EN

EN

Technical

-

High-Probability ICT Scalping for Fast Intraday Entries

27 February 2026 , Abe Cofnas

An ICT scalping strategy is a fast intraday entry model built for 1 clean move, not a full session trend. It works when you trade inside Kill Zones, identify a clear liquidity draw (BSL/SSL), then execute the same sequence: Sweep → Displace → Retrace → Enter. The real question is this: are you scalping a […]

- Read more

-

Optimal Trade Entry Techniques for ICT Traders

27 February 2026 , Abe Cofnas

Optimal Trade Entry (OTE) is a way ICT traders use Fibonacci to find a high-probability pullback zone inside a clear swing (usually the 61.8% to 79% retracement), but the real question is this: are you using it as a smart location tool (with structure and liquidity), or just drawing fibs on every dip and hoping […]

- Read more

-

Turn Market Gaps into Opportunities with ICT Liquidity Voids

27 February 2026 , Abe Cofnas

Have you ever noticed how prices in markets sometimes jump quickly, skipping over certain levels like a space? That’s a liquidity void. a spot where few trades occur due to imbalances caused by big players, often in ICT liquidity void setups. It creates price inefficiency zones that pull prices back, offering chances in liquidity void […]

- Read more

-

A Step-by-Step Guide to Trading Bullish Divergence RSI

27 February 2026 , Abe Cofnas

Price does not move randomly. It often slows down before changing direction, and momentum indicators help traders spot that shift early. One of the most reliable signals is bullish divergence RSI, which appears when the price continues falling but the RSI indicator starts rising. This pattern can signal weakening selling pressure and a possible reversal. […]

- Read more

-

How to Trade Using the MACD and Alligator Strategy

26 February 2026 , Abe Cofnas

The MACD and alligator strategy is a simple method that helps traders understand when a market may start moving up or down. It combines the MACD indicator, also called Moving Average Convergence Divergence, with the Bill Williams Alligator indicator to spot trends and measure momentum. Even if you are new to trading, this approach can […]

- Read more

-

Buy Side vs Sell Side Liquidity: A Trader’s Guide to Market Flow

25 February 2026 , Abe Cofnas

Understanding buy side and sell side liquidity reveals why price often sweeps highs or lows before strong moves. Buy-side liquidity often forms above recent highs, where stop-loss orders from short positions tend to cluster, while sell-side liquidity commonly develops below recent lows, driven by stop placements from long positions. However, these areas do not consist […]

- Read more

-

A Trader’s Guide to ICT Liquidity and Market Sweeps

24 February 2026 , Abe Cofnas

In ICT, liquidity is treated as a market execution feature rather than an assumption about intent. It refers to areas where orders are likely to cluster and where execution is typically easier because more participants are active around the same visible price levels. This shifts the trader’s focus away from reacting to sudden spikes and […]

- Read more

-

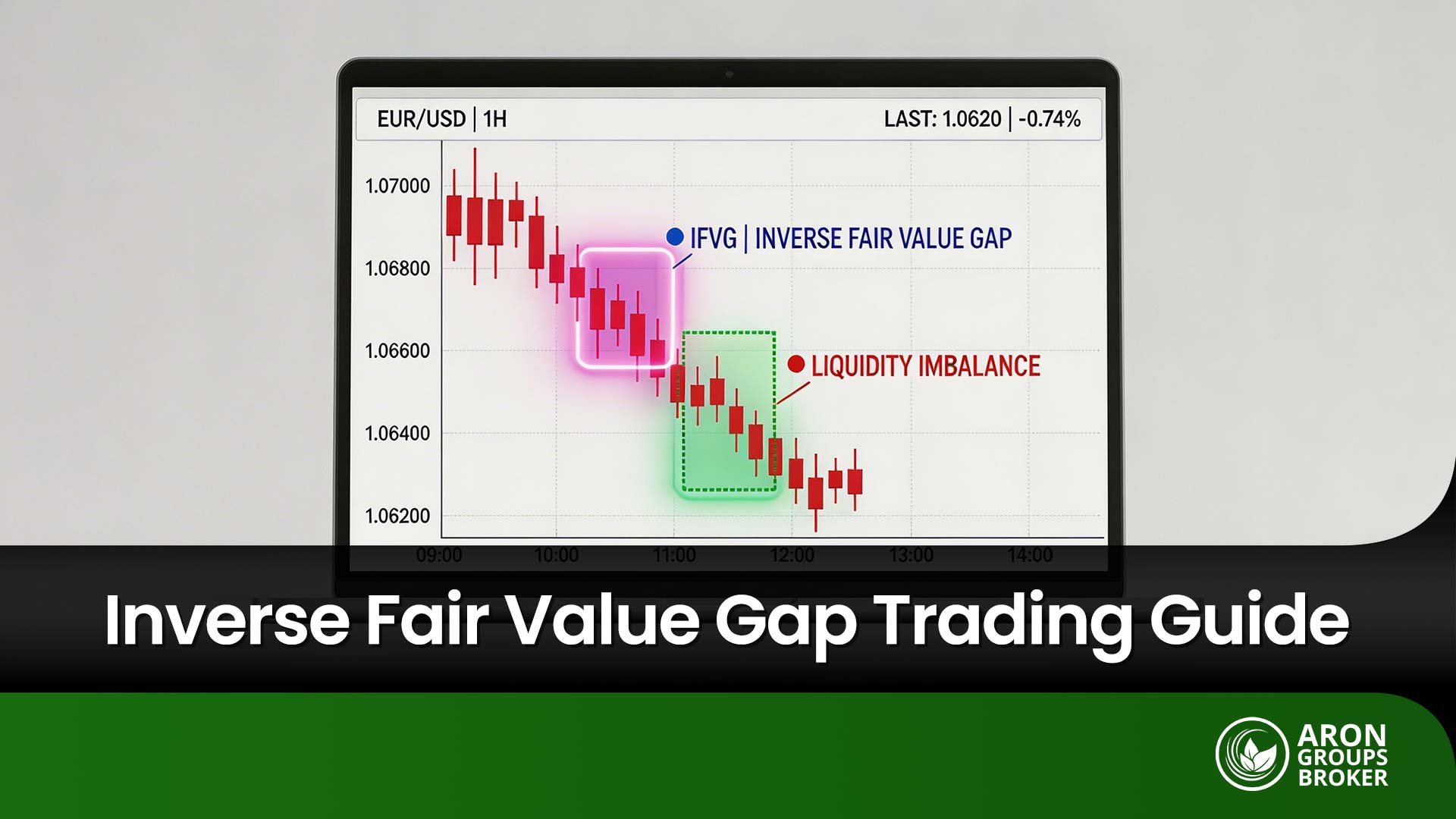

How to Trade the Inverse Fair Value Gap and Its Key Rules

24 February 2026 , Abe Cofnas

The inverse fair value gap (IFVG) is one of the most useful price concepts in modern technical trading. It describes a failed fair value gap that flips its role from support to resistance, or from resistance to support. This guide explains what an IFVG is, how it forms, and how to build a clear trading […]

- Read more

-

How to Profit from Market Gaps: Gap Fill Trading Explained

24 February 2026 , Abe Cofnas

When the price jumps from one session to the next without trading through the levels in between, traders call it a market gap. On the chart, it appears as an empty price zone with little or no trading.A gap fill strategy focuses on finding opportunities where the price reverses back into the gap as the […]

- Read more

-

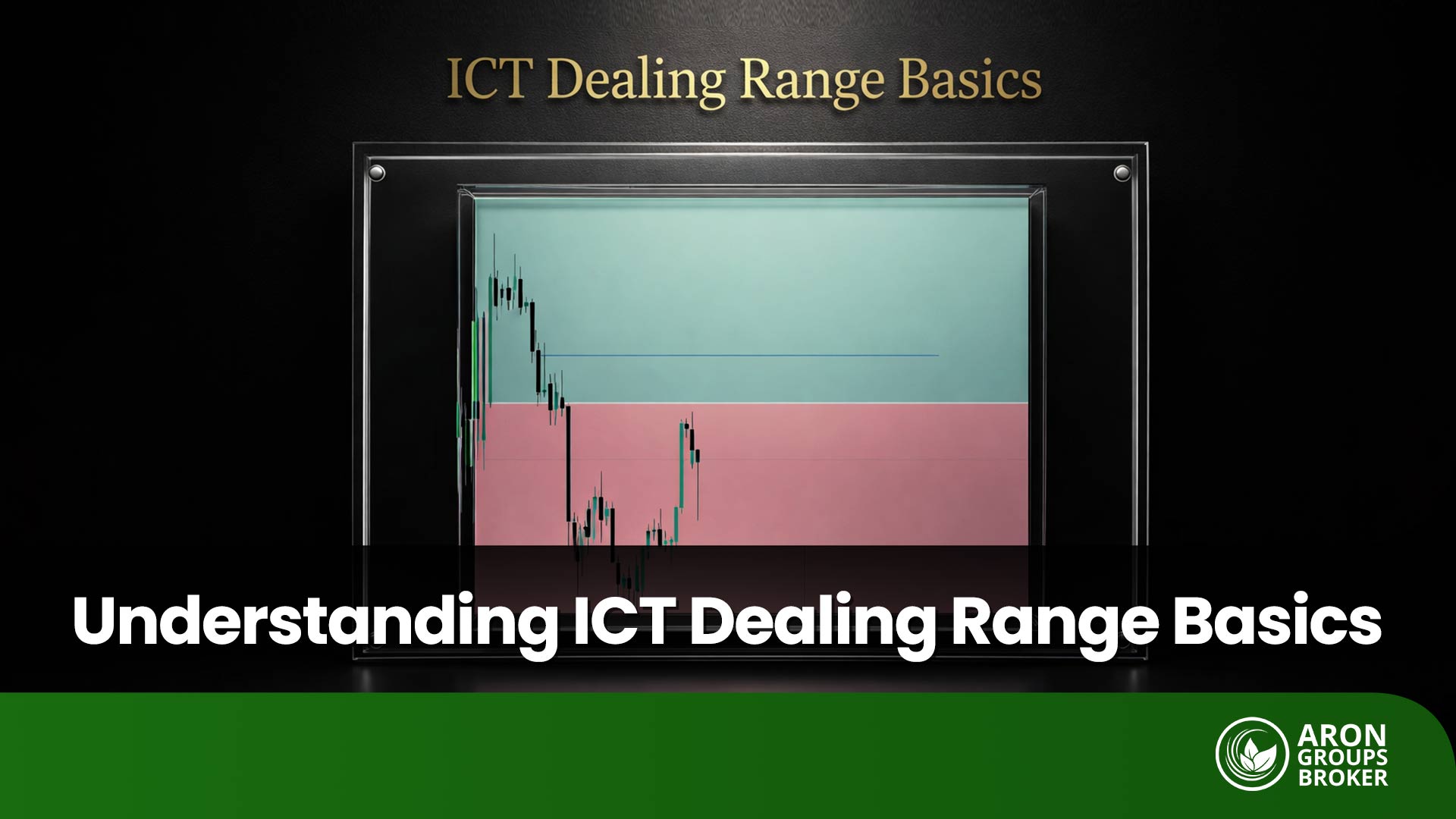

A Trader’s Guide to ICT Dealing Range and Market Structure

23 February 2026 , Abe Cofnas

ICT Dealing Range is simply the measuring tape Smart Money traders use: a meaningful high and low that lets you judge whether price is expensive or cheap inside that swing—but how do you pick the right high/low, and why does price so often poke above the range high or dip below the range low before […]

- Read more