The cryptocurrency market offers many investment opportunities, but scams like rug pulls can quickly deplete your funds. A rug pull occurs when the project team suddenly withdraws the liquidity, leaving investors with heavy losses. If you fail to recognize a rug pull in time, you could lose all your invested capital. In this article, we will introduce methods for identifying rug pulls and ways to protect your investments. If you want to safeguard your funds against these scams, keep reading.

- A rug pull occurs when the project team suddenly withdraws liquidity, leaving investors with worthless tokens.

- New projects with unrealistic promises and anonymous teams are significantly more prone to executing rug pulls. Therefore, investing in such projects without thorough research is highly risky.

- A combination of carefully reviewing the team, liquidity, smart contract, and community involvement enhances your ability to "identify rug pulls"; meaning, you play a central role in protecting your own investments.

What is a Rug Pull and Why is it Important?

A rug pull is one of the biggest threats in the cryptocurrency world, causing significant losses for many investors who are unaware of it. A rug pull is a type of scam that occurs when the team behind a project suddenly withdraws liquidity after attracting investments from users, leaving the project abandoned. In such cases, the tokens and cryptocurrencies lose their value, and investors are left facing significant losses.

Many new projects are launched without sufficient transparency, creating the perfect opportunity for a rug pull. Therefore, if you want to know how to avoid rug pulls, you need to familiarize yourself with the signs and characteristics of this type of scam. Early recognition of this threat will help protect your investments from these dangers.

According to CoinMarketCap, a sudden and sharp increase in the token's price as a tactic to attract users can be one of the first serious signs of a potential rug pull.

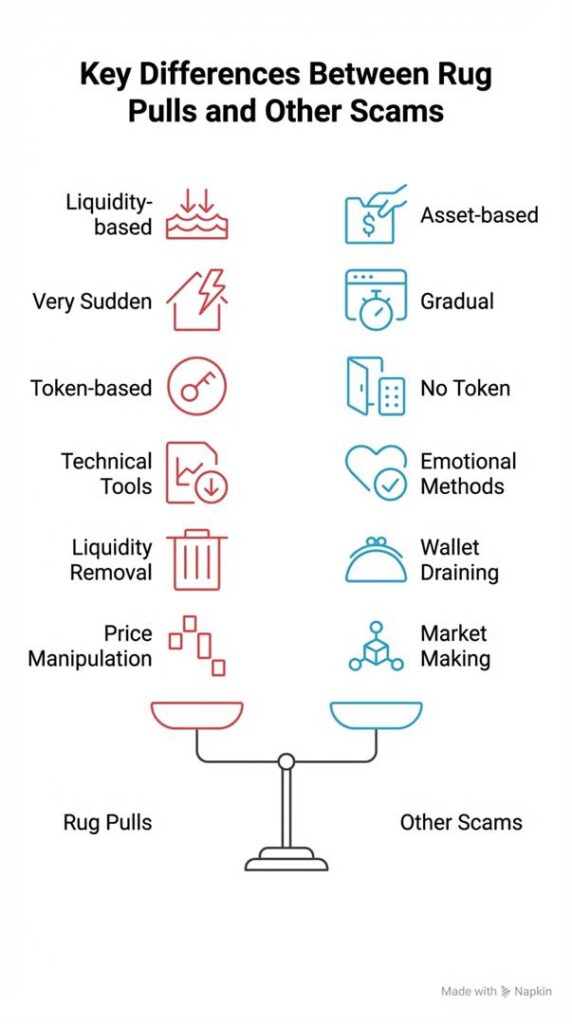

Differences Between Rug Pull and Other Scams

While a rug pull (Rug Pull) is a subset of exit scams, it has key differences from other types of financial fraud in the cryptocurrency market. Understanding these differences can help traders quickly identify suspicious patterns of behavior and reduce the risk of losing their capital.

Some of these differences include:

Nature of the Scam: Liquidity-Focused

In a rug pull, the scammer’s main focus is on removing liquidity from the DEX pools. In contrast, other scams, such as phishing or Ponzi schemes, typically involve directly stealing user assets or creating a continuous investment flow.

Practical Example: In DeFi projects, developers create fake tokens, add liquidity to a currency pair (e.g., X/ETH), users buy in, and then suddenly the entire liquidity is pulled out, causing the token price to crash to near zero.

Speed of Occurrence: Very Sudden

A rug pull usually happens within seconds to minutes, whereas many other scams unfold gradually, like Ponzi schemes, which continue until new investment stops.

Practical Example: The SQUID Token project in 2021 saw its price fall from $2,800 to $0.0007 in minutes after it attracted investments.

Token-Focused Scam

In a rug pull, the scam is centered around the design and control of the token, such as:

- The ability to disable sales

- Full control over the smart contract owner

- A large supply controlled by the team

In contrast, scams like exchange hacks or malware do not require a dedicated token.

Building Initial Trust Using Technical Tools

Projects that engage in rug pulls often use professional roadmaps, advanced websites, fake audits, and anonymous teams that are active on social media to create a sense of security. However, many other scams, such as phishing, rely on emotional manipulation and fake links, not technical tools.

Removing Liquidity Instead of Directly Draining User Wallets

In a rug pull, users do not directly send their funds to the scammer’s wallet; instead, the funds are held in liquidity pools. When the developer removes liquidity, the value of the tokens crashes, and users’ assets essentially become worthless. In other scams, like phishing or wallet drainers, assets are directly stolen from the user’s wallet.

Price Manipulation via Liquidity, Not Market Making

In a rug pull, the price suddenly drops to zero, not through market manipulation or artificial volume increases. In contrast, in a pump and dump, the price is driven up by promotions and coordinated buying, followed by mass selling, but liquidity is typically not removed.

Practical Example: In a pump and dump, the price might grow by 500% and then fall by 80%, but in a rug pull, the price often drops to near zero and becomes unrecoverable.

According to a report by Chainalysis, rug pull projects accounted for approximately 37% of the total cryptocurrency fraud revenue in 2021.

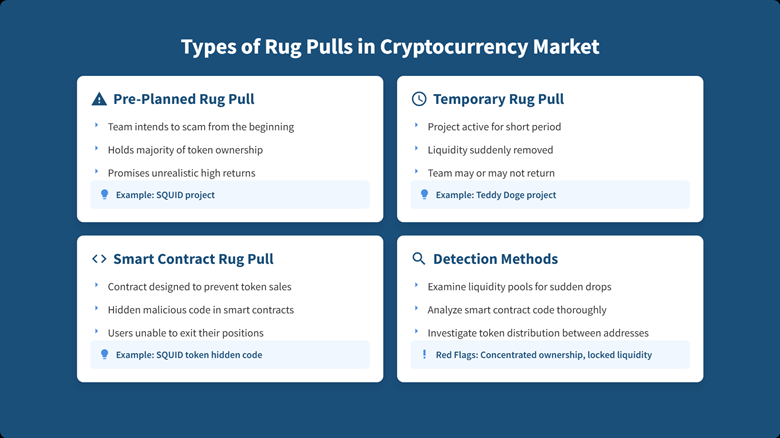

Types of Rug Pulls

In cryptocurrency trading, understanding the different types of rug pulls and how they operate can help investors approach projects with more caution. Below, we explain three main types of rug pulls:

Pre-Planned Rug Pull

In this type, the project team intends to scam investors from the very beginning, and all the plans are made for a quick exit. These projects typically hold the majority of the token ownership and promise high returns, but in reality, their goal is to pull the liquidity at the right moment. If you come across a project that is essentially a scam token, there’s a high chance it could be this type of rug pull. These projects usually crash after a short time.

Example: The SQUID project (related to the “Squid Game” series), which saw its developers pull the liquidity quickly, causing the price to drop from several thousand dollars to nearly zero. This is a classic example of what could be considered a crypto exit scam, where the developers vanish after making a significant profit at the expense of the investors.

Temporary Rug Pull

In this model of rug pull, the project is active for a short period, and then liquidity is suddenly removed. The project team may return, or they may not, but the effects of this scam remain. A significant reduction in liquidity is one of the main signs of a temporary rug pull.

To spot a rug pull and understand what a rug pull in crypto looks like, examining the liquidity pool of the project is crucial. If the liquidity has decreased or is completely gone, it’s a red flag. The project might also undergo a liquidity pool, making it impossible for investors to exit.

Example: The Teddy Doge project, which after raising funds in a short period, saw the team conduct large-scale sales of assets, causing the value of the project to plummet. This quick removal of liquidity is typical of a temporary rug pull.

Smart Contract Rug Pull

In this type of scam, the project team uses smart contract development to carry out malicious activities. For example, the team might design the contract in such a way that users cannot sell their tokens or are unable to create new tokens.

Therefore, reviewing the smart contract code is one of the primary methods for detecting a rug pull. If the contract blocks token sales, there’s a high likelihood that you are dealing with this type of scam.

Example: According to MDPI, the SQUID token had hidden code that only allowed developers to sell, trapping other users. This is a clear example of how a soft rug vs. hard rug distinction can be made, with soft rugs being more gradual and hard rugs occurring abruptly. This kind of rug pull is often executed through smart contract vulnerabilities.

One of the distinguishing signs of a rug pull compared to other scams is the abnormal price movement patterns. If a project's price chart rapidly spikes and then sharply crashes, you are likely dealing with an advanced form of rug pull.

Signs and Methods for Identifying Rug Pulls

Identifying a rug pull in its early stages can help prevent significant losses. Many fraudulent projects in the cryptocurrency market exhibit signs that can be detected. In this section, we will discuss three key criteria for identifying a rug pull.

Examine the Development Team and Their Transparency

The first thing to check is the project team. Are the team members known, or are they anonymous? Do they have a history in the cryptocurrency industry? Projects with anonymous teams or limited information available about them are more likely to be involved in a rug pull.

If the team makes unrealistic promises or claims that the project is team-less, caution is necessary. Generally, if the project team members are not easily identifiable, there is a high likelihood that you are dealing with a crypto exit scam or a rug pull.

What is a rug pull in crypto? It’s a scam where the project’s creators disappear with the funds, and it’s typically linked to a lack of team transparency.

Liquidity and Token Structure

The liquidity of the project and how the tokens are distributed (a part of the tokenomics) are crucial for detecting a rug pull. If the liquidity is not locked or if most of the tokens are controlled by the project team, there is a high chance that the team will pull the liquidity and abandon the project.

Example: In some projects, more than 70% of the tokens are held by the team, and after a while, the project’s value suddenly crashes. Therefore, reviewing the token distribution and liquidity structure is one of the key steps for identifying a rug pull. If liquidity is removed abruptly, it could be a liquidity pool.

One important indicator for identifying this type of scam is that the project team’s wallets should not hold more than about 5% of the total token supply.

Community Activity and Engagement

The activity and interactions of the project’s community on social networks such as Twitter and Discord can provide insight into the project’s status. If the project has a small community and the discussions are mostly promotional, it’s a red flag. Projects that make grand promises but lack regular updates or security reports (audits) are highly likely to be involved in a rug pull.

Evaluating the community’s activity and interactions can help you spot potential risks before investing. A project that shows signs of active community engagement with regular updates is far less likely to be a rug pull or liquidity pool scam. It’s crucial to understand the difference between rug pull vs. pump and dump, as the latter involves hype and manipulation rather than liquidity issues.

Best Tools and Websites for Detecting Rug Pulls

To identify rug pulls and avoid investing in fraudulent projects, many online tools can be of great help. These tools allow you to carefully assess the status of projects before making any investments, helping you avoid potential risks. Some of these tools include those for checking smart contracts, liquidity, token distribution, and security reports.

Tools like Token Sniffer help you examine the smart contracts of projects to check for any malicious code that might allow the team to pull liquidity or create new tokens. Additionally, tools such as De.Fi Scanner and Solana Rug Checker are useful for analyzing liquidity and token distribution. If the liquidity is not locked or if most of the tokens are held by a few individuals, the risk of a rug pull is high.

Moreover, tools like QuillCheck can show if a project has restricted token sales for users, which is a common sign of a rug pull. Using these tools helps you identify potential risks before making an investment, significantly reducing the chance of falling victim to a crypto exit scam or liquidity pool.

Methods for Protecting Your Investments Against Rug Pulls

The risk of rug pulls is always present when investing in cryptocurrencies, but with the right strategies, this risk can be reduced, and major losses can be avoided. Here, we will discuss methods to protect your investments from this type of fraud:

- Follow Safe Investment Principles in Crypto

- Only invest an amount you can afford to lose.

- Diversify your investments across different projects.

- Avoid investing in projects that promise unrealistic and extremely high returns.

- If a project promises high profits, the risk of a rug pull may be significant.

- Projects that offer large returns within a few days or weeks could be suspicious and potentially linked to a crypto exit scam.

- Education and Personal Project Analysis

- Review the development team, smart contracts, token distribution, and liquidity status before investing.

- Check reputable sources, engage with trusted communities, and review complaints or negative feedback from other users.

- This personal research will help you better identify rug pulls and detect high-risk projects.

- Use Reputable Exchanges and Platforms

- Projects listed on reputable exchanges are less likely to involve a rug pull.

- Even with reputable exchanges, check the project’s liquidity and transparency.

- Trusted exchanges typically perform security audits and lock liquidity to prevent rug pulls.

- If a project is not listed on major exchanges like Coinbase, approach it with caution.

The best defense against a rug pull is a combination of caution and personal research. No matter how many tools and knowledge you have, if you enter a project without due diligence and logical skepticism, you will still be at risk.

Conclusion

In this article, we explained what a rug pull is and why this type of scam is one of the biggest threats for investors in the cryptocurrency market. A rug pull occurs when the project team suddenly withdraws liquidity and abandons the project, causing investors to lose their capital.

To avoid these risks, you must approach each project with caution and conduct thorough research, using the right tools to detect a rug pull. Always remember that continuous education and awareness of how to identify these scams will help protect your investments and prevent you from entering high-risk projects.