EN

EN

Technical

-

Complete Guide to Turning Off Sound Alerts in MetaTrader 4 and 5

4 January 2026 , Abe Cofnas

If you’ve worked with MetaTrader before, you’ve probably noticed that every time an alert or notification is triggered, the platform plays a default sound. While these sounds can be helpful at first, they can become quite annoying if you spend long hours trading or work in a quiet environment. As a result, many traders are […]

- Read more

-

Complete Guide to the Slope Indicator and Its Role in Market Trend Analysis

3 January 2026 , Abe Cofnas

One of the ongoing challenges traders face in financial markets is accurately determining the direction and strength of trends. Even the slightest delay in decision-making can result in the loss of profitable opportunities. In such cases, tools like the slope indicator can play a crucial role. This indicator shows the speed of price changes as […]

- Read more

-

Comprehensive Guide to Fibonacci Settings for More Accurate Analysis in TradingView and MetaTrader

3 January 2026 , Abe Cofnas

Fibonacci is a valuable tool for improving technical analysis, but its effectiveness depends on how well it’s configured. Many traders may not fully understand its settings on platforms like TradingView or MetaTrader 4/5. By adjusting levels, colours, and display styles, you can enhance the clarity and reliability of your analysis. This article will guide you […]

- Read more

-

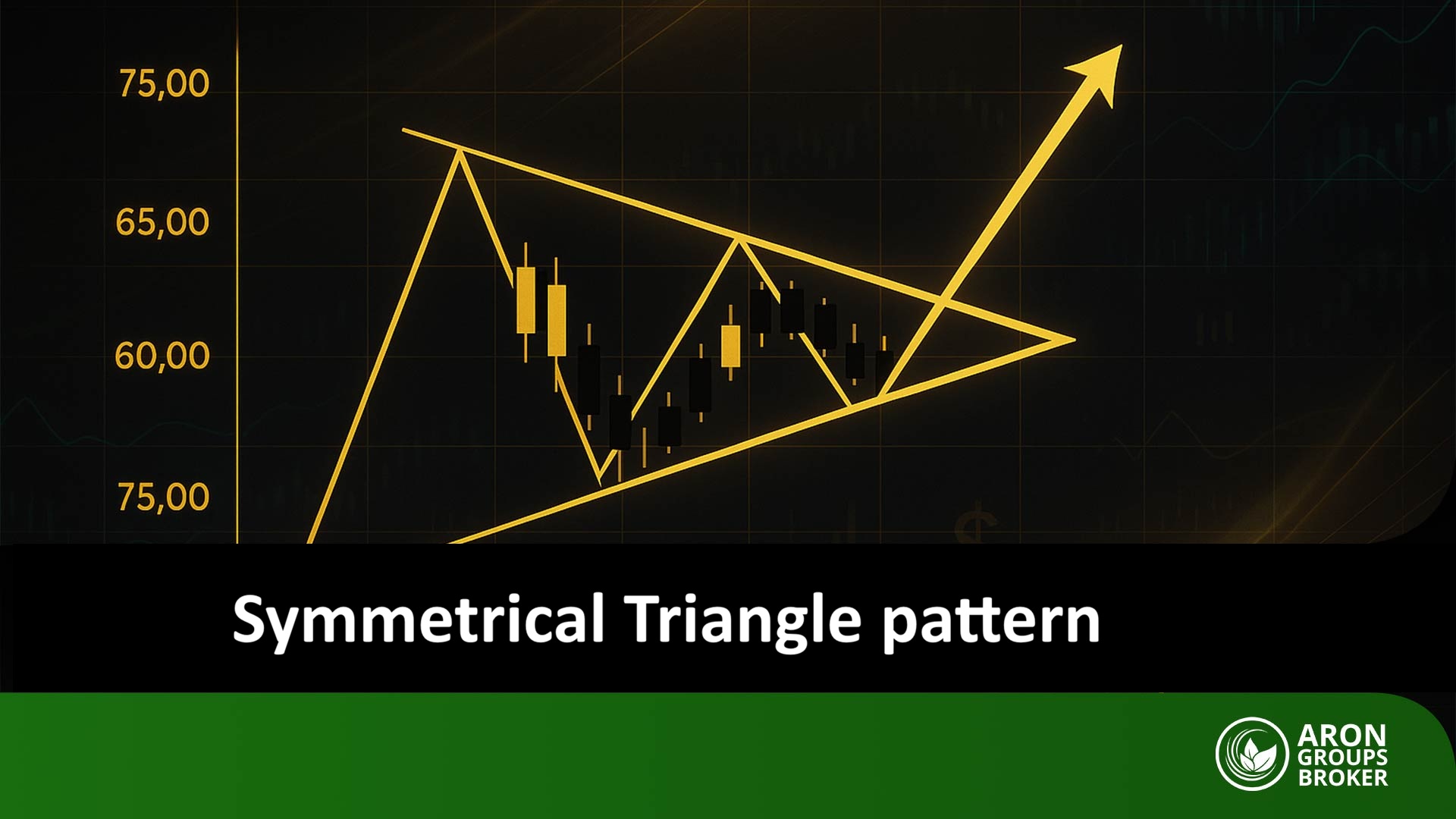

Symmetrical Triangle Pattern: Complete Guide to Identification and Trade Entry

1 January 2026 , Abe Cofnas

Technical analysis helps traders make better decisions by identifying price patterns in the market. The symmetrical triangle pattern, a powerful tool, shows market indecision through price compression and converging lines. This pattern often leads to strong price movements after consolidation. Understanding the symmetrical triangle pattern helps traders find precise entry and exit points and avoid […]

- Read more

-

Complete Guide to Order Flow Analysis with the Order Flow Indicator (Order Flow)

1 January 2026 , Abe Cofnas

In the past, surface-level price and volume analysis gave a general view of market behaviour. Today, high-frequency trading and rapid order shifts demand more precise tools for depth analysis. To better understand the supply-demand balance and spot genuine market activity, traders use advanced tools such as order flow indicators. These tools show real-time buy and […]

- Read more

-

Everything You Need to Know About the MSCI Index and Its Role in Global Financial Markets

31 December 2025 , Abe Cofnas

In investing, having a credible benchmark to measure market performance is essential for informed, comparable decisions. One of the most widely recognised benchmarks is the MSCI Index, introduced by Morgan Stanley Capital International (MSCI). Today, MSCI is recognised as a leading provider of financial data, risk management tools, and widely used market indices. MSCI indices […]

- Read more

-

Spike Indicator Guide: Day Trading Volatility Strategy

31 December 2025 , Abe Cofnas

Market analysis can feel like solving a complex puzzle, but tools like the Spike Indicator make it simpler. This tool helps identify sudden price spikes, allowing for profitable day trading. Whether you’re a beginner or an experienced trader, learning to use the Spike Indicator can enhance your trading strategies. In this article, we will introduce […]

- Read more

-

How does the Negative Volume Index (NVI) reveal hidden market trends?

31 December 2025 , Abe Cofnas

Unlike many volume indicators that focus on busy, high-volume days, the Negative Volume Index (NVI) takes a different view. It helps you track meaningful market activity on days when trading volume falls. NVI is not just a volume gauge; it is a window into spotting smart money (large, professional investors). With this distinctive approach, NVI […]

- Read more

-

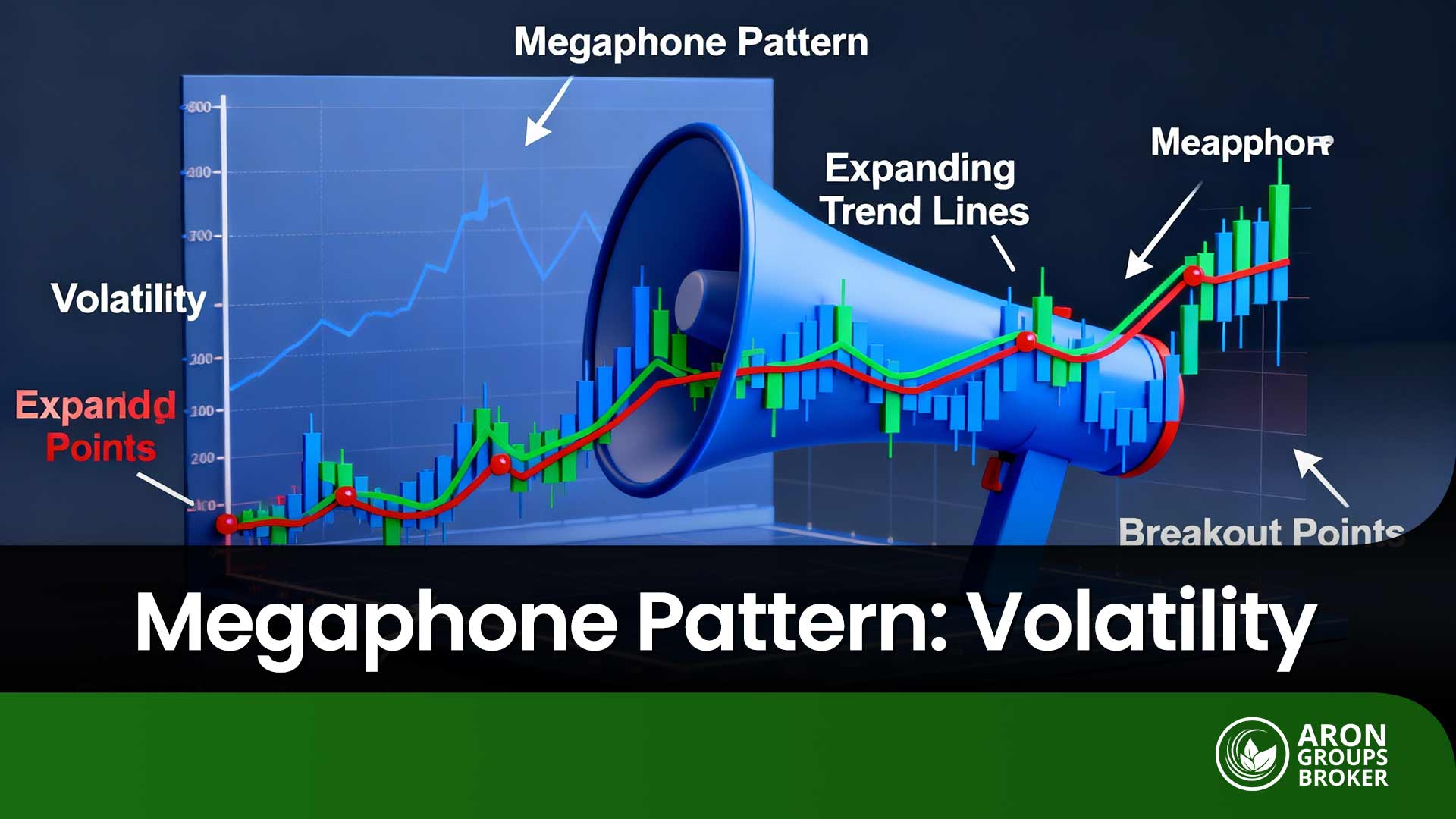

Megaphone Pattern in Technical Analysis: The Inverted Symmetrical Triangle Swing Traders Love

31 December 2025 , Abe Cofnas

In technical analysis, markets sometimes act neither bullish nor bearish, but wildly unstable and hard to predict. These sharp swings may look random at first, yet they often signal a specific formation called the Megaphone Pattern. This pattern confuses many beginners, but it can create strong opportunities for experienced swing traders. Inside the chaos, a […]

- Read more

-

Complete guide to Equal Highs (EQH) and Equal Lows (EQL) in Smart Money

30 December 2025 , Abe Cofnas

When you read a price chart, the numbers are only the surface; the real story is where traders’ orders cluster. In Smart Money Concept (SMC), that cluster is liquidity, and it often drives the market’s quick spikes and reversals. Two key patterns here are Equal Highs (EQH) and Equal Lows (EQL), which reveal common stop-loss […]

- Read more