Most online communities still sit on centralised platforms that control data, rules, and visibility, while users create value without real ownership. Web3 enables user-owned systems on blockchains, where DAOs use tokens and smart contracts to share decision-making and treasury control.

A Social DAO applies this model to culture and community, letting members not a platform govern how the group runs, funds projects, and sets priorities, much like a digital co-operative.

- Some Social DAOs use streaming payments, paying contributors continuously rather than in one-off grants.

- A few DAOs experiment with “multihome” membership, where one credential proves your reputation across several communities at once.

- Certain Social DAOs run time-limited “seasons,” so the roadmap and budget reset regularly instead of drifting forever.

- In advanced models, voting rights can decay over time if you stop participating, keeping decision-making power with active members.

- Some DAOs separate “social tokens” for access from “governance tokens” for voting to reduce conflicts between community and speculation.

What Is a DAO?

A DAO (Decentralised Autonomous Organisation) is an internet-native organisation that runs according to rules written in code and stored on a blockchain.

Investopedia defines a DAO as an organisational structure without a central governing body, in which decisions and ownership are distributed among community members and recorded transparently on a blockchain.

In practical terms, DAOs usually have three core elements:

- Smart contracts that encode rules and processes on-chain.

- Governance tokens that give members voting rights.

- A shared treasury is controlled collectively rather than by a single person.

Compared with traditional organisations, DAOs:

- Do not rely on a CEO or board to approve every decision.

- Use code and consensus instead of hierarchy and internal paperwork.

- Often allows people to join or leave simply by acquiring or selling tokens.

Did you know?

The UK Law Commission calls DAOs a “new kind of internet-based collaborative organisation” that coordinates people and resources using rules expressed in computer code.

This structure creates both new possibilities and new risks, which become especially visible when DAOs are used for social and cultural communities.

What Is a Social DAO?

A Social DAO is a DAO focused primarily on community and culture rather than purely on investment or protocol management. Request Finance describes Social DAOs as groups that prioritise social capital, reputation, and collaboration over financial returns in a space dominated by speculation.

You can think of a Social DAO as a community-owned digital collective. It usually has:

- A shared mission related to culture, content, networking, events, or art.

- Token-based or NFT-based membership.

- Governance processes that let members decide how the community evolves.

Social DAOs differ from other DAO types:

- Investment DAOs primarily pool capital to back assets or projects.

- Protocol DAOs govern DeFi protocols or infrastructure parameters.

- Charity DAOs coordinate donations and impact activities.

Creators and communities choose Social DAOs because they:

- Offer ownership and control over the brand and treasury.

- Allow contributors to be recognised and sometimes rewarded on-chain.

- Reduce dependency on a single Web2 platform’s policies or algorithms.

| DAO Type | Primary Focus | Goal |

|---|---|---|

| Social DAO | Community & Culture | Networking, Events, Reputation |

| Investment DAO | Capital & Assets | Return on Investment (ROI) |

| Protocol DAO | Code & Infrastructure | Manage DeFi Parameters |

| Charity DAO | Impact & Donation | Coordinate Social Good |

Important point

A Social DAO is not just a Discord server with a token. It becomes meaningful when governance, treasury use, and key rules are actually decided through DAO processes rather than informal admin decisions.

How Social DAOs Work

Although every Social DAO has its own style, most follow a similar structure.

Blockchain infrastructure and multi-chain support

Social DAOs are usually built on public blockchains such as Ethereum or compatible networks. The blockchain provides:

- A ledger of token balances and transactions.

- A secure environment for smart contracts that enforce rules.

- Public, tamper-resistant records of proposals and votes.

Did you know?

Some DAOs use Layer 2 networks or sidechains to reduce transaction fees, then bridge tokens back to main chains for broader liquidity. This improves usability for everyday governance.

Governance: proposals, voting, quorum, execution

Most DAOs follow a predictable governance cycle:

- Proposal: a member drafts a proposal (for example, to fund an event or launch a new content series).

- Discussion: the community debates it in forums or chat channels.

- Voting: token holders cast votes within a defined window.

- Quorum: the DAO may require a minimum level of participation for the result to be valid.

- Execution: if approved, a smart contract or multi-signature wallet carries out the decision, such as releasing funds.

In many DAOs, the vote itself is recorded on-chain, and the result triggers automatic execution, reducing room for human interference.

Membership models: tokens, NFTs, and reputation

Social DAOs use different membership models, often in combination:

- Token-gated access:

Holding a specific amount of the DAO crypto token grants entry to private channels or events. Token-based membership provides a clear way to distinguish actual members from passive followers. - NFT-based identity:

Some DAOs issue NFTs as passes or role badges, sometimes non-transferable to reflect reputation rather than wealth. - Reputation or points systems:

Activity, reliability, and contributions can be tracked via non-financial scores, which then influence responsibilities or soft power.

Important point

Membership is not always open. Several Social DAOs combine token-gating with an application process to maintain culture and quality, even if the underlying tools are permissionless.

Automation: treasuries, rewards, and operations

Smart contracts allow Social DAOs to automate many operational tasks:- Treasury management: funds are held in on-chain wallets; contracts define who can trigger payments under which conditions.

- Reward distribution: bounties and contributor payments can be processed automatically upon approval of a proposal.

- Access control: holding certain tokens or NFTs unlocks channels, tools, or event registrations.

Did you know?

Some DAOs use multi-signature wallets, where several trusted signers must approve sensitive transactions. Recent analyses have highlighted multisig governance as an important additional layer of security for high-value treasuries.

Real-World Examples of Social DAOs

Understanding Social DAOs is easier with concrete DAO examples. Several well-known communities show how tokenised governance and culture can work in practice.

Friends With Benefits (FWB)

Friends With Benefits (FWB) is one of the most cited Social DAOs. It is a token-gated community whose mission is to foster culture and creative agency using Web3 tools. Members must hold a minimum amount of the FWB token and pass an application to join.

CoinMarketCap’s beginner guide notes that FWB brings together “creators, rebels, artists, thinkers, and doers” who want to shape the future of content and culture in Web3. In practice, FWB runs online discussions, commissions creative work, and hosts real-world events funded from the DAO treasury.

Seed Club

Seed Club is a DAO-focused accelerator helping community-led projects design and launch their own tokens and communities. Seed Club Is Classified as a Social DAO because it exists to bring people together and support knowledge sharing, rather than solely to manage investments.

Seed Club works as a hub where founders, creators, and contributors collaborate on token design, community strategy, and long-term governance models, often across multiple smaller DAOs.

BanklessDAO

BanklessDAO is a decentralised media and education organisation that grew out of the Bankless podcast and newsletter. It coordinates writers, designers, developers, and organisers to create content and tools that help people “go bankless” and learn about DeFi and Web3.

The DAO uses governance tokens and structured proposals to decide which projects to fund, which guilds to support, and how to evolve the brand.

Other niche Social DAOs

The broader ecosystem includes many niche Social DAOs, such as:

- Communities built around specific NFT collections and real-world events.

- DAOs exploring shared ownership of sports clubs, co-living spaces, or local infrastructure.

These examples show that Social DAO is a flexible pattern. The common thread is community ownership, on-chain governance, and a shared cultural or social purpose.

Important point

Successful Social DAOs often start as strong communities first, newsletters, group chats, or events, and only formalise as DAOs once culture and trust already exist. Tokens are then used to reinforce, not to replace, that foundation.

Benefits of Social DAOs

When people search for the benefits of DAOs in a social context, they usually want clear, non-hyped advantages. A well-designed Social DAO can offer real benefits, while still carrying risk.

Transparency

In most DAOs, proposals, votes, and treasury movements are recorded on-chain. Wikipedia notes that DAO votes and activity are typically posted on a blockchain, making all actions viewable. This level of transparency is rare in traditional clubs or social platforms.

Shared ownership

DAOs are collectively owned and managed by their members, with built-in treasuries accessible only with member approval. In a Social DAO, this means members help decide how funds are spent, which projects matter, and how the community develops, rather than relying on a central company to make those decisions.

Security through code and checks

Smart contracts enforce consistent rules and can reduce some manual fraud risks, especially when audited and combined with multisig controls. At the same time, code risk never disappears, so Social DAOs must treat security as an ongoing process.

Did you know?

Some newer DAO frameworks include built-in emergency brakes, time-locks, or pause functions so the community can react if a critical governance bug or exploit is discovered.

Operational efficiency

Automation reduces reliance on manual administrators. Routine tasks such as access control and recurring payments can be handled by contracts after approval by votes, saving time and reducing overhead.

Community alignment

When carefully designed, token-based governance can align incentives. Rapid Innovation’s guide to DAO tokenomics emphasises that good token design should promote decentralised governance and align member incentives around long-term success. In Social DAOs, this can turn passive followers into active co-owners.

Global accessibility

Hedera’s overview highlights that DAOs can operate across borders and bring members together regardless of geography. This makes Social DAOs attractive to inherently global communities, such as digital creators, open-source contributors, or remote workers.

DAO governance: How Decisions Are Made

DAO governance determines who has a say, how votes are counted, and how rules change over time. For Social DAOs, governance quality often separates short-lived experiments from sustainable communities.

Governance tokens and voting power

Most DAOs use governance tokens to allocate voting rights. A straight “one token, one vote” model is still common, but recent research on DAO governance shows that this can lead to power concentration when a few wallets hold a large share of tokens.

DAOs therefore experiment with:

- Vote caps per wallet.

- Reputation-weighted voting.

- Distinct tokens for governance and for economic exposure.

Important point

Token distribution and voting rules are not just technical settings. They are political decisions that shape whose voices matter and how resilient the DAO is to manipulation.

Delegation and liquid democracy

Because many members lack time to study every proposal, some DAOs allow delegation, where holders assign their voting power to trusted representatives. Recent overviews of token-based governance note that delegation can raise effective participation but may also create a layer of professional delegates.

Used well, delegation can:

- Improve decision quality.

- Reduce voter fatigue.

- Create space for specialised expertise.

Used poorly, it can create new bottlenecks, with a few delegates holding most of the effective power.

Constitutions, charters, and smart contracts

Mature DAOs usually maintain written constitutions or charters that explain their mission, rights, and processes. The Blockstand report on DAOs stresses that clear governance frameworks, supported by smart contracts, are essential for legitimacy and stability.

Smart contracts then encode parts of these frameworks, such as:

- Who may submit proposals?

- How long do voting periods last?

- What quorum and majority are required for execution?

Did you know?

Some DAOs track all governance changes in a dedicated “constitution” contract, so the full amendment history is visible on-chain as a sequence of signed changes.

Long-term sustainability depends on how such rules are designed and updated.

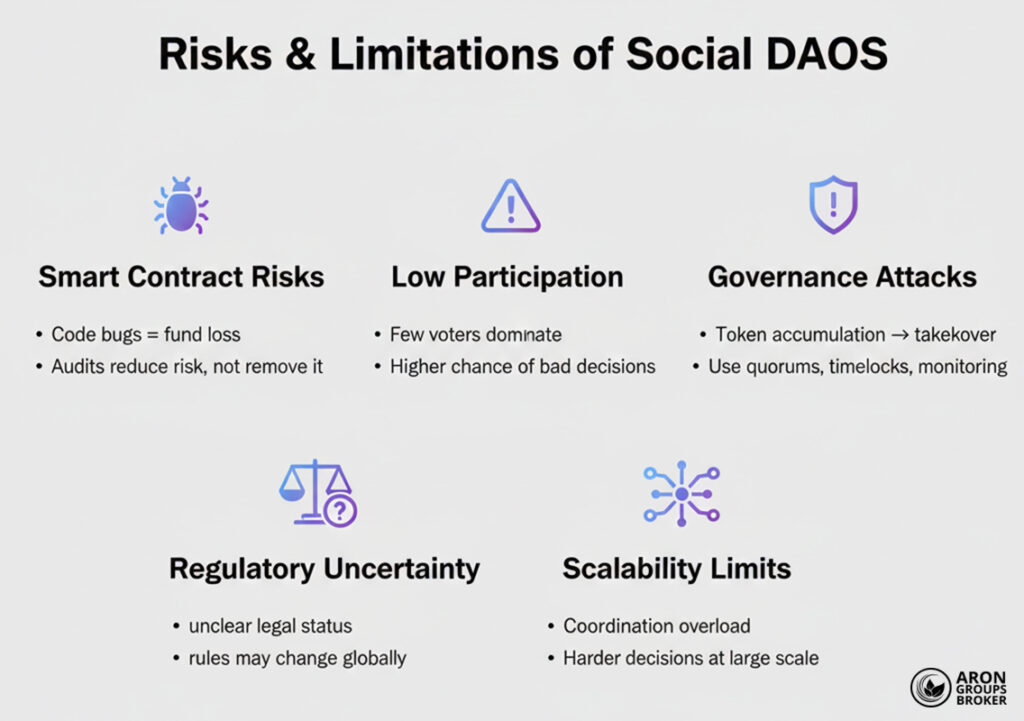

Risks and Limitations Of Social DAO

DAOs can be powerful, but DAO crypto and governance models come with serious limitations.

Smart contract vulnerabilities

History shows that flawed smart contracts can lead to major fund losses. Several legal analyses highlight that early DAOs suffered from hacks and exploits due to vulnerabilities in their code.

Regular audits, bug bounties, and cautious upgrade mechanisms are essential. Even then, contract risk cannot be reduced to zero.

Treasury mismanagement and low participation

OKX’s review of DAO governance challenges notes widespread voter apathy, with decisions often made by a small, concentrated group of token holders. Low participation amplifies the risk of poor spending decisions and governance capture.

Important point

A transparent on-chain treasury does not guarantee wise financial choices. Social DAOs still need budgeting processes, risk limits, and clear accountability for funded projects.

Governance attacks and manipulation

Governance attacks are where an actor buys or borrows enough tokens to pass self-serving proposals. If the quorum is low or voting windows are short, such attacks become easier.

Mitigations include:

- Higher quorum for sensitive changes.

- Time-locks before execution.

- Monitoring abnormal token accumulation.

Regulatory uncertainty

The legal status of DAOs is still evolving. The UK Law Commission notes that DAOs raise complex questions about liability and regulation. Legal specialists discuss “DAO 3.0” structures designed to give DAOs clearer legal wrappers and reduce unlimited member liability.

Future rules may affect how Social DAOs can issue tokens, hold assets, or operate across borders.

Scalability and coordination issues

Research on DAO governance warns that more direct participation does not automatically lead to better decisions. Coordination costs, information overload, and social conflict can still limit performance.

For Social DAOs, this means that community design, not only tooling, decides how workable day-to-day governance becomes.

How to Join a Social DAO?

Many readers want practical guidance: how to join a Social DAO safely and meaningfully.

Define your goals

Before choosing a DAO, decide what you want:

- Learning about Web3 and governance.

- Meeting peers in your industry or creative field.

- Contributing specific skills such as writing, design, or development.

Alignment between your interests and the DAO’s mission is crucial for long-term engagement.

Research the DAO’s culture and rules

Read:

- The DAO’s constitution or charter.

- Past proposals and their outcomes.

- Community discussions in forums or chat.

CoinMarketCap’s beginner guide to Social DAOs recommends checking a DAO’s transparency and how it handles disagreements before you commit time or money.

Did you know?

Many DAOs keep open archives of calls and proposal discussions; listening to a few recordings can reveal far more about culture than any marketing page.

Set up a secure wallet

You will need a compatible crypto wallet to hold tokens and sign governance actions. Basic practices include:

- Storing your seed phrase offline.

- Using hardware wallets for higher balances.

- Verifying contract addresses from official links, not from random messages.

Acquire or earn membership tokens

Depending on the Social DAO:

- You may buy governance tokens on supported exchanges.

- You may mint or purchase an NFT membership pass.

- You may earn tokens through contributions, bounties, or trial programmes.

Always verify that you are interacting with the official token contract and not a look-alike.

Start with small, low-risk participation

Once inside:

- Observe how proposals are written and debated.

- Vote on issues after carefully reading both sides.

- Take on small tasks or bounties to learn the workflow.

Over time, consistent contribution and thoughtful participation usually matter more than the amount of DAO crypto you initially hold.

Future of Social DAOs

Looking ahead, many analysts argue that the Future of DAOs and Social DAOs will be tightly linked to digital identity, work, and governance.

Token-gated communities and Web3 identity

A wallet-based identity can give members a portable way to prove participation and reputation across multiple platforms without exposing all their data.

For Social DAOs, this could mean:

- Smoother access to multiple apps and events with the same wallet.

- Richer reputation systems based on past contributions.

- Less reliance on centralised login providers.

DAOs as the next generation of social networks

Some foresight studies describe DAOs as “virtual communes” where communities cohabit, share labour, and coordinate value flows. Medium analyses of the future of DAOs argue that they may reshape organisations by making ownership and governance more programmable and transparent.

In that sense, Social DAOs can be viewed as early prototypes of user-owned social networks.

Hybrid models: blending digital and physical

Already, Social DAOs organise physical events, co-working sessions, and even co-living experiments, funded and governed by on-chain treasuries. This hybrid model, digital first but not digital only, could become more common as remote work and global collaboration continue to expand.

Did you know?

Some scenario studies envision DAOs operating as “digital cities” by 2035, with distinct “districts” (sub-DAOs) for culture, infrastructure, and services, all coordinated under a single broader governance framework.

Interoperable identities, micro-DAOs, and AI-assisted governance

Emerging research points to several likely developments:

- Interoperable identities that allow members to carry verifiable credentials between DAOs.

- Micro-DAOs focused on specific projects, nested inside larger Social DAOs for funding and support.

- AI-assisted governance, where tools summarise proposals, model outcomes, and flag risks, helping members make more informed decisions without replacing human judgement.

These trends could make governance more accessible, but will also raise new questions about bias, control, and accountability.

Conclusion

Social DAOs are an emerging way for communities to own their spaces, govern themselves, and manage shared resources using smart contracts and on-chain treasuries. They are still experimental, with real risks such as governance attacks, code vulnerabilities, low participation, and unclear regulation.

The sensible way to approach them is as coordination tools, not profit guarantees: understand how each DAO works, assess its security and governance, and participate carefully.