In the name of God

Crypto Exchange

The rapid growth of cryptocurrencies has transformed the financial landscape, giving rise to a thriving ecosystem of digital assets. At the heart of this ecosystem are cryptocurrency exchanges, the digital marketplaces where users can buy, sell, and trade various cryptocurrencies. Over the years, exchanges have played a pivotal role in shaping the cryptocurrency industry, driving innovation, and facilitating the mainstream adoption of digital currencies. In this article, we will explore the evolution of exchanges and their significance in the cryptocurrency world.

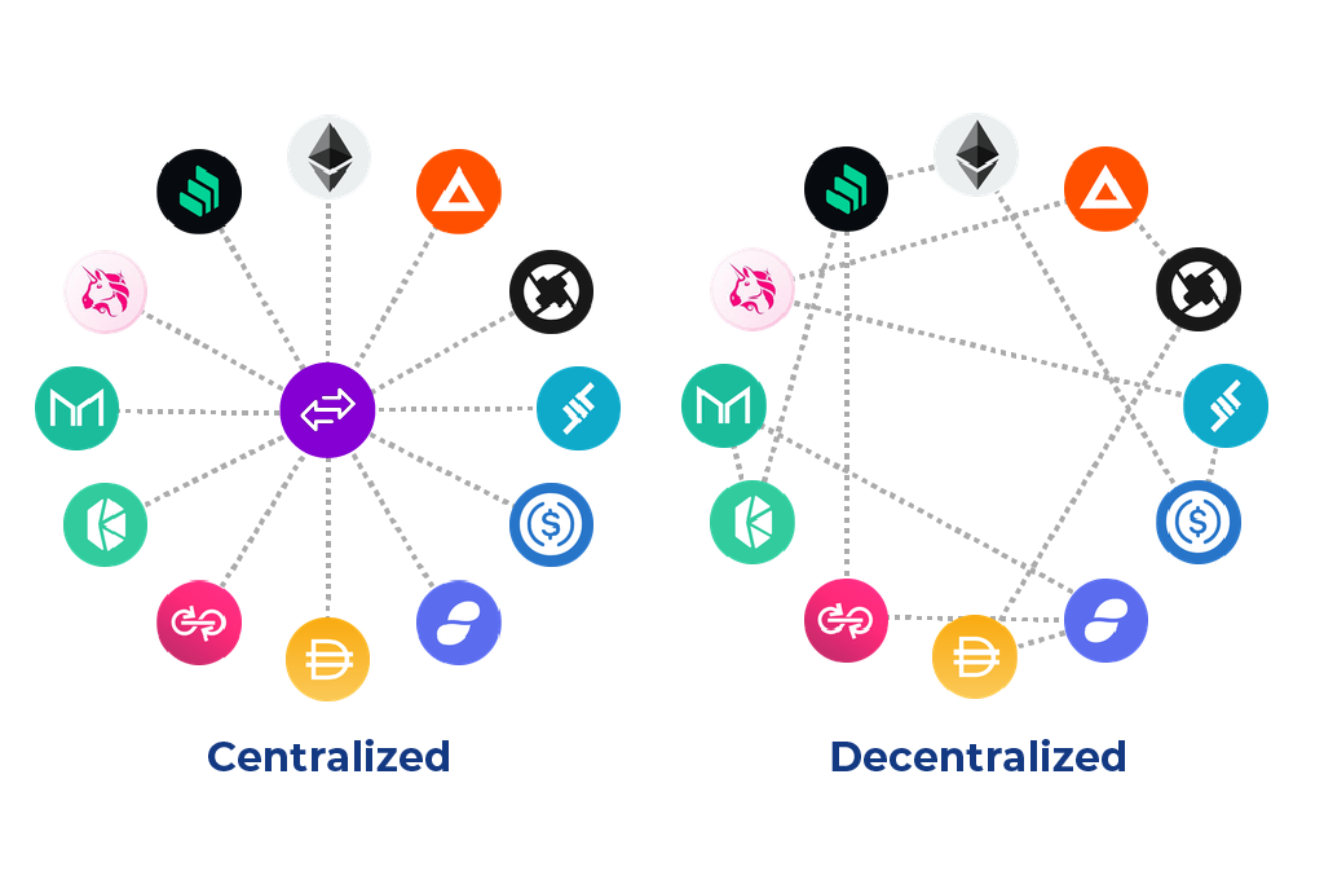

_ Centralized Exchanges :

In the early days of cryptocurrencies, centralized exchanges dominated the market. These exchanges acted as intermediaries, connecting buyers and sellers and facilitating transactions. Centralized exchanges operated on traditional trading principles, where users deposited their funds into the exchange’s custodial wallets, and transactions were executed within the exchange’s internal ledger. Examples of popular centralized exchanges include Coinbase, Binance, and Bitfinex.

Centralized exchanges offered a user-friendly interface, high liquidity, and a wide range of trading pairs, making them attractive to both novice and experienced traders. However, they also faced several challenges, including security vulnerabilities, regulatory scrutiny, and limited control over funds. The centralized nature of these exchanges made them susceptible to hacking incidents, which resulted in significant losses for users and damaged trust in the industry.

_ The Rise of Decentralized Exchanges (DEXs) :

To address the limitations of centralized exchanges, decentralized exchanges (DEXs) emerged as an alternative solution. DEXs operate on blockchain technology, utilizing smart contracts to automate the trading process and eliminate the need for intermediaries. By removing the central authority and allowing peer-to-peer transactions, DEXs aimed to enhance security, user privacy, and control over funds.

DEXs gained popularity due to their decentralized nature, which aligned with the core principles of cryptocurrencies – decentralization, transparency, and censorship resistance. Platforms like Uniswap, SushiSwap, and PancakeSwap became pioneers in the DEX space, offering users the ability to trade directly from their wallets without the need to deposit funds into a centralized exchange.

While DEXs have brought significant advantages to the table, such as reducing the risk of hacking and increasing user privacy, they also face challenges. DEXs generally suffer from lower liquidity compared to centralized exchanges, resulting in higher slippage and less competitive pricing. Additionally, DEXs are still grappling with scalability issues and user experience hurdles, which limit their mass adoption.

_ Centralized-DEX (CEX-DEX) Exchanges (Hybrid model) :

Recognizing the strengths and weaknesses of both centralized and decentralized exchanges, a new breed of exchanges known as centralized-DEX (CEX-DEX) exchanges has emerged. These exchanges aim to combine the best features of both worlds, offering users the benefits of decentralized trading while providing the liquidity and user experience of centralized exchanges.

CEX-DEX exchanges leverage the power of blockchain technology and smart contracts to enable peer-to-peer trading directly from users’ wallets, similar to DEXs. However, they also integrate order books and liquidity pools from centralized exchanges, allowing users to tap into a larger trading ecosystem. Examples of CEX-DEX exchanges include Serum, 1inch, and Loopring.

By adopting a hybrid approach, CEX-DEX exchanges address the liquidity challenges faced by DEXs while preserving the security and control over funds associated with decentralized trading. These exchanges are seen as a bridge between the traditional financial system and the decentralized world of cryptocurrencies, attracting both institutional and retail investors.

Exchanges have played a crucial role in the development and maturation of the cryptocurrency industry. From the early days of centralized exchanges to the rise of DEXs and the emergence of CEX-DEX hybrids, exchanges have evolved to meet the diverse needs of traders and investors. Each type of exchange brings its own set of advantages and challenges, and the future of exchanges in the cryptocurrency world is likely to be shaped by a combination of centralized, decentralized, and hybrid models.

As the cryptocurrency ecosystem continues to grow and evolve, exchanges will remain at the forefront, driving innovation, fostering liquidity, and enabling seamless trading experiences. It is essential for users to conduct thorough research, consider their specific requirements, and choose the exchange that best aligns with their needs, ensuring a secure and efficient journey in the exciting world of cryptocurrencies.