One of the most crucial principles in capital management and trading is risk control. Before entering any trade, a professional trader knows how much capital they’re risking and what potential profit they’re aiming for. This ratio is known as the “risk-reward ratio.” Using a risk-reward indicator on trading platforms like MetaTrader simplifies and refines this process, helping traders make more informed decisions. This article provides a comprehensive overview of this tool and how to use it.

- The risk-reward ratio is the ratio of potential profit to potential loss in a trade.

- The Risk-Reward Indicator helps you assess the risk before entering a trade.

- A 1:2 ratio means that for every 1 unit of risk, you are targeting 2 units of potential profit.

- A high risk-reward ratio (e.g., 1:3) increases your long-term probability of success.

- This tool is only a guide and must be combined with technical analysis.

- Never trade without setting a stop-loss order.

What is the Risk-Reward Indicator and Why is it Important?

The risk-reward ratio is a key concept in financial trading that indicates the ratio of potential profit (reward) to potential loss (risk) in a trade. For example, a 1:2 ratio means that for every one unit of risk, the trader is targeting two units of reward (profit). This ratio is the cornerstone of robust risk management and a successful trading strategy.

A risk-reward indicator is a tool that helps traders evaluate the ratio of potential profit to potential loss before entering a trade. This tool visually displays the stop-loss (SL) and take-profit (TP) levels on a chart, allowing traders to assess whether a trade meets their risk-reward criteria quickly or not.

Risk-Reward Indicator in MetaTrader 4 and 5

By default, the MetaTrader 4 and 5 platforms do not include a native tool for calculating risk-reward. However, risk-reward indicators, which are typically offered as third-party tools or plugins, are widely available for these platforms.

According to Forex Factory, traders can access free MT4 indicators that automatically calculate and display the risk-reward ratio, saving time and reducing human error.

Features and Capabilities of the Risk-Reward Indicator in MetaTrader 4

The Risk-Reward Indicator for MetaTrader 4 (MT4) simplifies the trading process by eliminating the need for manual calculations.

The key features of this indicator are:

- Visual Display: The indicator visually presents SL and TP levels directly on the chart. This visual aid helps traders quickly and easily determine if a potential trade meets their risk-reward criteria.

- Automatic Calculation: After setting the stop-loss and take-profit levels, the indicator automatically calculates and displays the risk-reward ratio.

- Flexibility: This indicator allows for easy adjustment of the stop-loss and take-profit levels via a simple drag-and-drop function.

- Trade Type Selection: It allows traders to select the type of trade, whether it’s a buy (long position) or a sell (short position).

- Broad Application: This tool can be used for various financial assets, including Forex pairs, indices, stocks, and commodities.

In MetaTrader 5, some indicators have the capability to adjust the risk-reward ratio based on the ATR, reflecting actual market volatility rather than relying solely on fixed price distances.

Features and Capabilities of the Risk-Reward Indicator in MetaTrader 5

Risk-reward indicators in MetaTrader 5 (MT5) offer similar capabilities to the MT4 version, including visual display, automatic calculation, and high flexibility. However, due to the more advanced structure of MT5, some of these indicators may provide greater precision and more advanced features in their data representation.

How to Install and Set Up the Risk-Reward Indicator in MetaTrader 4 and 5

Since the steps are similar for both platforms, the following guide will detail the installation process for MetaTrader 5, noting that the same procedure applies to MetaTrader 4.

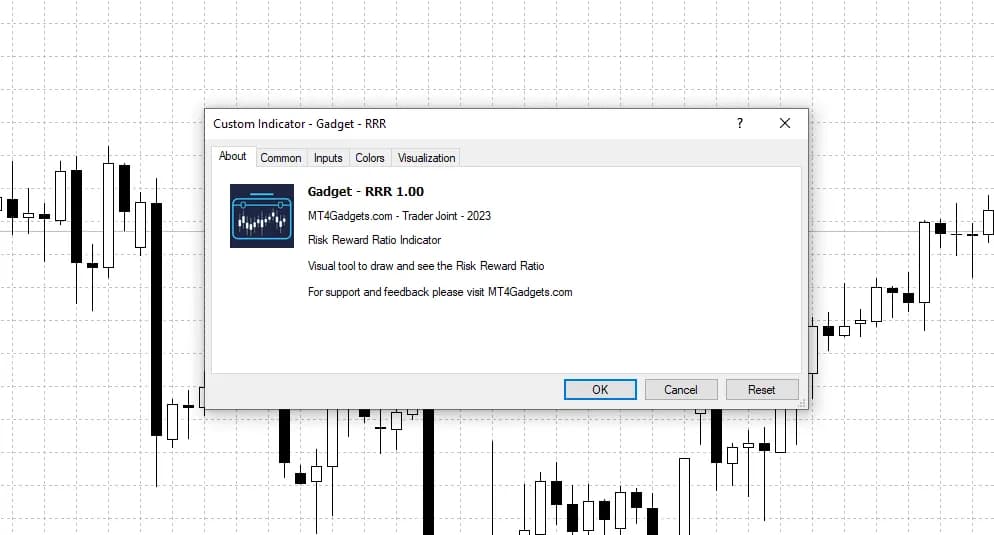

To install the Risk-Reward Indicator in MetaTrader 5, follow these steps:

- Download the indicator file from mql5.com;

- Open the MetaTrader 5 software;

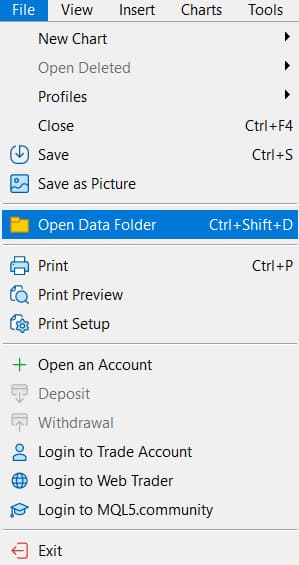

- In MetaTrader, navigate to the File menu and click on Open Data Folder;

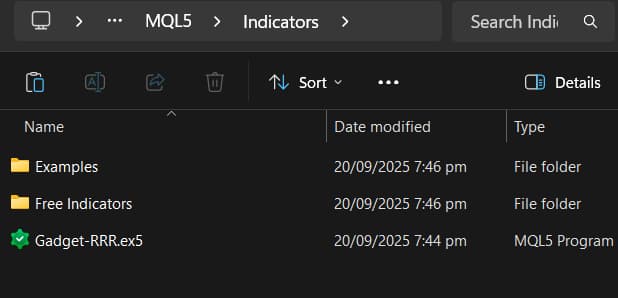

- In the new window that opens, open the MQL5 folder (or the MQL4 folder for MetaTrader 4);

- Copy the indicator file into the Indicators folder;

- Close and then reopen the MetaTrader software. Alternatively, you can right-click the indicator folder within the Navigator panel and select Refresh;

- You can now locate the indicator in the list and drag it onto your desired chart.

How to Use the Risk-Reward Indicator to Improve Your Trading

Proper use of this indicator can significantly enhance your trading performance. Follow these steps:

- Analyze and Determine Your Entry Point: Using your trading strategy, identify the optimal entry point for your trade.

- Set the Stop-Loss: Based on your technical analysis, determine the appropriate level for your stop-loss. The indicator visually displays this level on the chart.

- Define the Take-Profit: Specify your profit target and set the take-profit level by dragging the corresponding line on the chart.

- Check the Ratio: The indicator automatically calculates and displays the risk-reward ratio. If the ratio is favorable and logical, you can enter the trade. As a general rule, a ratio of 1:2 or higher is suitable for many traders.

Common Mistakes When Using the Risk-Reward Indicator

- Ignoring Analysis: Entering a trade solely because the risk-reward ratio is favorable is a major mistake. This tool is meant to complement your analysis, not replace it.

- Setting Illogical Levels: Placing stop-loss and take-profit levels at illogical points that don’t align with market analysis. These levels should be determined based on key price points, such as support and resistance levels.

- Failing to Backtest and Forward Test: To confirm the effectiveness of a trading strategy and its risk-reward ratio, it’s essential to perform backtesting (testing the strategy on historical data) and forward testing (testing the strategy under live market conditions).

The Risk-Reward Indicator can indirectly reveal when your position size is disproportionately large.

Conclusion

The Risk-Reward Indicator is a powerful tool for any trader looking to improve their risk management and optimize their trades. By visually displaying and accurately calculating the risk-reward ratio, this indicator helps traders make smarter decisions and effectively protect their capital. The correct and logical use of this tool, combined with comprehensive market analysis, is key to success in trading.