How many times have you taken a loss and immediately felt the urge to jump back into the market to “get your money back”? That’s the classic trap of revenge trading. Unlike other forms of emotional trading, revenge trading comes from anger, frustration, and loss aversion. In this guide, we will explore what revenge trading is, why it happens, and proven methods to stop it — with insights from trading psychology and risk management strategies.

- Revenge trading often begins not immediately after a loss, but from a subconscious urge to “prove oneself right.”

- Ignoring subtle emotional reactions, such as impatience or irritation, increases the risk of revenge trades.

- Even minor breaches of a pre-defined risk limit can trigger a chain of impulsive revenge trades.

- Revenge trading is fueled by a combination of cognitive biases, fear, and a memory of prior wins, rather than a single loss.

- Keeping a micro-journal of emotional cues alongside trades helps spot early signs of revenge trading.

What Is Revenge Trading and How Is It Different from Other Emotional Trading?

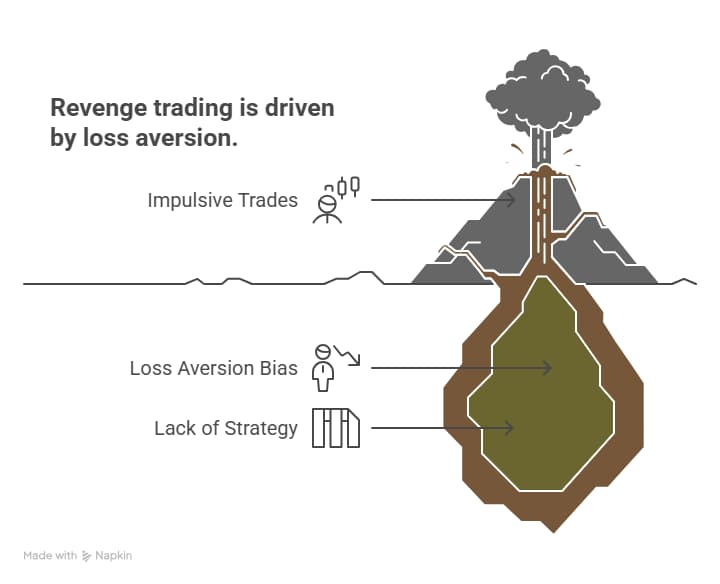

Revenge trading occurs when a trader attempts to recoup losses quickly by making impulsive trades without conducting proper analysis or employing a well-defined strategy. Unlike fear-based trading or greed-driven trading, revenge trading is strongly tied to loss aversion bias — the psychological tendency to fear losses more than we value gains.

Example: A trader loses $500 on EUR/USD and immediately doubles their position size without a clear entry signal, hoping to win back the loss.

Common Signs of Revenge Trading

Recognizing the early warning signs of revenge trading is crucial for protecting both your trading account and your mental state. These signs often appear immediately after a significant loss, when emotions take precedence over discipline. By identifying them, traders can pause before falling into the destructive cycle of overtrading and poor risk management.

Rushing to Recover Losses

One of the most apparent indicators of revenge trading is the urge to instantly “win back” money lost in a previous trade. Instead of waiting for a valid setup, traders enter new positions impulsively, often ignoring technical signals, fundamental analysis, or even market conditions. This behavior is typically fueled by loss aversion bias, where the pain of losing feels unbearable, pushing traders to act irrationally.

Increasing Position Size Without Analysis

A dangerous escalation occurs when traders double or triple their lot size after a loss, hoping for a quick recovery. This practice is a textbook example of overtrading, where risk exposure exceeds acceptable limits. Without proper analysis or confirmation, oversized trades often lead to even greater losses, creating a vicious cycle of emotional and financial damage.

Consecutive Entries Without a Clear Plan

Another common sign of revenge trading is entering multiple trades back-to-back without any predefined strategy. Traders may switch from one currency pair, stock, or cryptocurrency to another, driven by frustration rather than a well-defined plan. This lack of discipline reflects impulsive behavior and often leads to scattered results, inconsistent performance, and faster drawdowns.

Emotional Reactions After a Loss

Revenge trading is deeply tied to emotions. After taking a loss, many traders experience anger, anxiety, fear, or even desperation. Instead of stepping back, they stay glued to the screen and trade emotionally, trying to prove themselves right. These emotional reactions cloud judgment, leading to irrational decisions such as ignoring stop-loss rules, mismanaging risk, or holding onto losing trades for too long.

Traders are more prone to revenge trading after experiencing a sequence of small wins, due to overconfidence and a tendency to underestimate risk.

Why Revenge Trading Is So Dangerous

Revenge trading is not just another emotional trading mistake — it’s one of the fastest ways to destroy a trading account. When traders act out of anger or frustration, they often abandon their trading plan, increase risk per trade, and ignore stop-loss rules. This combination leads to rapid account drawdown, blown accounts, and emotional exhaustion.

Another danger is the loss of objectivity: instead of analyzing the market, traders focus on “winning back” previous losses, which clouds judgment and leads to impulsive trades. Over time, this cycle creates a negative feedback loop, where losses lead to more revenge trades, and these in turn lead to even bigger losses.

Example: A day trader loses $1,000 on Bitcoin, doubles the position size without confirmation, and loses again — resulting in a $3,000 loss in a single day.

Revenge trading is amplified in markets with thin liquidity, where price swings exaggerate emotional responses to small losses.

The Psychology Behind Revenge Trading

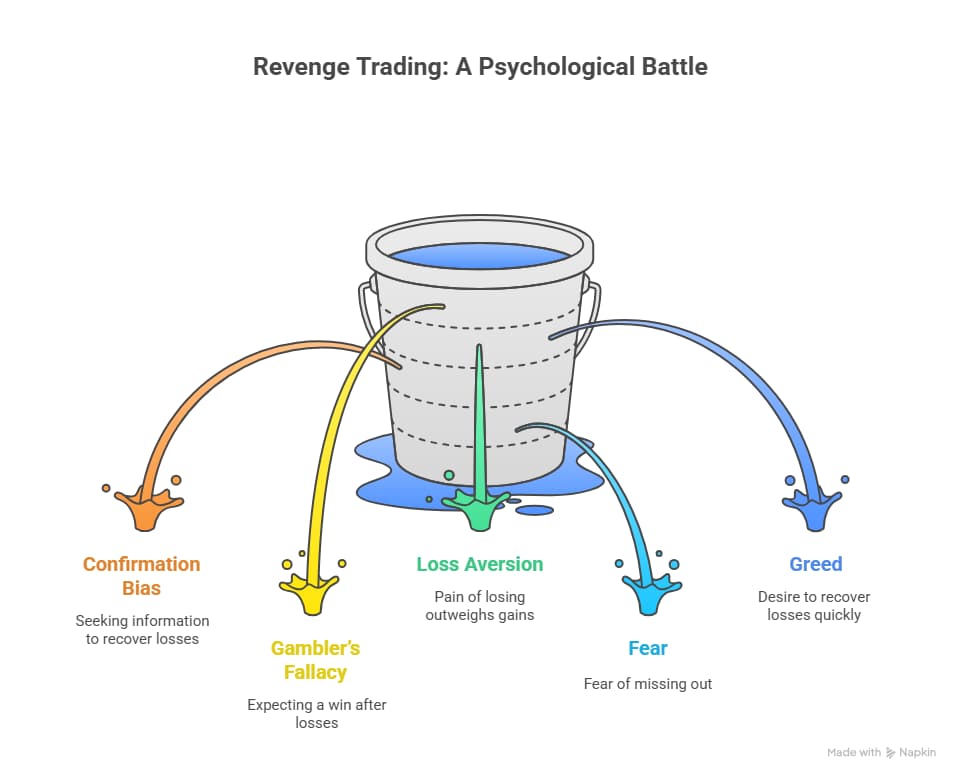

To effectively stop revenge trading, traders must first understand the psychological mechanisms that drive it. Several cognitive biases and emotional triggers prompt traders to adopt a revenge mindset.

Cognitive Biases and Mental Traps

Cognitive biases are mental shortcuts that often lead to poor decision-making in trading. Two of the most common in revenge trading are:

- Confirmation Bias – The tendency to seek only information that supports the belief that you can recover losses quickly.

- Gambler’s Fallacy – Believing that after a series of losses, a “big win” is due, even though each trade is independent.

These mental traps give traders a false sense of control, encouraging them to keep trading recklessly.

Loss Aversion in Decision-Making

According to BehavioralEconomics.com, people experience the pain of losing money about twice as strongly as the pleasure of winning the same amount. This phenomenon is called loss aversion.

In trading, this means a $500 loss feels far worse than a $500 gain feels good. As a result, traders feel compelled to “erase” that pain by immediately trying to win the money back — a direct trigger for revenge trading.

Example: A trader who loses on a EUR/USD trade may disregard their risk plan and immediately re-enter with a larger lot size, hoping to mitigate the emotional discomfort.

The Role of Fear and Greed

Two of the strongest emotions in trading — fear and greed — are at the heart of revenge trading.

- Fear: Fear of being wrong, missing out, or not being able to recover losses.

- Greed: The desire to recover losses quickly or even profit beyond them.

Together, fear and greed create a potent combination that drives traders to abandon logic and discipline. Instead of sticking to a trading strategy, they chase the market — often leading to even greater losses.

How to Stop Revenge Trading Effectively

Stopping revenge trading requires a combination of discipline, structured strategies, and emotional management. Traders must address both the psychological triggers and the procedural safeguards to break the cycle.

Build and Stick to a Detailed Trading Plan

A well-defined trading plan is the foundation for preventing revenge trades. It should include:

- Clear entry and exit rules;

- Position sizing based on risk tolerance;

- Predefined stop-loss and take-profit levels.

Following a structured plan keeps traders accountable and reduces impulsive behavior.

Example: A trader sets a rule to risk only 1% of their account per trade. Even after a loss, they cannot arbitrarily increase the lot size, preventing emotional overtrading.

Always Use Stop-Loss and Risk Management

Effective risk management is the most vigorous defense against the emotional urge to “win it back.” Stop-losses prevent single trades from wiping out accounts, while position sizing controls exposure.

Example: After losing $200 on a trade, the trader maintains the 1% risk per trade limit on the next entry, ensuring that losses do not escalate due to revenge trading.

The presence of algorithmic signals or misleading news headlines can subconsciously reinforce the desire for immediate “revenge” trades.

Keep a Trading Journal to Track Emotions

Recording both trades and emotional states allows traders to identify patterns that trigger revenge trading.

Example: Logging thoughts like “felt anxious after yesterday’s loss” alongside the trade results highlights emotional triggers and helps prevent repeated mistakes.

Step Away from the Market When Emotional

Sometimes the best action is no action. Taking a break after a loss resets the mind and allows rational decision-making.

Example: A trader closes the laptop for an hour after a losing trade instead of immediately entering another position, reducing the chance of impulsive revenge trades.

Apply Emotional Management Techniques

Techniques such as mindfulness, meditation, deep breathing, and physical activity help traders regulate their emotional responses and maintain clarity during stressful periods.

Example: Before placing a trade, a trader practices a 5-minute mindfulness exercise to calm anger and anxiety, ensuring decisions are rational.

Seek Guidance from a Mentor or Trading Psychologist

External accountability can break the cycle of revenge trading. A mentor or psychologist can help:

- Identify cognitive biases;

- Offer perspective on losses;

- Suggest strategies for emotional regulation.

Example: A mentor reviews a trader’s weekly performance and points out impulsive trades triggered by recent losses, providing corrective guidance.

Conclusion

Stopping revenge trading is not just about controlling losses; it’s about controlling yourself. By combining a strict trading plan, proper risk management, emotional awareness, and professional guidance, traders can avoid the psychological traps of revenge trading and maintain long-term profitability. Two of the strongest emotions in trading, fear and greed, are at the heart of revenge trading.