Position size determines what happens to your account if your analysis turns out to be right—or wrong. When calculated correctly, even losses become a natural part of the trading journey. But if ignored, a small market move could be enough to wipe out a large portion of your capital. So, the real question is: do you actually know how much volume you should allocate to each trade?

If you want to learn what position size is, why it matters, and how to calculate it, stay with us until the end of this article.

Key Points:

|

What Is Position Size in Forex?

Position size simply refers to the actual volume of a trade you open in the market. It shows how much of a currency pair or financial asset you are buying or selling in a single transaction. Choosing the correct position size is the core of risk management in Forex, as it determines how much profit or loss you will experience with each price movement.

For a more detailed explanation and examples of position sizing techniques, check out this guide by Quantified Strategies.

In Forex, trades are measured in lots, and each lot represents a specific amount of the base currency:

- Standard Lot: Equals 100,000 units of the base currency;

- Mini Lot: Equals 10,000 units of the base currency;

- Micro Lot: Equals 1,000 units of the base currency.

Example

Suppose your trading account balance is $10,000 and you want to trade the EUR/USD pair:

- If you buy 1 Standard Lot, you are essentially trading €100,000 against the U.S. dollar. In this case, every 1-pip movement in price equals $10 in profit or loss.

- If instead you trade 1 Mini Lot, your position size is €10,000, and the value of each pip is only $1.

- If you trade 1 Micro Lot, you are trading just €1,000, and each pip is worth $0.10 (10 cents).

Now, imagine in a buy trade the EUR/USD price rises by just 50 pips:

- With 1 Standard Lot, your profit would be $500.

- With 0.1 Lot (Mini Lot), your profit would be $50.

- With 0.01 Lot (Micro Lot), your profit would be $5.

This example clearly shows that your choice of position size determines not only the level of risk but also your potential profit.

Why Is Position Size Important in Risk Management?

Position size is one of the most critical factors that can make the difference between a successful trader and a losing one. Even the best strategies and most accurate analyses can lead to heavy losses if the proper position size is not respected. In fact, choosing the right trade volume determines how much of your account is at risk if the market moves against you.

If your position size is too large, even a small market fluctuation can wipe out a significant portion of your trading account. On the other hand, if your position size is too small, you won’t be able to take full advantage of profitable opportunities. If you’re new to risk management in Forex, ThinkMarkets’ position sizing guide

Therefore, finding the right balance when choosing position size is the most important step toward survival and sustainable profitability in the market.

The Relationship Between Position Size and Risk-to-Reward Ratio

One of the golden rules of money management is maintaining the risk-to-reward ratio. This ratio shows how much potential profit you expect in return for the risk you take in a trade.

Position size is directly linked to this ratio. For example, suppose you decide to risk 100 pips in a trade with a target profit of 200 pips. If your position size is too large, the loss from 100 pips could become unreasonably heavy and put your account at serious risk. On the other hand, by adjusting your position size in proportion to your account balance and acceptable risk percentage (for instance, 1% or 2% per trade), you can ensure that even if the trade results in a loss, your capital remains safe, giving you the chance to take advantage of future opportunities.

Simply put, position size is your control tool for balancing risk and reward.

The Impact of Position Size on Margin and Leverage

Position size not only affects the level of risk in a trade but also directly influences the required margin and the extent of leverage used.

The larger the position you open, the more margin will be locked from your account. This means you will have less free margin available to withstand market fluctuations. At the same time, larger positions increase your leverage usage, which can multiply potential profits but also raise the risk of a margin call and rapid loss of capital.

This is why professional traders always calculate their position size carefully—to benefit from leverage while maintaining full control over account risk.

Methods of Calculating Position Size in Forex

One of the most important skills every trader must master is the ability to correctly calculate position size before entering a trade. There are several methods for determining position size, which we will explore below.

Manual Calculation Based on Equity and Acceptable Risk

One of the simplest and most commonly used methods of calculating position size is based on account equity and the percentage of risk the trader is willing to accept per trade. According to Investopedia, in this method, position size is calculated by dividing the maximum acceptable loss per trade by the maximum acceptable loss per share (or per unit):

Position Size = Maximum Acceptable Loss per Trade ÷ Maximum Acceptable Loss per Share

To clarify, let’s look at an example:

Suppose a trader has a $10,000 account and sets their acceptable risk per trade at 2%. This means the trader should not lose more than $200 on a single trade.

Now, imagine this trader wants to buy stock X, priced at $100 per share, with a stop-loss set at $90 (a $10 risk per share).

In this case, the appropriate position size would be:

Position Size = 200 ÷ 10 = 20 shares

This means that with a $10,000 account and a 2% risk level, the trader can buy a maximum of 20 shares at $100 each. If the price falls to the stop-loss level of $90, the total loss will be exactly $200—within the defined risk limit.

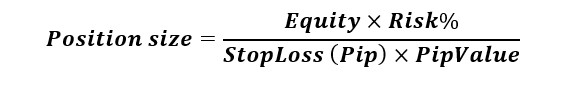

Using the Lot Size Formula

Another method for calculating the appropriate position size is by using the lot size formula.

The general formula for calculating lot size (position size) is as follows:

Practical Example

Suppose you have an account with the following details:

- Account Balance (Equity): $10,000

- Acceptable Risk: 2% (i.e., $200)

- Stop-Loss: 50 pips

- Trading Pair: EUR/USD

In major Forex pairs, the pip value for one standard lot is $10.

In this case, the appropriate lot size (position size) would be:

Position Size = 0.4 Standard Lots

This means you should enter the trade with a volume of 0.4 standard lots. That way, if the market moves against your analysis and the 50-pip stop-loss is triggered, you will lose only 2% of your total account ($200), which matches your predefined risk limit.

| Since the pip value in a standard lot equals $10, the pip value in a trade with a size of 0.4 standard lots will be $4. |

Introducing the Position Size Calculator

While manual calculations and formulas are accurate, in practice they can be time-consuming and sometimes confusing. For this reason, many traders use a Position Size Calculator, which is available online or integrated into trading platforms.

| With the Lot Size (Position Size) Calculator from Aron Groups Broker, you can quickly and easily determine the appropriate position size for your trade by entering just a few simple parameters.

To access the Position Size Calculator page, click here. |

Trading Strategies Based on Position Size

Professional traders use different strategies to manage position size depending on market conditions and their trading style. Below are some of the most common methods.

Fixed Lot Position Size

In this method, the trader always enters the market with a fixed volume—for example, always trading 0.1 lot or 1 standard lot—regardless of risk level or changes in account size. This approach is simple and fast, but its main drawback is that the risk does not adjust according to the account conditions.

For instance, if your account balance decreases but you continue trading with the same lot size, the percentage of risk you take on each trade will gradually increase. This method is more suitable for traders with relatively large capital, where account fluctuations do not significantly affect their psychology.

Dynamic Position Sizing

In the dynamic method, the position size is always adjusted according to account equity and the acceptable risk level. This way, whether your account grows or declines, the amount of risk per trade remains constant and controlled. This is the approach professional traders use to ensure long-term sustainability and to avoid severe drawdowns.

Combining Position Size Strategy with the Third Trendline Touch

One professional approach to risk management is combining position size with reliable technical signals. In price action trading, the third touch of a trendline is considered one of the strongest signals, since after two previous reactions, the probability of a strong market response on the third touch increases.

In such a scenario, the trader can manage position size in a scaling-in approach. For example, they may initially risk only part of the allowed exposure (say, 50%) at the third touch, and if the price reaction is confirmed by the following candle (such as a pin bar or engulfing pattern), they can add the remaining position size.

This method offers several key advantages:

- The initial risk is reduced;

- Trade entry is executed with greater precision and caution;

- The risk-to-reward (R/R) ratio is improved.

Practical Example

In the chart below, a downtrend line is marked with three points of contact. The third touch is often recognized as a valid entry point in the direction of the prevailing trend. After this touch, the trader can calculate the appropriate position size based on the predefined stop-loss and the account’s acceptable risk, and then enter only part of the position. If the following candle confirms the trend reversal, the remaining position size can be added.

This approach ensures that you benefit from a strong technical signal while managing risk at a more professional level.

Common Mistakes in Choosing Position Size

One of the main reasons trading accounts get wiped out is incorrect position sizing. Even the best strategies, if paired with an illogical position size, will ultimately lead to heavy losses. Below are some of the most common mistakes in this area:

- Overrisking on Each Trade: Many beginner traders, driven by excitement or greed, enter trades with oversized positions. The outcome is usually one or two losing trades that wipe out a large portion of their account.

- Ignoring the Stop-Loss: Without setting a stop-loss, calculating position size becomes meaningless. If a trader doesn’t define a stop-loss, the level of risk per trade remains unknown, and any sudden market movement can cause irreparable damage.

- Keeping Trade Size Fixed Without Considering Equity Changes: Some traders always trade with the same volume, even when their account balance has decreased. This increases the risk-to-capital ratio and raises the likelihood of a margin call.

- Ignoring Leverage and Margin: Sometimes traders focus only on trade volume and forget how leverage and required margin affect actual risk. This oversight leads to opening positions beyond the account’s capacity, which can trigger a margin call at the first major market swing.

- Not Understanding Currency Pair Differences and Pip Value: The pip value is not the same across all pairs. For example, in EUR/USD, one pip in 1 standard lot equals $10, but in USD/JPY or cross pairs, the value can differ. Ignoring this detail means the trade size may not truly match the intended risk.

- Emotional Trading and Adjusting Position Size Based on Feelings: A common mistake is when traders, after several consecutive losses, increase their trade size in an attempt to recover quickly—leading to overtrading. This emotional behavior often results in even larger losses.

| The Golden Rule: Never risk more than 1% to 2% of your account on a single trade. |

Conclusion

Position size is not a random number—it is your most important tool for controlling risk and ensuring long-term survival in the market. Choosing the right trade size prevents even your best strategies from being destroyed by excessive risk, while still allowing you to take advantage of price movements in a logical and sustainable way. In reality, mastering position sizing is the key to balancing profitability and survival in Forex.