In a modern economy, a central bank does not control inflation simply by printing money. Instead, it uses a set of tools to manage the flow of liquidity more precisely.

The reserve requirement is one of the most important of these tools. It is the percentage of bank deposits that financial institutions are required to hold with the central bank and are not allowed to lend out.

This ratio plays a crucial role in balancing economic growth and inflation control.

- When inflation is high, the central bank can raise the reserve requirement, which reduces banks’ lending capacity and shrinks the money supply in circulation.

- By contrast, during economic downturns, lowering the reserve requirement increases liquidity and helps stimulate investment and demand.

- The reserve requirement is one of the oldest monetary policy tools and has been used in banking systems since the 19th century.

- Sudden changes in the reserve requirement can cause significant volatility in financial and credit markets.

- Some countries, such as Canada and Australia, have eliminated formal reserve requirements and rely on other monetary policy instruments.

- In times of economic crisis, central banks typically lower the reserve requirement so that banks can extend more credit.

What Is the Reserve Requirement and Why Does It Matter?

The reserve requirement ratio (also called banks’ statutory reserves) is the percentage of total deposits received by banks (including demand deposits, savings deposits, etc.) that they are obliged to hold with the central bank.

A key point is that banks are not allowed to use this portion of their funds for purposes such as lending or investment. This money is effectively “locked” at the central bank.

According to the definition provided by Doubtnut, the reserve requirement has two main components:

- Cash Reserve Ratio (CRR);

- Statutory Liquidity Ratio (SLR).

The Cash Reserve Ratio (CRR) is the portion of deposits that banks must hold in cash with the central bank.

The Statutory Liquidity Ratio (SLR) consists of liquid and marketable assets such as gold and approved securities that banks are required to hold.

The reserve requirement is one of the core instruments of monetary policy used by the central bank to achieve macroeconomic goals such as:

- Controlling inflation;

- Maintaining price stability;

- Supporting sustainable economic growth.

This tool, alongside other monetary policy instruments such as interest rates and open market operations, forms the central bank’s policy toolkit for managing the economy.

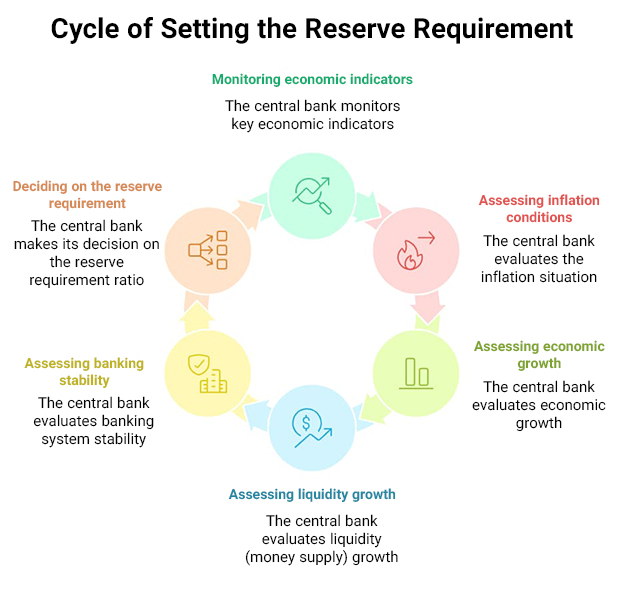

How Does the Central Bank Set the Reserve Requirement?

The decision to set the reserve requirement is made by monetary authorities (such as central banks or, in Iran, the Money and Credit Council based on the central bank’s proposal). This decision is directly linked to the central bank’s broader monetary policy objectives.

To decide whether to increase, decrease, or keep the reserve requirement unchanged, policymakers closely monitor several key economic indicators:

- Inflation conditions:

This is the most important variable. If inflation runs above the targeted rate, the central bank considers using contractionary tools (such as raising the reserve requirement). - Economic growth:

If the economy is in recession and unemployment is rising, the central bank moves toward expansionary policies (such as lowering the reserve requirement) to stimulate demand and investment. - Level and growth rate of the money supply:

The central bank evaluates whether money growth in the economy is aligned with growth in goods and services. - Stability and soundness of the banking system:

The central bank must ensure that banks can comply with new ratios and that an increase in the reserve requirement does not trigger a liquidity crisis in the banking system.

Example:

Suppose the central bank sets the reserve requirement at 10%. If a bank reports total customer deposits of 1,000 billion dollars, it must hold 100 billion dollars (10% of 1,000 billion dollars) as reserves with the central bank and is allowed to lend only the remaining 900 billion dollars to its customers.

Now, if the central bank decides to raise the reserve requirement to 15%, the same bank must hold 150 billion dollars (15% of 1,000 billion dollars) as reserves and can lend only 850 billion dollars.

This reduction in lending capacity reduces the money supply and, as a result, inflationary pressure.

The Role of the Reserve Requirement in Central Bank Monetary Policy

The role of the reserve requirement in monetary policy can be analysed in several key dimensions:

- Controlling Money Supply and Liquidity

By changing the reserve requirement, the central bank can regulate the volume of money in circulation.

- Raising the reserve requirement reduces banks’ ability to create money through lending, which in turn lowers overall liquidity.

- Conversely, lowering the reserve requirement allows banks to extend more credit, increasing liquidity in the economy.

- Inflation Management

The reserve requirement is an effective tool for controlling inflation.

- When inflation is high, the central bank can increase the reserve requirement to reduce the money supply and ease inflationary pressure.

- This approach, known as contractionary monetary policy, helps control inflation by dampening aggregate demand in the economy.

- Supporting Economic Growth

During periods of economic recession, the central bank can lower the reserve requirement to support growth.

- Reducing the ratio boosts banks’ lending capacity, stimulating demand and investment.

- This approach, known as expansionary monetary policy, increases the money supply and credit and helps revive economic activity.

- Promoting Financial Stability

The reserve requirement also contributes to the stability of the banking system.

- By obliging banks to hold a portion of their deposits as reserves, the likelihood of banking crises is reduced.

- This helps maintain public confidence in the banking system and supports the financial sector’s overall stability.

The reserve requirement is just one monetary policy tool. Others include interest rates (the price of money) and open market operations (buying and selling government securities). Central banks usually combine these tools, for example, cutting both the reserve requirement and interest rates to stimulate the economy.

Impact of the Reserve Requirement on Inflation and Economic Growth

Lowering the reserve requirement usually leads to faster credit expansion and higher consumption. In the short term, this can boost economic activity, but if not properly managed, it may lead to high inflation.

Conversely, increasing the reserve requirement restricts banks’ lending capacity and, by reducing liquidity, helps contain inflation. However, if applied too aggressively, this policy can slow economic growth and increase unemployment.

According to Investopedia, during economic recessions, the U.S. Federal Reserve may reduce the reserve requirement so that banks can extend more credit and thereby help stimulate economic growth. For example, in March 2020, in response to the economic crisis caused by the COVID-19 pandemic, the Federal Reserve cut the reserve requirement to zero per cent to support the economy.

Statutory Reserves in Iran: A Look at the Central Bank’s Experience

In Iran, the reserve requirement (also called statutory reserves) has always been one of the Central Bank’s core and active tools of monetary policy. Under the Monetary and Banking Act of Iran (adopted in 1339 in the Iranian calendar, with later amendments), the Central Bank is authorised to require banks to hold a percentage of their deposits as reserves. Over different periods, the ceiling for this percentage has ranged from 10% to 30%.

History of the Reserve Requirement in Iran’s Banking System

Up until Azar 1383, the reserve requirement on demand (current) deposits and savings deposits was about 20%, while for longer-term deposits (two- to five-year deposits) it was reduced to 10%.

This approach continued in subsequent years. According to a Central Bank announcement in 1387, the reserve requirement was again set on a tiered basis:

- Demand (current) deposits: 20%

- Short-term and one-year deposits: 17%

- Two- and three-year deposits: 15%

- Five-year deposits: 11%

This history shows that the Central Bank has used the reserve requirement not only to control liquidity, but also to encourage banks to attract more stable, long-term funding.

Periods of Change in the Reserve Requirement and the Reasons Behind Them

Changes in the reserve requirement over time have been a direct response to economic conditions, especially inflation and money supply growth:

- Incentivising Long-Term Funding

As stated in the 1387 announcement, by applying a lower rate (11%) to five-year deposits compared with demand deposits (20%), the Central Bank was signalling to banks that they should attract more stable, long-term resources and strengthen their financial stability. - Liquidity and Inflation Control (Recent Decade)

Over the past decade, the main driver of change has been the need to curb liquidity growth. Reported data show that the ratio of statutory reserves to total deposits in the banking system rose from around 9.7% in Tir 1399 to 11.7% in Bahman 1402. This move formed part of the Central Bank’s contractionary policy aimed at restraining money supply growth. - Response to Economic Shocks

In addition to liquidity growth, the Central Bank has emphasised in its analyses that Iran’s chronic inflation, especially after 1397, has also stemmed from exchange-rate volatility and external shocks. These shocks forced the Central Bank to use its monetary tools more actively, including the reserve requirement.

The Role of This Policy in Controlling Liquidity and Inflation in the Past Decade

The main objective of this policy in recent years has been to reduce banks’ ability to create money and thereby control liquidity. When the Central Bank raises the reserve requirement, banks’ lendable funds decline directly, which can help in containing inflation.

- Effectiveness (Based on Data)

Domestic research supports this effectiveness. For example, one statistical study finds that an increase in the reserve requirement has a negative and significant long-term effect on the money supply, with a coefficient of -8.782. In other words, this tool has been able, over the long run, to contribute to liquidity control. - Policy Limitations

However, the impact of the reserve requirement on Iran’s economy in the past decade has also faced challenges and constraints:- Need for Complementary Tools:

This instrument alone is not sufficient. Its success depends on coordination with other tools, such as interest rate policy, open market operations, and exchange rate policy. - Time Lags:

The effects of changes in the reserve requirement are not immediate. They typically appear with a time lag in macroeconomic variables such as inflation. - Supervisory Challenges:

When the banking system is affected by balance-sheet imbalances or supervisory weaknesses, banks may use mechanisms such as overdrafts from the Central Bank to offset the restrictive effects of higher reserve requirements. This can reduce the policy’s overall effectiveness.

- Need for Complementary Tools:

Comparing Reserve Requirements Across Countries

Central banks’ approaches to the reserve requirement vary widely across the world. These differences reflect each country’s economic conditions (such as inflation and growth) and the degree of development and sophistication of its monetary policy framework.

Some countries use the reserve requirement as an active lever to control liquidity, while many advanced economies have largely moved away from it.

Below is a comparison of reserve requirement ratios in selected countries (based on the latest available data from sources such as Trading Economics and CEIC Data):

| Country / Region | Reserve Requirement (%) |

|---|---|

| United States | 0% |

| European Union | 1% |

| Japan | 0.8% |

| China | 6.6–7.5% |

| India | 3.75-4% |

| Brazil | 21% |

| Russia | 4.5% |

| Indonesia | 9% |

| Turkey | 25% |

| Nigeria | 45% |

Countries with a Different Approach (No Formal Reserve Requirement)

Interestingly, some large and advanced economies no longer use a traditional reserve requirement framework:- Canada: According to the Bank of Canada, since 1994, the country has had no statutory reserve requirement, and monetary policy is implemented purely through interest rate-based tools.

- United Kingdom: The Bank of England removed percentage reserve requirements in 2009 and shifted to other systems for liquidity management.

- Australia: According to the Bank for International Settlements (BIS), Australia also does not impose percentage-based reserve requirements on deposits.

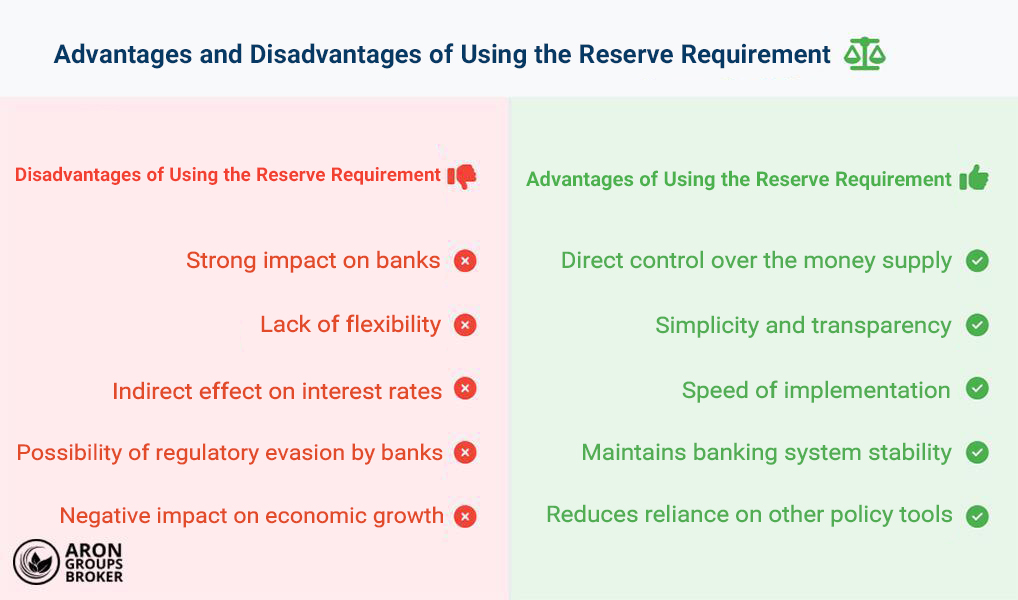

Advantages and Disadvantages of Using the Reserve Requirement

As one of the central bank’s key monetary policy tools, the reserve requirement has distinct advantages and disadvantages.

Advantages of the Reserve Requirement

The main advantages of using the reserve requirement are:

- Direct control over the money supply

The reserve requirement allows the central bank to directly influence the volume of money. By affecting banks’ lending capacity, it changes the amount of money in circulation and thereby helps in controlling inflation. - Simplicity and transparency

The reserve requirement is a simple and transparent tool that is easy to understand and implement. Unlike some more complex monetary policy instruments, it can be clearly explained, and banks can comply with it without difficulty. - Speed of implementation

Changes in the reserve requirement can be implemented quickly, and their impact on the money supply becomes visible in a relatively short time. This makes it a useful tool for responding to rapid changes in economic conditions. - Supporting banking system stability

By requiring banks to hold a portion of their deposits as reserves, the likelihood of banking crises is reduced. This helps maintain public confidence in the banking system and supports overall financial stability. - Reducing reliance on other policy tools

Effective use of the reserve requirement can reduce the central bank’s dependence on other monetary policy tools such as interest rates. This is especially important when those other tools face constraints or lose effectiveness.

Disadvantages of the Reserve Requirement

The main disadvantages of using the reserve requirement are:

- Strong impact on banks

Changes in the reserve requirement can heavily affect banks’ operations. A sudden increase in the ratio may reduce bank profitability and, in severe cases, create liquidity problems for them. - Limited flexibility

The reserve requirement is a relatively inflexible instrument. Frequent changes in this ratio can create instability in the banking system and make long-term planning more difficult for banks. - Indirect impact on interest rates

The reserve requirement has an indirect effect on interest rates, which can generate volatility in financial markets. For example, an increase in the reserve requirement can push up the interbank rate, which then spills over into other interest rates in the economy. - Possibility of regulatory arbitrage by banks

In some cases, banks may try to circumvent reserve requirements through various methods. Such behaviour can reduce the effectiveness of the reserve requirement as a policy tool. - Impact on economic growth

Raising the reserve requirement can negatively affect economic growth. Reducing banks’ lending capacity can lower investment and consumption, thereby slowing overall economic activity.

Conclusion

The reserve requirement is one of the central bank’s fundamental monetary policy instruments for maintaining macroeconomic balance. It has a direct impact on liquidity, inflation, and economic growth. Countries such as the United States and China have used calibrated adjustments to the reserve requirement to help manage economic fluctuations.

In Iran as well, a proper understanding of how the reserve requirement works and its coordinated use alongside other policy tools can contribute to monetary stability and lower inflation.