The ICT London Killzone is a narrow yet powerful window at the start of the London Session when liquidity, volatility, and institutional order flow align. Rather than trading all hours indiscriminately, precision-focused traders use the Killzone to synchronize their execution with the market’s most meaningful moves. This article breaks down how the ICT London Killzone works, why timing matters as much as price, and how traders can structure high-probability entries using market structure, liquidity, and disciplined risk management.

- The ICT London Killzone is a timing filter, not a standalone strategy.

- Liquidity grabs around Asian highs and lows drive early London price action.

- Order blocks and fair value gaps provide precise Killzone entry zones.

London Killzone Quick Overview

The ICT London Killzone refers to a specific time window during the London session when the Forex market experiences a sharp increase in liquidity and volatility. This period typically begins as the Asian session winds down and London becomes fully active, allowing institutional participants to execute large orders that were not efficiently filled earlier in the day.

Compared to quieter sessions, the market during the London Killzone shows clearer reactions around key levels such as:

- Asian session highs and lows

- Previous day’s high or low

- Short-term liquidity pools

For example, EURUSD may remain range-bound during the Asian session, moving only 20–30 pips. Once London opens, the same pair can expand 70 pips or more within a short period. This behaviour makes the London Killzone particularly attractive to traders who focus on precision entries rather than extended trade management.

Key Insight:

The ICT London Killzone defines the conditions under which structured setups perform as intended.

Key Features of ICT London Killzone

One defining feature of the ICT London Killzone is its role in redistributing liquidity accumulated during the Asian session. Overnight trading often produces a narrow range, where stop losses cluster above obvious highs and below obvious lows. When London opens, the price frequently moves toward one side of that range to access this liquidity.

Another key characteristic is volatility expansion. Candle size increases, spreads tighten, and momentum becomes more directional. This environment is particularly suitable for structured approaches such as market structure analysis, order blocks, and fair value gaps.

The London Killzone is also known for influencing the daily high or low. On many trading days, the most extreme price level is formed during this window and is not revisited later. This makes early-session analysis especially valuable.

Instruments tied to European currencies tend to perform best, including:

- EURUSD

- GBPUSD

- EURJPY

- GBPJPY

However, as Forexloaded notes, this window also carries risk. False breakouts and short-term manipulation are common, especially in the first moves after the open. For this reason, successful traders avoid reacting to the first push and instead wait for confirmation through structure or price reaction.

Important Clarification

The Killzone is not a strategy by itself. It is a timing filter. It tells you when to look for trades, not how to enter blindly.

Why Killzone Timing Matters for Precise Entries

In professional trading, timing is a core variable, not a secondary detail. Many technically valid setups fail simply because they are executed during low-liquidity periods. The ICT London killzone time addresses this issue by narrowing focus to the hours when market participation is highest.

A clean order block or fair value gap is far more likely to hold during the London Killzone than during the Asian session. The reason is simple: institutional order flow is active, providing the volume needed for the price to react meaningfully.

Using the London Killzone as a timing filter offers several practical benefits:

- Faster trade development

- Reduced exposure time

- Clearer invalidation levels

Q: Can you use the same ICT London Killzone strategy outside the Killzone hours?

A: Yes, it’s possible. But the statistical edge is usually lower because liquidity and momentum are weaker outside that window.

Optimal London Session Hours & Killzone Timing

The London session is not uniformly active from open to close. Instead, liquidity and volatility concentrate in specific time blocks, which is why precise timing matters more than simply “trading London.”

The ICT London killzone time aligns with the period when institutional order flow increases sharply. This is when price is most likely to break consolidation, seek liquidity, and form the day’s key high or low. Traders who operate outside these windows often experience slow execution, weaker follow-through, and unnecessary drawdown.

Prime Killzone Time Windows (GMT & Broker Time)

The London Killzone typically runs from 07:00 to 10:00 GMT. This window begins as the Asian session ends and London becomes fully active. During this transition, liquidity increases rapidly and spreads tighten.

A common mistake is ignoring the broker server time.

For example, if a broker uses GMT+3:30, the London Killzone will appear on the chart from 10:30 to 13:30 broker time. Failing to adjust for this leads to trading the wrong hours.

Forex Session Overlaps (London-New York) and Market Impact

The London–New York overlap starts later in the day.

As New York desks come online, liquidity deepens, and order flow becomes more two-sided. This can do one of two things:

- fuel continuation of the London move

- or trigger a reversal if London’s push was mainly a liquidity sweep.

The overlap becomes especially important on days with scheduled U.S. releases such as CPI, NFP, or FOMC-related events. In those cases, price may behave quietly after the London open, then expand again as New York liquidity enters.

Q: Should you wait for the overlap to trade?

A: Not necessarily. The London ICT killzone remains the best window for early directional setups, while the overlap is better for continuation or a second entry.

Volatility Patterns During London Open

Volatility during the London open is rarely clean or linear. The typical pattern is:

expansion → pullback → decision.

Price often makes a sharp first move to grab liquidity (for example, sweeping the Asian high), then stalls or retraces. This pause is where many traders get trapped—either chasing the move late or entering too early without confirmation.

A higher-probability approach is to wait for a clear reaction and a structure signal.

For example, if EURUSD spikes 25 pips above the Asian high, then breaks back below and forms a lower high, that shift often provides a more controlled entry with a tighter stop. The key is not to trade volatility itself, but to trade how the price behaves after volatility appears.

Precision Timing Strategies for High-Probability Entries

The ICT London Killzone provides a timing framework that aligns retail execution with institutional activity. When liquidity and participation increase, technical models are more likely to perform as expected.

A key principle of the ict London killzone strategy is filtering trades by time before analyzing price. Instead of reacting to every signal, disciplined traders restrict execution to the Killzone window, where volatility expansion and order flow support decisive moves. This approach reduces false signals, improves risk-to-reward efficiency, and limits exposure during low-quality market conditions.

Adjusting Entries to Market Momentum

Market momentum during the London Killzone is dynamic, not constant. Price often accelerates sharply, pauses, and then either continues or reverses. Adjusting entries means waiting for confirmation after volatility appears, rather than chasing the initial move.

For example, if EURUSD spikes above the Asian high during the London open, an immediate entry is often premature. A higher-probability entry forms after:

- A clear price reaction

- A pullback into a key level

- A market structure shift confirming direction

This adjustment allows tighter stops and better risk control while staying aligned with momentum.

Using Killzone Time Windows with Forex Session Overlaps

The London–New York overlap can reinforce or invalidate moves initiated during the London ict killzone. If the price holds structure, overlap liquidity often extends the trend. If not, it may expose a false move.

A practical rule is to treat the Killzone as the primary entry window, while using the overlap for confirmation, partial profit-taking, or trade management—never as a replacement for proper timing discipline.

Typical Price Behaviour During the Killzone

Price behaviour during the ICT London Killzone follows recurring patterns that reflect how liquidity is redistributed at the start of the London session. This period is not random or chaotic; it is structured around stop placement, order execution, and shifts in short-term market control.

Common Patterns Before and During the London Killzone

Before the London open, the price typically consolidates during the Asian session. This consolidation forms a visible range, with clear highs and lows acting as liquidity pools. As London opens, prices often:

- Briefly breaks above or below the Asian range

- Accelerates rapidly for several candles

- Pauses or retraces once liquidity is collected

These patterns repeat across pairs such as EURUSD and GBPUSD and form the foundation of many ICT London killzone strategy models.

Spotting Breakouts vs False Moves

Not every breakout during the Killzone is genuine. A true breakout usually holds above or below a key level and builds structure. False moves, by contrast, often:

- Break a level aggressively

- Fail to hold above it

- Reverse quickly with strong momentum

Waiting for confirmation prevents traders from chasing volatility.

Liquidity Grabs and Stop Hunts at London Open

Liquidity grabs are a defining feature of the ICT London killzone. Price frequently targets stops above the Asian high or below the Asian low. These moves are designed to trigger orders, not to signal trend continuation by default.

Recognizing a liquidity grab helps traders anticipate a reaction rather than blindly follow the first move.

Identifying Market Structure Shifts Before Entry

A high-probability entry forms only after a market structure shift. This usually appears as:

- Failure to continue after a liquidity grab

- A break in the short-term structure

- A clear change in high/low sequencing

In the ICT London killzone, time and structure confirm intent. Without it, entries remain speculative rather than strategic.

Advanced Entry Techniques

Advanced entries within the ICT London Killzone are built on confirmation, not anticipation. Once liquidity has been addressed and volatility expands, the focus shifts from spotting movement to executing with precision.

This is where structure, price imbalance, and risk control come together.

Applying the ICT Killzone Strategy to Market Structure

Market structure is the backbone of any ICT London killzone strategy. After a liquidity grab at the London open, the price often shows a clear change in behaviour. A valid entry requires:

- A failure to continue in the direction of the liquidity sweep

- A short-term market structure shift (higher low for buys, lower high for sells)

- A decisive break in the internal structure

Without this shift, any entry remains speculative, even if timing is correct.

Using Order Blocks and Fair Value Gaps for Killzone Entries

Order blocks and fair value gaps (FVGs) offer precise entry points during the ICT London Killzone. These tools identify zones where price is likely to react, either continuing the trend or reversing.

- Order Blocks: Areas where institutional buying or selling has occurred in the past. In the Killzone, prices often retrace to these areas, creating an ideal entry setup.

- Best Stop Loss: Just beyond the order block’s boundary to protect against any sharp reversals.

- Fair Value Gaps (FVGs): Gaps left by rapid price moves often signal areas where price will retrace to fill them. Entering near these zones allows for precise, low-risk entries.

- Best Stop Loss: Place the stop just below the start of the gap or the nearest swing low/high.

Using both order blocks and FVGs for entries ensures traders have a high-probability entry aligned with institutional activity.

Premium vs Discount Zones During the Killzone

The concept of premium vs. discount zones is crucial for determining the best entry areas during the ICT London Killzone. These zones refer to the relative price compared to the ideal entry level within the market cycle.

- Premium Zone: When the price is above the equilibrium (Fair Value), it’s considered a premium zone, typically ideal for shorting.

- Best Entry: Sell at premium levels after a liquidity grab or false breakout.

- Stop Loss: Just above the recent high or structure break.

- Discount Zone: When the price is below equilibrium, it’s considered a discount zone, where buying is favoured.

- Best Entry: Buy at discount levels after the price shows signs of reversal.

- Stop Loss: Place it just below the recent low or liquidity zone.

For optimal entry during the London ICT Killzone, focus on discount zones for long positions and premium zones for short positions. Always ensure your stop-loss is strategically placed near structural breaks to protect against false moves.

Risk Management for Killzone Trades

In the ICT London Killzone, volatility is high, and sudden price movements can lead to rapid fluctuations. To manage risk properly, consider these core principles:

- Position Sizing: Never risk more than a fixed percentage of your trading capital (usually 1-2% per trade).

- Stop Loss Placement: Set the stop just beyond key levels, such as liquidity grabs or structural breaks, to avoid being taken out prematurely.

- Risk-to-Reward Ratio: A minimum of 1:2 (risk-to-reward) is ideal, aiming for larger moves after market structure shifts.

In summary, risk management in the London kill zone comes down to proper position sizing, a stop-loss strategy, andrealistic profit targets based on market behaviour.

Trading Point:

Set Stop-Loss just beyond liquidity grabs, order blocks, or recent swing highs/lows to avoid early stop-outs.

Best Forex Pairs and Instruments for the Killzone Window

During the ICT London Killzone, major pairs like EUR/USD, GBP/USD, and USD/JPY are ideal due to their liquidity and volatility. Cross-currency pairs such as GBP/JPY and EUR/JPY also show significant price movements, particularly during the overlap with the New York session. Additionally, commodities like Gold (XAUUSD) perform well in this window, benefiting from its volatility and strong market reactions to global events.

Major Forex Pairs Performance

During the ICT London Killzone, the major forex pairs exhibit distinct behaviours based on institutional and retail activity. These pairs are the most liquid and offer some of the clearest price moves.

- EUR/USD: This is one of the most traded pairs during the London session. The EUR/USD pair is highly volatile in the Killzone, with strong momentum during the initial hour after the London open.

- GBP/USD: Another top performer, the GBP/USD tends to show sharp price movements, especially when the market reacts to UK economic data or geopolitical events. The ICT London Killzone strategy works well with this pair when volatility is high.

- USD/JPY: The USD/JPY also benefits from institutional activity. The price tends to be more volatile after 8:00 AM GMT, providing additional trading opportunities.

Trading Gold (XAUUSD) During London Killzone

While forex pairs are the primary focus during the ICT London Killzone, commodities like Gold (XAUUSD) also perform well due to their high volatility and correlation with broader market sentiment.

The price action of GOLD is often the most aggressive from 7:00 AM to 10:00 AM GMT during the London session. This is the ideal time to enter trades, as gold typically moves in line with major market shifts during this window.

- Strategies for Trading Gold:

- Use Fibonacci retracements and order blocks to spot entry points during pullbacks or after a liquidity grab.

- Watch for shifts in market structure and price rejections at key levels, which signal the continuation or reversal of trends.

Risk Management Note:

Due to gold's volatility, always ensure your stop-losses are properly placed outside key liquidity zones, and be mindful of the market's broader sentiment.

Tools and Indicators to Enhance Killzone Trading

To make identifying kill zones easier, several indicators have been developed for trading platforms such as TradingView and MetaTrader. These indicators are custom tools, meaning they are not included by default in these platforms and must be added manually by the user.

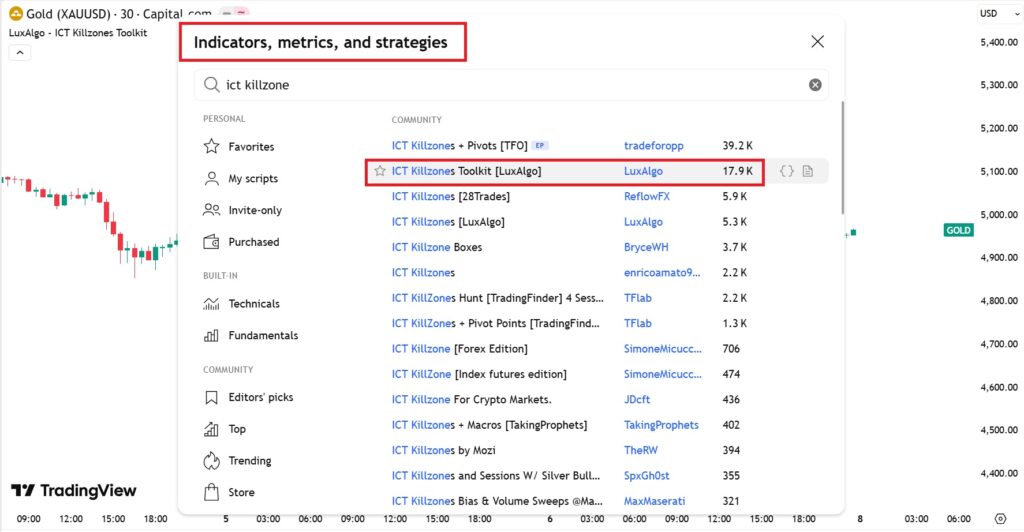

According to How to Trade, one of the most well-known ICT Killzone indicators on TradingView is the one developed by LuxAlgo. As described on TradingView, this indicator not only highlights ICT Killzones but also identifies Order Blocks, Fair Value Gaps (FVGs), and Market Structure Shifts, making it a comprehensive tool for ICT-based analysis.

To install an ICT Killzone indicator on TradingView:

In the Indicators section of the top toolbar on TradingView, search for “ ICT Killzone” and select one from the many indicators that TradingView offers in this category.

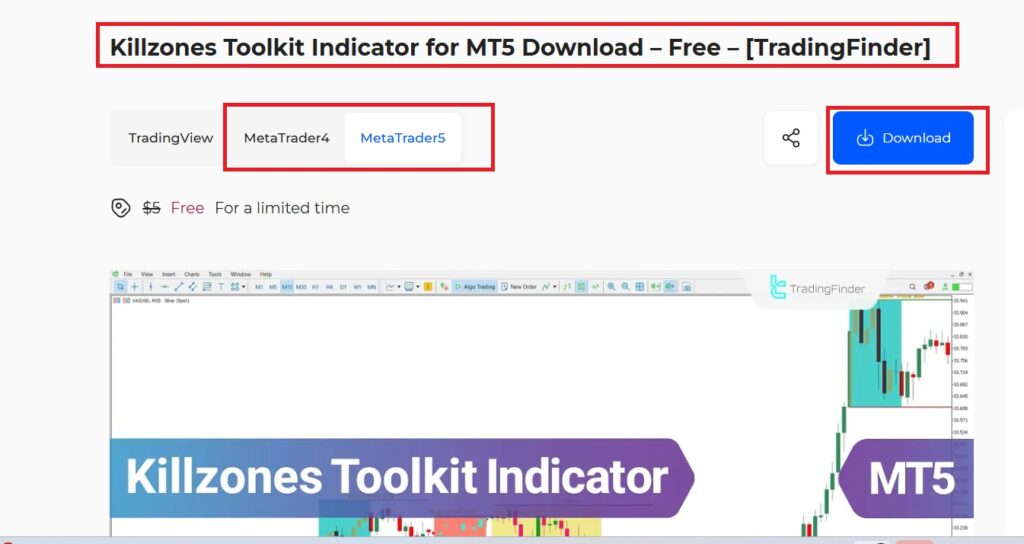

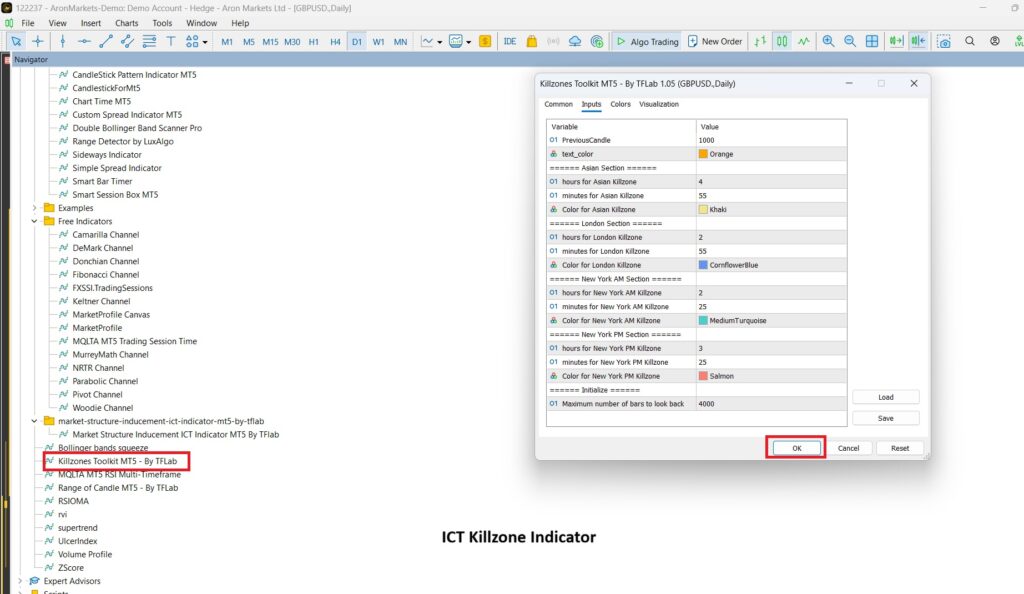

To install an ICT Killzone indicator on MetaTrader:

- Visit the TradingFinder website and download the indicator file.

- Extract the ZIP file and click on the indicator’s .ex5 file so that it appears in the MetaTrader Navigator panel.

- Then, click on the indicator name to open the settings window, apply your preferred adjustments, and confirm the settings to add the indicator to the price chart.

Using the ICT Killzone Indicator for Precise Entry Signals

The ICT Killzone Indicator is designed to highlight the optimal trading times during this high-probability window. By identifying key entry points based on market structure and liquidity dynamics, traders can use this indicator to refine their entries and improve accuracy. The ICT Killzone Indicator can be customized to reflect your trading preferences and risk tolerance, making it an essential part of any precision-based strategy.

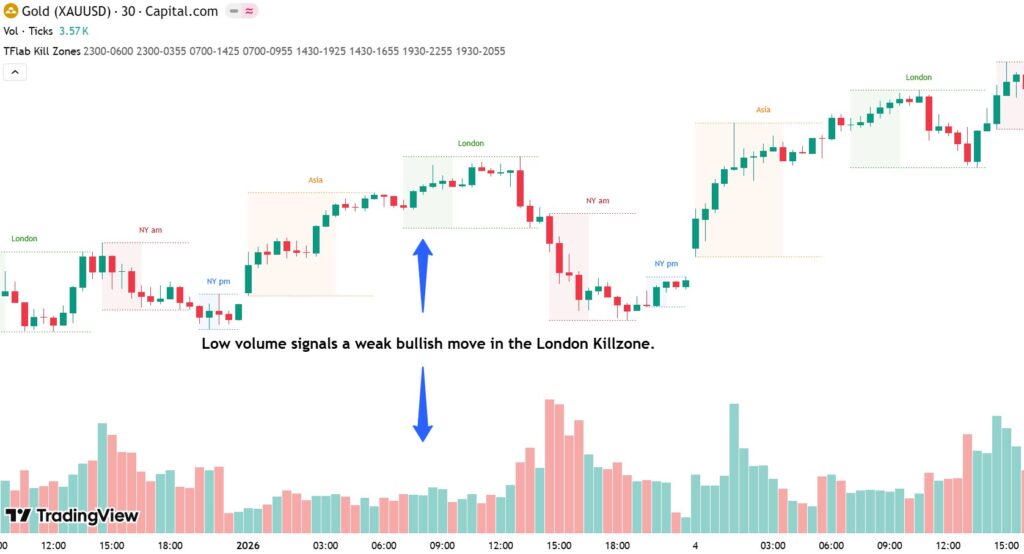

Using Volume and Volatility Indicators Effectively

Volume and volatility indicators play a crucial role in enhancing Killzone trading strategies. By monitoring volume changes during the London Killzone, traders can gauge the strength behind price moves. High-volume spikes often indicate institutional participation, which is a strong signal to consider entering or exiting trades.

Combining these indicators with volatility metrics, such as the Average True Range (ATR) or Bollinger Bands, can provide additional confirmation of trade setups, increasing the probability of success.

Leveraging ICT Killzone Strategy Templates

ICT Killzone strategy templates offer a structured approach to market analysis, from identifying key liquidity zones to pinpointing optimal entry and exit points. By following these proven frameworks, traders can minimize emotional decision-making and stick to a consistent methodology.

Integrating Technical Analysis with Killzone Timing

Combining technical analysis with the timing of the ICT London Killzone creates a powerful edge for traders. During this period, market conditions are primed for significant price movements, so using technical tools such as support and resistance levels, moving averages, and chart patterns can enhance entry precision. Traders can identify breakout points, reversal signals, and continuation patterns that align with the high liquidity and volatility of the Killzone. By aligning technical indicators with the timing of this critical trading window, traders can improve their setups and increase overall profitability.

Conclusion

The ICT London Killzone offers traders a statistical and structural edge by narrowing focus to the market’s most active hours. When timing is treated as a strict filter and combined with liquidity analysis, market structure, and sound risk management, entries become cleaner, faster, and more controlled. Ultimately, consistent Killzone trading is not about catching every move—but about executing fewer trades under the right conditions, with precision and intent.