When you hear the word “coin,” your mind probably jumps straight to Bitcoin and the world of cryptocurrencies. But contrary to the common assumption, a coin is not just “internet money” used only for buying and selling. Behind every coin, there can be an independent network, a precise reward mechanism, and sometimes even a full-scale economic transformation.

In this article, we’ll clear up the confusion and comprehensively answer these questions: What is a coin? How is it different from a token? Why are some coins considered the backbone of a blockchain network, and what is their critical role in network security and stability? Stay with us to understand what a coin really is, how it works, and why it matters in the blockchain world.

- A coin is an independent cryptocurrency with its own native blockchain, while a token is built on existing blockchains.

Content Guidelines

- Coins are used for payments, network fees, and rewards within blockchain networks, and they play a vital role in security and network stability.

Content Guidelines

- Layer-1 coins (such as Bitcoin and Ethereum) form the core infrastructure of blockchain networks, which other projects build on top of.

Content Guidelines - Coins are created and distributed through mining, validation (staking), or initial offerings (ICO/IEO/IDO).

What Is a Coin, and What Does It Do in Blockchain Networks?

According to the ledger, a coin is a cryptocurrency that operates on its own independent blockchain. Unlike tokens, which rely on existing blockchain infrastructure, coins have their own dedicated network.

In a blockchain, a coin functions much like fuel in an engine. Without it, the network cannot run properly. Coins are used to:

- Send transactions;

- Pay transaction fees;

- Participate in data verification and validation (as part of the network’s consensus process).

In many networks, coins are also paid as rewards to those who secure the system, such as miners (in mining-based networks) or validators (in staking-based networks). These incentives play a key role in maintaining the blockchain’s security, decentralisation, and long-term stability.

Coins are not just a payment tool in the crypto world; they are a core part of blockchain infrastructure.

Coin vs Token: What’s the Difference?

The main difference between a coin and a token is the blockchain infrastructure behind them.

- Coins (like Bitcoin or Ethereum) run on their native blockchains. The base network is designed for that coin, and all transactions, validation, and data storage happen on that specific blockchain.

- Tokens (like Tether (USDT) or Chainlink (LINK)) are created on existing blockchains (such as Ethereum or Tron). They do not have their own blockchain and depend on another network to operate and transfer.

In practical terms, coins and tokens often serve different purposes:

- A coin is typically used for payments, as a store of value, and transaction validation.

- A token is commonly used to access specific services, run smart contracts, or represent assets (digital representations of real-world or digital assets).

In one sentence: a coin is native to a blockchain, while a token is a guest on that blockchain.

A token’s “home” is the smart contract address, not a separate blockchain. That’s why contract risk (bugs, admin keys, upgrades) matters more for tokens than for native coins.

Why Are Coins Vital to Blockchain Credibility?

Coins are vital to a blockchain’s credibility because, without them, there is no sustainable incentive to protect the network, accurately record transactions, or keep the system running.

In decentralised blockchains, there is no central authority to manage or control the network. Instead, network participants validate and record transactions using consensus algorithms such as Proof of Work (PoW) or Proof of Stake (PoS).

Coins play two critical roles in a blockchain:

- Coins act as rewards

Participants who contribute to blockchain operations (such as miners or validators) receive coins in return for supporting network security and stability. This reward, often called a block reward, encourages users to commit resources (such as electricity, hardware, or locked digital assets) to maintaining the network. - Coins act as a credibility signal

The more valuable and widely used a network’s coin is, the more users and investors typically perceive the network as more credible and trustworthy.

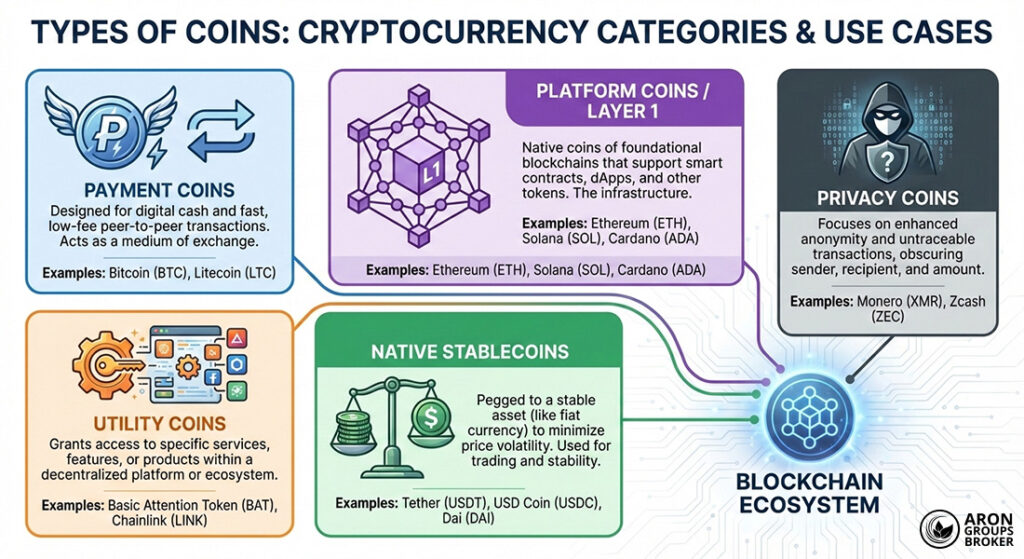

Types of Coins

Coins come in different categories, each designed for a specific goal and use case:

- Payment coins (Payment Coins);

- Platform coins / Layer 1 coins (Platform Coins / Layer 1);

- Privacy coins (Privacy Coins);

- Utility coins (Utility Coins);

- Native stablecoins (Native Stablecoins).

Below is an explanation of each category.

Payment Coins

These coins are designed for buying, selling, and transferring digital money, often as alternatives to traditional currencies (such as the US dollar or euro).

- Bitcoin (BTC): the first and best-known coin for peer-to-peer (P2P) payments;

- Litecoin (LTC): a lighter, faster version of Bitcoin;

- Bitcoin Cash (BCH): a Bitcoin fork created to process transactions faster.

Platform Coins / Layer 1 Coins

These coins are the base layer of blockchain networks on which other tokens and applications are built. Examples include:

- Ethereum (ETH): the largest platform for smart contracts;

- BNB: the native coin of Binance Smart Chain (BSC);

- Solana (SOL): a fast, low-fee blockchain suited to decentralised applications;

- Cardano (ADA): a platform with a research-driven approach and a focus on scalability;

- Avalanche (AVAX), Polkadot (DOT), Elrond (EGLD): other Layer 1 platform examples.

Privacy Coins

These coins are designed to increase privacy and keep transactions more anonymous, such as:

- Monero (XMR);

- Zcash (ZEC);

- Dash (DASH).

Utility Coins

Although utility use cases are more common in tokens, some coins also have specific internal functions within their own platforms, for example:

- BNB for paying fees within the Binance network;

- NEO for developing smart contracts on the NEO network.

Native Stablecoins

Some blockchains issue a dedicated stablecoin pegged to a stable asset, such as the US dollar.

- UST (TerraUSD) was an example of this type of coin before its collapse.

Comparison of Coin Types and Their Uses

| Coin type | Primary purpose | Examples |

|---|---|---|

| Payment | Alternative to traditional money | BTC, LTC, BCH |

| Platform / Layer 1 | Smart contracts and decentralised applications (DApps) | ETH, BNB, SOL, ADA |

| Privacy | Anonymous transactions | XMR, ZEC, DASH |

| Utility | Internal use within platforms | BNB, NEO |

| Native stablecoin | Price stability backed by a USD peg | UST (historical) |

The Difference Between Layer 1 Coins and Other Digital Assets

Layer 1 coins are cryptocurrencies that run on their own native blockchains and form the core infrastructure of a decentralised network. In contrast, other digital assets, such as tokens or “dependent” coins, are usually built on top of these infrastructures and rely on another network to function.

To make this intuitive: Layer 1 coins are like a building’s electrical wiring. They provide the underlying system, and without them, nothing works.

Other digital assets are more like the electrical appliances inside that building. To be usable, they must connect to the existing infrastructure (the wiring).

Key characteristics of Layer 1 coins

- They have an independent blockchain

Layer 1 coins operate on a dedicated network and are not dependent on any other blockchain. For example, Bitcoin (BTC) runs on the Bitcoin network. - They can execute core functions directly

Layer 1 coins can validate and record transactions on their own network, run smart contracts (where supported), and provide the base layer for creating tokens and decentralised applications (dApps). - They serve as the infrastructure for other projects

Many applications, tokens, and blockchain projects are built on these networks. Put simply, Layer 1 coins are the foundation and base layer that other “buildings” are constructed on.

How Are Coins Created and Issued?

In blockchain networks, coins are typically created and issued through three main methods: mining, validation (staking), and initial offerings. All three connect to the network’s consensus process (the mechanism that confirms transactions and records data on the blockchain).

Mining

In networks that use the Proof of Work (PoW) consensus algorithm (such as Bitcoin), new coins are produced through mining. In this method, participants use high-powered hardware to solve complex mathematical problems. In return, they receive a reward in newly issued coins.

This reward serves two purposes:

- It incentivises participants to secure the network.

- It introduces new coins into circulation.

Validation or Staking

In networks that use Proof of Stake (PoS) or more advanced variants (such as Ethereum 2), users can lock (stake) a portion of their coins to be selected as network validators.

Instead of consuming electricity like PoW, validators secure the network with their capital and earn coins for confirming transactions.

Initial Offerings

In some projects, coins are introduced to the market through a process called an initial offering. To raise funding, developers sell part of their coin supply to early investors. This can take several forms:

- ICO (Initial Coin Offering): coins are sold directly by the project team.

- IEO (Initial Exchange Offering): coins are issued through a cryptocurrency exchange.

- IDO (Initial DEX Offering): coins are issued through decentralised platforms.

Many coins have a fixed maximum supply (e.g., Bitcoin), while others use ongoing issuance (inflation) to fund security, and the validator rewards supply design can directly affect long-term price pressure.

Should You Buy a Coin or a Token?

Your choice depends on what you want to do: invest long-term or use a specific crypto product.

Choose a coin if you want long-term exposure

If you’re looking for long-term investing, coins are generally seen as the more reliable option. Coins are built on their own native blockchains and play a fundamental role in the network’s security and operations. Because coins typically have greater credibility and relative stability, they can be a better choice for long-term value storage.

Choose a token if you want to use a specific project or app

If you plan to engage with a specific project or a decentralised application (dApp), tokens are often the better fit. These assets are usually designed for defined purposes such as accessing a platform’s services, participating in governance votes, or representing a digital asset.

For example, holding a token in a blockchain game may allow you to buy in-game items, or in a financial protocol, you might receive a share of participation rewards. Tokens are highly diverse and have become widely used across areas like DeFi (decentralised finance), blockchain gaming, and NFTs.

A token can be “real” and still be risky if it has low liquidity; big buys/sells can move the price fast. Always check trading volume and spread before committing capital.

Conclusion

Coins are more than a simple payment tool in the crypto world. They are core, foundational elements that help ensure the security, decentralisation, and stability of blockchain networks. Understanding the difference between coins and tokens, knowing the main types of coins, and grasping how they are created and used will help you make more informed decisions in the volatile crypto market.

Whether you want to preserve value over the long term, participate actively in decentralised projects, or simply better understand this complex ecosystem, knowing what a coin is and how it works is a smart and essential starting point for entering the world of blockchain. With this knowledge, you can move forward more confidently and make the most of the many opportunities this technology offers.