Digital money doesn’t come from printing presses. Central banks don’t issue cryptocurrencies such as Bitcoin and aren’t controlled by any single authority. Instead, they are generated through code, mathematical algorithms, and specialized computer hardware. This process, known as cryptocurrency mining, not only creates new coins but also plays a crucial role in maintaining the security and stability of blockchain networks.

In fact, without mining, no transaction could be verified and no new block could be added to the chain. That’s why mining is often referred to as the backbone of the cryptocurrency ecosystem and one of its most profitable activities.

In this comprehensive guide, you’ll learn step-by-step what mining actually is, how to get started, what equipment you need, and how to calculate potential profitability. If you’re looking to enter the world of crypto mining with the right knowledge and tools, this article will serve as your reliable roadmap.

- Choosing the right mining algorithm (such as Ethash or SHA-256) before purchasing hardware helps avoid costly mistakes.

- Mining isn’t just about generating coins; it’s about securing the network and validating transactions, and miners’ rewards depend directly on node performance.

- Professional miners use monitoring software like HiveOS to manage temperature, hash rate, and automatic restarts.

What Is Cryptocurrency Mining?

Cryptocurrency mining is the process of creating new blocks and verifying transactions within blockchain networks that operate on a Proof-of-Work (PoW) consensus mechanism. In this process, miners use powerful hardware such as ASIC devices (Application-Specific Integrated Circuits) or GPUs (Graphics Processing Units) to solve complex cryptographic puzzles, resulting in the addition of a new block to the chain.

The primary goal of mining is to validate legitimate transactions and ensure the security and stability of the blockchain. In other words, miners act as decentralized computational nodes that dedicate processing power and electricity to confirm transactions and protect the network from attacks such as double-spending.

In return for their contribution, miners receive rewards consisting of two components:

- Block Rewards: Newly created coins issued by the network, serving as the main source of supply for cryptocurrencies such as Bitcoin.

- Transaction Fees: Fees paid by users, which, over time, are expected to play a larger role in miners’ total income.

In the early days, cryptocurrency mining could be performed on personal computers. Today, however, it has evolved into a capital-intensive industry, requiring specialized equipment, large-scale mining farms, and substantial electricity and maintenance costs. Despite these challenges, mining remains one of the fundamental ways to participate in the cryptocurrency economy and contribute to the security of blockchain networks.

How Does the Mining Process Work?

Cryptocurrency mining forms the operational backbone of blockchain networks based on the Proof-of-Work (PoW) algorithm. It serves two main purposes: generating new digital currencies and verifying the validity of transactions within the network. The following breakdown explains how each transaction becomes a permanent part of the blockchain.

Stages of the Cryptocurrency Mining Process

1. Transaction Collection and Block Formation

Transactions initiated by users are first broadcast across the network as unconfirmed. Miners collect these pending transactions, validate their authenticity (for example, ensuring that the sender has sufficient balance and the transaction is not fraudulent), and then organize the verified transactions into a new block.

2. Creating a Candidate Block

Miners select a group of validated transactions and package them into what is known as a candidate block, preparing it for submission to the network.

3. Calculating the Block Hash

Miners compete to find a hash (a cryptographic fingerprint of the block) that meets the specific difficulty target set by the network. They do this by repeatedly changing a variable called the nonce until the resulting hash begins with a required number of zeros or matches other predefined criteria.

4. Finding a Valid Hash

This is the most computationally demanding part of the process, requiring significant processing power (hash rate). Once a valid hash is found, the block is recognized as valid by the network.

5. Broadcasting the Block to the Network

The successfully mined block is broadcast to other nodes, which verify its accuracy. Once confirmed, the block is permanently added to the existing blockchain.

6. Receiving the Reward

The miner who successfully mines the block receives the block reward, newly issued coins, and the transaction fees associated with that block.

This continuous cycle of competition and validation ensures the security, transaction integrity, and long-term stability of the blockchain network. A higher network hash rate indicates stronger competition among miners and greater overall network security.

Professional miners often prioritize stable hash rates over peak performance, as consistency within mining pools leads to more regular and predictable payouts.

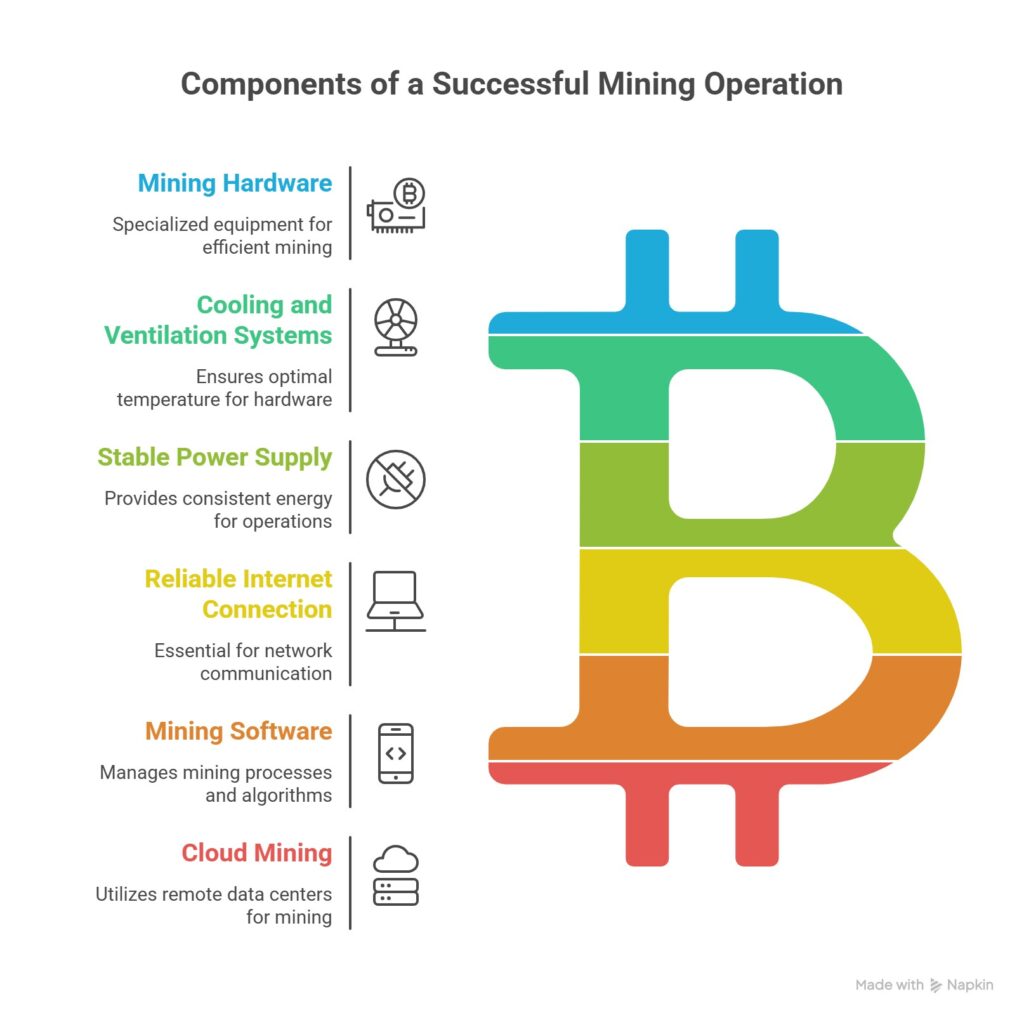

Essential Equipment for Cryptocurrency Mining

To mine cryptocurrencies effectively, you need hardware that is compatible with the network’s mining algorithm. The higher your system’s processing power and energy efficiency, the greater your chances of success. Below is a detailed look at the equipment required for profitable and stable mining operations.

1. Mining Hardware (Miner)

The mining device is the core component of any operation. It performs the heavy mathematical computations required to verify transactions and generate new blocks. There are two main categories of mining hardware:

- ASIC Miners (Application-Specific Integrated Circuits): Used for Bitcoin and similar cryptocurrencies.

These specialized devices, such as the Antminer S21 or WhatsMiner M60S, operate on the SHA-256 algorithm and are built exclusively for mining a single cryptocurrency—most commonly Bitcoin. ASIC miners deliver exceptionally high hash power and efficiency, but are expensive and energy-intensive. They are the industry standard for Bitcoin mining due to their superior performance.

- GPU Miners (Graphics Processing Units): Used for cryptocurrencies like Ethereum Classic or Monero.

GPU miners rely on high-performance graphics cards such as the NVIDIA RTX 3070 or AMD Radeon VII to perform mining computations. While less powerful than ASICs, GPUs are more flexible and can mine multiple coins using different algorithms. GPU rigs typically consist of several cards mounted in a frame with dedicated cooling and ventilation systems.

2. Cooling and Ventilation Systems

Mining, especially with ASICs or multi-GPU rigs, generates significant heat. Excessive temperatures reduce performance (lower hash rate), damage components, and shorten hardware lifespan. An efficient cooling system is therefore essential.

Typical setups include high-capacity industrial fans, air-conditioning units, exhaust ducts, or even liquid-cooling systems in professional mining farms. Proper airflow design and maintaining ambient temperatures below 30°C (86°F) are key to ensuring stable operation. In colder climates, miners often take advantage of natural ventilation to reduce cooling costs.

3. Stable and Sufficient Power Supply

Every mining device or rig requires a power supply unit (PSU) that matches its energy consumption.

- ASIC miners usually rely on industrial-grade PSUs ranging from 1,000 to 3,000 watts.

- GPU rigs require high-efficiency PSUs (preferably with 80 PLUS Gold or Platinum certification) that provide consistent voltage and protection against power fluctuations.

Voltage stability is critical; severe power surges can cause system resets, reduce hash rate, or even damage equipment. Large-scale mining farms typically use industrial power panels, surge protectors, and backup systems such as UPS units or diesel generators to prevent downtime during blackouts.

For a deeper understanding of mining rewards, refer to the article on “Satoshi”.

4. Reliable Internet Connection

Contrary to popular belief, mining doesn’t require high-speed internet, but it does require a stable and continuous connection. Even a few minutes of downtime can reduce earnings, delay the submission of valid blocks to the mining pool, or result in lost work.

A wired Ethernet connection is preferred over Wi-Fi for stability. Choose an ISP with low latency (ping) and minimal outages. Professional farms usually maintain a backup internet line to ensure uninterrupted mining operations.

5. Mining Software

Mining software acts as the interface between your hardware and the mining pool. It retrieves data from the blockchain, performs hash computations, and submits the results to the network. Depending on the cryptocurrency and hardware type, several reliable options exist:

- CGMiner: Supports both ASIC and GPU devices.

- NiceHash Miner: Offers multi-coin mining with a simple setup interface.

- PhoenixMiner and T-Rex: Optimized for AMD and NVIDIA GPUs, respectively.

These programs typically allow manual configuration of clock speeds and display real-time data such as hash rate, temperature, power usage, and error logs. Some even integrate API access for remote monitoring or farm management dashboards.

6. Cloud Mining

For users without access to hardware, space, or technical expertise, cloud mining provides an alternative. Instead of owning physical machines, users rent computational power from a mining company and receive a share of the generated revenue.

This model eliminates the need for maintenance, electricity, or physical setup—but carries significant risks, including potential scams, lack of transparency, and full dependence on the provider’s performance.

Some well-known platforms include Genesis Mining, Hashflare, and NiceHash, though users should conduct thorough due diligence before investing in any service.

Which Cryptocurrencies Are Profitable to Mine?

According to updated reports from reputable sources such as CoinDesk and Cointelegraph, during the first half of 2025, cryptocurrencies like Bitcoin (BTC), Litecoin (LTC), Dogecoin (DOGE), Ethereum Classic (ETC), and Monero (XMR) remain among the most profitable options for mining.

Despite Bitcoin’s high network difficulty, it continues to be profitable for miners operating powerful ASIC machines and benefiting from low-cost electricity.

In contrast, coins such as Ethereum Classic and Monero, which use GPU-compatible algorithms, are more suitable for smaller or independent miners. Emerging projects like Ravencoin (RVN), Kaspa (KAS), and Vertcoin (VTC) have also gained popularity due to their lower network difficulty and reduced hardware requirements, making them attractive to new miners.

Experts consistently emphasize that daily market monitoring, difficulty tracking, and energy cost analysis are essential for selecting the most profitable cryptocurrency to mine.

In some countries, cryptocurrency mining powered by renewable energy sources (such as solar panels) is tax-exempt or even subsidized.

Methods of Mining Reward Distribution

Mining rewards are distributed through two main mechanisms:

- Direct payment from the blockchain network

- Payment via mining pools

Let’s explore how each works.

1. Direct Payment from the Blockchain

In this model, solo miners who successfully mine a valid block receive the entire block reward, including both newly generated coins and transaction fees. While highly profitable, solo mining requires enormous computational power and carries substantial risk due to high variance.

2. Payment through Mining Pools

This is the most common method. Miners join a pool, combining their processing power to improve the chances of discovering a block. Rewards are then distributed proportionally based on each miner’s share of the total hash rate.

Common pool payment models include:

- PPS (Pay Per Share):

You receive a fixed payout for every share contributed, regardless of whether the pool finds a block. It’s similar to a fixed salary model, ideal for those seeking steady, predictable income. - PPLNS (Pay Per Last N Shares):

Rewards are distributed only when a block is found, and only to miners whose shares contributed to that block’s discovery. It carries more risk, but potentially higher returns for lucky participants. - FPPS (Full Pay Per Share):

An enhanced version of PPS that, in addition to fixed payments per share, includes a proportional share of transaction fees. This method is considered more transparent and fair, as it better reflects each miner’s contribution to total pool revenue.

Each model has its own advantages and trade-offs. Successful miners carefully evaluate pool structure, fee transparency, and their own operational profile before choosing a payout method.

Calculating Mining Profitability

If you want to estimate potential mining profits before investing, use reliable online profitability calculators provided by well-known platforms:

- NiceHash Profitability Calculator: Enter your hash rate, power consumption, and electricity price to view estimated daily and monthly profits instantly.

- Minerstat: Offers profitability tracking across different algorithms and hardware types.

- Hashrate Index and Braiins Calculator: Provide advanced tools to model price changes, network difficulty trends, and ROI (Return on Investment) over time.

These platforms are designed for users of all levels, from beginners to professionals, and help you make data-driven decisions before entering the mining market.

Key Factors Affecting Mining Profitability

Profitability in cryptocurrency mining depends on far more than raw hardware power. A combination of economic, technical, and environmental factors influences it. The most important variables include:

- Market Price of the Cryptocurrency: Changes in the price of Bitcoin, Ethereum Classic, or any mined coin have a direct impact on mining profitability.

- Network Difficulty: As more miners join a network, difficulty rises, increasing competition and extending the average time required to mine each block.

- Electricity Costs: In regions with high electricity tariffs, profits decline sharply. Power costs remain one of the most influential inputs in profitability models.

- Mining Hardware Performance: Devices with higher hash rates and greater energy efficiency (such as next-generation ASICs) yield better returns.

- Pool Payment Structure: The chosen reward system, PPS, PPLNS, or FPPS, directly affects payout stability and potential earnings.

- Pool and Transaction Fees: Fees charged by mining pools and blockchain transaction costs both reduce net income.

- Geographic Location of the Mining Farm: Local factors such as climate, energy pricing, internet reliability, and regulatory policy play a major role in determining overall profitability.

Mining profitability is a dynamic calculation that fluctuates with market conditions and infrastructure costs. Without ongoing analysis of these variables, mining operations can quickly turn from profitable to loss-making.

Challenges and Risks of Cryptocurrency Mining

While cryptocurrency mining can be profitable, it also carries significant risks that investors and miners must carefully evaluate. The main challenges include:

- High price volatility: Extreme fluctuations in cryptocurrency prices can quickly erase profits and even lead to financial losses.

- Hardware failure and maintenance costs: Continuous, high-load operation of mining equipment increases the risk of damage, and repairs or replacements can be expensive.

- Operational vulnerabilities: Power outages, cyberattacks, internet connectivity issues, or even international sanctions can severely disrupt mining operations in certain regions.

- Regulatory risks: In many countries, unauthorized mining may result in fines or confiscation of equipment.

- Policy uncertainty: Sudden changes in government regulations, energy consumption policies, or tax laws can impose additional constraints on mining activities.

In short, entering the mining industry requires a thorough understanding, data-driven analysis, and professional risk management to ensure sustainable profitability.

Solo miners sometimes earn rewards from a single successful block that exceed several months of pooled mining income, but this comes with exceptionally high risk.

Conclusion

Cryptocurrency mining has evolved into a multi-billion-dollar global industry, powering the very core of decentralized networks like Bitcoin. However, entering this field without a deep understanding of its technical foundations, cost structure, profitability models, and associated risks can lead to significant financial losses.

Mining isn’t as simple as buying a machine and turning it on. Success depends on selecting the right algorithm, managing energy efficiency, choosing the right geographical location, connecting to reliable mining pools, and staying informed about market and network changes.

To put it plainly: mining can be a powerful source of income, but only for those who approach it with knowledge, proper tools, and a long-term perspective.