If you’ve ever wondered why a single central bank decision can suddenly cause bond prices to plunge, equities to swing, and the forex market to turn volatile, the answer lies in interest rate risk. This hidden but powerful force casts its shadow across all financial markets.

In this article, you’ll learn how interest rate risk works, why it affects bonds, stocks, currencies, and even gold, and—most importantly—which innovative strategies can help protect your investments against it.

- Interest rate risk is a type of systematic risk that can only be mitigated through active risk management.

- A mix of swaps, options, futures, maturity diversification, laddered bond purchases, and counter-cyclical assets provides the strongest shield against interest rate shocks.

- Any change in interest rates can alter corporate borrowing costs and, consequently, their profitability.

- Rising or falling interest rates are not always just risks; for savvy investors, they can also create opportunities to rebalance portfolios and capture higher returns.

What Is Interest Rate Risk?

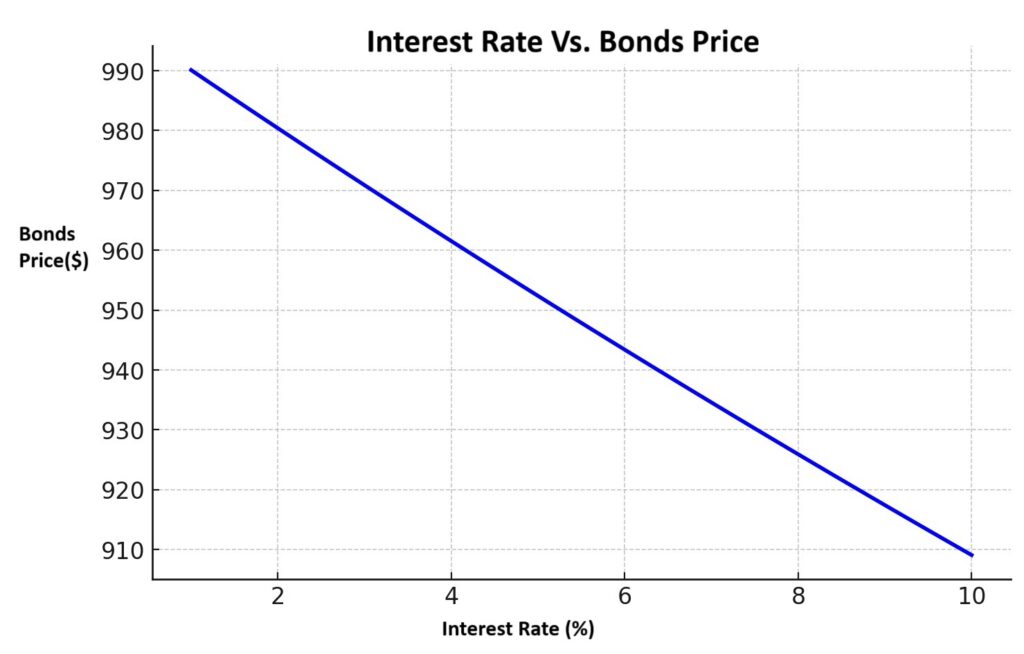

According to CFI, interest rate risk refers to the potential decline in the value of financial assets due to unexpected fluctuations in interest rates. This risk primarily affects fixed-income securities such as bonds, since their prices have an inverse relationship with interest rates. Put simply, whenever interest rates rise, the market price of existing bonds falls—and vice versa.

For example, consider an investor who purchases a 5-year bond worth $500 with a 3% coupon rate. If market interest rates climb to 4%, newly issued bonds with higher yields become more attractive, forcing the investor to sell the existing bond at a discount, below $500. Conversely, if rates drop to 2%, that same 3% bond gains value and will trade at a premium above its face value.

The reason behind the inverse relationship between interest rate risk and bond prices lies in the concept of opportunity cost. When interest rates rise, new bonds are issued with higher yields, making older bonds with lower rates less attractive to investors. As a result, the price of existing bonds must fall in order to remain competitive in the market.

Why Are Interest Rate Changes Considered a Risk?

Interest rates are one of the key drivers in financial markets, and fluctuations can directly affect the value of assets. When interest rates rise, the price of fixed-income securities declines because newly issued bonds with higher yields become more attractive. Conversely, when rates fall, older bonds with higher coupons gain value.

This is why interest rate changes are classified as a systematic risk—a type of risk that no investor can completely escape, regardless of portfolio diversification.

The degree of a bond’s price sensitivity to interest rate changes is measured by an indicator known as Duration.

Types of Interest Rate Risk

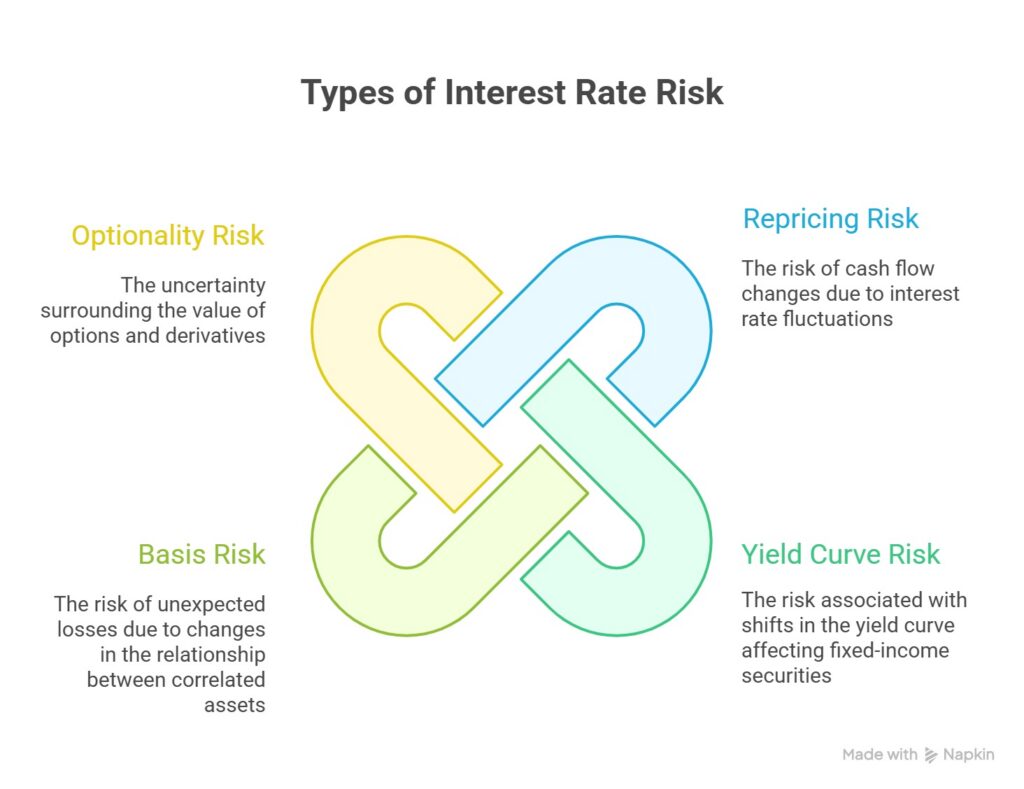

Interest rate risk is not limited to the rise or fall in bond values; it manifests in different forms and can challenge the profitability and financial stability of companies and banks. Understanding these types of risk helps investors make better decisions and safeguard their portfolios against market volatility. According to Finance Strategists, the main types of interest rate risk include:

- Repricing Risk;

- Yield Curve Risk;

- Basis Risk;

- Optionality Risk.

Repricing Risk

This risk arises when a bank’s or company’s assets and liabilities are repriced at different times and under new interest rates. If liabilities reprice earlier than assets and interest rates rise, costs increase more quickly while income remains unchanged.

🔹 Simple Example:

Suppose a bank has issued 5-year fixed-rate loans at 10%, but renews customer deposits annually at prevailing market rates. If market rates climb to 15%, the bank must pay higher interest to depositors while still earning only 10% on its loans.

Yield Curve Risk

The yield curve represents the relationship between interest rates and bond maturities. When the shape of this curve changes (for example, flattens or inverts), the value of different assets and liabilities shifts accordingly. Such changes can significantly impact the income of banks or investors.

🔹 Simple Example:

If a bank has issued 10-year loans while funding them with short-term deposits, and the yield curve flattens (meaning short- and long-term rates converge), the bank’s net interest income declines because there is no longer a meaningful spread between returns on long-term assets and the cost of short-term liabilities.

Basis Risk

Basis risk refers to the mismatch in movements between two different benchmark interest rates. It occurs when hedging instruments (such as swaps or futures contracts) are not perfectly aligned with the rate on the underlying asset or liability. As a result, even with hedging, losses may still occur.

🔹 Simple Example:

A bank hedges its loan portfolio tied to LIBOR using a futures contract based on SOFR. If LIBOR and SOFR do not move simultaneously or by the same magnitude, the hedge will be imperfect, and the bank could face losses.

The LIBOR (London Interbank Offered Rate) was the average interest rate at which major international banks in London were willing to lend to one another on a short-term basis. For decades, it served as the global benchmark for pricing loans and financial instruments.

The SOFR (Secured Overnight Financing Rate), on the other hand, is based on actual transactions in the U.S. Treasury repurchase (repo) market—overnight loans collateralized by Treasury securities. It has been introduced as a more transparent and reliable replacement for LIBOR.

Optionality Risk

This risk arises from embedded options within financial instruments—situations where the counterparty has the right to decide whether to settle a contract earlier or later than expected. Such unexpected behavior can disrupt cash flows and alter future income.

🔹 Simple Example:

If interest rates decline, mortgage holders may choose to prepay their loans in order to refinance at lower rates. In this case, the bank loses the future interest payments it would have earned, reducing its profitability.

Factors Contributing to Interest Rate Risk

Interest rate risk is usually the result of a combination of macroeconomic policies, market conditions, and investor expectations. The factors that can drive changes in interest rates—and ultimately affect the value of interest rate–sensitive assets and liabilities—include:

- Central bank monetary policies;

- Inflation and inflation expectations;

- Economic conditions and business cycles;

- Supply and demand dynamics in money and capital markets.

Central Bank Monetary Policies

Central banks play a direct role in shaping interest rates through tools such as changes in interbank lending rates, open market operations, and reserve requirements. Whenever the policy rate rises, borrowing costs increase, and bond prices fall.

🔹 Example: If the Federal Reserve raises interest rates, bonds previously issued with a fixed 3% coupon lose their appeal, as newly issued bonds with higher yields enter the market.

Inflation and Inflation Expectations

Inflation is one of the most important drivers of interest rates. When the general price level rises, investors demand higher returns to preserve their purchasing power. This dynamic leads to higher interest rates and a decline in the value of outstanding bonds.

🔹 Example: If annual inflation in an economy jumps from 4% to 8%, investors will no longer be willing to hold bonds yielding 5%, since their real return effectively becomes negative.

Economic Conditions and Business Cycles

Periods of expansion and recession have a direct impact on interest rate policies. During economic booms, demand for capital rises, pushing interest rates higher. In contrast, during recessions, central banks often lower rates to stimulate economic activity.

🔹 Example: During the COVID-19 recession, many central banks around the world reduced interest rates to encourage borrowing and investment. This move boosted the value of fixed-rate bonds.

Money and Capital Market Supply and Demand

Like any other commodity, interest rates are influenced by supply and demand dynamics. When demand for loans and capital increases, interest rates tend to rise. Conversely, if financial resources are abundant but demand is weak, rates decline.

🔹 Example: In a developing country, if the government borrows heavily to finance large infrastructure projects, the demand for capital surges, driving interest rates higher across the economy.

The factors driving interest rate risk can create volatility in the profitability of fixed-income investments. By understanding these factors and monitoring them closely, investors can develop more effective strategies to manage risk within their portfolios.

How Does Interest Rate Risk Affect Financial Markets?

Interest rate risk is one of the main sources of instability in financial markets, influencing asset values, liquidity flows, and investor decisions both directly and indirectly. Fluctuations in interest rates not only move bond and equity prices but also impact currency and commodity markets. Below, we examine how interest rate risk affects different segments of the market.

Impact of Interest Rate Risk on Bonds and the Debt Market

The bond and debt markets are the most sensitive to interest rate risk. When interest rates rise, the value of existing bonds declines because newly issued bonds with higher yields become more attractive. This risk directly pressures bond prices in the secondary market.

🔹 Practical Example: A fixed-rate bond yielding 5% will only attract buyers at a discount if market rates climb to 7%.

According to Investopedia, long-term bonds are generally more sensitive to interest rate changes and tend to experience larger price swings in response to rate fluctuations. To compensate investors for this added risk, a higher long-term yield—known as the Maturity Risk Premium—is typically offered.

Impact of Interest Rate Risk on the Stock Market and Public Companies

Companies rely heavily on loans and bank credit for financing. Interest rate risk emerges when rate changes increase the cost of capital and put pressure on corporate cash flows. Moreover, in a high-interest-rate environment, investors often pull capital out of equities and shift it into lower-risk bonds.

🔹 Practical Example: When interest rates rise, manufacturing firms are forced to refinance their debt at higher rates, which reduces profitability and, in turn, lowers their stock prices.

Relationship Between Interest Rate Risk and the Forex Market

In currency markets, interest rate risk is tied to the interest rate differential between countries. Rate changes can shift global capital flows, causing significant volatility in exchange rates.

When a country raises its interest rates, foreign investors are drawn in to capture higher returns, boosting demand for that country’s currency and strengthening its value. Conversely, rate cuts often weaken a currency.

🔹 Practical Example: If the Federal Reserve hikes U.S. dollar interest rates, international investors flock to the dollar, driving its value higher against other currencies such as the euro or the Japanese yen.

The Role of Interest Rate Risk in Gold and Commodity Markets

Gold and commodities are also highly sensitive to interest rate risk. These assets typically have an inverse relationship with interest rates. When rates rise, the opportunity cost of holding gold increases, since investors can earn better returns from bonds or bank deposits. As a result, demand for gold falls and its price declines. Conversely, when interest rates drop, gold and commodities become more attractive as safe-haven assets.

Table: Impact of Interest Rate Risk on Different Markets

| Market | Overall Effect of Interest Rate Risk | Example |

|---|---|---|

| Debt Market | Changes in bond values depending on interest rate fluctuations | When rates rise, older bonds lose appeal and their prices fall. |

| Stock Market | Shifts in financing costs and volatility in company valuations | Higher interest rates increase borrowing costs and squeeze profitability. |

| Forex Market | Capital flows between countries and exchange rate volatility | Higher interest rates attract foreign investors, strengthening the currency. |

| Gold & Commodities | Changes in investment appeal and price fluctuations | Gold typically loses appeal when rates rise, since it offers no yield. |

Impact of Interest Rate Risk on Investors and Their Strategies

Depending on their risk tolerance, investment horizon, and asset allocation, investors respond differently to interest rate fluctuations. Below are the main groups and how they are affected by this risk.

Risk-Averse Investors Facing Interest Rate Changes

Risk-averse investors seek to preserve capital while earning stable returns, often allocating funds to low-risk or risk-free assets such as Treasury securities or bank deposits. However, interest rate movements can still impact the value of their holdings:

- When interest rates rise, the value of existing assets declines.

- When interest rates fall, the yield on safe assets diminishes.

Interest Rate Risk for Institutional Investors and Funds

Investment funds, insurance companies, and pension funds are highly exposed to interest rate risk due to their large holdings of fixed-income securities. Rate changes can cause significant fluctuations in their portfolios and may even affect their ability to meet long-term obligations. For this reason, these institutions typically employ hedging instruments to manage interest rate risk.

Different Impacts of Interest Rate Risk on Short-Term vs. Long-Term Investors

An investor’s time horizon plays a crucial role in determining their vulnerability to interest rate risk.

- Short-term investors are generally less affected, since they can reinvest their assets at new rates when short-term maturities expire.

- Long-term investors, on the other hand, face greater exposure because they are locked into fixed-income assets that may lose significant value if rates rise.

🔹 Practical Example: An investor holding a 1-year bond can reinvest at higher rates when it matures if interest rates go up. But an investor locked into a 20-year bond at 4% will suffer a major loss in value if rates rise to 7%.

Methods of Managing and Hedging Interest Rate Risk

Interest rate risk is one of the most significant challenges faced by investors and financial institutions. The key strategies to hedge against it include:

- Diversification within the investment portfolio

- Using derivative instruments (swaps, futures, options)

- Investing in counter-cyclical assets (gold, commodities, currencies)

- Implementing a bond laddering strategy

Diversification in the Investment Portfolio

Diversification is one of the oldest and most effective risk management strategies. When a portfolio includes a mix of assets—such as short- and long-term bonds, equities, gold, or currencies—interest rate changes will only impact part of the capital.

🔹 Example: If an investor holds only long-term bonds, they will face heavy losses when rates rise. However, if part of the portfolio is allocated to equities or gold, the positive performance of these assets can help offset bond losses.

Using Derivative Instruments (Swaps, Futures, Options)

Derivatives are widely used, especially by financial institutions, as a direct way to manage interest rate risk. Common derivative tools for hedging include:

- Interest Rate Swaps: Converting fixed-rate debt into floating, or vice versa, to balance cash flows.

- Interest Rate Futures: Contracts that lock in a specific interest rate for the future.

- Options: Instruments that provide the right (but not the obligation) to buy or sell interest rate–sensitive assets at a set price in the future.

🔹 Example: A bank that has issued long-term fixed-rate loans can use an interest rate swap to protect itself against the risk of rising rates.

Investing in Counter-Cyclical Assets (Gold, Commodities, Currencies)

Some assets tend to move inversely with interest rate changes, earning them the label counter-cyclical assets. Gold, certain commodities, and even currencies like the U.S. dollar or Japanese yen often attract investors when interest rates rise or markets become unstable.

🔹 Example: When the Federal Reserve raises interest rates and bond prices fall, many investors shift toward gold to preserve the value of their wealth.

Bond Laddering Strategy

This strategy involves purchasing bonds with staggered maturities—for example, part of the portfolio in 1-year bonds, part in 3-year, 5-year, and 10-year bonds. This way, the investor frees up liquidity at different intervals and can reinvest at prevailing rates.

🔹 Example: If interest rates increase, the bonds maturing sooner can be rolled over into new bonds with higher yields, helping to offset losses on older, lower-yield bonds.

Conclusion

Interest rate risk lies at the very heart of pricing in financial markets: when rates rise, bond prices fall, corporate funding costs increase, and vice versa. A savvy investor is one who understands this mechanism and protects their portfolio against rate-driven volatility through tools such as portfolio diversification, derivatives, counter-cyclical assets, and bond laddering strategies.