The terms “bullish” and “bearish” have a long history in financial markets, dating back to the 18th century. They are used to describe market sentiment, with “bullish” indicating an expectation of rising prices and “bearish” indicating an expectation of falling prices.

Understanding whether the market is bullish or bearish helps investors make informed decisions about buying, holding, or selling assets.

Origin of “Bullish”

The term “bullish” is derived from the behavior of bulls. When bulls attack, they thrust their horns upward, symbolizing an upward movement. This action metaphorically represents the optimism and aggressive buying that leads to rising market prices.

Origin of “Bearish”

The term “bearish” comes from the behavior of bears. When bears attack, they swipe their paws downward, symbolizing a downward movement. This action metaphorically represents the pessimism and aggressive selling that leads to falling market prices.

Historical Context

The use of these terms can be traced back to the London Stock Exchange in the 18th century. Speculators and traders would use the actions of bulls and bears to describe market movements.

These terms became more widely adopted and standardized with the development of Wall Street and modern stock exchanges in the 19th century.

Symbolism and Usage

Bullish indicates confidence, aggressive buying, and an expectation of increasing prices. Investors might say, “I’m bullish on this stock,” meaning they believe the stock’s price will go up.

Bearish indicates caution, aggressive selling, and an expectation of decreasing prices. Investors might say, “I’m bearish on this market,” meaning they believe the market will decline.

The imagery of bulls and bears has become deeply ingrained in financial culture, often depicted in statues, artworks, and media, symbolizing the constant push and pull between optimism and pessimism in financial markets.

Bullish and Bearish Concepts

Bullish

A bullish outlook indicates optimism about the future of a particular asset, market, or economy. Investors who are bullish believe that prices will rise, leading them to buy and hold assets in anticipation of future gains.

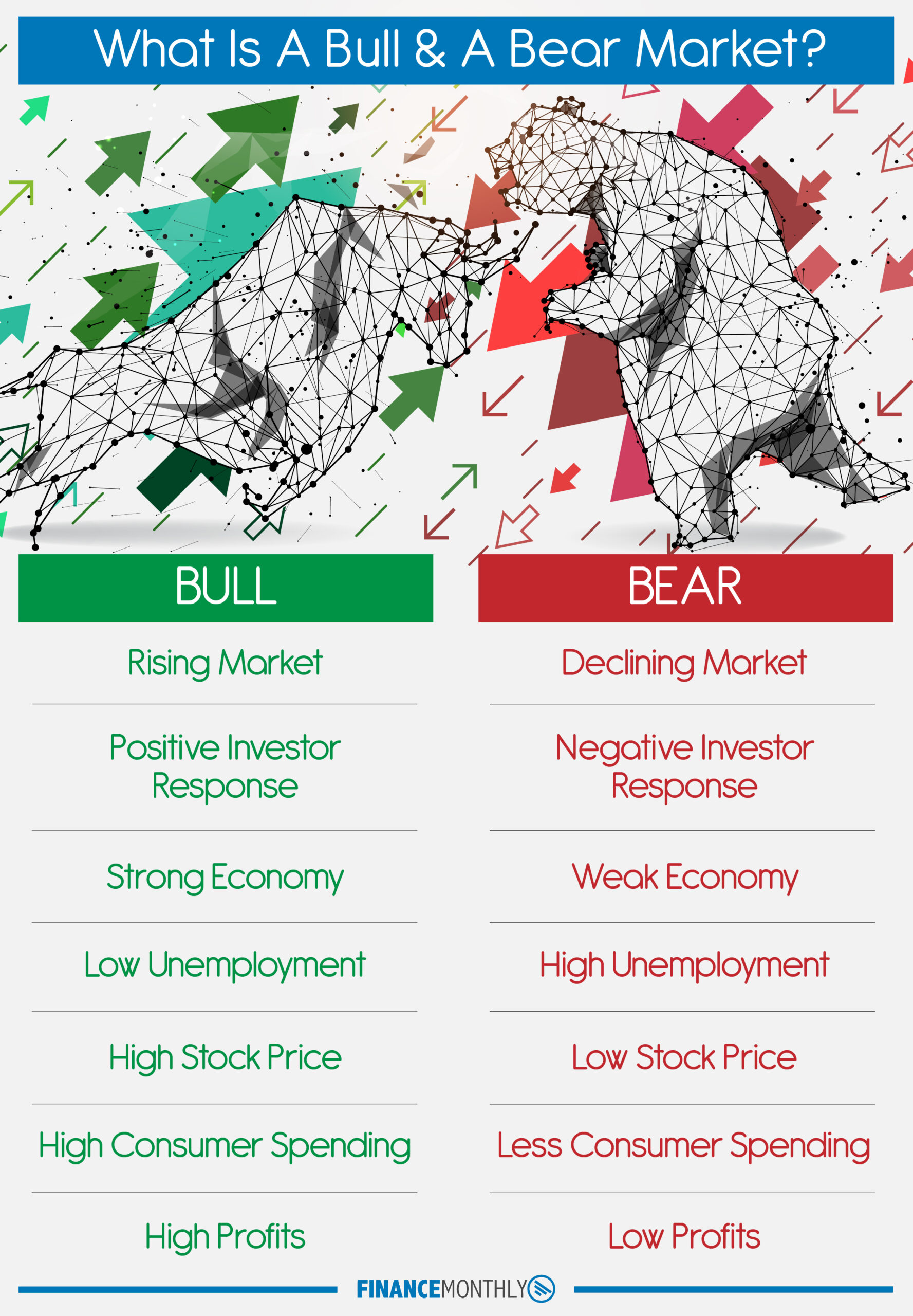

Characteristics of a Bullish Market:

- Rising Prices: Asset prices consistently increase.

- High Trading Volume: More transactions occur as confidence grows.

- Positive Economic Indicators: Strong GDP growth, low unemployment, and high consumer confidence.

- Investor Confidence: Widespread belief in sustained economic or sectoral growth.

Bearish

A bearish outlook signifies pessimism about the future of a particular asset, market, or economy. Investors who are bearish believe that prices will fall, leading them to sell assets or avoid buying them.

Characteristics of a Bearish Market:

- Falling Prices: Asset prices consistently decrease.

- Low Trading Volume: Fewer transactions occur as confidence wanes.

- Negative Economic Indicators: Weak GDP growth, high unemployment, and low consumer confidence.

- Investor Caution: Widespread belief in an economic downturn or sectoral decline.

Famous Examples

Bullish Examples

- Dot-com Boom (Late 1990s):

The rapid rise of internet-based companies led to a significant bull market in tech stocks. Investors were highly optimistic about the potential of internet businesses, leading to soaring stock prices.

- Post-2008 Financial Crisis Recovery:

Following the 2008 financial crisis, the global stock markets entered a prolonged bull market. Economic recovery measures, low-interest rates, and quantitative easing policies contributed to investor confidence and rising stock prices.

- Bitcoin and Cryptocurrency Surge (2020-2021):

Bitcoin and other cryptocurrencies saw massive price increases, driven by growing institutional adoption, technological advancements, and speculative trading.

Bearish Examples

- Great Depression (1929-1939):

The stock market crash of 1929 led to a prolonged bearish market. Economic hardship, high unemployment, and widespread pessimism dominated this period.

- Dot-com Bust (2000-2002):

Following the dot-com boom, many internet companies failed to deliver on their promises, leading to a sharp decline in tech stocks and a broader market downturn.

- 2008 Financial Crisis:

Triggered by the collapse of the housing bubble and financial institutions, global markets experienced a severe bear market. Stock prices plummeted, and investor confidence was shattered.

Market Sentiment Indicators

To gauge whether the market is bullish or bearish, investors often look at various indicators as below:

- Movements in stock markets indexes like the S&P 500, Dow Jones, and NASDAQ.

- economic Reports like GDP growth rates, unemployment rates, consumer spending, and inflation rates.

- Company performance and earnings reports.

- Sentiment surveys such as the American Association of Individual Investors (AAII) Sentiment Survey.

- Chart patterns, moving averages, and other technical indicators.