In financial trading, understanding the tools that simplify decision-making is crucial. The ITM (In The Money) status in options trading is one such tool. It shows positions with intrinsic value, drawing attention from many technical analysts. Knowing ITM helps traders understand when to enter or exit the market. It also helps in managing trade risks more effectively.

This article explains what ITM means in options trading, how it’s calculated, and how to use it with other indicators. If you want to learn a tool that increases your chances of success in trading, stay with us until the end.

- When an option is ITM, it has intrinsic value, which reduces risk and lowers the chance of mistakes.

- Delta in ITM contracts approaches ±1, meaning the option price moves nearly in sync with the underlying asset's price.

- ITM options are usually more expensive due to their intrinsic value, but the percentage return may be lower.

- Deep in-the-money options, where the strike price is far from the market price, are ideal for conservative traders.

What Are ITM Options in Trading?

The term In The Money (ITM) is key in derivatives markets, especially in options trading. An option is considered ITM when it has intrinsic value. Simply put, if the option were exercised right now, it would generate a profit for its holder.

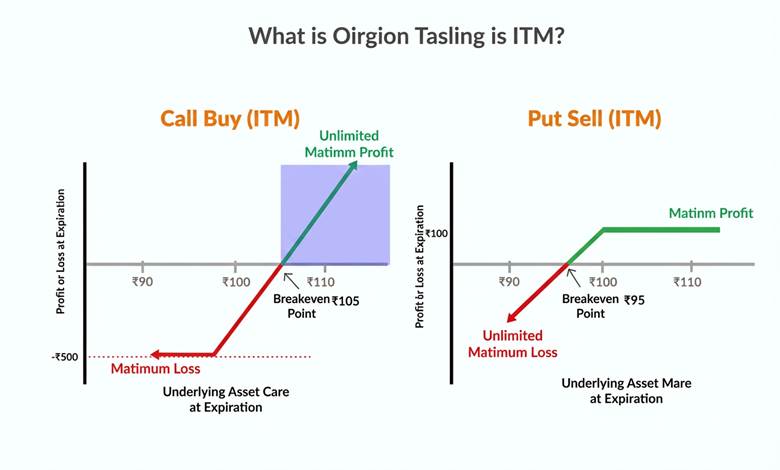

- For a call option, it’s ITM when the current price of the underlying asset is higher than the strike price.

- For a put option, it’s ITM when the current price of the underlying asset is lower than the strike price.

This characteristic makes ITM options less risky than “At The Money” (ATM) or “Out of The Money” (OTM) options. Their value is based not just on market movement expectations, but on intrinsic profit.

In technical analysis, traders use the ITM concept to assess the probability of profitability and manage risk more effectively. When an option is ITM, it is more sensitive to changes in the underlying asset’s price. This sensitivity is crucial when deciding when to enter or exit the market.

Compared to tools like the TDI indicator, which focuses on momentum and technical market conditions, ITM emphasizes the status of option contracts and their intrinsic value.

Source Box

According to Accounting Insights, understanding the In-The-Money (ITM) status allows a trader to quickly determine if a contract has intrinsic value. This awareness accelerates decision-making and makes it more reliable.

How to Calculate ITM in Options Contracts

Unlike many technical analysis tools with complex mathematical formulas, ITM in options trading is a simple computational status. To determine if an option is ITM, compare the current market price with the strike price:

- For a call option, if the current price is higher than the strike price, the option is ITM.

Intrinsic Value = Current Market Price – Strike Price

- For a put option, if the current price is lower than the strike price, the option is ITM.

Intrinsic Value = Strike Price – Current Market Price

Calculating ITM is essentially determining the intrinsic value of the contract. By simply looking at the price chart and strike price, a trader can easily tell if the option is ITM.

Unlike the Fisher indicator, which works on price normalization and market volatility to identify trends or potential reversals, ITM focuses solely on the intrinsic value of the contract. This makes it a direct indicator in the derivatives market.

Difference Between ITM and RSI & MACD Indicators

The RSI indicator indicates whether the market is overbought or oversold. When the RSI exceeds 70, the price might have risen too much, and a correction may be near. When it falls below 30, it suggests the market may be oversold and poised to reverse.

The MACD indicator shows the market trend by comparing moving averages. It tells us if the market is more likely to rise or fall. If the MACD line crosses the signal line, it may signal a trend change or the beginning of a new movement.

However, ITM is different from these two indicators. ITM doesn’t track overbought conditions or market trends. It simply answers, “Does this option contract have profit right now?” If the contract would be profitable if exercised immediately, it’s ITM.

RSI and MACD focus on price Behaviour, but ITM focuses on the “profitability status” of the option contract. Even if you use other tools like the PPO indicator to analyse market momentum, ITM still stands out. It looks at the contract’s intrinsic value, not just price movement.

| Feature | ITM Status | RSI / MACD |

|---|---|---|

| Focus | Intrinsic Value (Profitability) | Price Action & Momentum |

| Signal Type | Is it profitable now? | Is it overbought/oversold? |

| Usage | Risk Management & Strike Selection | Timing Entry/Exit |

| Calculation | Price vs. Strike Price | Mathematical formulas on price history |

How to Trade in ITM Status in Options Trading

Traders can use ITM status in options trading by understanding that it directly shows an option’s profitability. When an option is ITM, it means the trader will make a profit if exercised immediately. This feature makes many market participants use ITM for entry/exit decisions and risk management.

How to Determine Entry and Exit Points in ITM Options Trading

When the market price is higher than the strike price in a call option, it is ITM and profitable. This situation can be ideal for entering a trade. If the market price is lower than the strike price in a put option, it signals an opportunity for a bearish position.

In these cases, since delta is usually close to 1, changes in the underlying asset’s price have a larger effect on the option price. This simplifies decision-making. For greater accuracy, the Ease of Movement (EMV) indicator can help assess liquidity, price momentum, and ITM status.

How to Set Stop Loss in ITM Options Trading

An advantage of ITM options is that traders can better manage risk. Since these contracts have intrinsic value, stop-loss levels can be set more closely and precisely. Even if the market moves against expectations, intrinsic value minimises the trader’s loss.

When trading volume is combined with ITM status, as in a relative volume indicator, stop-loss levels become more logical. This ensures that traders remain in a trade only when the market has sufficient liquidity and support, and exit early when necessary.

Pro Tip

Using ITM contracts as a risk hedging tool is very popular, especially when ITM put options protect long-term assets.

Q: When is it more advantageous to exercise an ITM option rather than sell it before expiry?

A: Exercising an ITM option is generally only practical when the remaining time value is negligible or zero. In most cases, selling the option is more efficient, as it allows the trader to capture both the intrinsic value and any remaining time premium. Early exercise can make sense for deep ITM call options approaching expiry, especially when dividends are due or when liquidity is limited.

Combining ITM in Options Trading with the MACD Indicator

Using ITM with MACD helps traders ensure the option is profitable. It also ensures the option aligns with the market trend. When the ITM status matches a positive or negative MACD signal, the likelihood of analysis errors decreases.

False signals are filtered out when ITM aligns with MACD signals. This improves the analysis’s accuracy. Some traders use the Impulse System strategy with ITM to better organise entry and exit points, making decision-making simpler and more reliable.

Combining ITM in Options Trading with the RSI Indicator

Sometimes, combining ITM status with RSI signals can provide more reliable results. When a call option is ITM and RSI moves above 30, a strong upward movement is more likely.

Similarly, when a put option is ITM and RSI shows above 70, the market is in overbought territory. A continued downtrend is expected.

This combination helps traders avoid relying on just one indicator, leading to more accurate decisions.

Combining ITM in Options Trading with Moving Averages

Many traders use ITM with moving averages to confirm the overall market trend. For instance, if a call option is ITM and the price moves above the simple or exponential moving average, a stronger buy signal is generated.

Conversely, when a put option is ITM and the price is below the moving average, a continued downtrend is more likely.

This simple yet effective combination can help prevent incorrect entries.

Advantages and Disadvantages of ITM in Options Trading

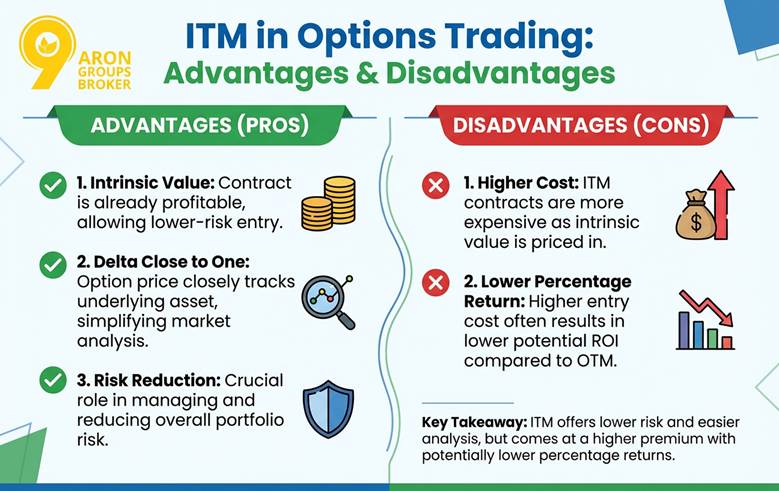

Using ITM status in options trading offers several key advantages for traders. The most important is the intrinsic value. This means the contract is already profitable, allowing the trader to enter a lower-risk position without waiting for the next market move.

Another feature is delta, which is close to one. This means changes in the underlying asset’s price affect the option price similarly, making market analysis easier. Thus, using ITM can play a crucial role in risk reduction.

However, there are also disadvantages, including:

- ITM contracts generally cost more than OTM options, as part of their value is already priced in.

- On the other hand, the percentage return on these contracts may be lower, as traders pay more to enter.

Q: How does time decay (Theta) affect ITM options compared to ATM and OTM contracts?

A: Time decay impacts ITM options less aggressively than ATM or OTM options because a larger portion of their value is intrinsic rather than time-based. While ITM contracts still lose time value as expiration approaches, the erosion is slower since inherent value does not decay. This makes ITM options more suitable for traders who want directional exposure without heavy theta pressure, especially in medium-term strategies.

Source Box

According to Avatrade's definition, the ITM status means a trader enters the market with lower risk but at a higher cost.

How to Activate and Set ITM in MetaTrader and TradingView

It’s important to note that ITM is not an installable tool like RSI or MACD, but a status in options contracts. This status indicates whether the contract currently has intrinsic value. Therefore, there’s nothing to download or activate directly.

In MetaTrader, traders can compare the current market price with the option’s strike price. If this difference shows a profit, the contract is ITM. To better understand, traders can mark strike price lines on the chart to easily see the contract’s profit or loss.

TradingView follows a similar approach. By adding option tools to the chart and displaying the strike price, you can compare the asset’s current price with it. Whenever the market price benefits the trader, the contract is considered ITM. No specific settings are needed, and the analysis relies on the trader’s chart-reading accuracy.

Q: How can ITM options be used as a stock replacement strategy?

A: ITM options can serve as a stock replacement, providing similar price exposure with a lower capital commitment. Deep ITM call options typically have high delta, meaning they closely track the underlying asset’s price movement. This allows traders to control the same directional risk as owning the asset itself while reducing capital usage and limiting downside risk to the option premium paid.

Conclusion

The ITM concept in options trading helps traders determine whether an option contract currently has intrinsic value. This reduces trade risk and makes decision-making more logical. Using ITM alone can provide a clear view of an option’s profitability. However, its most excellent effectiveness comes when combined with other technical analysis tools.

Combining ITM with indicators such as RSI, MACD, or moving averages makes signals more reliable and reduces the likelihood of trade errors. Ultimately, as part of a comprehensive strategy, ITM can play an essential role in risk management and in improving accuracy in options trading.