One of the most significant outcomes of technological advancement in recent decades has been a tremendous increase in task performance speed. This transformation has also profoundly influenced the world of financial markets, trading, and investing. In such an environment, traditional trading methods no longer meet the needs of today’s traders. At this point, algorithmic trading emerges as a modern, robust solution transforming the playing field.

Algorithmic trading plays a crucial role in improving liquidity and reducing transaction costs. However, this type of trading can also present specific challenges. In this article, we will take a comprehensive look at algorithmic trading, its advantages, disadvantages, and practical strategies to help you gain a deeper understanding of this innovative approach to investing.

- Algorithmic trading can reduce transaction costs by 50–60% and execute orders instantly, which is crucial in highly volatile markets such as Forex.

- High-frequency algorithms can enhance market liquidity by performing rapid, small-scale trades.

- The use of algorithmic trading in financial markets may exacerbate financial crises or cause systemic disruptions, especially when multiple algorithms exhibit similar behavior simultaneously.

How Does Algorithmic Trading Work?

Algorithmic trading is the process of using computer programs and mathematical models to automatically buy and sell assets in financial markets. These systems work without direct human involvement and execute orders based on rules defined in advance.

The algorithms constantly analyze market data such as past trading volumes, market depth, and current buy and sell orders. When they detect price movements or trend changes, they automatically decide whether to buy or sell.

Example 1:

Imagine you are using an algorithm in the stock market that is designed to buy stocks that are rising in value. The algorithm monitors market data and notices that the price of a stock is suddenly increasing. It immediately places a buy order to take advantage of the trend.

When the price of an asset starts to fall, the algorithm places a sell order. This happens in a fraction of a second, much faster than any human could react.

Example 2:

Now suppose you want to use the concept of correlation in the Forex market to profit from price fluctuations. The algorithm you use is designed to find and prioritize common correlations by constantly analyzing market data.

One of the most common correlations is between the price of gold (XAU/USD) and the euro-to-dollar pair (EUR/USD). The algorithm studies historical price data for gold and the euro to detect positive or negative correlations.

It observes that in many cases, when the price of gold rises, the U.S. dollar weakens and the euro strengthens. Based on this, the algorithm predicts that if gold prices go up, the euro will likely strengthen against the dollar. It then places a buy order for EUR/USD.

This is a simple example of how an algorithm can use a common concept in Forex trading. You can make your algorithm more advanced by adding extra parameters and improving its accuracy.

The core of algorithmic trading lies in combining statistical analysis, technical indicators such as moving averages, and optimization algorithms. The goal of these systems is to identify profitable opportunities within market fluctuations based on price behavior, trading volume, and supply and demand levels.

Why Has Algorithmic Trading Become Popular?

Algorithmic trading has become increasingly popular in recent years due to its unique advantages. One key reason is that algorithms can execute trades at very high speed and with high accuracy.

In fast-moving, highly volatile markets, human decision-making cannot always keep pace. Algorithms, however, can easily handle these challenges and react instantly to market changes.

Another reason for their popularity is their ability to analyze massive amounts of data. Trading algorithms can process millions of data points in a very short time and make well-optimized trading decisions. High-Frequency Trading, or HFT, is one example of this type of system.

Algorithmic trading also reduces execution costs and removes the need for human brokers. In addition, it helps minimize human error and supports better risk management.

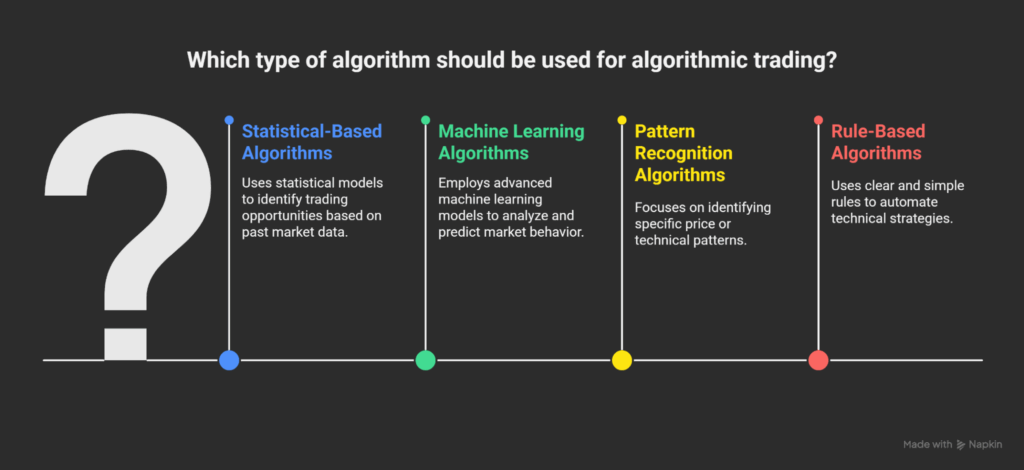

Types of Algorithms in Algorithmic Trading

Algorithms are the core intelligence behind automated trading systems. Each algorithm is built on a specific logic and can respond differently to various market conditions, depending on the data and strategy it uses.

Some of the main types of algorithms based on decision-making and data processing methods include:

- Statistical-based algorithms;

- Machine learning algorithms;

- Pattern recognition algorithms;

- Rule-based algorithms.

In the following sections, we will take a closer look at each type, explain how they work, and explore their role in automated decision-making within financial markets.

Statistical-Based Algorithms

These algorithms use statistical models such as averages, variance, standard deviation, correlations, and regression models to identify trading opportunities. The main idea is that past market data can provide insights into future price movements.

For example, consider an algorithm designed based on the Mean Reversion model. If the price of gold has moved unusually far from its 20-day average during the past 10 days, the algorithm assumes the price is likely to move back toward the average and issues a buy or sell order accordingly.

Machine Learning Algorithms

These algorithms rely on advanced machine learning models such as decision trees and neural networks to analyze and predict market behavior. They can learn from existing data and gradually improve their performance over time.

For instance, an algorithm powered by a neural network can be trained using thousands of data points including Bitcoin prices, related news, Twitter sentiment, and trading volume. Over time, it learns the conditions under which prices are more likely to rise and executes buy or sell trades based on hidden patterns it identifies.

Pattern Recognition Algorithms

These algorithms focus on identifying specific price or technical patterns such as candlestick formations (like hammer, engulfing, or inside bar), classical chart patterns (like triangles, head and shoulders, or channels), and harmonic patterns (like butterfly or Gartley).

For example, an algorithm can be programmed to automatically scan the oil price chart. When it detects a bullish triangle pattern, it places a buy order. If it identifies a bearish head and shoulders pattern, it places a sell order.

Rule-Based Algorithms

In this approach, algorithms are programmed using clear and simple rules. These rules may include conditions such as “if the price is above the 50-day moving average and volume increases, place a buy order.”

These types of algorithms are ideal for traders who want to automate their technical strategies precisely. For example, you can design an algorithm that buys an asset when the RSI drops below 30 and the price reaches a previous support level. Conversely, it can sell when the RSI rises above 70 and resistance remains unbroken.

As you can see, algorithmic trading is not just a simple piece of software. Behind it lies a variety of logical and sometimes complex systems. If you are a trader interested in designing or using these algorithms, it is essential to understand how their decision-making structures work to use them effectively.

How Is an Algorithmic Trading System Built?

Building an algorithmic trading system is a multi-step process that combines programming, statistical analysis, and portfolio optimization. The goal is to turn trading strategies into executable code that can automatically operate on trading platforms. The main stages include:

- Defining a trading strategy;

- Choosing the right technology tools;

- Collecting and processing data;

- Implementing the algorithm code;

- Backtesting with historical data;

- Optimizing and adjusting parameters;

- Running trial executions;

- Going live and performing continuous monitoring.

Let’s take a closer look at each step.

Defining the Trading Strategy

The first step is to clearly define a trading strategy. The strategy must be detailed enough to translate into mathematical logic or code. For example, a simple strategy could be: “Buy when the 50-day moving average crosses above the 200-day moving average.”

These rules must be specific and unambiguous so that the algorithm can follow them accurately. Strategies may be based on technical analysis, fundamental analysis, market behavior, or a combination of these approaches.

Choosing the Right Technology Tools

Next, the appropriate programming language and trading environment are selected. Common programming languages include Python, R, and C++, and useful libraries such as Pandas, NumPy, and Scikit-learn. Trading platforms might include MetaTrader, TradingView API, or cryptocurrency exchanges like Binance.

For example, if you are developing an algorithm for the gold market (XAU/USD), you can use Python to connect to your broker’s API, collect live price data, and analyze it.

If you are interested in building AI-powered trading bots that can automatically analyze markets and execute trades, consider checking out a comprehensive guide to developing AI trading bots.

Collecting and Processing Data

In this stage, relevant market data is gathered, including historical prices, trading volumes, economic indicators, news, and even social media sentiment. The data must be clean, noise-free, and well-structured to ensure the algorithm functions correctly.

For example, when developing a sentiment analysis algorithm for Bitcoin, data can be collected from X, Reddit, and CoinMarketCap to study how the market reacts to news or volatility.

Implementing the Algorithm Code

At this point, the trading strategy is converted into code. The algorithm executes the decision-making logic based on incoming data and generates buy or sell orders. The code should include capital management rules, take-profit and stop-loss settings, and entry and exit conditions.

For example, in the Forex market, you could program an algorithm that opens a buy position when the EUR/USD enters the RSI oversold zone and a reversal candle forms at the same time.

Backtesting with Historical Data

The next step is to test the algorithm’s performance using historical market data. This helps evaluate how it behaves under different market conditions, such as bullish, bearish, or sideways markets. Key metrics like win rate, average profit/loss, drawdown, and annual return are analyzed.

For instance, you might test a gold trading algorithm using five years of historical data and find that it performs better during periods of falling U.S. interest rates.

Optimizing and Adjusting Parameters

If the algorithm’s performance is weak or can be improved, important parameters such as time frames indicator, stop-loss and take-profit levels, and trade filters are fine-tuned. This step must be done carefully to avoid overfitting, which can make the algorithm unreliable in live conditions.

Trial Execution

Before deploying the algorithm in a live market, it should be tested in a demo account or simulated environment. This allows you to identify potential issues and assess how it performs under real market conditions without risking actual capital.

Live Execution and Continuous Monitoring

After confirming that the algorithm performs well in testing, it is launched in the live market. The system connects to a trading platform and automatically executes buy and sell orders in real time based on predefined rules.

However, human supervision remains essential. Unexpected events, system errors, or sudden market movements may require manual intervention.

For example, imagine an algorithm trading the WTI crude oil index that usually operates during the night, making trades based on volume fluctuations and price behavior. Suddenly, an unexpected U.S. crude oil inventory report causes sharp volatility, and prices surge rapidly.

The algorithm automatically closes its short position to prevent further losses. At that moment, the human operator receives an alert, reviews the market conditions, checks the risk parameters, and may temporarily disable or adjust the algorithm as needed.

Building algorithmic trading systems requires a combination of programming skills, precise analysis of historical data, and a deep understanding of financial markets. From algorithms designed to minimize execution costs to those powered by artificial intelligence, this process is constantly evolving.

Types of Algorithmic Trading and Common Strategies

In this section, we will explore the main types of algorithmic trading strategies. Each one is designed for specific market conditions and serves a different purpose. Some strategies focus on speed, others on analyzing news data, minimizing execution costs, adjusting prices, or predicting price trends.

The most common types include:

- High-Frequency Trading;

- Arbitrage Trading;

- Momentum-Based Trading;

- Mean Reversion Trading;

- News-Based Trading;

- Black Box Trading;

- Pair Trading;

- Execution Cost Minimization Algorithms;

- Inline Price Algorithms.

Below, we will examine each of these strategies in more detail.

High-Frequency Trading (HFT)

High-Frequency Trading strategies execute a very large number of trades in extremely short time intervals, sometimes within milliseconds. These algorithms use advanced data processing speed to identify even the smallest profit opportunities.

For example, imagine an HFT algorithm monitoring the EUR/USD pair. When it detects a slight price discrepancy between two exchanges, it immediately executes dozens or even hundreds of buy and sell orders within milliseconds to profit from those tiny price differences.

Arbitrage Trading

Arbitrage algorithms look for price differences of the same asset across two different markets or related derivatives. The goal is to buy in the market where the price is lower and sell where it is higher, generating a relatively risk-free profit.

For instance, if EUR/USD is priced at 1.1030 on one exchange and 1.1035 on another, the algorithm can buy from the first and sell on the second, capturing a profit of 5 pips.

Momentum-Based Trading

Momentum algorithms make decisions based on market trends. When an asset shows strong upward or downward momentum, the algorithm follows the trend and enters a position assuming the move will continue.

For example, an algorithm detects that Bitcoin has been rising consistently over the past hour and has broken a key resistance level. It opens a buy position and holds it until a clear reversal signal appears.

Mean Reversion Trading

These algorithms are based on the theory that prices tend to return to their historical average. When a price moves too far above or below its mean, the algorithm assumes a correction is likely and trades accordingly.

For example, if oil prices usually fluctuate between 70 and 75 dollars but suddenly fall to 65, the algorithm predicts a short-term recovery and opens a buy position to profit as prices move back toward the average.

News-Based Trading

News-based algorithms instantly analyze economic data and news events to make trading decisions. They may interpret published data or apply sentiment analysis to news content.

For example, if the U.S. Federal Reserve announces an interest rate cut, the algorithm quickly processes the news and executes a buy order for gold, viewing it as a safe-haven asset during periods of lower interest rates.

Black Box Trading

Black box algorithms rely on complex models and large datasets for decision-making. Their internal logic is often hidden, even from their developers. These algorithms are commonly used in highly complex markets.

For instance, in cryptocurrency trading market, some trading systems use black box algorithms to analyze market behavior and predict price changes. They simulate various scenarios using both historical and real-time data to automatically decide when to buy or sell digital assets. In fact, black box trading is often considered a subset of high-frequency trading.

Pair Trading

Pair trading algorithms are designed to identify price discrepancies between two correlated assets. In Forex, for example, the EUR/USD and GBP/USD pairs may be monitored together. When one pair deviates significantly from the other, the algorithm takes action.

If EUR/USD suddenly strengthens while GBP/USD lags, the algorithm may buy euros and sell pounds to profit from the price divergence.

Execution Cost Minimization Algorithms

These algorithms aim to reduce trading costs and improve order execution efficiency. Suppose a trader wants to buy 1000 shares of a stock. The algorithm automatically finds the best available prices and divides the order into smaller parts to minimize slippage and prevent sudden price spikes.

For instance, the algorithm might spread the 1000-share purchase throughout the day, using market depth analysis and order distribution strategies to achieve the most cost-effective execution.

Inline Price Algorithms

Inline price algorithms are designed to adjust prices dynamically in real time. In stock markets, they analyze order book data to predict price movements and optimize order placement.

For example, if a stock experiences high volatility and buying pressure increases, the algorithm automatically raises the bid price to stay ahead of the market and take advantage of the momentum.

This approach is especially effective in markets like ETFs and large-cap stocks, particularly during periods of strong volatility.

Advantages and Disadvantages of Algorithmic Trading

Algorithmic trading has revolutionized the way assets are bought and sold, becoming one of the most efficient trading approaches in modern financial markets. One of its biggest advantages is speed. Algorithms can execute trades within fractions of a second, allowing traders to take advantage of even the smallest price fluctuations.

Another major benefit is accuracy. Algorithms continuously analyze market data, which reduces human error and leads to more optimized trading decisions. These systems can also operate effectively in complex and highly volatile market conditions, where human traders might struggle to react in time.

Despite these advantages, algorithmic trading also comes with certain drawbacks. One of the main challenges is its heavy reliance on historical data and predefined assumptions. When sudden or unusual market conditions occur, algorithms may fail to respond appropriately.

Another concern involves security risks. Cyberattacks or technical failures in algorithmic systems can lead to significant financial losses for investors.

In addition, algorithmic trading may increase market volatility, especially in low-volume markets. When multiple algorithms place large numbers of orders simultaneously, they can create unexpected price swings.

Finally, the complexity of algorithmic systems and the high level of expertise required to design and manage them pose another challenge. For many traders and investors, this technical barrier can make it difficult to implement or maintain such systems effectively.

According to financial edge: Algorithmic trading helps minimize market impact by breaking large orders into smaller parts, allowing traders to execute high-volume trades without causing sudden price spikes.

Conclusion

Today, algorithmic trading has become one of the most advanced and effective tools in the world of investing. By leveraging data analysis and high-speed execution, it allows traders to automatically and continuously identify trading opportunities.

This approach has proven to be especially attractive in today’s complex and volatile markets, offering a powerful way to generate profit and optimize financial performance.

However, despite its many advantages, algorithmic trading still comes with certain challenges. To succeed, traders must manage these risks carefully through proper strategies and a solid understanding of market dynamics.