Did you know that the New York Stock Exchange alone has a market value of over $25 trillion? Or that China, with its two major exchanges in Shanghai and Shenzhen, is competing with the U.S. and Japan? In a world where investment is no longer confined by borders, understanding the world’s largest and most important stock exchanges is not a choice, but a necessity. These markets, such as the New York Stock Exchange, NASDAQ, Tokyo, and London Stock Exchanges, are not only the engines driving the global economy but also provide the best routes for diversification and reducing risk in investment portfolios.

But which exchange is more suitable for Iranian investors? Which options are high-risk, and which are safer? In this article, we will provide a comprehensive comparison of the world’s most important stock exchanges to help you choose the best one for investment.

- On the Tokyo Stock Exchange, the daily price fluctuation limit is dynamically determined based on the previous day's closing price.

- On the Shanghai and Shenzhen Stock Exchanges, foreign investors are only allowed to invest through specific programs like QFII and Stock Connect.

- Unlike many other exchanges, the London Stock Exchange easily facilitates dual listing across multiple markets for companies.

- Contrary to popular belief, the New York Stock Exchange and NASDAQ are not part of the same group; NASDAQ has a completely independent structure based on algorithmic and automated trading systems.

New York Stock Exchange (NYSE): The King of Global Exchanges

If we had to name a symbol of global economic power, the New York Stock Exchange (NYSE) would undoubtedly top the list. Established in 1792 in the heart of Wall Street, this exchange now boasts a market value exceeding $30 trillion, making it the answer to the question, “Which country has the largest stock exchange in the world?” The NYSE is not only the oldest stock exchange globally, but with over 2,400 large companies listed, it plays an indispensable role in the global economy.

One of the unique features of this exchange is its high liquidity, which makes it the safest platform for buying and selling stocks. Industrial giants like Apple, JPMorgan, and energy companies like Chevron are listed on this exchange, and it sees daily trading volumes of around $450 billion. This figure highlights the attractiveness of the NYSE to both institutional and retail investors seeking access to low-risk, profitable securities.

Interestingly, the physical structure of the NYSE has been combined with an electronic trading system to ensure speed and transparency. Additionally, the famous Dow Jones index, which tracks the performance of the top 30 companies on the exchange, is regarded as a barometer for the U.S. economy and the world. For a more detailed understanding of the history and regulations of this exchange, you can visit the New York Stock Exchange page on Wikipedia.

If you’re looking to invest in the most reputable stock exchanges in the world, the NYSE, with its combination of stability, industrial diversity, and stringent regulatory oversight, is the best choice for entering advanced financial markets. In the next sections, we will compare this market giant with competitors such as NASDAQ and London!

NASDAQ: The Home of Tech Giants

The NASDAQ, one of the most important stock exchanges in the world, is known as the home of tech giants and hosts companies like Google, Amazon, Tesla, Apple, and Microsoft. Founded in 1971, with a focus on stocks of innovative companies in the technology sector, it has become the largest stock market globally in terms of technology. With a market value exceeding $19 trillion, NASDAQ lists over 3,300 companies, most of which are leaders in the digital and technology industries. This focus makes NASDAQ an attractive destination for investors looking for rapid growth in the financial and technology sectors.

The main difference between NASDAQ and the New York Stock Exchange (NYSE) lies in their structure. NASDAQ was the world’s first fully electronic market, where all trades are conducted online, in contrast to the NYSE, which retains a mix of both in-person and electronic trading.

This electronic structure provides high speed and liquidity, enabling a massive volume of daily transactions. Due to its rapid growth and focus on startups and high-risk companies, NASDAQ is ideal for risk-tolerant investors. The NASDAQ 100 index, which tracks the performance of the top 100 companies, is a testament to the dynamism of this market.

In the NASDAQ index, companies are weighted based on market capitalization, while in the Dow Jones (NYSE), the weighting is based on the stock price, not the size of the company.

Tokyo Stock Exchange (TSE): The Heart of Asia’s Economy

The Tokyo Stock Exchange (TSE), as one of the most important stock exchanges in the world, plays a central role in Japan’s economy and Asia’s financial landscape. Established in 1878, with a market value exceeding $6 trillion (as of 2024), it is the largest stock market in Japan and one of the most influential financial centers in the region. The TSE is not only the main pillar of the third-largest economy in the world, Japan, but also serves as a bridge connecting Asian markets to the global economy. Japan’s economic stability, ensured by precise fiscal policies and advanced infrastructure, has made TSE a safe and reliable destination for international investors.

Large companies like Toyota, Sony, and SoftBank are listed on this exchange and play a crucial role in boosting its appeal. These companies not only power Japan’s economy but also, through their global operations, have turned the Tokyo Stock Exchange into a key player in Asia.

The Nikkei 225 index, which tracks the performance of the top 225 companies on the TSE, is one of the most prominent global stock indices and provides a benchmark for measuring the economic health of the region.

Some exchanges, such as the New York Stock Exchange and the London Stock Exchange, only list company stocks, while exchanges like Eurex in Germany and the Tokyo Stock Exchange host not only stocks but also complex derivatives and structured products.

One of the standout features of the TSE is its high trading volume, which reaches billions of dollars daily, reflecting the dynamism and liquidity of the market. This characteristic, coupled with Japan’s economic stability, has made the Tokyo Stock Exchange a central hub for both domestic and international investors.

While other Asian markets, such as Shanghai and Hong Kong, are also important, the Tokyo Stock Exchange remains the beating heart of Asia’s economy due to its advanced infrastructure and the presence of multinational companies.

London Stock Exchange (LSE): A Gateway to the European Market

The London Stock Exchange (LSE), one of the most important stock exchanges in the world, is recognized as one of the oldest financial markets globally, with its history dating back to 1698 and its operations originating from Jonathan’s coffee house. Officially established in 1801, it has since become a key hub for securities trading in the UK and Europe.

The LSE hosts over 2,000 companies from 60 countries, offering a unique diversity of listed companies, including multinational giants such as BP, HSBC, and GlaxoSmithKline. This diversity, along with strict regulatory oversight by bodies like the UK’s Financial Conduct Authority (FCA), has made the London Stock Exchange one of the most reputable financial markets in the world, playing a vital role in the UK and European economies.

As a gateway to the European market, the LSE provides investors access to broader opportunities across the continent through its collaboration with Euronext. The FTSE 100 index, which includes the 100 largest companies by market capitalization, is a key benchmark for measuring the performance of this market.

According to its Wikipedia page, approximately 80% of the revenue of FTSE 100 companies comes from outside the UK, reflecting the strong multinational activity of the exchange. This significant feature makes the London Stock Exchange particularly attractive to European investors, as it provides opportunities to invest in companies with a global reach. Additionally, London’s favorable time zone facilitates connections with both Asian and U.S. markets, making it an international financial hub.

Shanghai and Shenzhen Stock Exchanges: Emerging Powerhouses of the East Top of Form

China, with its rapid economic growth in recent decades, has become one of the world’s major financial powers. The Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) have emerged as two key pillars of this transformation, ranking among the most important exchanges in the world.

The Shanghai Stock Exchange, established in 1990, is the largest in China, with a market value exceeding $6.5 trillion (as of early 2025), and hosts large state-owned companies such as PetroChina. In contrast, the Shenzhen Stock Exchange, also launched in 1990, has a market value of about $4.4 trillion and focuses on smaller, innovative companies, especially in the technology sector.

What’s the Difference Between Shanghai and Shenzhen Exchanges?

The main difference between these two exchanges lies in the types of companies they list and their structures. The Shanghai Stock Exchange relies more on traditional and state-owned companies, with the SSE Composite Index serving as the key benchmark for its performance.

On the other hand, the Shenzhen Stock Exchange, with its ChiNext market similar to NASDAQ, focuses on Chinese tech companies like BYD and Tencent, and the SZSE Component Index tracks the growth of this sector. The daily trading volume on both exchanges reaches billions of dollars, with bond issuance playing an important role in attracting capital.

One notable feature of these exchanges is the access they provide to foreign investors through initiatives like Stock Connect (since 2014). These programs have made it easier for foreign investors to access A-shares and have increased market liquidity. The Shanghai Stock Exchange’s STAR Market (since 2019) and the Shenzhen Stock Exchange’s ChiNext provide platforms for tech startups, helping foster innovation and attract investment.

Comparison Table of Major Stock Exchanges

To better understand and compare the world’s most important stock exchanges, we present key information in the following table. This table includes metrics such as market capitalization, number of listed companies, average trading volume, and trading hours, which will help investors gain a comprehensive view of these markets. By examining this data, you can make more informed decisions when investing in the world’s largest financial markets.

| Exchange | Market Capitalization (Trillion USD) | Number of Listed Companies | Average Trading Volume (Billion USD) | Trading Hours (Local Time) |

|---|---|---|---|---|

| New York (NYSE) | 25 | 2400 | 2-6 | 09:30-16:00 |

| NASDAQ (NASDAQ) | 19 | 3300 | 1.5-4 | 09:30-16:00 |

| Tokyo (TSE) | 6.1 | 3575 | 1-3 | 09:00-15:00 |

| London (LSE) | 4.3 | 2000 | 1-2 | 08:00-16:30 |

| Shanghai (SSE) | 6.5 | 2100 | 1-2 | 09:30-15:00 |

| Shenzhen (SZSE) | 4.4 | 2700 | 1-2 | 09:30-15:00 |

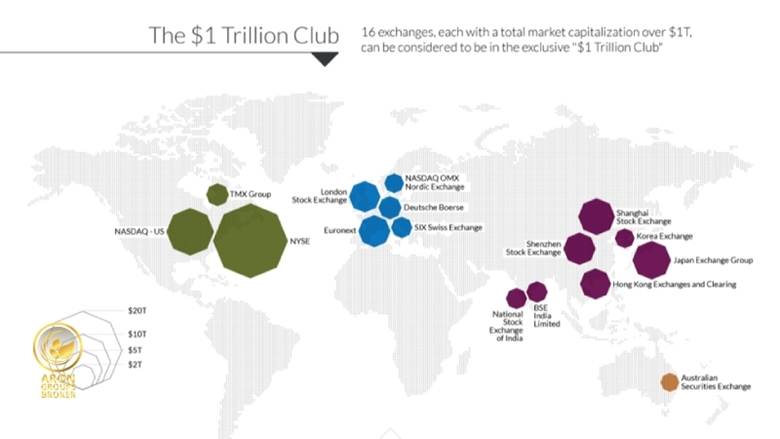

Market Capitalization

The New York Stock Exchange (NYSE) is the largest in the world, with a market capitalisation exceeding $25 trillion. This is due to the presence of massive companies such as Apple and Walmart.

NASDAQ follows in second place with a market value of $19 trillion. Its focus on fast-growing tech companies such as Amazon, Tesla, and NVIDIA has helped it achieve this position.

Asian exchanges like Tokyo (TSE), with a market value of $6.1 trillion, and Shanghai, with a market value of $6.5 trillion, have made significant progress, thanks to the rapidly growing economies of Japan and China.

When comparing East and West, the West (U.S.) remains dominant with the NYSE and NASDAQ, but Asia is quickly catching up.

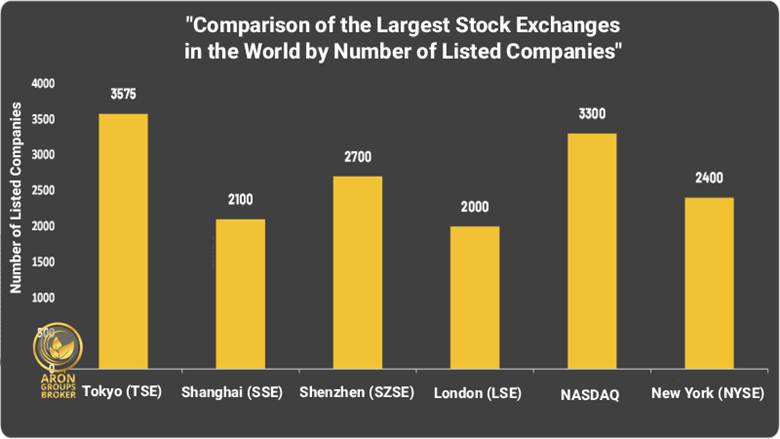

Number of Listed Companies

The Tokyo Stock Exchange, with 3,575 companies, and the Shenzhen Stock Exchange, with 2,700 companies, have the highest number of listed companies. In comparison, NASDAQ hosts 3,300 companies, and the Shanghai Stock Exchange has 2,100.

The NYSE, with 2,400 companies, has fewer listed companies but includes high-value companies like JPMorgan. A larger number of companies does not necessarily indicate greater power, as the value and influence of the companies play a more important role.

Average Trading Volume

NASDAQ has a high average trading volume, ranging from $1.5 to $4 billion per day, thanks to the presence of tech companies and fast-paced trading.

Chinese exchanges such as the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) have seen significant growth in trading volume in recent years due to the influx of foreign investors through Stock Connect. Their trading volumes now range from $1 to $2 billion. High volume provides more liquidity for traders, allowing for quicker market entry and exit.

Trading Hours

Trading hours in U.S. exchanges like the New York Stock Exchange (NYSE) and NASDAQ are continuous from 09:30 to 16:00 (local time), which makes them more attractive to global investors. However, Asian exchanges like the Tokyo Stock Exchange (09:00-15:00 with a break) and the Shanghai Stock Exchange (09:30-15:00 with a break) have segmented trading hours. This difference affects global investors’ access, as the continuous trading in the U.S. provides more overlap with other regions, making trading more convenient.

A comparison of the major global exchanges shows that the New York and NASDAQ exchanges lead in market capitalization and trading volume. However, Asian exchanges have become competitive in the number of listed companies and in rapid growth. Choosing the right exchange depends on the investment strategy.

Key Differences in Structure and Regulations of the World’s Major Stock Exchanges

The world’s most important stock exchanges, such as the NYSE, NASDAQ, Tokyo Stock Exchange (TSE), and London Stock Exchange (LSE), each have different structures and regulations that distinguish them from each other. These differences in trading systems, listing requirements, the role of market makers, tax laws, and access for foreign investors directly impact the performance and appeal of these markets.

For example, the world’s largest international exchange, NYSE, guarantees high liquidity through a combination of traditional and electronic trading systems, while other exchanges adopt different approaches. Let’s examine these differences in detail.

Trading Systems (Electronic or Hybrid)

Trading systems in the world’s major exchanges vary widely. The New York Stock Exchange uses a hybrid system, combining physical floor trading on Wall Street with electronic trading. However, since 2007, most of its trades have been conducted electronically. In contrast, NASDAQ has been the world’s first fully electronic exchange since 1971, which increases speed and efficiency. The Tokyo Stock Exchange also transitioned to an electronic system in 1999 but still maintains some traditional methods.

Listing Requirements

Listing requirements at the world’s largest exchanges are backed by strict regulatory oversight.

The New York Stock Exchange and London Stock Exchange have stringent standards for company listings. For example, companies must meet minimum profitability, market value, and public share criteria.

NASDAQ, with its focus on technology companies, has more flexible conditions to attract startups.

On the other hand, Chinese exchanges like Shanghai (SSE) are heavily regulated by the China Securities Regulatory Commission (CSRC) and generally accept state-owned enterprises.

Unlike the New York Stock Exchange or NASDAQ, which settle trades with a two-day delay (T+2), the Shanghai and Shenzhen Stock Exchanges operate with a T+1 system. This means that stocks purchased cannot be sold on the same day, and this difference limits the ability to implement a quick exit strategy in Asian markets.

Role of Market Makers

Market makers play a critical role in maintaining liquidity at major exchanges.

At the New York Stock Exchange, market makers are key in balancing supply and demand and facilitating trades in exchange for a commission.

NASDAQ uses a multiple market maker system, enhancing competition.

In contrast, the Tokyo and Shanghai exchanges have less involvement from market makers, with most transactions handled through automated systems.

Tax Laws and Access for Foreign Investors

Tax laws and access for foreign investors vary across these exchanges.

In the U.S., foreign investors face capital gains taxes on exchanges like the NYSE and NASDAQ but can easily access these markets through international brokers.

The London Stock Exchange offers tax exemptions for certain foreign investors, increasing its appeal.

Chinese exchanges like Shanghai and Shenzhen had strict limitations on foreign investors until 2014, but access has been improved with the Stock Connect program.

Which Stock Exchange is More Suitable for International Investors?

The world’s most important stock exchanges each have advantages and disadvantages for international investors. The choice of the best foreign exchange for international investors depends on access, trading instruments, risk, and return.

The New York Stock Exchange offers high liquidity and large companies, easy access, but heavy taxes.

NASDAQ is suitable for high-risk investors focusing on technology, but its volatility is high.

The Tokyo Stock Exchange is stable but harder to access.

The London Stock Exchange, with its multinational activity, is attractive for conservative investors.

Access to these markets is possible through international brokers, but for Iranians, sanctions are a major obstacle. NASDAQ and the London Stock Exchange may be the best foreign exchanges for Iranians. The New York Stock Exchange and NASDAQ offer a variety of trading instruments, while the London Stock Exchange and Shanghai Stock Exchange are more focused on stocks. Additionally, NASDAQ and Shanghai offer high returns but also higher risks, while the London Stock Exchange and Tokyo Stock Exchange are more stable.

The table below offers portfolio suggestions for international investors with different risk tolerances:

| Investor Type | Suggested Exchanges | Reasons for Selection |

|---|---|---|

| Conservative | LSE, TSE | Stability, low risk |

| Moderate Risk Tolerance | NYSE, LSE | Liquidity, balance between risk and return |

| High Risk | NASDAQ, SSE | High return, fast growth |

| Looking for Innovation and Growth | NASDAQ, Shenzhen | Focus on technology, growth potential |

Ultimately, choosing among the world’s major stock exchanges depends on your strategy and risk tolerance.

If you are looking for stability, the London Stock Exchange and Tokyo Stock Exchange are suitable. If you want high growth and returns, NASDAQ and the Shanghai Stock Exchange are ideal.

By clearly understanding your needs and making intelligent investments, you can succeed in global markets.

Which Global Stock Exchanges Can Iranians Invest In?

Among the world’s major stock exchanges, none are officially or directly accessible to Iranian investors without restrictions. International sanctions and banking limitations have severely restricted Iranians’ access to global financial services.

However, from a realistic standpoint, some markets are relatively more accessible due to their geographic proximity, legal flexibility, or the adaptability of intermediaries, though they are not ideal options. The Istanbul Stock Exchange (Borsa Istanbul) is one of the most accessible choices because of its geographical closeness, informal economic interactions, and the presence of some regional brokers who work with Iranian investors.

The Frankfurt Stock Exchange in Germany also offers indirect access through intermediaries based in countries like Turkey or Armenia. In contrast, U.S. exchanges such as the New York Stock Exchange and NASDAQ, despite their high attractiveness, are practically inaccessible to Iranian users. Any attempt to invest directly or under an Iranian identity carries a serious risk of funds being frozen.

Therefore, under current conditions, Iranian investors must rely on indirect methods, proceed with extreme caution, and carefully consider all legal and financial risks before making any investment decisions.

Conclusion

Understanding the world’s major stock exchanges is essential for every international investor, as these markets play a vital role in the global economy. The New York Stock Exchange (NYSE), as the largest financial market in the world, with its high market value and exceptional liquidity, is ideal for conservative investors. NASDAQ, with its focus on technology companies, suits risk-tolerant investors and offers high-return opportunities.

The Tokyo Stock Exchange (TSE) and London Stock Exchange (LSE), supported by economic stability, are considered safe options for financial investment, while the Shanghai and Shenzhen exchanges, with their rapid growth, provide opportunities for investors seeking innovation. Each of these markets has unique characteristics that can support different investment strategies.