If you are active in the Forex market or plan to enter it, navigating the market without understanding currency pairs will lead you down a path of confusion and mistakes. Every trade in this market is based on currency pairs, but do you really know how these pairs work? What’s the difference between majors, minors, and exotics? And which pair is the best fit for you?

In this article, we will guide you step by step through what currency pairs are, how to make the right choice, how to add symbols to MetaTrader, and what factors influence their behavior. If you are looking for a solid start or more precise decision-making in your trades, don’t miss out on the rest of this article.

- Always remember that while exotic currency pairs offer higher profit potential, they also come with the risk of greater volatility and require more precise capital management and wider stop-loss levels.

- Before opening multiple trades simultaneously, be sure to check the correlation between currency pairs to avoid inadvertently increasing the risk in your trading portfolio.

- Highly volatile pairs are more suitable for scalping and short-term trading, while pairs with lower volatility are recommended for long-term strategies with reduced risk.

What is a Currency Pair in Forex and How Does it Work?

In the Forex market, currencies are always traded in pairs. These combinations are known as currency pairs. The concept of a currency pair means that when you buy one currency, you are simultaneously selling another. This structure is the foundation of all trades in Forex. For example, when you buy the EUR/USD currency pair, you are essentially buying Euros and selling U.S. dollars.

Ultimately, understanding the structure and nature of each currency pair is the foundation of informed trading in the Forex market.

How Currency Pairs are Displayed and Read

Each currency pair consists of two parts: the base currency and the quote currency. The base currency is on the left, and the quote currency is on the right. For example, in the pair EUR/USD, the euro is the base currency, and the U.S. dollar is the quote currency. If the price of this pair is 1.1500, it means that 1 euro equals 1.15 U.S. dollars.

Understanding the structure of this display is crucial for traders. When a trader buys EUR/USD, they are essentially expecting the value of the euro to rise relative to the dollar. If the price reaches 1.1700, they will make a profit from the price difference. Conversely, if the trader wants to trade in the direction of a price decrease, they will enter a sell position (short).

Another point is that currency pairs are represented using three-letter symbols for each currency. For instance, USD represents the US Dollar, JPY represents the Japanese Yen, GBP stands for the British Pound, and so on. The combination of these symbols forms the identity of the currency pair.

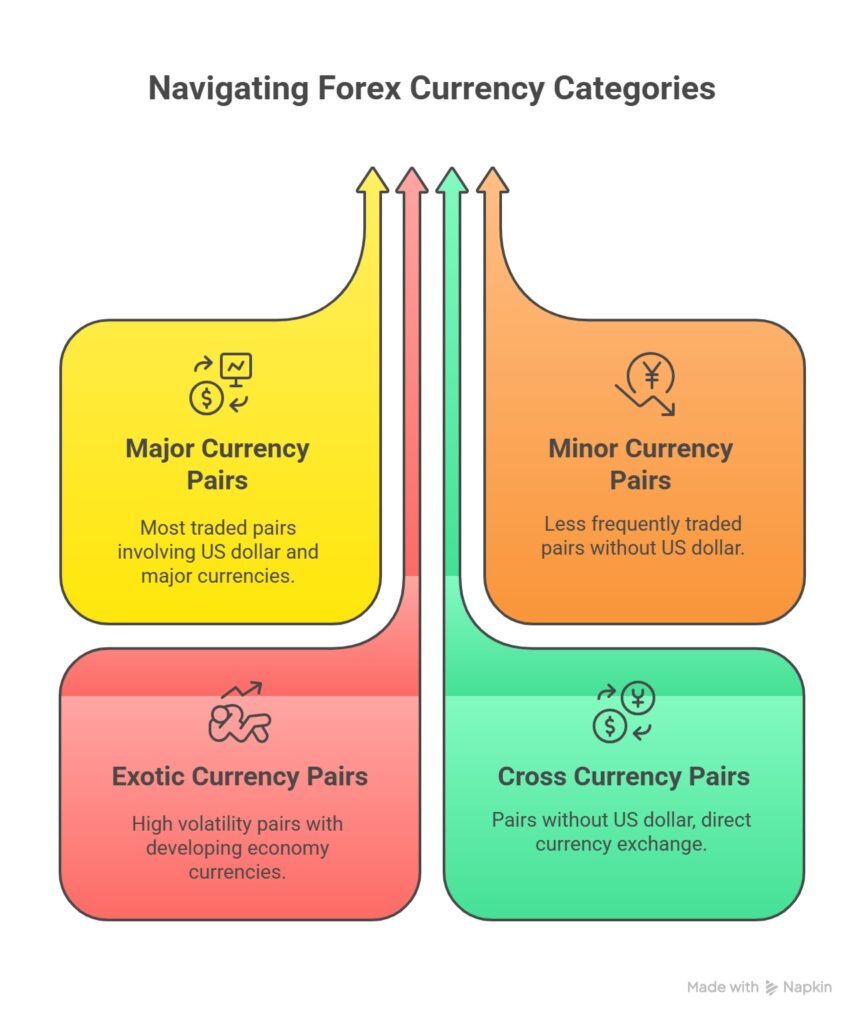

Types of Currency Pairs in Forex

In the Forex market, currency pairs are divided into various categories, each with different characteristics, liquidity levels, and behaviors. Understanding these categories helps traders make informed choices, control their risks, and design more effective strategies. These categories include major currency pairs, minor currency pairs, exotic pairs, and cross currency pairs. Let’s explore each of these categories in more detail:

Major Currency Pairs

Major currency pairs are the most traded and liquid pairs in the Forex market. These pairs typically involve the US Dollar combined with the currencies of the world’s largest economies, such as the Euro, British Pound, Japanese Yen, Australian Dollar, and Canadian Dollar. Examples of major currency pairs include EUR/USD, GBP/USD, USD/JPY, and USD/CHF.

These pairs typically have a lower spread, higher trading volume, and high analyzability. For this reason, many traders prefer to focus on major currency pairs in Forex, especially in strategies like scalping and day trading.

Minor Currency Pairs

Minor currency pairs, or “minors,” are those that do not involve the US Dollar but include major global currencies such as the Euro, British Pound, Japanese Yen, or Swiss Franc. For example, EUR/GBP, EUR/JPY, and GBP/CHF are considered minor pairs.

These pairs generally have lower trading volumes compared to major pairs, and as a result, their spreads are slightly higher. However, due to their unique behavior and sometimes high volatility, they can be profitable in specific strategies like swing trading or fundamental analysis.

Exotic Currency Pairs

According to Babypips, Exotic currency pairs or “Exotics,” consist of a combination of a major currency with the currency of a developing country or a smaller market. Examples include USD/TRY (US Dollar and Turkish Lira) or EUR/ZAR (Euro and South African Rand). These pairs typically come with high spreads, lower liquidity, and more volatility.

A notable feature of exotic currency pairs is their heightened sensitivity to political and economic news from developing countries. As a result, the risk associated with trading these pairs is higher, making them more suitable for professional traders with advanced risk management strategies.

Cross Currency Pairs

َAccording ti Investopedia, Cross currency pairs refer to pairs that do not involve the US Dollar. Examples include EUR/GBP, AUD/JPY, or GBP/CHF. In the past, most non-USD transactions had to be converted into dollars first, but modern markets now allow direct trading of cross pairs.

These pairs often exhibit stronger reactions to interest rate differentials, regional reports, and policies from non-US central banks. For example, EUR/GBP may respond significantly to remarks from the Governor of the Bank of England or inflation data from the Eurozone. Cross currency pairs are a good choice for diversifying a trading portfolio and reducing direct exposure to US Dollar volatility.

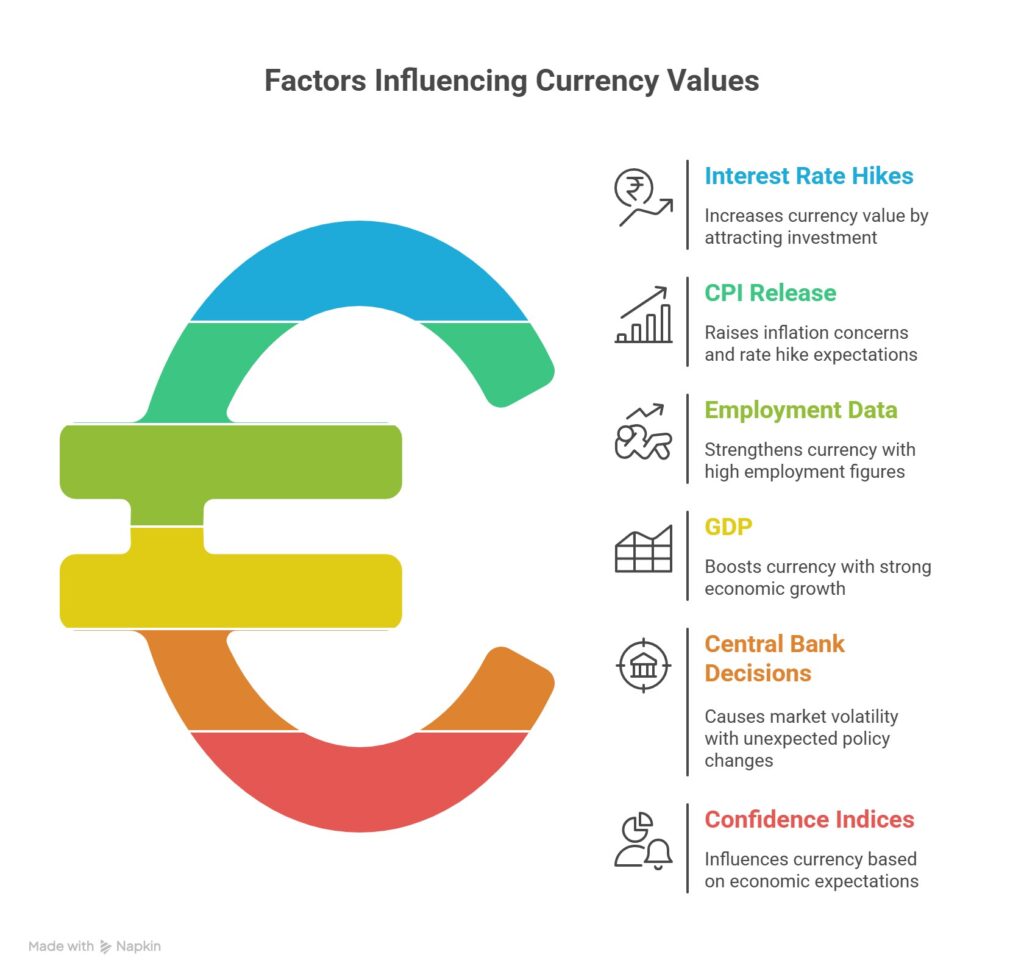

Impact of Economic News on Currency Pairs

To succeed in currency pair trading, knowing technical analysis alone is not enough. What often significantly changes market trends are economic news and important reports from countries and central banks. Before making trading decisions, it is essential to understand which news can alter the market’s direction. Below, we explore the direct impact of these news events on currency pairs:

- Interest Rate Hikes by Central Banks: When central banks raise interest rates, it strengthens the currency of that country. For instance, a rate hike in the U.S. typically boosts the value of the U.S. dollar in pairs like USD/JPY or EUR/USD.

- Consumer Price Index (CPI) Release: The CPI measures inflation. A sharp increase in the CPI can raise inflation concerns and increase expectations for interest rate hikes.

- Employment Data such as the U.S. NFP Reports: This is one of the most important economic data releases for the dollar. High employment figures typically strengthen the U.S. dollar, and vice versa.

- Gross Domestic Product (GDP): A high growth rate signals economic strength and directly positively impacts the country’s currency.

- Unexpected Decisions by Central Banks: Occasionally, central banks change interest rates or initiate easing policies without prior notice, which can cause significant market volatility.

- Consumer Confidence Index and Producer Confidence Index: Changes in the economic expectations of consumers and companies can also influence currency movements.

Ultimately, analyzing economic news without understanding the interrelationship of currency pairs can lead to misguided trades. Paying attention to currency pair correlations, studying market reaction histories, and comprehending global economic conditions create a strong foundation for making informed and precise decisions.

Best Currency Pairs for Beginner Traders

For novice traders, it is recommended to start with the least volatile currency pairs and those with high liquidity. Pairs such as EUR/USD, USD/JPY, and GBP/USD are good choices due to their high trading volumes, low spreads, and extensive analytical resources.

Choosing the right currency pair not only increases the chances of success but also reduces the psychological pressure on the trader at the beginning of their journey.

Remember that choosing the right currency pair not only affects your profit potential but also has a direct impact on your mental peace and your risk tolerance in trading.

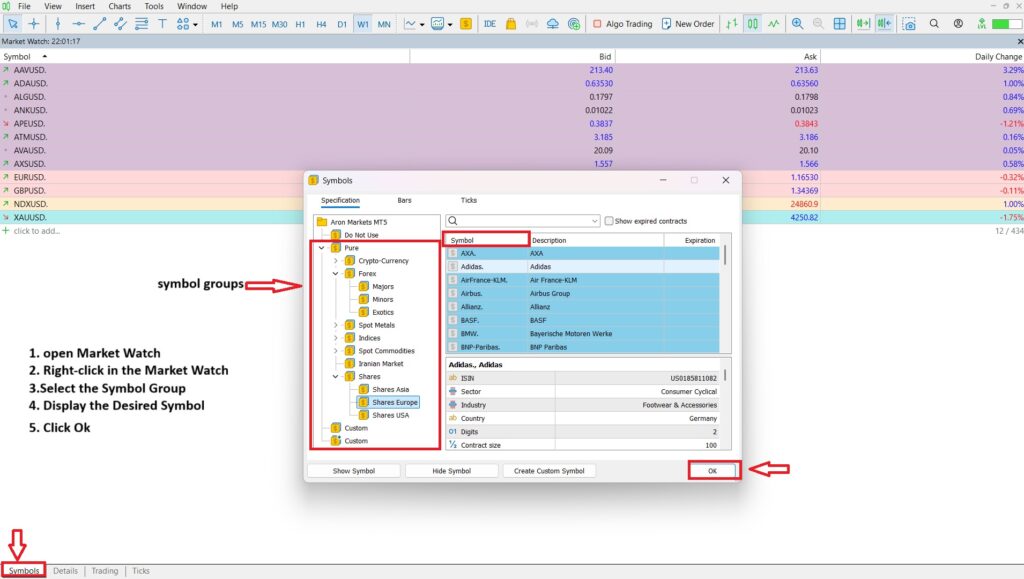

Training: Adding a Currency Pair to MetaTrader

If you want to activate a specific currency pair in MetaTrader or add new symbols for analysis and trading, you first need to display them in the list of symbols. Below are the step-by-step instructions for this process:

Steps to Add a Currency Pair to MetaTrader

- Open the Market Watch Window:

From the top menu of the platform, select “View” and then click on “Market Watch,” or press the shortcut key Ctrl+M. - Right-click in the Market Watch Window:

Right-click on any empty space in the window and select the “Symbols” option. - Select the Symbol Group:

In the Symbols window, open the group related to the currency pair you want (e.g., Forex Majors or Forex Minors). - Display the Desired Symbol:

Click on the preferred currency pair and press the “Show” button so that the symbol appears in the Market Watch window. - Close the Symbols Window:

After selecting all the desired symbols, click Ok and close the window. The currency pairs are now ready for analysis and trading.

Adding the required symbols not only organizes the MetaTrader environment but also helps you focus on specific strategies and avoid unnecessary symbols.

Important Tips for Choosing a Currency Pair for Trading

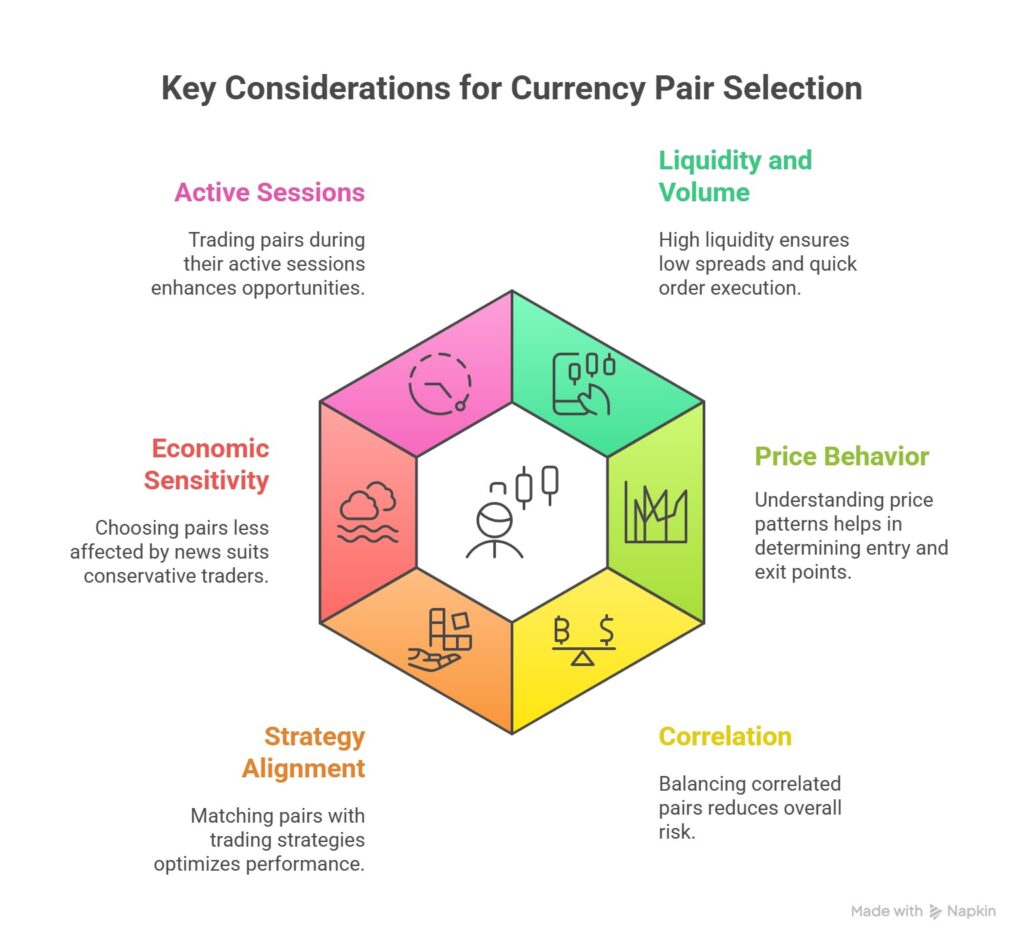

One of the most impactful decisions in Forex trading is selecting the right currency pair. This choice should be based on a thorough understanding of the market, trading conditions, and trading style to avoid unexpected fluctuations and hidden risks.

Key Points to Consider When Choosing a Currency Pair for Trading

- Liquidity and Trading Volume:

Currency pairs such as EUR/USD or USD/JPY usually have the highest liquidity, which leads to low spreads and quick order execution. - Understanding the Price Behavior of the Currency Pair:

Knowing the price range, reversal zones, and reactions to support and resistance levels across various timeframes is crucial in determining entry and exit points. - Consideration of Correlation:

Simultaneously trading correlated pairs (e.g., EUR/USD and GBP/USD) may increase the overall risk of positions. Balance and diversification between pairs should be maintained. - Alignment with Trading Strategy:

Some currency pairs are better suited for short-term trades, while others exhibit more consistent volatility for longer-term trades. - Sensitivity to Economic News:

Choosing pairs that are less affected by major economic events may be more suitable for conservative traders. - Active Trading Sessions:

Pairs like AUD/JPY are more active during the Asian session, while EUR/USD is more commonly traded during the European and New York sessions.

Ultimately, having a clear understanding of the structure and characteristics of currency pairs helps traders make more logical decisions and avoid falling into erratic or inconsistent trades that don’t align with their trading style.

In the dynamic and volatile world of Forex, only with comprehensive analysis (both fundamental and technical) and attention to the details of currency pairs can you take a solid step toward success.

Conclusion

Currency pairs are the foundation of all transactions in Forex, and having a precise understanding of them is essential for entering the market professionally. Understanding the structure of currency pairs, how to choose them based on liquidity, volatility, and market activity times has a direct impact on the quality of trading decisions. Properly adding symbols to MetaTrader also optimizes the workspace and allows more focus on personal strategies. Furthermore, neglecting economic news and the correlation between pairs can increase risk. If your goal is to achieve sustainable profits, a complete understanding of currency pairs should be a priority in your training.