Liquidity risk is the very danger that can push a major bank to the brink of bankruptcy within days or cause a trader’s equity in the stock market to drop sharply. Time and again, this hidden risk has been the primary driver behind some of the world’s most significant financial crises, and it remains a key concern for banks, corporations, and investors alike.

To understand precisely what liquidity risk is, how it emerges, and its impact on banks and capital markets, continue reading.

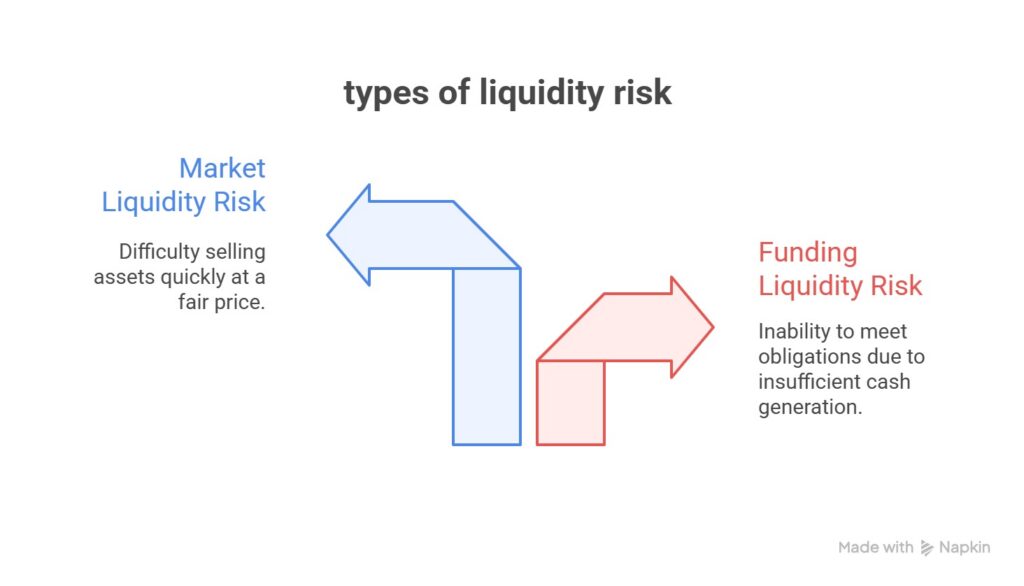

- Liquidity risk comes in two forms: funding liquidity risk (the inability to meet debt obligations) and market liquidity risk (the inability to sell an asset at a fair price).

- Banks are the most vulnerable to liquidity risk due to their maturity transformation model and heavy reliance on short-term deposits.

- In capital markets, low trading volumes, shallow market depth, and wide bid-ask spreads are the primary indicators of liquidity risk.

What Is Liquidity Risk and Why Does It Matter?

Liquidity risk occurs when an individual or institution is unable to meet financial obligations on time or convert assets into cash without incurring significant losses.

This risk is critically important in both banking and the stock market. The reason it matters so much is that even a business or bank that appears financially strong on paper can quickly fall into crisis if it cannot generate cash when needed.

According to Investopedia, liquidity risk typically takes two primary forms:

Funding Liquidity Risk

Funding liquidity risk refers to the inability of a bank, corporation, or individual to generate sufficient cash to meet obligations as they come due.

For example, imagine a bank that has allocated a significant portion of its assets to long-term loans. If depositors suddenly decide to withdraw a substantial portion of their funds, the bank would be forced to liquidate its long-term assets quickly. Such sales are typically made at steep discounts or even at a loss, which can significantly erode the bank’s credibility.

Market Liquidity Risk

Market liquidity risk occurs when an asset (such as a stock or bond) cannot be sold quickly at a fair price in the market.

For instance, a stock with low trading volume and fewer active buyers and sellers can be extremely difficult to sell during times of market stress. In such situations, an investor may be forced to sell the stock well below its fair value to obtain cash quickly.

The Difference Between Liquidity Risk, Credit Risk, and Market Risk

Liquidity risk is one of the key pillars of risk management in finance, but it is often confused with other types of risk, such as credit risk and market risk. Each has its own unique nature, and understanding these distinctions is crucial for both investors and banks.

As mentioned earlier, liquidity risk refers to the possibility that an individual or organization may be unable to generate enough cash to meet short-term obligations.

Credit risk, on the other hand, relates to the likelihood of default by a borrower—that is, the possibility that debt will not be repaid. In simple terms, when a bank issues a loan, there is always the chance that the borrower may fail to repay the principal and interest. This risk depends on the counterparty’s creditworthiness and emphasizes the borrower’s ability and willingness to repay, rather than the liquidity of assets.

Market risk falls under the category of systematic risk and refers to the unpredictable changes in asset prices within financial markets. It arises from fluctuations in interest rates, stock prices, exchange rates, or commodities. For example, if interest rates suddenly rise, bond values will drop. Similarly, if oil prices fall, oil company stocks will come under pressure.

To make the differences clearer, consider a simple example:

- If a bank has enough assets but cannot quickly convert them into cash, it is exposed to liquidity risk.

- If a bank customer fails to repay loan installments, the bank faces credit risk.

- And if the value of the bank’s assets declines due to an interest rate hike or a stock market crash, that is market risk.

Comparison Table: Liquidity Risk vs. Credit Risk vs. Market Risk

| Type of Risk | Short Definition | Practical Example | Main Impact On |

|---|---|---|---|

| Liquidity Risk | Inability to quickly convert assets into cash without significant loss | A bank forced to sell long-term loans at steep discounts to cover deposit withdrawals | Asset liquidity and ability to meet short-term obligations |

| Credit Risk | Possibility of a borrower failing to repay principal or interest | A customer defaulting on loan installments | Return on capital and future cash flows |

| Market Risk | Losses from unforeseen changes in prices, interest rates, or currencies | Decline in bond values due to rising interest rates | Market value of assets and investments |

Liquidity Risk in Banks

As the backbone of the financial system, banks are more exposed to liquidity risk than any other institution. The type of liquidity risk banks primarily face is funding liquidity risk.

In the following, we will examine the reasons behind this exposure and explore the methods banks use to manage liquidity risk.

Why Are Banks the Most Exposed to Liquidity Risk?

Banks operate with customers’ short-term deposits but allocate a large portion of these funds into long-term loans or illiquid investments. This mismatch between the maturities of assets and liabilities means banks are constantly vulnerable to potential liquidity shortages.

Factors such as economic recessions, macro-level financial crises, and a decline in public confidence in the banking system can trigger a wave of withdrawals, thereby amplifying liquidity risk in banks.

The Role of Depositors and Sudden Withdrawals in Creating Liquidity Crises

One of the biggest liquidity threats for banks is depositor behavior. If customers believe that a bank is in weak financial condition, they are likely to withdraw their deposits en masse. This phenomenon, known in financial literature as a bank run, can drive even a fundamentally healthy bank to the brink of collapse.

In 2023, fueled by panic amplified through social media, Silicon Valley Bank (SVB) in the United States faced a severe liquidity shortage as startups and tech companies simultaneously withdrew their deposits—ultimately leading to the bank’s collapse.

Liquidity Risk Management Methods in Banks

To mitigate liquidity risk, banks and financial institutions employ a range of tools and strategies. Some of the most important methods include:

- Maintaining adequate cash reserves: Banks are required to hold a portion of deposits as cash reserves with the central bank or in highly liquid funds.

- Diversifying funding sources: Relying on a single type of deposit or short-term borrowing can be risky. Banks create a mix of funding sources through bonds, credit lines, and other instruments.

- Asset-liability management (ALM): By analyzing the timing of cash inflows (such as loan repayments) and outflows (such as deposit withdrawals), banks aim to minimize the mismatch between short-term liabilities and long-term assets, ensuring sufficient liquidity at all times.

- Stress testing: Banks simulate hypothetical crisis scenarios—such as a bank run or severe recession—to assess potential liquidity shortfalls and determine the necessary countermeasures.

Access to emergency facilities: In special circumstances, banks can rely on central bank credit lines or interbank funding to secure emergency liquidity.

One of the most important tools for mitigating liquidity risk is the existence of regulatory and supervisory frameworks. By setting standards such as liquidity ratios, regulators not only help maintain the stability of the financial system but also safeguard depositors’ interests against potential crises.

Liquidity Risk in Stocks and Capital Markets

Liquidity risk is not limited to banks; it also plays a significant role in the stock market and exchange-traded investments. The type of liquidity risk that stocks and capital markets face is market liquidity risk.

What Is Stock Liquidity Risk?

Stock liquidity risk refers to a situation where an investor cannot sell a stock quickly and at a price close to its fair value. Stocks with low trading activity and limited participation from buyers and sellers are more vulnerable to this risk.

Practical Example:

Imagine you purchased shares of a small company. After negative news breaks, you want to sell quickly. Due to the lack of sufficient buyers, you are forced to sell the shares at a much lower price than their true value. This scenario is a clear example of liquidity risk in the stock market.

The Impact of Trading Volume and Market Depth on Stock Liquidity

Two key factors determine the liquidity of a stock: daily trading volume and market depth.

- High trading volume indicates that a stock is frequently bought and sold, which increases its liquidity.

- Market depth refers to the presence of multiple buy and sell orders at different price levels. The greater the market depth, the easier it is for investors to execute trades without causing significant price fluctuations.

Stocks with low trading volume and shallow market depth are more exposed to liquidity risk.

The Relationship Between Bid-Ask Spread and Liquidity Risk

One of the key indicators for measuring liquidity risk in stocks is the bid-ask spread, which represents the gap between the highest bid price and the lowest ask price.

- Narrow spread: Indicates high liquidity and active participation of traders in the market.

- Wide spread: Signals low liquidity and higher transaction costs for investors.

Large, actively traded stocks—such as those of index-leading companies—typically have very narrow spreads, while smaller or thinly traded stocks tend to carry wider spreads and pose higher liquidity risk.

Factors Contributing to Liquidity Risk

Liquidity risk is the result of a combination of economic conditions, monetary policies, and even the psychological behavior of investors. Understanding these factors helps banks, corporations, and traders prepare for potential crises.

Economic Conditions and Financial Crises

Economic recessions, high inflation, or global financial crises can directly impact liquidity. In such situations, asset values decline and markets face a shortage of buyers. For example, during the 2008 financial crisis, many banks were unable to liquidate their assets quickly, triggering a wave of bankruptcies and subsequent government bailouts.

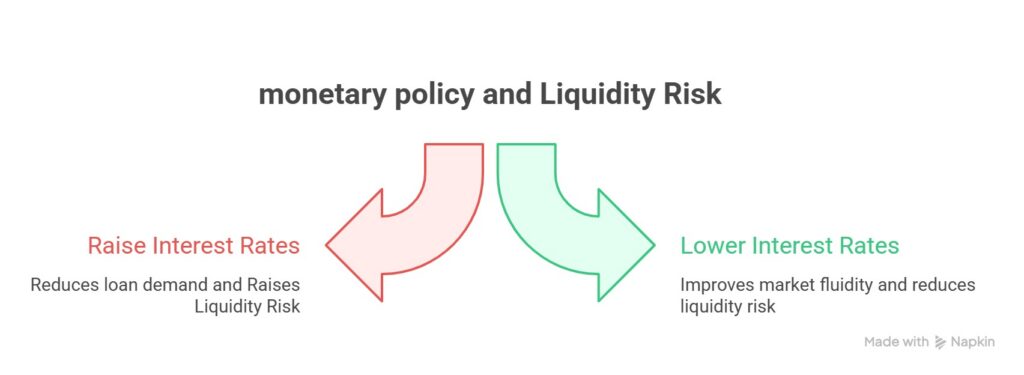

Monetary and Banking Policies

Central bank decisions regarding interest rates, money supply, or credit restrictions are among the most influential drivers of liquidity risk.

- Rising interest rates typically reduce demand for loans and make it harder to liquidate assets.

- Conversely, expansionary monetary policies—such as lowering interest rates or injecting liquidity—can improve market fluidity and reduce liquidity risk.

Investor Distrust and Emotional Behavior

Financial markets are highly sensitive to investor sentiment and confidence. A mere rumor about the weakness of a bank or company can trigger a wave of selling or deposit withdrawals. These emotional reactions—often lacking any rational basis—can escalate into a full-blown liquidity crisis.

Consequences of Liquidity Risk for the Economy and Investors

Liquidity risk is not just a challenge limited to banks or corporations; its effects can ripple across the entire economy and financial markets. It not only raises funding costs but also depresses asset values and can even create a domino effect in the broader economy.

Rising Funding Costs for Banks and Corporations

When liquidity risk increases, banks and companies must pay higher interest rates to attract capital or secure cash resources. For example, a company attempting to issue debt during a liquidity crisis will need to offer a higher coupon rate to entice investors. This reduces profitability while placing additional pressure on customers and shareholders alike.

Decline in Asset and Stock Values in the Market

Liquidity shortages typically drive asset prices downward. When investors or banks are forced to liquidate their holdings quickly, they often sell at prices below fair value. In the stock market, this phenomenon intensifies selling pressure, drives prices lower, and ultimately results in losses for both retail and institutional investors.

The Domino Effect on Financial Markets and the Broader Economy

One of the most dangerous consequences of liquidity risk is the domino effect. A crisis in a single bank or corporation can quickly spread to other parts of the financial system. For example, the collapse of a bank due to a depositor run undermines not only that institution but also public confidence in the entire banking sector. This chain reaction can lead to economic recession, reduced investment, and even rising unemployment at the macroeconomic level.

Liquidity risk is not merely a threat to a bank’s balance sheet or an investor’s portfolio; if left unchecked, it can escalate into a widespread crisis capable of shaking the very foundations of the entire economy.

Strategies for Managing and Mitigating Liquidity Risk in Banks and Capital Markets

Although liquidity risk cannot be completely eliminated, it can be effectively managed and significantly reduced through a set of proper tools and policies. Below are some of the key strategies:

The Role of Central Banks and Regulatory Authorities in Controlling Liquidity Risk

Central banks and regulators serve as the first line of defense against liquidity crises. By establishing requirements such as liquidity ratios within frameworks like Basel III, they mandate banks to maintain a minimum level of liquid assets at all times. In addition, central banks can provide emergency credit lines, which act as a safeguard against depositor runs or liquidity shortages within the banking system during periods of stress.

Basel III is an international regulatory framework for banks, developed in the aftermath of the 2008 financial crisis. Its goal is to enhance the stability and resilience of banks against financial shocks by setting stricter capital and liquidity requirements.

Liquidity Management Strategies in Banks and Financial Institutions

Liquidity management is an internal process that banks and financial institutions use to ensure their ability to meet day-to-day obligations. This process focuses on planning, monitoring, and allocating internal resources so that the bank consistently maintains a safe liquidity position. The key approaches include:

- Monitoring daily cash flows;

- Maintaining cash reserves and highly liquid assets;

- Managing maturity mismatches;

- Diversifying investments and balancing between high-risk and liquid assets.

Choosing Highly Liquid Stocks to Reduce Investment Risk

In capital markets, investors should pay close attention to stock liquidity. Selecting stocks with high trading volumes and narrow bid-ask spreads reduces the likelihood of being trapped in a liquidity crisis.

Conclusion

Liquidity risk is a silent threat to banks, corporations, and investors alike. While it cannot be entirely eliminated, its impact can be minimized through smart management, adherence to regulatory standards, and the selection of liquid assets. Ultimately, recognizing this risk and responding to it promptly is the key to preserving financial stability and achieving long-term investment success.