

- Forced Liquidation: Brokers will begin closing your positions automatically at or below these specific margin level points.

Smart Strategies to Avoid Overleveraging

Consistency in trading comes from survival. By capping your exposure, you ensure that no single mistake is fatal.Core Risk Management Principles

Avoiding overleveraging in trading requires shifting your mindset from profit maximisation to capital preservation. The following rules ensure long-term viability:- Dynamic Position Sizing: Before entering a trade, check the current Volatility Index (VIX) or ATR (Average True Range). If volatility is spiking, proactively cut your position size by 50%.

- The Event Rule: Reduce or close leveraged exposure ahead of scheduled high-volatility events (e.g., NFP reports, Earnings).

- Distance-Based Sizing: Always calculate your position size based on the distance to your stop-loss. A wider stop (necessary in volatile markets) must result in a smaller position size to keep your total risk at the standard 1%-2% of equity.

Setting Practical Leverage Limits

Setting a personal leverage limit independent of the maximum offered by your broker is a critical step in avoiding over-leveraged trading. Many experienced traders operate at effective leverage ratios far below legal maximums to ensure long-term sustainability.The Prudent Approach

- Start Small: Begin with lower leverage and increase it gradually as your experience and consistency grow.

- Effective vs Maximum: For retail forex, a ratio of 5:1 to 10:1 is commonly recommended, even when brokers permit 30:1 or higher.

Comparison: Maximum vs Recommended Leverage

| Market | Maximum Broker Leverage (Retail) | Commonly Recommended Effective Leverage |

|---|---|---|

| Forex (Major Pairs) | Up to 30:1 (EU Regulated) | 5:1 - 10:1 |

| Stocks (Margin) | Up to 2:1 – 5:1 | 1:1 - 2:1 |

| Crypto Futures | Up to 100:1 (Some Venues) | 2:1 - 5:1 |

Note:

Maximum leverage ratios vary significantly by jurisdiction and broker. Always verify the specific rules and margin requirements that apply to your individual account.

Stop-Loss, Position Sizing, and Diversification Tips

The Role of the Stop-Loss

A stop-loss order is a pre-set instruction to automatically close a position if the price reaches a specific adverse level.

- The Essential Tool: It is the most direct method for limiting losses on a leveraged position.

- The Danger of Manual Monitoring: Without a stop-loss, an over-leveraged trader is forced to monitor the market manually at all hours, which is not a reliable or sustainable strategy.

Strategic Position Sizing

Determining your position size (units or lots) should be a mathematical decision, not an emotional one.

- The Calculation: Size should be based on the distance to your stop-loss and your maximum acceptable loss per trade, rather than your hoped-for profit.

- The Volatility Principle: * Volatile Markets: Use smaller positions.

- Stable Markets: Use larger positions.

Diversification as a Safety Net

Diversifying across uncorrelated instruments prevents a single adverse event from wiping out your entire portfolio.

Concentration Risk: Investing all your capital into a single currency pair, stock, or cryptocurrency while heavily leveraged is one of the fastest paths to an over-leveraged disaster.

Overleveraging in Different Markets

Each market has a “hidden” cost to leverage that can catch unaware traders off guard.

Forex: Execution Risks and Rollover

In the foreign exchange market, overleveraging introduces unique execution risks:

- Overnight Swap Charges: Positions held overnight accrue “swap” (interest rate differentials). Over-leveraged trades held for multiple days see these charges rapidly erode equity, even if the price remains stable.

- Price Gaps: In fast-moving sessions, the market may “gap,” causing stop-losses to execute far from the intended level.

- Practical Definition: You are over-leveraged in Forex when a small pip movement against you wipes out your margin, leaving no buffer for normal fluctuations or overnight risk.

Stocks: Margin Risk and Earnings Gaps

Stock traders face a specific hazard that Forex and Crypto typically do not: Earnings Gaps.

- After-Hours Volatility: When companies report results outside of trading hours, the share price can open significantly higher or lower than the previous close.

- Limited Exit Ability: A trader heading into earnings with an over-leveraged position cannot exit during the gap. This can lead to losses far exceeding the planned risk.

- Practical Definition: You are over-leveraged in stocks when a typical intraday swing or opening gap would eliminate a disproportionate share of your equity or trigger a margin call.

Q: How do I calculate “Typical Magnitude” for a stock’s swing?

A: Look at the Average True Range (ATR) over the last 14 days and check the stock’s historical performance on previous earnings days. If a stock typically moves 10% on earnings, and your leverage means a 5% move triggers a margin call, you are over-leveraged for that event and should reduce your position before the closing bell.

Crypto: Liquidation Cascades and Volatility Spikes

The 24/7 nature of crypto, combined with a lack of “circuit breakers,” creates extreme danger for leveraged positions.

- Liquidation Cascades: Forced closures trigger further price declines, which trigger more liquidations. These events can move prices 20%-30% in minutes.

- Thin Liquidity: Prices can move sharply on low volume, particularly during off-hours, liquidating accounts even at moderate leverage.

- Exchange Risks: In a crash, order book liquidity can fail, causing slippage that results in losses even larger than anticipated.

Conclusion

Over leveraging in trading is the leading cause of account failure. True mastery requires a disciplined respect for the relationship between margin, volatility, and response time.

By limiting risk to 1%-2% per trade and setting conservative leverage caps, you transition from gambling to professional portfolio management. Leverage is a tool for success when used proportionately; over-leverage is simply risk without a safety net.