Many traders, when entering the market, often face the question of what trade size is appropriate and how they can manage risk in a logical way. Using tools such as the Position Size Calculator Indicator makes these calculations simple, eliminating the need for complex formulas or guesswork. Whether you are looking to download the Position Size Calculator Indicator for MT4 or test the MT5 version in MetaTrader, this tool can help make your trades more focused and more confident. If you want to understand exactly how this indicator works and why so many professional traders consider it essential, stay with us until the end of this guide.

- The Position Size Calculator Indicator ensures that trade size is always aligned with account conditions, preventing excessive risk.

- This indicator minimizes calculation time and allows traders to keep their main focus on market analysis.

- By using the indicator, traders can reduce the influence of emotions on decision-making and make choices that are more logical.

- The tool delivers the best results when combined with a personal trading strategy and sufficient practice on a demo account.

What is the Position Size Calculator Indicator and Why Is It Useful?

One of the biggest challenges traders face before entering a position is deciding how much to trade. The Position Size Calculator Indicator is built precisely for this purpose. By taking into account factors such as account balance, chosen risk percentage, stop loss level, and pip value, it determines the most accurate lot size for the trade. Integrated into platforms like MetaTrader, it allows traders to avoid tedious manual calculations and focus on making timely decisions.

The indicator is widely used not only in forex but also in markets such as gold, indices, and CFDs. For many professionals, it has become a standard part of their routine because it helps keep risk per trade within a safe range, typically one to two percent of account equity, which is fundamental for long-term risk management.

Imagine a trader with a 5,000 USD account planning a position on EUR/USD. With a one percent risk tolerance and a stop loss set at 50 pips, the indicator calculates that the optimal trade size is about 0.5 lots. This clarity allows the trader to enter the market knowing that potential losses remain under control even if the trade does not go as planned.

Different versions of the indicator are available. Some traders prefer the Position Size Calculator Indicator MT4 download, while others choose the more recent Position Size Calculator Indicator MT5 for its advanced features. Whichever option is selected, this tool is considered essential for anyone who wants to trade with discipline and consistency.

Benefits of Using the Position Size Calculator Indicator

One of the main reasons behind the popularity of the Position Size Calculator Indicator is its ability to help traders make more rational and calculated decisions. It prevents overtrading and significantly reduces the chance of wiping out an account. By limiting the risk on each position to only a small portion of the account balance, traders can achieve greater consistency and stability in their profitability.

Another advantage of this tool is the speed at which it performs calculations directly on the chart. Instead of wasting time on manual math, the indicator instantly provides the optimal trade size, allowing traders to dedicate more attention to market analysis. It also takes into account additional costs such as commissions and swaps, ensuring that the calculated position size reflects real trading conditions with greater accuracy.

The indicator is particularly valuable for smaller accounts. With its ability to adjust for leverage and manage margin requirements, it ensures that even limited capital is used efficiently. Since all the calculations are automated, emotional bias is reduced, and trading decisions are driven by logic and structured risk management rather than impulse.

According to medium, using a position size calculator in MT4 not only standardizes your risk management but also eliminates emotional decision-making, since every trade is based on predefined risk parameters rather than gut feeling.

How to Install and Use the Position Size Calculator Indicator in MetaTrader

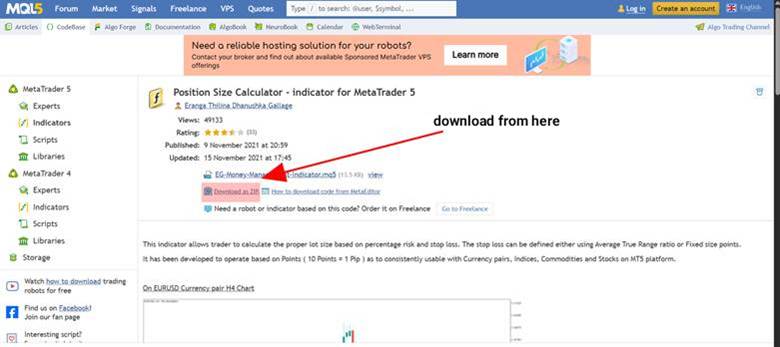

Installing and using the Position Size Calculator Indicator in MetaTrader is straightforward and allows traders to quickly calculate the correct trade size. First, download the indicator file from sources such as mql5.com. To download the Position Size Calculator Indicator MT4, select the .ex4 file, and for the Position Size Calculator Indicator MT5, choose the .ex5 version. The installation steps are as follows:

- Extract the downloaded file and copy the MQL4 folder (for MT4) or MQL5 folder (for MT5) into the Data Folder of MetaTrader. This folder can be opened from the menu by selecting File > Open Data Folder.

- Place the .ex4 or .ex5 file inside the Indicators directory.

- Restart MetaTrader so the indicator is added to the list of available tools.

- From the Navigator panel, open the Indicators section and drag the tool onto your chosen chart to activate it.

Once activated, enter details such as entry price, risk percentage, and stop loss. The indicator will automatically display the appropriate lot size for the trade. Some versions also allow the use of hotkeys for even faster execution, enabling quick trade entries without delay. This way, the exact trade size is calculated instantly, and risk management becomes far more precise without the need for manual calculations.

How to Install and Use the Position Size Calculator Indicator in TradingView

On the TradingView platform, many scripts can be found in the Public Library. Simply search for the tool by name and click on “Add to Chart” to apply it to your chart. Once activated, a settings panel will appear where you can enter details such as account size, risk percentage, entry point, stop loss level, and target profit.

After entering these parameters, a small table is displayed directly on the chart showing the recommended trade size, the risk-to-reward ratio, and the estimated profit or loss. You can also adjust the entry, stop loss, and take-profit lines manually on the chart, with all calculations updating in real time as you make changes. This makes using the Position Size Calculator Indicator in TradingView fast, intuitive, and highly practical.

Compared with MetaTrader, the main advantage of the web-based version is that it requires no additional installation and can be accessed easily from any device. This feature is especially appealing to traders in forex and markets such as crypto, as it allows them to check the precise trade size with just a few clicks and make more confident decisions.

According to TradingView, there are scripts on the platform that, once the risk amount in USD is entered, automatically calculate the position size by taking into account the difference between the entry and stop-loss levels and then display it directly on the chart.

Important Tips for Using the Position Size Calculator Indicator

The Position Size Calculator Indicator delivers the best results when configured carefully and used in combination with a clearly defined trading strategy. It is always recommended to test its performance on a demo account before applying it to live trades. This ensures the accuracy of the calculations and confirms that the tool aligns with the trader’s approach. In addition, it can serve as a valuable complement to a money management expert advisor, further strengthening overall risk control.

Choosing the Right Risk Percentage per Trade

Determining the appropriate risk percentage requires attention. A common guideline is to risk between one and two percent of account equity on any given trade. However, market conditions can influence this choice. For example, when trading highly volatile pairs, lowering the risk percentage is often a more prudent decision to protect capital.

Compatibility with Different Assets

This indicator is not limited to major currency pairs. It can also be applied to minors, gold, indices, and other CFDs. By adjusting the contract size for each instrument, calculations become more precise and the results shown are tailored to the characteristics of that specific market.

Common Mistakes Traders Make

A frequent mistake is overlooking the impact of commissions and swap fees in the calculation. Errors can also occur when pip values are miscalculated across different instruments. In some cases, traders rely too heavily on the indicator’s output and neglect their own market analysis. The best results come from combining precise calculations with thoughtful analysis and sound strategy.

According to HW, before using the tool in live trading, it is better to test it on highly volatile instruments in a demo environment to ensure that the settings are accurate and reliable under different market conditions. This step is frequently recommended by reputable sources.

Alternatives and Other Methods for Calculating Position Size

When the Position Size Calculator Indicator is not available, there are other practical ways to determine trade size. Online calculators and manual calculations provide simple methods that allow traders to adjust position size according to their account balance and preferred risk level without needing additional software.

Using an Online Position Size Calculator

Many reputable websites offer online tools that can quickly calculate the appropriate position size. Traders only need to enter details such as account balance, risk percentage, and stop loss distance, and the calculator will instantly provide the recommended trade size. This approach is especially useful for those who value speed and convenience. A practical example is the Position Size Calculator provided by Aron Groups, which features a user-friendly interface and delivers precise calculations in seconds, helping traders maintain better control over risk management.

Manually Calculating Position Size in Forex

Position size can also be calculated manually with a relatively simple formula. First, multiply the account balance by the percentage of risk allocated to the trade. Then, divide that amount by the stop loss in pips multiplied by the pip value. The formula looks like this:

Trade Size = (Account Balance × Risk %) ÷ (Stop Loss (pips) × Pip Value)

For example, with a 10,000 USD account, a 1% risk (100 USD), and a stop loss of 50 pips on EUR/USD, the appropriate trade size would be approximately 0.2 lots for a standard contract. Depending on the account size and strategy, traders can also use mini or micro lots to fine-tune their risk exposure. While this method takes more time, it provides a deeper understanding of how position sizing works and offers greater confidence in managing trades.

Conclusion

The Position Size Calculator Indicator offers traders a practical way to control risk with precision and determine the appropriate trade size for every position. By automating complex calculations, it reduces the time spent on manual work and allows greater focus on market analysis and decision-making. It also minimizes the emotional aspect of trading, creating a more disciplined approach. The most effective way to benefit from this tool is to begin practicing with a demo account before applying it in live trading, ensuring confidence and smooth integration with a personal strategy. In the long run, consistent use of this indicator can play a vital role in building sustainable trading success.