EN

EN

Technical

-

The Secret Behind the Spinning Top Candle: A Sign of Indecision or the Start of a Major Shift?

6 January 2026 , Abe Cofnas

Financial markets are full of signals that appear on price charts in the form of candlesticks. One of the most important of these is the spinning top candle pattern. This candle forms when the market reaches a relative balance between buyers and sellers, with neither side able to take full control of the trend. Therefore, […]

- Read more

-

PVI Indicator in Technical Analysis: Understanding Volume-Driven Trends

6 January 2026 , Abe Cofnas

The PVI indicator (Positive Volume Index) is a volume-based tool that measures bullish trend strength by analysing price behaviour during sessions of increasing trading volume. Built on the premise that volume reflects market sentiment, particularly retail participation, the PVI indicator helps traders assess trend reliability and identify potential entry points. Key Points: The PVI indicator […]

- Read more

-

How to Manage Investment Risk Through Portfolio Diversification

5 January 2026 , Abe Cofnas

Portfolio diversification reduces investment risk by spreading capital across various assets, rather than relying on a single market or instrument. This approach is a core principle of sound portfolio management and a key reason why portfolio diversification is essential for long-term investors. In the following sections, we explore the benefits of portfolio diversification and introduce […]

- Read more

-

Understanding the Ichimoku Cloud and Its Trading Signals

5 January 2026 , Abe Cofnas

Technical analysis is most effective when the tools used can simultaneously reveal price behavior, trend strength, and potential reversal points. The Ichimoku indicator is specifically designed with this goal in mind. It provides a comprehensive view of market balance and imbalance, rather than offering a single perspective. The Ichimoku indicator is not just a technical […]

- Read more

-

Everything You Need to Know About Market Index

5 January 2026 , Abe Cofnas

In financial markets, the market index acts as a “market thermometer,” providing a simple number that reflects the overall market’s health. By tracking market indices, investors can gauge whether the market sentiment is optimistic or bearish. This makes market indices a key tool for understanding the broader economic trends and the direction of the market, […]

- Read more

-

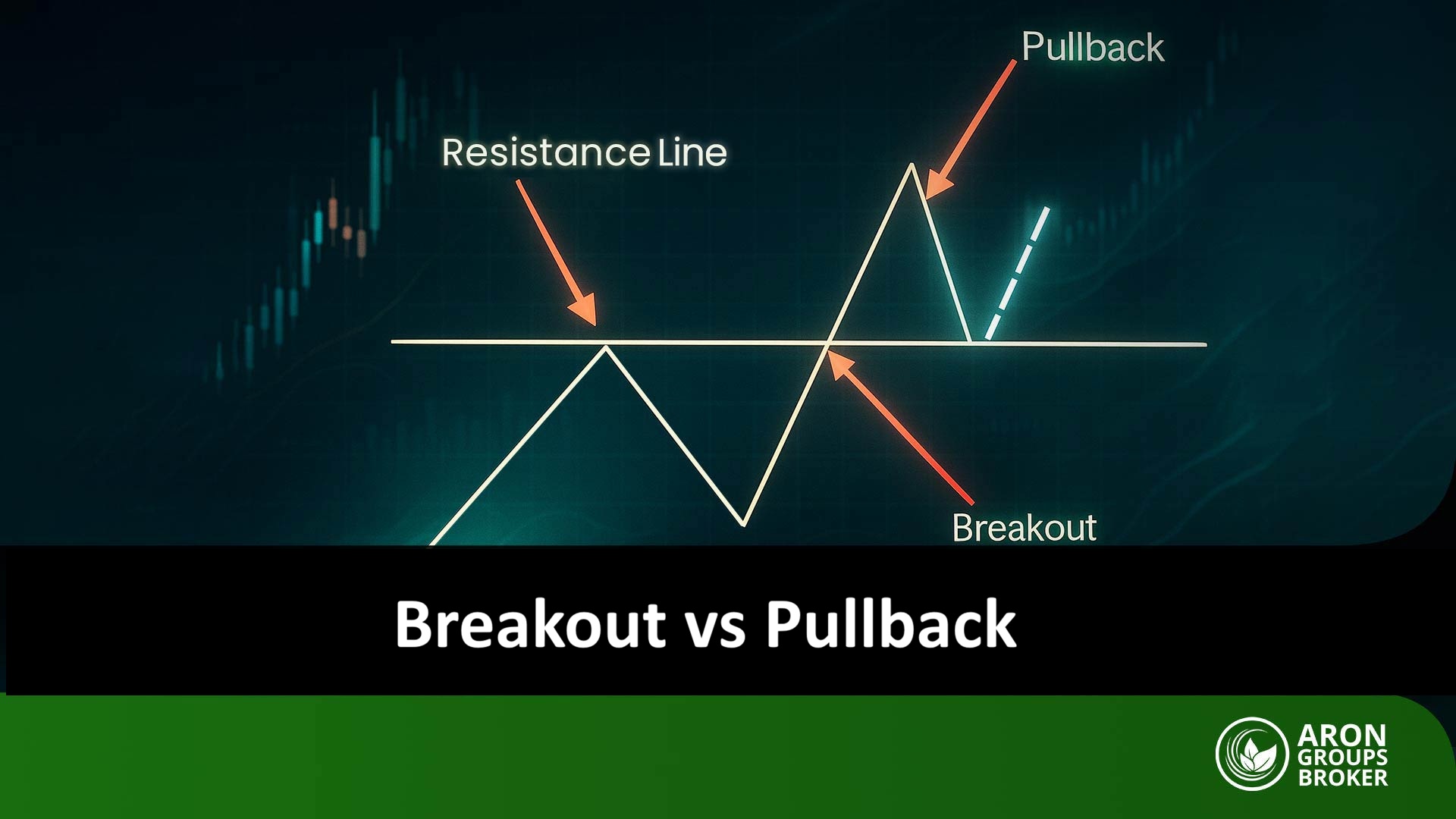

A practical comparison of pullbacks and breakouts, and how they shape trading decisions

5 January 2026 , Abe Cofnas

In trading, judging whether a move is a strong breakout or a temporary pullback is one of the most vital skills. Many new traders treat them as opposites, but good analysis shows pullbacks often follow breakouts as the next phase in markets. Understanding their differences and how they connect helps you make better trading decisions, […]

- Read more

-

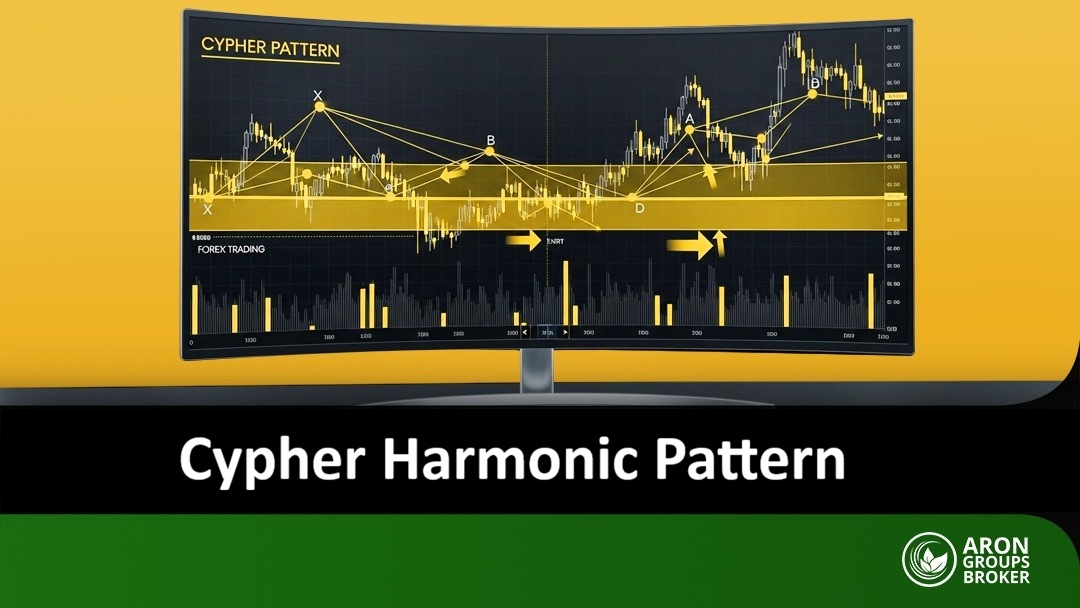

Cypher Harmonic Pattern: A Complete Trading Guide

5 January 2026 , Abe Cofnas

When it comes to technical analysis, one pattern that has gained popularity among professional traders is the Cypher Pattern. This pattern belongs to the harmonic patterns category and uses Fibonacci ratios. It helps identify potential price reversal points. Simply put, the Cypher Pattern acts like a map, helping traders locate critical market areas. These are […]

- Read more

-

Everything You Need to Know About US Treasury Bonds and Their Role in the Global Economy and Investing

4 January 2026 , Abe Cofnas

US Treasury bonds are among the most widely used financial instruments worldwide, and the US government uses them to fund spending. They are also treated as a key reference point in fundamental analysis across global markets. These bonds directly influence interest-rate expectations and shape the US Dollar Index, especially through changes in Treasury yields. For […]

- Read more

-

Everything You Need to Know About the Relative Volume (RVOL) Indicator and Potentially Profitable Ways to Trade It

4 January 2026 , Abe Cofnas

Trading volume is one of the most important factors in revealing the real story behind price moves. But watching raw volume alone is not always enough, because you cannot judge today’s volume against normal conditions. For that reason, traders use the Relative Volume (RVOL) indicator to compare current activity with its historical average. This indicator […]

- Read more

-

What Is a Trading Setup? A Complete Guide to Building Profitable, Practical Setups

4 January 2026 , Abe Cofnas

In successful trading, a clear and reliable trading setup is the difference between blind entries and disciplined decisions. Many beginners trade without a framework, and that lack of structure is a common reason losses keep repeating. If you want a clear route for entries and exits, this guide explains trading setups in a simple, usable […]

- Read more