Can you trade stocks on the weekend? This common question arises because trading apps remain accessible even when exchanges are closed. In reality, stock markets shut down from Friday to Monday. Understanding what happens during this pause helps traders avoid false assumptions, manage weekend risk, and prepare for how prices actually form when markets reopen.

- A trading app being online does not mean the stock market is operating; exchanges, not platforms, determine when trades can occur.

- Placing an order over the weekend is only a queued instruction; execution depends entirely on Monday’s live liquidity.

- Without market makers and institutional participation, there is no real price discovery — only expectations.

- Weekend news does not move stock prices gradually; it often appears suddenly as Monday morning gaps.

- Markets like cryptocurrency trade 24/7 because they lack centralised exchange hours; stocks, on the other hand, rely on structured sessions and active participation.

Is the Stock Market Open on Weekends? Here’s the Reality

Unlike crypto markets, stocks do not have defined weekend trading hours because exchanges are fully closed.

This means stock markets do not operate on weekends. Major exchanges such as the NYSE and NASDAQ close on Friday afternoon and remain closed until Monday morning. During this period, no actual stock transactions occur, regardless of what trading apps or broker platforms may display.

This is where many traders get confused. Platforms may still allow you to place orders, view charts, or monitor prices, but none of this means the market is active. The exchange itself is offline. Without the exchange, there is no order matching, no liquidity flow, and no trade execution.

Understanding this distinction is critical. Weekend activity on a trading platform does not mean weekend trading is happening.

NYSE and NASDAQ Closing Times Explained

As explained in NYSE and NASDAQ, regular trading hours for both exchanges run from 9:30 AM to 4:00 PM Eastern Time, Monday through Friday. Pre-market and after-hours sessions extend this window slightly, but only on weekdays.

While after-hours trading exists during the week, there is no concept of after hours trading on the weekend.

Once Friday’s session ends:

- No pre-market session exists on Saturday or Sunday

- No after-hours trading continues into the weekend

- The exchange infrastructure is fully paused

This pause is necessary for pricing integrity. Stock prices depend on active participation from institutions, market makers, and traders.

What Happens to Orders Placed on Saturdays and Sundays?

When you place an order over the weekend, it does not reach the exchange. Your broker simply stores it as a queued instruction.

- The order waits in the broker’s system

- It does not interact with live prices

- It is released only when the market reopens on Monday

This is why weekend orders often face price gaps at execution.

The logic is straightforward:

Trading over the weekend is essentially gambling. You might wake up to a massive market gap on Monday that either makes you a fortune or wipes out your entire account. Even if you have a stop-loss in place, it may fail to trigger due to the price skipping your level.

Why You Can’t Actually Trade Stocks Over the Weekend

A common follow-up question is what stocks can you trade on the weekend. The reality is simple: none. real stock trading requires three elements: an active exchange, live liquidity, and continuous price discovery. None of these exist on weekends.

Even if technology allows platforms to stay online, the market structure itself is inactive.

- Exchanges are closed

- Market makers are not quoting prices

- Institutional order flow is paused

Without these components, trading cannot happen reliably.

How Exchanges and Market Makers Keep Markets Functioning

During the week, market makers and institutions constantly provide bids and offers. This creates depth in the order book and allows trades to be executed instantly.

This ecosystem ensures:

- Tight spreads between bid and ask

- Fast execution speeds

- Fair and transparent pricing

On weekends, this ecosystem is offline.

Liquidity, Pricing, and Why Trading Pauses

Liquidity allows traders to enter and exit positions without causing large price swings. Pricing depends on continuous participation.

If trading continued without liquidity:

- Spreads would widen dramatically

- Prices would become unstable

- Slippage would increase significantly

This is why exchanges prefer to pause trading instead of allowing illiquid conditions.

key Insight:

No liquidity = No real price. Weekend quotes are expectations, not transactions.

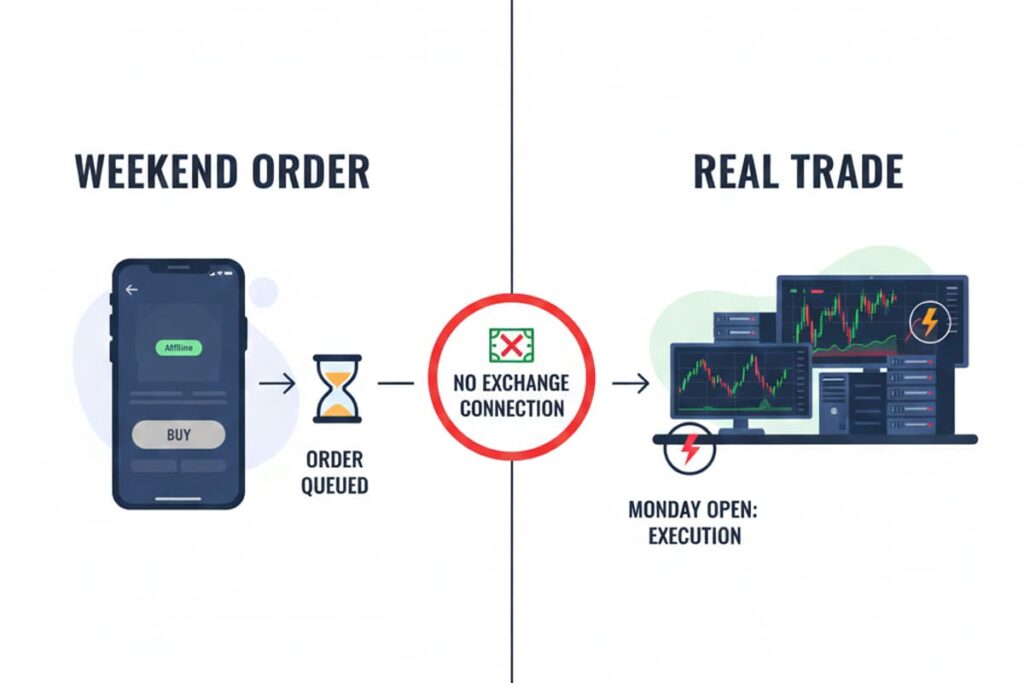

Weekend Orders vs Real Trades: A Crucial Difference

Placing an order is not the same as executing a trade. This difference becomes critical on weekends.

- An order is a request to trade

- A trade is the execution of that request in a live market

On weekends, you can only do the first action.

How Queued Orders Work Before Monday’s Open

Queued orders remain stored in the broker’s system until pre-market or regular hours begin on Monday.

When the market reopens:

- Orders are sent to the exchange

- They are matched against real liquidity

- Execution price depends on current market conditions, not weekend prices

This often results in slippage or unexpected entry points.

Placing an Order vs Executing a Trade

This distinction explains a common misunderstanding about weekend trading. Placing an order is the act of instructing a broker to buy or sell an asset at a specific price or time. Executing a trade is the fulfilment of that order when it matches with a counterparty in the market. Placing is the request, whereas executing is the final, completed transaction.

| Feature | Placing an Order (Weekend) | Executing a Trade (Monday) |

|---|---|---|

| Action | You send a request to the broker. | The broker matches you with a seller. |

| Status | Queued / Pending | Filled / Completed |

| Price | Hypothetical (Last Friday's close). | Real (Monday's market price). |

| Risk | High (You don't know the fill price). | Standard (You see the live price). |

What Markets Are Open While Stocks Are Closed?

Not all financial markets follow the same schedule. Some markets remain active even when stock exchanges are closed. According to Bitget, the Forex and Cryptocurrency markets are two of the most important markets open on weekends.

This difference has become more visible with the rise of digital assets and derivative instruments.

Cryptocurrencies and the Rise of 24/7 Trading

Crypto markets operate continuously without centralised shutdowns.

- Bitcoin and Ethereum trade 24/7

- Global participation keeps liquidity active

- There is no fixed exchange closing time

This structure allows real trading to continue over the weekend.

Keep in mind:

Crypto trades 24/7 because it has no central exchange. Stocks don’t. That’s the whole difference.

Accessing Stock Exposure via CFDs

Some traders seek weekend exposure to stock price movements through Contracts for Difference (CFDs).

- CFDs allow speculation without owning the stock

- Some providers offer synthetic weekend pricing

- Prices reflect expectations, not real exchange trades

CFD weekend pricing is based on projections, related markets, or internal models, not actual stock exchange activity.

Do Any Stock Exchanges Operate on Weekends?

Most stock exchanges around the world follow a Monday–Friday trading schedule. However, not all markets share the same weekend structure. Some countries operate on a different weekly calendar, which creates the impression that stocks may trade on weekends.

This is not weekend trading in the traditional sense. It is simply a different definition of the trading week.

- Western markets close on Saturday and Sunday

- Some Middle Eastern markets close on Friday and Saturday

- Their trading week runs from Sunday to Thursday

Understanding this difference prevents confusion about what “weekend trading” actually means.

| Market Region | Exchange Example | Trading Week | Weekend Status |

|---|---|---|---|

| USA / Europe | NYSE, NASDAQ, LSE | Monday – Friday | CLOSED (Sat/Sun) |

| Middle East | Saudi Exchange (TASI) | Sunday – Thursday | OPEN (Sunday) |

| Crypto | Binance, Coinbase | 24/7 | ALWAYS OPEN |

The Saudi Exchange (TASI) and Its Trading Week

The Saudi Exchange (TASI) operates from Sunday to Thursday. Friday and Saturday are considered the weekend.

This means that on Sunday, while NYSE and NASDAQ remain closed, TASI is fully operational.

- Orders are matched in real time

- Liquidity is active

- Price discovery functions normally

This is not an exception to the rule. It is simply a different market calendar based on regional workweeks.

How Global Market Calendars Differ

Trading calendars depend on local business culture and banking systems.

Because of this:

- “Weekend” does not mean the same thing globally

- Market closure depends on regional schedules

- Trading days shift based on cultural norms

Keep in mind:

A market is not closed because it is Sunday. It is closed because it is a non-trading day in that region.

Liquidity and Volatility in Weekend Conditions

When participation drops, market quality changes. This is why exchanges avoid operating during periods of thin liquidity.

Liquidity is what keeps spreads tight and pricing stable. Without enough participants, price behaviour becomes unreliable.

Why Spreads Widen When Participation Drops

Spreads represent the gap between buyers and sellers. In active markets, this gap is small because many participants compete.

When participation falls:

- Fewer buy and sell orders exist

- Market makers reduce quoting activity

- The bid–ask spread becomes wider

This makes trading more expensive and less predictable.

Price Behaviour in Thin Markets

In thin markets, small orders can cause large price moves. This creates artificial volatility that does not reflect true supply and demand.

- Prices jump instead of moving smoothly

- Slippage increases

- Execution becomes inconsistent

An important point:

Thin participation creates exaggerated price moves. That is not volatility — that is illiquidity.

From Weekend Shutdown to Monday’s Opening Bell

The transition from market closure to market reopening is one of the most important moments for traders. A lot of information accumulates while the market is closed.

This information does not affect prices immediately. It waits for the first moment liquidity returns.

Monday Morning Gaps and Weekend News Impact

When markets reopen on Monday, prices often “gap” away from Friday’s close.

This happens because:

- News events occur over the weekend

- Economic or political developments change expectations

- Orders queued over the weekend hit the market at once

The result is a price jump before normal trading resumes.

The Role of Pre-Market Sessions

Pre-market sessions help absorb some of this pressure before the regular session begins.

During pre-market hours:

- Early liquidity providers start quoting prices

- Queued orders begin interacting with the market

- Initial price discovery starts forming

This phase reduces some of the shock before the opening bell.

Crypto vs Stocks: Weekend Trading Compared

The difference between crypto and stocks becomes very clear on weekends. One market remains fully active. The other is completely paused.

This contrast highlights the structural differences in crypto trading vs stock trading, especially during weekends, and how market structure affects trading availability.

Trading Hours, Liquidity, and Accessibility

Crypto markets operate continuously because they are decentralised and global.

- No central exchange controls trading hours

- Participants from all time zones provide liquidity

- Orders can be executed at any time

Stock markets rely on centralised exchanges with defined schedules.

Don't forget:

The availability of a platform does not equal the availability of a market.

Risk Differences Weekend Traders Should Know

Weekend crypto trading comes with different risk dynamics compared to weekday stock trading.

- Liquidity can still fluctuate depending on participation

- Volatility may increase during off-peak hours

- Price movements continue without pause

Stocks avoid these conditions by closing the market.

This is why weekend trading is normal in crypto but structurally impossible in equities.

Can Trading Apps Like Robinhood Execute Weekend Stock Trades?

Many traders assume that if a trading app is online, trading must still be possible. This is especially common with platforms like Robinhood, leading many users to ask whether you can trade stocks on the weekend using Robinhood. This assumption is incorrect. Broker platforms can operate 24/7, but they cannot execute stock trades when the exchange is closed.

This confusion happens because traders see an active interface and mistake it for an active market.

- The app is working

- Your account is accessible

- Orders can be submitted

- But the exchange is offline

Without the exchange, no real stock transaction can occur.

How Broker Platforms Handle Weekend Orders

When you place an order over the weekend, the broker does not send it anywhere. The order is stored internally as a queued instruction.

- It waits in the broker’s system

- It is not matched with any counterparty

- It is transmitted only when the market reopens

This process is automatic and invisible to most traders, which is why many believe trading is still happening.

Note:

A broker can accept your order anytime. Only the exchange can execute it.

Indirect Market Exposure Through Derivatives

Some platforms offer access to derivatives such as CFDs or other synthetic instruments during the weekend. These products may reflect expected price movements in underlying stocks.

- You are not trading the real stock

- Pricing is based on projections or related markets

- Liquidity depends on the provider, not an exchange

This creates exposure, but not true equity trading.

How Traders Prepare Before the Weekend Begins

Experienced traders treat the weekend as a risk period, not a rest period. Markets may be closed, but information flow continues.

News, earnings reports, geopolitical events, and macroeconomic developments can all occur while trading is paused.

Managing Positions Ahead of Friday’s Close

Before the market closes on Friday, traders often adjust their exposure.

- Closing short-term positions to avoid gap risk

- Reducing leverage before the weekend

- Locking in profits or limiting downside

This preparation reduces uncertainty when the market reopens.

Hedging Against Weekend Event Risk

Some traders use hedging strategies to protect against unpredictable weekend events.

- Using options to limit downside risk

- Diversifying positions across assets

- Reducing concentration in volatile stocks

Conclusion

So, can you trade stocks on the weekend – or even place a trade when exchanges are closed? No, you cannot trade stocks on the weekend because the exchange itself is closed. While broker platforms remain accessible, they only allow order placement, not execution.

Understanding the difference between platform activity and market activity removes most of the confusion around weekend trading.

Markets such as crypto continue to operate because they do not rely on centralised exchange hours. Stocks, however, depend on structured trading sessions, active liquidity, and institutional participation.

Knowing this helps traders avoid false assumptions, manage weekend risk properly, and prepare for Monday’s opening conditions with realistic expectations.